In yesterday’s feature article, The Yield Curve Recession Predictor: Impact on Gold? we outline a timeframe for the next US and global recession to potentially arrive. We explained how the next bull market in gold and silver is also likely in it’s early stages.

This article we came across this week also outlines why gold is currently the best long term bet and how higher gold prices are likely coming…

The Next Gold Bull Market Looms

By Jason Stevenson

-> Major political change

-> Gold is the best long term bet

-> A growing movement

-> What this means for gold

-> Higher gold prices are coming

Gold is the best long term bet

German Chancellor Angela Merkel won her fourth term on 4 March. That shouts ‘more of the same’ for another four years — higher taxes, more regulation and austerity are the name of the game.

Merkel is planting the seeds for the next sovereign debt crisis.

She’s in charge of the European Union’s largest economy and was a chief architect behind the refugee crisis. Merkel is an extremely dangerous career politician and a huge supporter of the European Union — an unelected and power-hungry establishment.

I believe multiple countries will leave the European Union within the next five years, thanks to Merkel’s hard-line policies. In fact, as you may have read from my work, Italy could be next country to leave.

Five Star Movement — an anti-establishment party — became the largest single party on 4 March.

Luigi Di Maio — the political party’s leader — wants to renegotiate the country’s policies with the EU. But, considering Greece’s negotiations in 2015, there’s a slim chance of a successful outcome — especially with Angela Merkel in government. If negotiations fail with the EU, Luigi Di Maio says he would let the people vote to leave the EU.

50% of Italians voted for anti-establishment parties. That can’t be ignored. The majority aren’t happy with the status quo and are demanding change.

I expect a referendum put to the people in the second half of the year. Whatever happens, politicians tend to drag negotiations on for months. So, uncertainty should rise across Europe throughout the year. That plays into the hands of safe-haven assets. And it could drive gold sharply higher.

A growing movement

Multiple countries are electing ultra-right-wing leaders, such as Donald Trump in the US and Shinzo Abe in Japan. And at the age of just 31, Sebastian Kurz became the world’s youngest Prime Minister in Austria last year.

Other countries have rejected their former socialist governments. But they haven’t moved fully to the right yet.

Socialist nations, such as France, decided on a centralist government last year. It couldn’t decide on a left- or right-wing party. The Dutch couldn’t decide either. Politicians took 208 days to form a centralist government last year.

Former Italian Prime Minister Silvio Berlusconi also wants to form a new centralist government. He wants to sway voters away from Five Star Movement in the Italian election. There’s a good chance his plan could work, considering what happened in France and the Netherlands.

Jacinda Ardern, leader of the New Zealand Labour Party, won the federal election in October. She is ultra-left-wing. But, similar to the stories above, voters wanted something drastically different to their previous government. That’s why they elected the youngest woman in history as prime minister.

Jeremy Corbyn is the Labour Party leader in the UK and is a favourite to win the next election. He is a pure Marxist and wants to keep the UK in the European Union. Given the failures of the Theresa May government, especially when dealing with Brexit, there’s a good chance he could win.

It’s clear that people aren’t happy and want something different. That’s why we’re seeing old governments thrown out and extreme politicians, whether left or right, elected around the world.

What this means for gold

Martin Armstrong — a legendary macro forecaster that I’ve followed for years — believes gold is the hedge against confidence in government. That said, despite rising dissatisfaction towards global governments, he isn’t bullish on gold yet and says it could fall below $1,000 before the next bull market starts.

There’s always a chance that could happen. But there are three big reasons why it likely won’t happen for years.

First, geopolitical risk continues to rise in Syria. The main players have become Turkey, Russia, the US and Syria. A shooting war has already started between a few factions backed by these counties. The situation could develop into a fully-fledged war between the US and Russia at any time.

That could send gold prices through the roof.

Second, don’t forget about Robert Mueller’s investigation into Donald Trump. He’s trying to prove Trump colluded with the Russians in the 2016 election. The Democrats also want to dethrone Trump.

For now, given recent news, it seems that Robert Mueller’s investigation may be coming to an end. But if Trump is eventually impeached by his witch hunt, gold could skyrocket US$100 per ounce in a day.

Finally, the debt cycle has entered its terminal stage — central banks are moving away from money printing and towards higher interest rates. Interest rates have moved higher in the US and the UK. Australia is looking at raising rates. Europe wants to end its money-printing program. The Bank of Japan has slowly reduced its bond purchases, which traders have described as ‘stealth tapering’.

Central banks are changing their monetary policies.

Higher interest rates should put more pressure on the global financial system in the years ahead.

Higher gold prices are coming

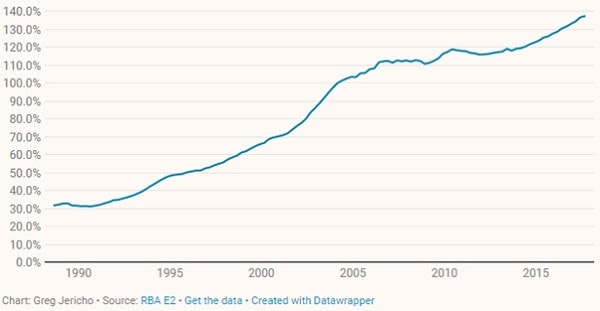

Australian households — similar to most other Western nations — already hold record amounts of mortgage debt. The level of housing debt is around 140% of disposable income. Take a look at the picture below:

Source: The Guardian

Click to enlarge

As interest rates move higher around the world, debt levels — including personal, business and national debt — should explode. People will likely find it more difficult to repay their mortgages and go about their daily lives. In other words, the financial system should show cracks which haven’t been seen since the Global Financial Crisis of 2008. Remember, money printing and ultra-low interest rates have kept the global economy on life support for over 10 years.

Gold prices could rise during a higher interest rate era.

Read more: Gold Cycles vs Property Cycles: When Will Gold Reach Peak Valuation?

I believe the yellow metal is a hedge against the sustainability of the financial system — not a collapse in confidence of government.

The yellow metal has rallied into every financial crisis since 1971. I showed two examples to Gold & Commodity Stock Trader readers on 11 January. Subscribers can read the details here.

Prior to 1971, gold was on a fixed exchange rate system. That said, adjusted for inflation, gold has surged into every financial crisis over the past 100 years.

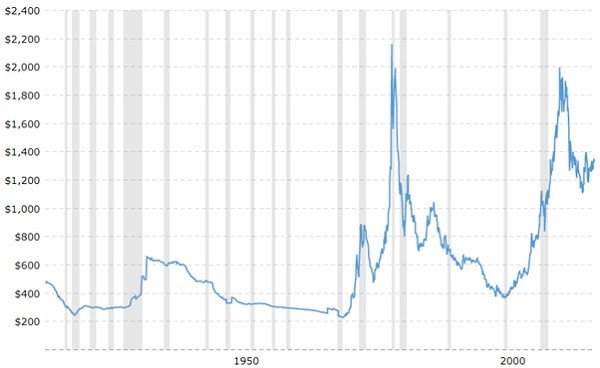

Check out the chart below:

Source: macrotrends.com

Click to enlarge

Every time the sustainability of the financial system was tested, history shows gold rallied in real terms (adjusted for inflation).

Heading into the sovereign debt crisis of 1931–33, when the gold price was fixed, the yellow metal tripled in real terms according to macrotrends.com. Homestake Mining Company — one of the world’s largest gold miners from the 19th Century to early this century — also skyrocketed during this time.

See the yellow line on the chart below:

Source: Safehaven.com

Click to enlarge

Homestake Mining Company’s share price surged — when most stocks were crashing —from 1929 to 1933. That said, when the sovereign debt crisis ended on 5 April 1933, the share price quadrupled from 1929. A US$10,000 investment in October 1929 would have turned into US$62,000 by December 1935.

Will gold stocks see similar results during the next sovereign debt crisis?

Perhaps.

But gold stocks are more likely to surge into and after the financial meltdown. That’s why we’re looking at a multi-year gold bull market in the making. Remember, gold was fixed and used as money (it could buy bread) during the Great Depression. That’s why capital flocked into gold shares at the time.

Gold was seen as money and equal to hoarding cash during the Great Depression. Homestake Mining Company was seen as a safe haven investment — it legally printed money.

People also hoarded gold until Franklin D Roosevelt signed Executive Order 6102 on 5 April 1933, ‘…forbidding the Hoarding of gold coin, gold bullion, and gold certificates within the continental United States.’

The financial system has changed over the past 100 years.

Gold is no longer used as money to buy bread — it’s an asset; one that floats freely on the foreign exchange market. That said, the yellow metal is still considered a safe haven by many. That’s why gold could move sharply higher into 2020, as money-printing policies phase out and interest rates rise around the world.

Remember, two days before the US Federal Reserve raised interest rates for the first time in December 2015, gold made a low at US$1,037 per ounce. It hasn’t looked back. So, gold could react positively to other major central banks raising rates.

The Fed plans to increase interest rates four times this year. The Bank of England expects to lift rates again in May, with more to follow. Australia is on the verge of higher interest rates. The European Central Bank and Bank of Japan are still a while away from lifting rates.

I expect the dark days for gold are coming to an end. The yellow metal could break out into a bull market later this year, while central banks gradually become more aggressive with monetary policies, and if Italy issues a referendum to leave the Eurozone. The yellow metal should start to skyrocket alongside debt levels when more central banks — similar to the Federal Reserve and Bank of England — put their foot on the throttle into 2020.

So, despite junior gold stocks being out of favour right now, the situation could change very quickly. That’s why, despite the multiple failed bullish calls on gold by pundits around the globe, you should take the precious metal sector seriously today.

To find the best junior gold stocks on the ASX — as well as a number of quality junior stocks in other commodities, including those riding the growing battery trend — go here now.

Cheers,

Jason Stevenson,

Resources Analyst, Gold & Commodities Stock Trader

Read more: Here’s How Inflation Could Surprise Everyone

Pingback: When to Buy Gold or Silver: The Ultimate Guide (Updated) - Gold Survival Guide