See why the further weakening of the New Zealand dollar is the number one reason to buy gold in New Zealand today. In this post you’ll see what might cause the Kiwi dollar to fall further. Along with why you should be concerned about the Reserve Bank of New Zealand (RBNZ) right now.

If you’ve read anything about gold in the news lately it will likely have been about how the gold price has been falling recently.

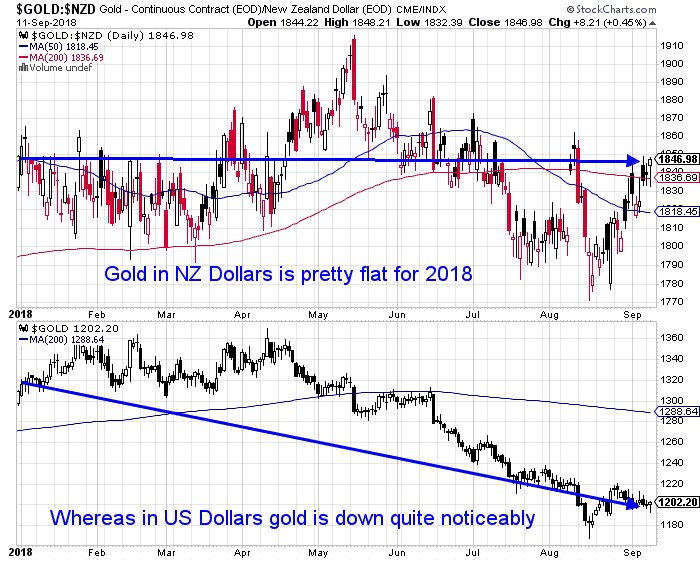

However here in New Zealand, that hasn’t really been the case. The chart below shows gold priced in NZ dollars in the top section and gold in US dollars below that.

The NZ dollar gold price is pretty flat for 2018. Whereas in US Dollars the gold price is down quite noticeably so far this year.

As we’ve said many times before it’s important to track the gold price in the currency in which you purchase gold.

>> Read more: Why You Should Ignore the USD Gold Price When Buying in New Zealand

The Reason That Gold in NZ Dollars is Holding Firm

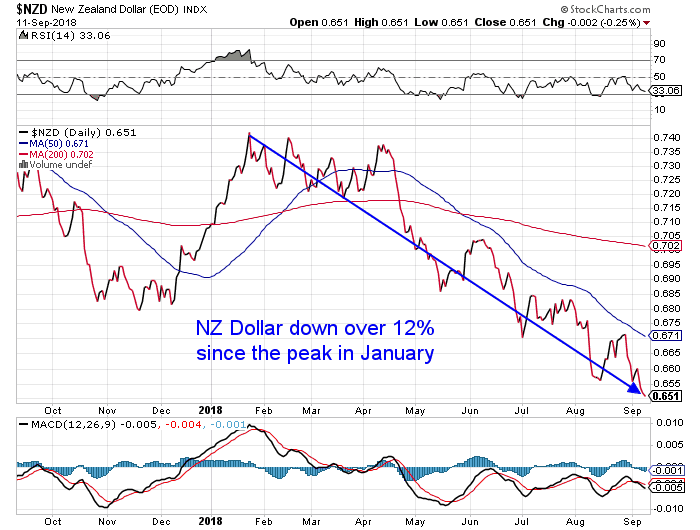

Gold priced in NZ dollars is holding firmly simply due to the sharp weakening of the NZ dollar so far this year. Down over 12% since its January peak.

This weakening NZ dollar has been a good reason to own gold in New Zealand over the past year. Protecting your purchasing power.

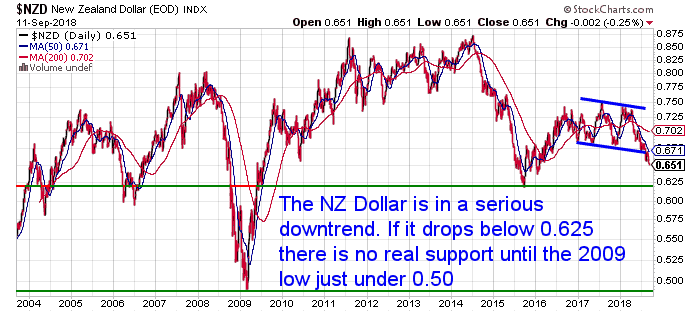

If you check out the chart below, the weakening NZ dollar could also be a good reason to own gold over the next year too.

Why?

Because the Kiwi dollar has clearly broken below the downtrend line that dates back to the start of 2017. This suggests a likely move to test the 2015 low for the kiwi just below 0.625 (top green line).

Why the NZ Dollar Could Fall Even Further

New Zealand May Be Affected By Contagion

However we believe there is a decent chance of the NZ dollar falling even further.

Currently there are numerous currencies in freefall against the US dollar.

- Argentina

- Venezuela

- Turkey

Now these might seem to be developing nations (at best) or perhaps more rightly considered countries run by tin pot dictators.

Surely New Zealand is nothing like these nations?

Well no at first glance almost certainly not.

However New Zealand can simply be impacted by contagion, as the plunging New Zealand dollar of 2008-09 showed.

The interconnected nature of the global financial system means that troubles in one country can impact many others.

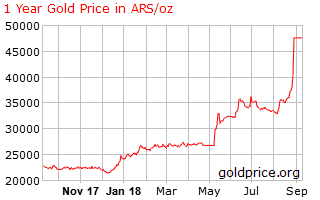

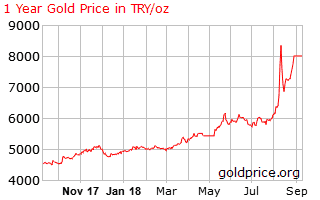

Here are some one year charts showing the price of gold in each of the above countries. They show how badly devalued these 3 currencies have been this year.

Gold Price in Argentina – 1 Year Chart

Gold Price in Turkey – 1 Year Chart

Gold Price in Venezuela – 1 Year Chart

Warnings Sign at the RBNZ

We also think there are warning signs emanating from the Reserve Bank.

The new Reserve Bank Governor Adrian Orr is garnering praise as sounding “pragmatic” and a “good communicator”. Probably important attributes in maintaining the confidence of the people we guess.

But there have been some alarm bells ringing.

In August we reported on the RBNZ monetary policy statement. We said:

…if annual GDP growth stays below 3% over 2019 and it’s clear growth is not picking up as expected, “the OCR would need to be reduced by around 100 basis points” by mid-2020.

That would take the OCR down to just 0.75% based on the current 1.75% level. Bear in mind this is in response to growth staying below 3% and “not picking up as expected”. Lower growth is hardly a financial crisis situation.

Then from an OCR of 0.75% it is not a massive leap to get to a negative interest rates or even quantitative easing scenario.”

Both of these are scenarios that the NZ central bank has clearly spelled out in recent months, but have largely gone unreported in the mainstream.

>> Learn more: RBNZ Prepared to Print Money and Implement Negative Interest Rates in a Crisis

These statements on negative interest rates and money printing are actually quite extreme for the RBNZ. Who by international standards has been a very conservative central bank.

Perhaps the aim of these recent information releases by the RBNZ was to push the NZ dollar lower? As a weaker Kiwi is meant to be good for exports. If so it has certainly worked.

But for the average person on the street, a weaker NZ dollar simply means he or she pays more for everyday goods. Oil prices are already rising and a weaker NZ dollar compounds this.

Numbers Now 50:50 for a Rate Cut by Mid 2019

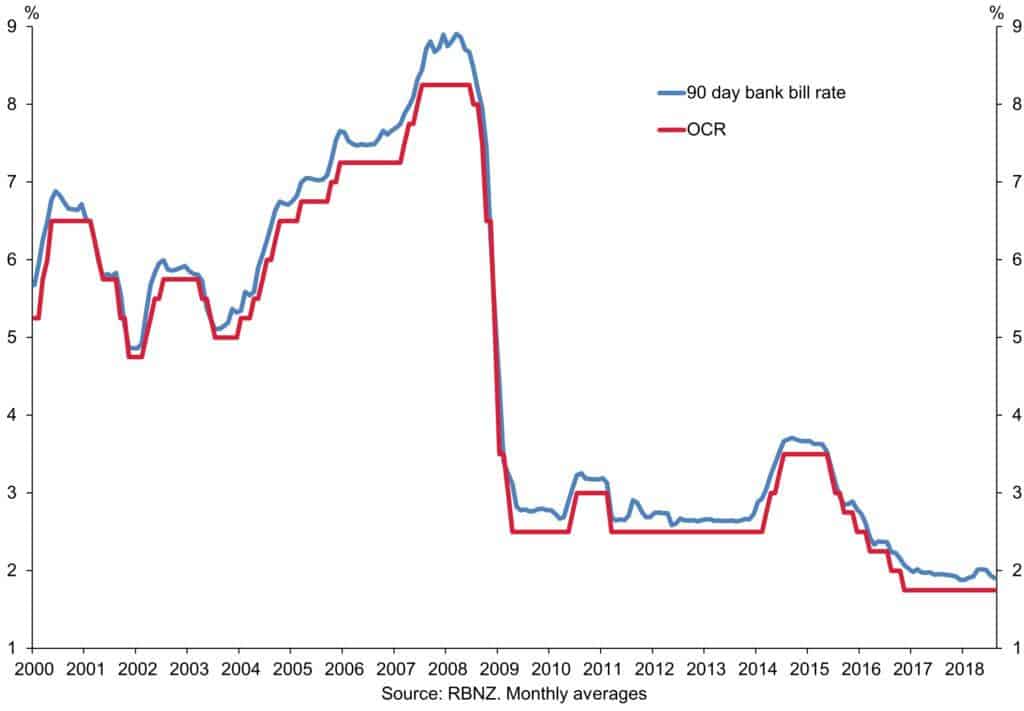

The overnight cash rate (OCR) has been on hold at the current 1.75% level since late 2016. Since then the Reserve Bank has been saying they would remain low for an extended period but the expectation was that the next move would be up.

However the latest numbers from the overnight interest rate swap market showed the market is pricing in a 50% chance of an interest rate cut by mid 2019.

This is a significant change. Bear in mind that until very recently the expectation was for interest rates to be lifted by the RBNZ.

The New Zealand dollar has been falling this year even while the OCR has stayed flat.

Meanwhile the US central bank is looking at two more rate hikes this year and another three next year.

If during this time we actually see an OCR cut by the RBNZ what will this do to the NZ dollar?

If the NZ Dollar Fell to 0.50 Again, What Would it Do to Gold?

In the earlier chart we showed how the NZ dollar has broken lower and now will likely test the 0.625 level. That same chart showed that below 0.625 there was little support until 0.50.

Were the NZ central bank to embark on a series of rate cuts from already record lows, there is a good chance of the 0.625 level being broken eventually.

If the New Zealand dollar was to fall to 0.50 again as it did in 2009, this could give gold a real boost. We believe protection from a weakening NZ dollar is the number one reason to buy gold in New Zealand today.

>> Related: Why Buy Gold: 14 Reasons to Buy Gold Now >>

A fall from the current rate of 0.65 down to 0.50 equates to a drop of 23%.

If the US dollar gold price stayed the same at say around $1200, this would result in a New Zealand dollar gold price of $2400. Around a 30% rise from current levels.

So simply buying gold can prove a great way to shield yourself from a devaluing of the local currency. It can even improve your purchasing power as the price of everyday goods rises in nominal dollar terms.

For more information on how to buy gold see: How to Buy and Invest in Gold >>

The RBNZ Has Left Raising Rates Too Late

Like many other central banks around the world, the New Zealand Reserve Bank has left it too late to start raising interest rates.

Of course ideally the interest rate should be set by the market not by old men.

But if rates are to be set by old men, then rates should have been raised while the New Zealand economy was growing strongly.

Instead we are at record low interest rates at a time when it seems likely the NZ economy is slowing down.

There will be little room to move when the next recession arrives. So the RBNZ’s seemingly unlikely talk of negative interest rates and quantitative easing is perhaps not that unlikely after all?

>> Related: Could Stagflation Happen Again?

Pingback: Is Now a Good Time Buy Gold in New Zealand? - Gold Survival Guide

Pingback: Why Buy Gold? Here's 14 Reasons to Buy Gold Now

Pingback: Rickards: The Lucky Country is Out of Luck - How About New Zealand? - Gold Survival Guide

Pingback: Gold Confiscation - Could it happen in New Zealand?

Pingback: Currency Charts Indicate an Asia-Pacific Slow Down

Pingback: Gold in NZ Dollars Hits New 6 Year Record High - Gold Survival Guide

Pingback: RBNZ Slashes OCR - The Race to the Bottom is Speeding Up and NZ Won’t Be Left Behind! - Gold Survival Guide

Pingback: Why New Zealand Won’t Have Any Say in a Global Currency Reset - Gold Survival Guide

Pingback: Are the Federal Reserve’s “Temporary” Money Injections Becoming Permanent? - Gold Survival Guide

Pingback: New Zealand Dollar Third Best Performing Currency Since 2001 - So Why Does it Still “Suck”? - Gold Survival Guide