Late Update – RBNZ Increases QE to $100 Billion

As we were about to hit send breaking news that the RBNZ just increased its currency printing from $60 billion to $100 billion. And extended the duration out to 2022.

RBNZ says a package of additional monetary instruments, including possibly a negative Official Cash Rate ‘must remain in active preparation’

The Reserve Bank has again put the foot on the accelerator with its quantitative easing programme, increasing it to $100 billion from $60 billion – although it has also increased the duration of the programme by another 12 months.

However, it has also indicated it is likely to “front load” its purchase of assets as the market for bonds is now bigger and central bank purchases would be able to absorb a bigger share now of the bonds without affecting market functioning.

Additionally, the RBNZ appears to be opening the door ever wider for the prospect of a negative Official Cash Rate.

Capital Economics Australia and New Zealand economist Ben Udy said the RBNZ had “sent its clearest message yet” that negative rates are coming.

“We still expect the Bank to wait until next year before bringing the OCR into negative territory, though the risk now is that the Bank moves sooner rather than later.”

Prices and Charts

The Correction Finally Arrives!

The correction for which we have been preparing has finally arrived today.

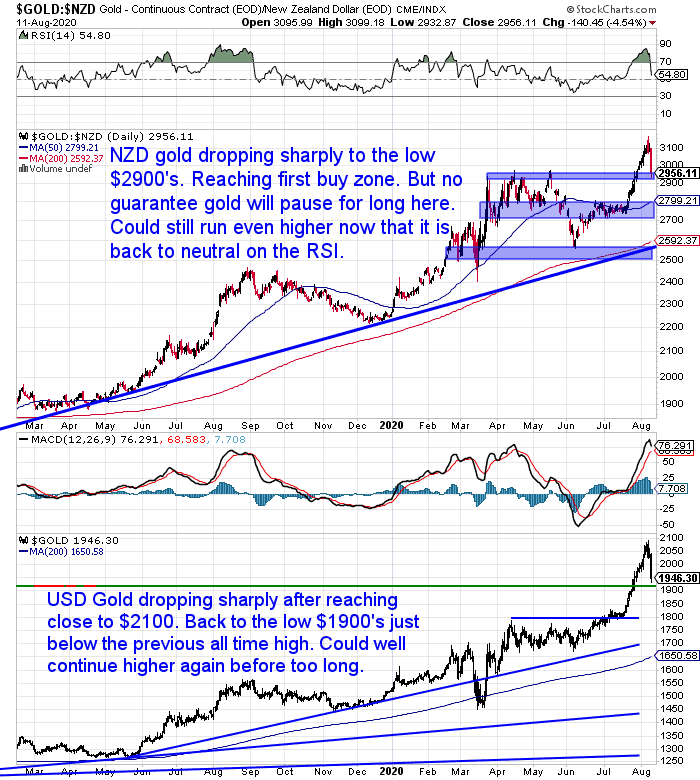

Gold is down around 5% from yesterday. Although compared to a week ago, NZD gold is down only about 4%.

Having got as high as $3150 during the week, gold priced in New Zealand dollars is today sitting at $2920. The price has reached the first of the buy zones marked on our short term chart below. Now will it reach the next one is the bg question?

We wouldn’t count on it. The RSI overbought oversold indicator is already back down to neutral territory. NZD gold is now sitting around the previous all time high from 2011. So this could be a decent support area.

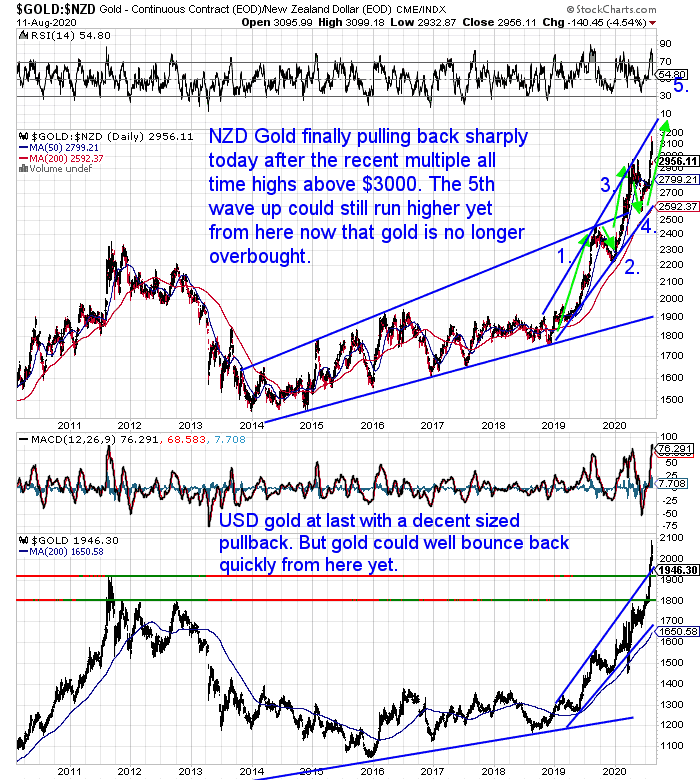

We also wonder whether this 5th wave up could have further to run yet. The 5th wave up in elliott wave theory (if you follow such theories) could have room to run higher yet if this is just a short pause.

How deep this correction will be is unknowable. So be careful about trying to pick the bottom. Consider breaking the amount you want to purchase into multiple tranches. Buy some now and keep some fund back in case of a deeper correction.

We also wonder whether this 5th wave up could have further to run yet. The 5th wave up in elliott wave theory (if you follow such theories) could have room to run higher yet if this is just a short pause.

How deep this correction will be is unknowable. So be careful about trying to pick the bottom. Consider breaking the amount you want to purchase into multiple tranches. Buy some now and keep some fund back in case of a deeper correction.

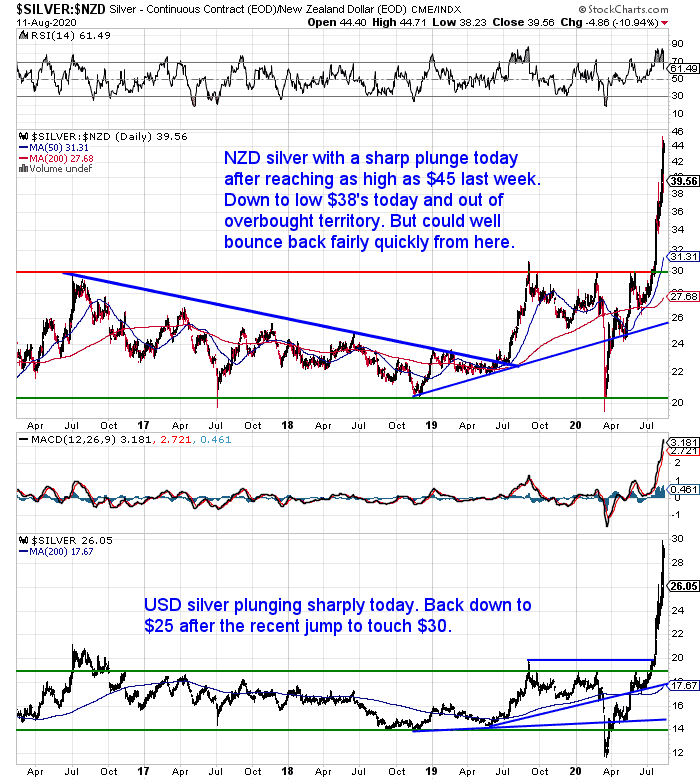

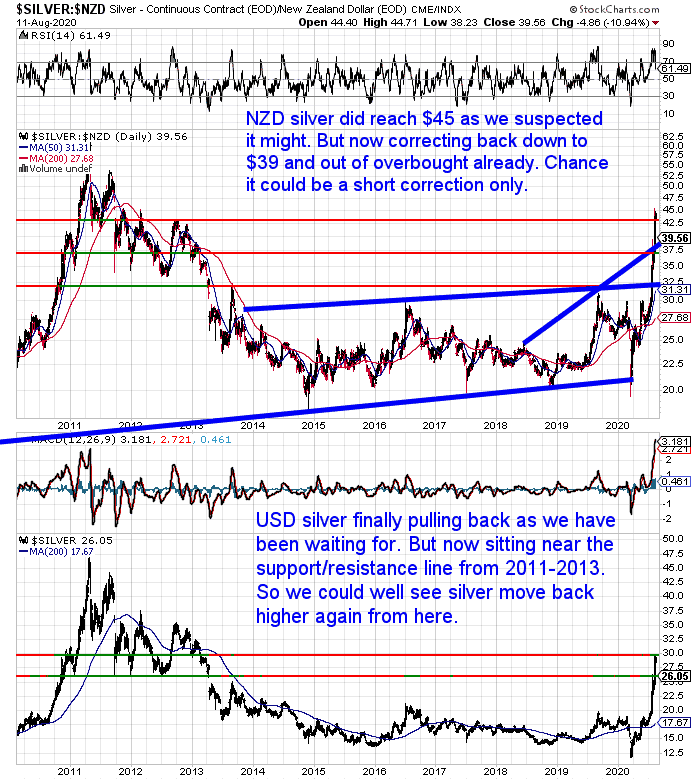

Silver Down 12% Overnight

Silver in New Zealand dollars is down 12% overnight. Whereas from last Wednesday silver is only down about half a percent. After reaching $45, as we suspected it might, NZD silver is down to $38 today. Retracing close to half the breakout move.

Like gold, silver is out of overbought territory already. So it’s an even bet whether we see lower prices yet, or whether silver starts moving higher again fairly soon.

Like gold, silver is out of overbought territory already. So it’s an even bet whether we see lower prices yet, or whether silver starts moving higher again fairly soon.

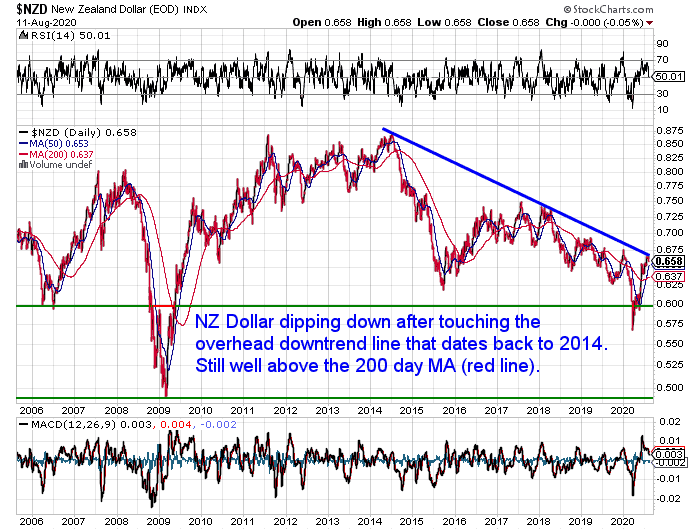

NZ Dollar Drifts Lower

The New Zealand dollar has taken a back seat to the movement in gold and silver this week. But the Kiwi is down close to one percent froma week ago. It could go lower yet too.

As Roger J Kerr points out, August is never a happy month for the Kiwi dollar.

“The New Zealand dollar has depreciated in value during August in nine out of the past 10 years.”

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

NEW: Certified Organic Long Life Emergency Food

This easy to carry bucket has 90 servings of organic breakfasts and mains

Free Shipping NZ Wide

Get Peace of Mind For Your Family NOW….

—– Question? If the US dollar Was to Crash How Do You Measure the Price of Silver and Gold?

The US dollar has been weakening in recent months against most other currencies. This has likely got people thinking about where this all ends?

This week we answer a question from a reader, “if the US dollar was to crash how do you measure the price of silver and gold?”

First we look at the 3 ways that a US dollar collapse could occur.

Then we look at 7 scenarios that could play out in the aftermath…

Gold vs Collectibles: Should I Sell My Vintage Car and Buy Gold if Inflation is Coming?

Also another question answered this week:

“Serious question related to future inflation. Let’s say you have a collectible car from the 1968 era currently has seen massive inflation over 10 years. Today would you hold or convert to PM?

I’m confused and foggy on what will happen in nz will collectibles increase or decrease in fiat terms or will it depend on a multitude of drivers? We have seen inflation accelerating in very recent weeks in terms of food already what will be next.

Any way what I’m really asking is, if you got a car worth 100k should I sell now? and get shinny stuff.

Not after advice I’m after an honest professional opinion.”

Obviously this is a question to which the answer may vary from person to person. But we have a crack at considering all the variables. Including:

- Collectible Car vs Gold in Inflation

- Collectible Car vs Gold in Deflation

- Collectible Car vs Gold in Stagflation

- Non-Monetary Benefits of a Collectible Car (and Gold)

- How has the Collectible Car Performed Compared to Gold Over the Last 2 Decades?

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Gold – A Doubt Infested Bull Market

This week Dan Denning had some interesting thoughts on the gold market. Granted, this was before todays huge plunge lower in gold and silver. But we think he has the “feeling” about right.

“…there is still a lot of doubt [about a precious metals bull market], even from hardened gold bugs. Why? Because we’ve seen this script before. Just when all of our arguments about fiat money and government deficits and sound money seem to be coming true, the central bank pulls out another fake ace from its sleeve or some mysterious large sell order appears in the futures market to smash the price of gold down.

What’s telling about the recent price action is that the four and five percent moves in the futures markets are to the upside. Since gold last peaked in 2011, big one-day moves have almost always been to the downside. The price action seems favourable as gold or silver reaches some technically significant point and then BAM! A big decline, often in the space of minutes.

Is this time different? Another telling data point is that 3.27 million ounces of physical gold were delivered on the first day of August on COMEX. Traders seem to be taking physical possession of gold. The ‘paper’ gold market, where huge short positions have traditionally existed (often the bullion banks themselves) are getting squeezed.

This could be another example of Thiers’ Law: good money drives out bad. When in doubt, take the gold. It’s good money. If the bears in the ‘paper’ gold market are under pressure, the upside for the gold price — in all currencies — could be much higher than anyone currently imagines. And I can imagine a LOT.”

We don’t know whether gold and silver will go much lower in this correction. We are much more confident that their prices in the long run will be, as Dan says, “much higher than anyone currently imagines”.

So to repeat ourselves, consider breaking up any funds you want to hoard gold and silver with, into a number of tranches. Then split your purchases over the coming weeks or even months.

Please get in touch if you have any questions about buying gold or silver.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Here’s how to always have clean fresh drinking water on hand.

The Sport Berkey Water Filter Bottle – $69 Delivered

Ideal for travel. Driving, camping, backpacking.

Free Shipping NZ Wide.

—–

|

Pingback: A Warning If Waiting For a Bigger Correction - Gold Survival Guide