Greg Canavan wrote last week in his excellent Rum Rebellion eletter that the Reserve Bank of Australia is destroying the Aussie economy.

It prompted us to have a think about how this compares to the New Zealand economy and ask a similar question: “Is the RBNZ destroying the New Zealand economy too?”

Here is what Greg had to say. Then below it we compare his Australian numbers to those here in New Zealand…

“…in global financial markets, it’s all about the ‘inversion of the yield curve’. That is, the 10-year bond yield is now below short-term interest rates. From the Wall Street Journal (WSJ):

‘The market’s most reliable recession indicator is finally flashing red. With the Treasury yield curve inverting on Friday—the 10-year yield fell sharply to be lower than the three-month for the first time since 2007—is it finally time to prepare for an economic downturn?

‘The answer is nuanced. It is true that the yield curve is the best forecasting tool for recessions, having inverted before each of the last seven recessions as measured by the National Bureau of Economic Research.

‘But the idea that the gap between short- and long-dated Treasury yields is a rock-solid predictor you can use for your portfolio positioning is mistaken in several ways.’

The author goes on to explain that the yield curve has inverted a few times in the past without a recession unfolding. That’s because the Fed cut rates sharply and the economy continued to grow.

The bizarre thing about this time around is that the Fed only just finished raising rates. The Fed funds rate is at its lowest point in history at the end of a tightening cycle.

And now, just a few months after the Fed finished tightening, the market thinks it will soon have to ease again. From the WSJ article:

‘The futures market on Friday intensified its bets on rate cuts after more weak economic data. Federal-funds futures put a 60% chance on rate cuts by December, with a 20% chance of two or more cuts.’

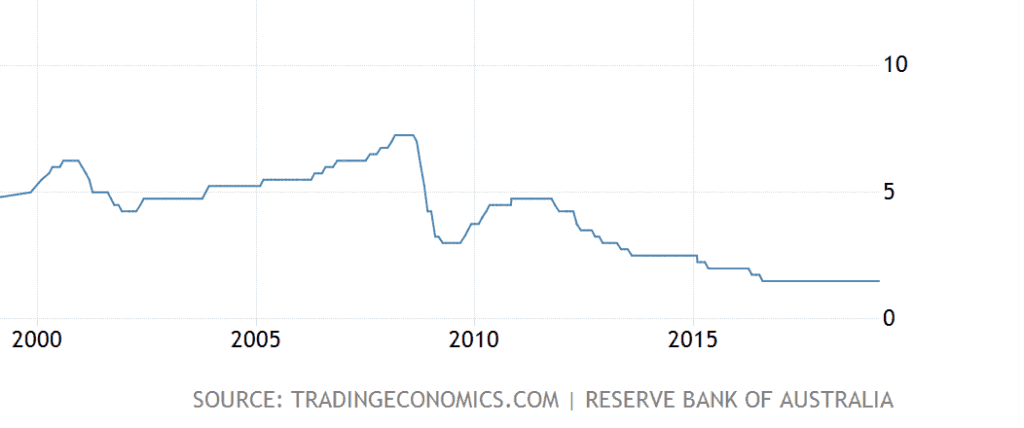

At least the Fed managed to raise rates a few times before they had to stop. In Australia, the RBA merely keep rates on hold throughout the recent global economic expansion. For the RBA, being on hold is the new tightening.

Rates have been on hold here since August 2016. Despite booming commodity markets (especially iron ore and coal), which increases Australia’s national income, the RBA has been too scared to tighten rates.

In a normal economy, rising national incomes via strong commodity prices forces the RBA to raise rates. The idea is that rate rises cool the domestic economy as money flows in from the commodity boom. This prevents a rise in inflation.

For example, the RBA raised rates from a post-GFC low of 3% in October 2009 to 4.75% in November 2010. This was in response to China’s stimulus and the consequent rise in commodity prices, particularly iron ore and coal.

The rise in rates gave the RBA plenty of ammunition to cut when things turned down again, which they did after commodities peaked in 2011/12. The RBA started cutting rates in November 2011 and kept on cutting…all the way to August 2016 to leave rates at 1.5%.

This may have kept the economy ticking over. But at what cost? Household debt is weighing on consumers more than ever. House prices went through a destabilising boom and are now falling.

And now, we find ourselves at the start of an interest rate easing cycle having not raised rates beforehand. This is unprecedented. It’s an indictment on modern central bankers, their flawed models, and their flawed theories.

The scary thing is, the real official interest rate in Australia (the nominal rate minus inflation) is negative. In other words, rates are highly accommodative. Yet the domestic economy is weak. Thanks to already high debt levels, monetary policy has lost its bite.

If it weren’t for China and healthy bulk commodity prices, we’d be in real trouble. When Chinese stimulus measures fade later in the year, expect more interest rate cuts from the RBA. Monetary policy may have lost its bite, but it won’t stop the RBA trying to preserve its relevance.

The reality is that the central bank is slowly destroying the Aussie economy, by altering its structure and impacting productivity.

The weird thing is, no one seems to care. These bureaucrats remain as venerated as ever…

Source.

RBA Interest Rate Since 2000

How Does New Zealand Compare? Is the RBNZ Destroying New Zealand Too?

That is a pretty damning indictment of the Australian central bank. How does New Zealand compare? How has the Reserve Bank of New Zealand (RBNZ) done since the financial crisis of 2008?

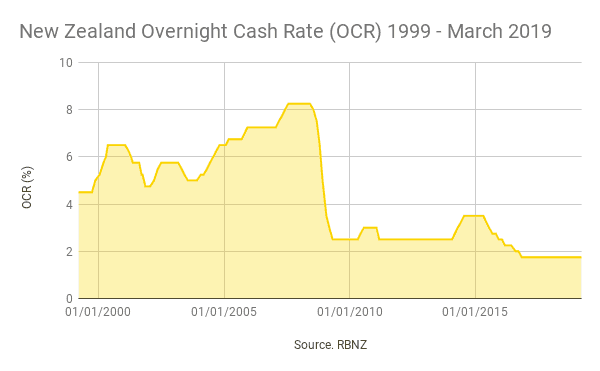

In New Zealand interest rates were cut in response to the financial crisis from 8.25% in 2008, all the way down to 2.50% in April 2009.

The New Zealand central bank did manage to get them back up to 3.00% in the second half of 2010. However by March 2011 the official cash rate (OCR) was once again back down to 2.5%.

Despite a growing economy, interest rates stayed at 2.5% right through to March 2014.

In fact it was in January 2014 when HSBC chief economist for Australia and New Zealand, Paul Bloxham – coined the phrase “rockstar economy” for New Zealand. As the New Zealand economy was reported as being one of the strongest in the world.

By July 2014 the RBNZ had managed to increase rates up to 3.5%. However despite the “rockstar” status they were once again cutting rates in June 2015. By November 2016 New Zealand interest rates were at all time record lows of just 1.75%.

New Zealand Still at Record Low Interest Rates Despite the “Good Times” We’ve Seen

For the past couple of years we’ve heard talk of the next rate rise not being too far off. Despite this rates have remain stuck at the record low of 1.75%. Remember the current interest rate is even lower than during the aftermath of the financial crisis! And these are meant to be the “good times”.

Now New Zealand appears to be slowing. The last announcement from the RBNZ was an about face, pointing to the next interest rate move being down rather than up. Something that we’ve been saying is far more likely than economists have been reporting.

So to us the RBNZ looks to have done no better than the RBA. Maybe they’ve done even worse! As Greg says, with the RBA, being on hold may have been the new tightening. For the RBNZ it seems like cutting has been the new tightening!

Perhaps we’re being a bit harsh. Afterall the New Zealand Central Bank did manage to increase rates by 1% from 2014 to 2015. But then they reversed course sharply to cut to the current record lows.

So just like the RBA, the RBNZ has also been too scared to raise interest rates.

Also just like Australia these record low interest rates have goosed the economy. House prices have risen sharply and a policy of high immigration has also helped prop up the economy.

House Prices Are Softening

But now house prices are flattening out. In Auckland recent data shows that the number of Auckland homeowners selling their properties for less than they paid for them has doubled over the past year. 7.2 percent of sales in the first quarter of this year have actually resulted in a capital loss for Auckland property owners). Source.

Managing director of Devon Funds, Slade Robertson, was also quoted in a recent New Zealand Herald article saying (Emphasis added is ours):

‘Historically, Auckland follows behind Sydney by about 12-18 months and their property market is currently falling sharply.

Unfortunately, the negative momentum across the Tasman appears to be accelerating. Recent auction clearance rates in Sydney have collapsed and during October traded towards levels last seen in the GFC (in the 30 per cent range).

With our household debt to GDP now sitting at 92 per cent we are highly sensitive to any Sydney-like downturn.’

Household Debt Also at Record Highs

When we look at household debt as a percentage of income it looks even worse.

Taylor Kee at Money Morning NZ reports:

“According to RBNZ data, …Between 2014 and 2019, household debt as a percentage of income has jumped from 153% to 164%.

For reference, the Eurozone has an average debt-to-income of 94%.

What does this mean?

Kiwis owe a lot and make a lot less. It locks them up in a long-term pattern of servicing that debt…and reduces their ability to react to market events.

In other words, debt makes you vulnerable to crashes.

You have less room to cut back on your spending because you’ve got to service that debt no matter how the market performs.

For some, they considered that when they decided to take on debt…and built in a cushion. They borrowed less than they could afford. So if things get rocky, they still have some room to breathe.

…It’s a scenario that the IMF warns could have explosive consequences if it plays out. Here’s what the IMF stated in a recent overview of New Zealand’s economy:

‘Household debt remains high under the baseline outlook and would amplify the impact of large downside shocks, notwithstanding recent improvements in its risk structure after macroprudential policy intervention. Such shocks could also trigger a disruptive housing market correction.’

Amplified shocks triggering market-wide corrections. It’s not a pretty picture.

But it is a very real threat to you and your wealth right now.

Perhaps you’re vulnerable and you have debt up to your eyeballs. Consider stress-testing your financial future…see how you’d fare if things go south. If your stability cracks under the stress, it might be a good time to consider focusing your efforts on paying off some of your debt burden.”

Source.

Real Interest Rates in New Zealand Are Also Negative.

Inflation is running at 1.9% currently while the interbank lending rate is also under 2%. So inflation is higher than lending rates. Meaning real interest rates are negative.

What Does This All Mean For New Zealand?

Just like Australia it seems we are now at the beginning of an interest rate easing cycle with rates at record lows already. This is unprecedented. Along with household debt likely to be an albatross around the neck of the average Kiwi.

We agree with Greg Canavan that this is an indictment on modern central bankers, their flawed models, and their flawed theories.

Like Australia we have been aided by China and their appetite for our commodities.

But we also will be at the mercy of any slowdown in China.

Perhaps if we’re lucky not as bad as Australia. As Satyajit Das pointed out a few years ago, the demand for our food and agriculture products may not diminish quite as much as for the metals and construction ingredients that Australia exports.

The RBNZ is sure to react to any slow down just as every other central bank has done to date.

Kiwibank economists are even now saying that an OCR of 0.75% is possible as soon as next year.

‘OCR of 0.75% possible next year and a volatile descent for NZ currency’

Kiwibank economists say there’s a 40% chance the Reserve Bank might have to continue cutting interest rates next year, while they see the New Zealand dollar possibly dropping into the US50sKiwibank’s economists see a fairly strong chance that the Official Cash Rate will go as low as 0.75% next year, while they’re predicting that the Kiwi dollar, “our beautiful bird”, is about to be “broken”. In a Kiwibank ‘Our Take’ publication, chief economist Jarrod Kerr says he’s confident interest rates will fall further “and remain at or below historic lows for a very, very long time”.

Source.

Kiwibank chief economist Jarrod Kerr is also calling for the government to spend up.

“Governments could be building infrastructure by borrowing money at interest rates that are “ridiculously low,” he argues.

“A 10-year government bond rate at 1.80%, that’s the lowest we’ve ever seen. The government could issue billions of dollars at that rate and I think just about every construction worker in New Zealand could come up with a project that could easily cover that very, very low hurdle with interest. And we desperately need a lot more infrastructure in this country.”

He also argues that sharp rate cuts will drop the Kiwi dollar to 0.60 which would be a “win” for exporters. But as we’ve argued before a lower dollar actually hurts the average guy or girl in the street.

What Will Happen in New Zealand From Here?

So in summary here’s where we think things are heading… Here’s our best guess anyway:

- The Reserve Bank will indeed cut interest rates much further than they are.

- The government is likely to do just what Kerr wants – which is spend a lot more money. All in the name of “stimulating” the economy.

- Money printing in New Zealand remains a distinct possibility down the track once rates get close enough to zero.

- We might see “Q.E. for the people” where the government prints money to fund different projects as opposed to just shore up bank balance sheets.

- This is what will then lead to higher inflation or more likely stagflation.

Do you have your wealth insurance in place for what lies ahead?

Buy gold today while prices remain flat.

Pingback: Gold in NZ Dollars Hits New 6 Year Record High - Gold Survival Guide