We pointed out late last year that it was likely a good time to buy gold and silver as it appeared they might have bottomed already. And that buying at the end of the year had historically been a good time to buy as the price of gold was usually higher at the end of the next year.

This proved to be correct with gold and silver rallying from mid December to early January.

This piece of technical analysis below from Richard Smith indicates that a continuation of the stealth rally in gold is now looking quite likely and how gold may even continue to move higher for the next 7-8 months…

The Stealth Rally in Gold Continues

From Richard Smith, Founder, TradeStops:

Nobody is paying attention to gold these days as bitcoin and other cryptoassets have stolen gold’s gleam. Meanwhile, gold is mounting a quiet rally and that’s a very good sign for our favorite metal.

We’ve been bullish on gold for well over a year now and so far, we haven’t been disappointed. Since we last alerted you to the stealth rally in gold just six weeks ago, the price of gold has risen over 5%. This is almost as much as the well-publicized move higher in the S&P 500 over the same period of time.

Gold triggered a Stock State Indicator (SSI) Entry Signal last April and has slowly been moving higher. The high for the past year was in September at $1,346 and it looks as if gold may well push past this soon, which would be a very encouraging sign.

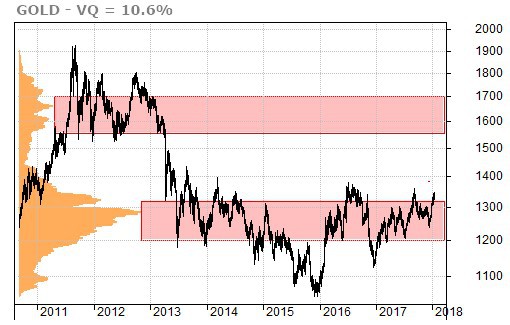

The volume-at-price (VAP) chart for gold shows this most recent break above $1,300. It’s the fifth time since 2014 that gold has pushed above this strong resistance level. Each time before, it has come back down. Could this time be the one that finally pushes gold back above $1,400?

We think so.

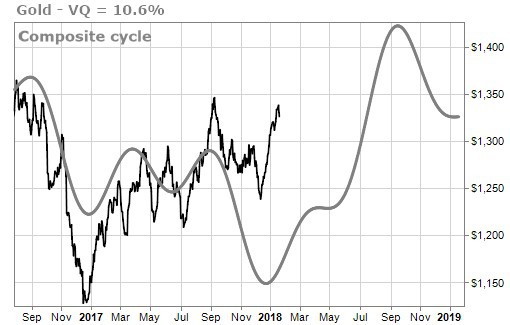

The time-cycle forecast for gold supports the continuation of the uptrend. The forecast that we published last March has been very accurate.

If the forecast continues to be accurate, we could see gold move higher for the next 7-8 months.

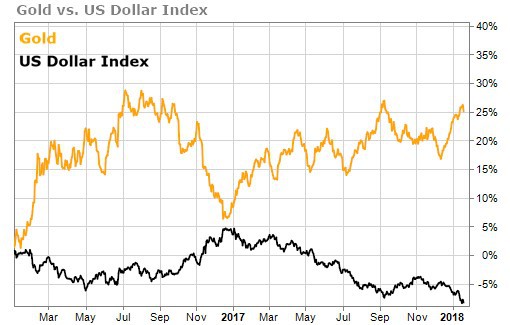

The price of gold is heavily correlated to the price of the U.S. dollar. They have an inverse relationship. As the dollar has been dropping, the price of gold has been rising.

There’s a good chance that this inverse relationship will continue in gold’s favor.

Related: To learn more about using technical analysis to help with timing when to buy gold and silver see: Gold and Silver Technical Analysis: The Ultimate Beginners Guide

Later this week, we’ll look at how this rally in gold has affected the gold miners and see if there are any opportunities that could be advantageous for investors.

The winds seem to be lined up behind gold’s sails and we could see it cross the $1,400 mark in the near future. The continuing focus on cryptocurrencies should allow gold to stay under the radar for a while. Under the radar and moving higher is a good combination.

Good investing,

![]()

Richard Smith, PhD

CEO & Founder, TradeStops