|

LIMITED QUANTITY GOLD SPECIALS GOLD KIWI 1 oz COIN

1oz NZ Mint 99.99% Gold Kiwi Coins Normally priced at Spot + 5.7% at NZ Mint. Through us: Packaged Gold Kiwis: (Approx $1764) (40 in Stock) ***** PERTH MINT 1 oz GOLD BARS 1oz Perth Mint 99.99% Gold Bars In Green Packaging Approx $1783 (12 green in stock; black sold out) Ph 0800 888 465 and speak to David or reply to this email. |

This Week:

- Good Time to Buy Gold in NZ Dollars

- One of America’s Largest Companies is Stockpiling Food and Gold for the Next Financial Crisis

- Economies Across the Globe are Slowing Down

- NZ Likely is Too

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1684.40 | – $42.09 | – 2.43% |

| USD Gold | $1108 | – $48.40 | – 4.18% |

| NZD Silver | $22.97 | – $0.87 | – 3.64% |

| USD Silver | $15.11 | – $0.86 | – 5.38% |

| NZD/USD | 0.6578 | – 0.012 | – 1.79% |

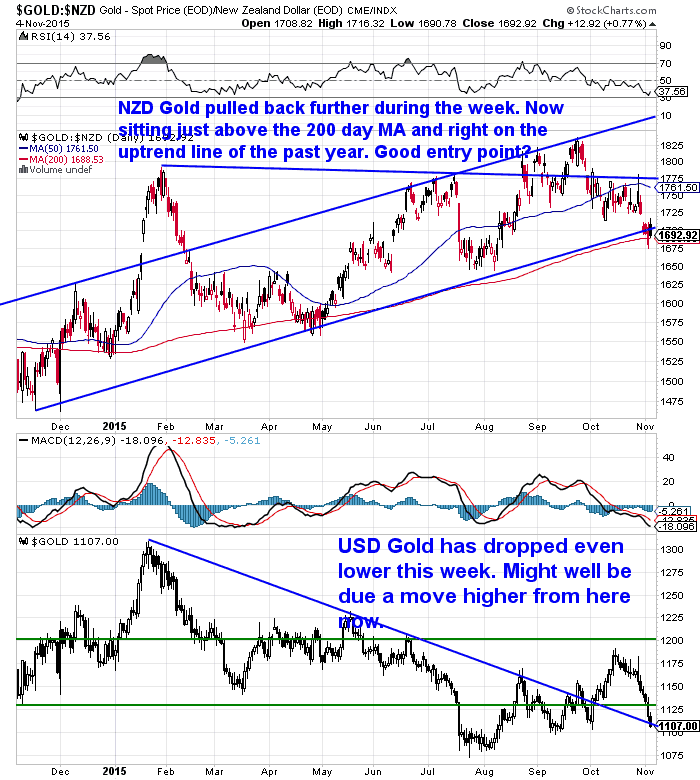

Good Time to Buy Gold in NZ Dollars

Precious metals took a tumble this week. Gold in NZ Dollars was down 2.43%, while NZD silver fell 3.64%. The Kiwi dollar also weakened which arrested the falls somewhat here in NZ.

Looking at the gold in NZ dollars chart below, this puts the current price at what looks to be a very good buying zone.

Why?

Because it is sitting just above the 200 day moving average (MA) – the red line. You can see the 200 day MA has proven to be good support over the past year.

The current price is also right on the blue uptrend line of the past year. While there are no guarantees, if things continue within this same upwards trending trading range that would make the current price a good entry position if you have been considering buying.

The fact that we are approaching oversold levels in the RSI indicator also backs up the notion that we could see the price turn higher from here.

The USD gold price also looks ready to turn back up after falling for the past 3 weeks.

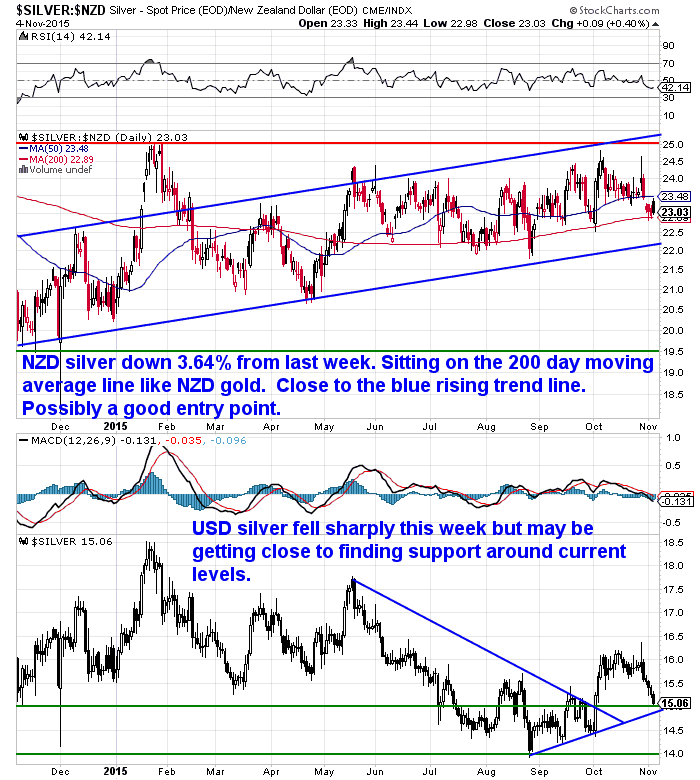

NZD silver is in a similar position

Like gold silver is also sitting just above the 200 day moving average. Although there is possibly room for it to move a little lower into the low $22 range and test the rising blue trend line It has held above for the past year.

But in the long run around this level could well be a decent entry point for silver too.

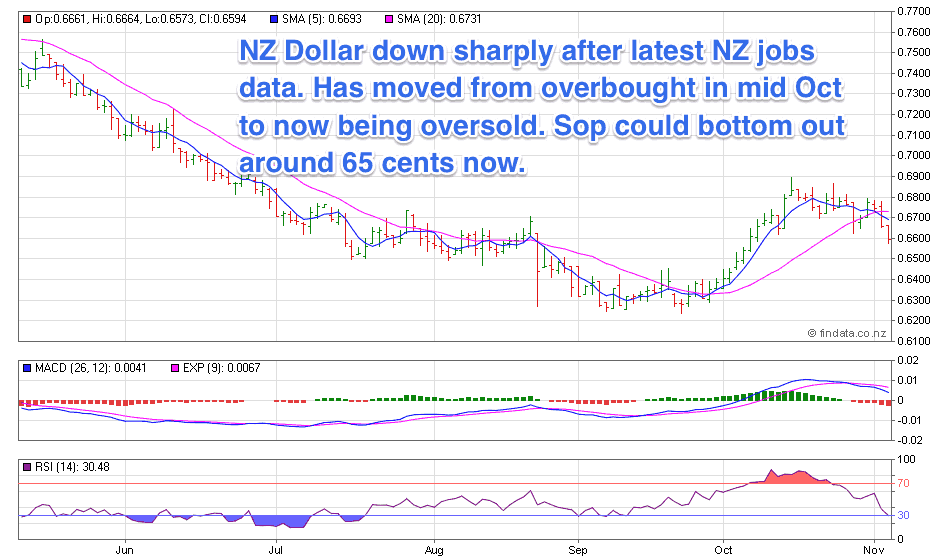

The NZ dollar is down 1.79% on last week. It seems the worse than expected employment numbers here in NZ prompted a few to sell the Kiwi. More on that below.

Economies Across the Globe are Slowing Down

A number of reports out this week indicate that things are slowing up just about everywhere you look.

Casey Research reports that:

“South Korea is flashing warning signs of a global recession…

South Korea is known as a “canary in the coal mine” for the global economy. The country is a major exporter of cars, mobile phones, and personal computers. It’s also the 11th-largest economy in the world. It has a bigger economy than Australia, Russia, Spain, or Mexico.

Last month, South Korean exports plummeted 15.8%. It was the country’s largest monthly drop since 2009. It was also the tenth month in a row that South Korean exports dropped from the previous year.

Many South Korean companies blame the huge drop in exports on China’s slowing economy. China is, by far, South Korea’s largest trade partner. The country sends 25% of its exports to China.

• China’s slowing economy is dragging down the entire region…

Last year, China’s economy grew at its slowest pace since 1990. And last month, China’s services sector grew at its slowest pace in seven years.

China’s factory output also fell for the eighth straight month in October. Yesterday, Bloomberg Business said China’s manufacturing activity hasn’t been this slow since the global financial crisis. Factory orders in Indonesia, Malaysia and Taiwan are shrinking as well.”

The Daily Reckoning had similar news out of the USA, Europe, Germany and China in an email this week too…

“Seven years and $4 trillion worth of quantitative easing after the financial crisis of 2008, American manufacturing hasn’t returned to pre-crisis output or employment levels. And it’s showing few signs of improvement…

According to a Monday report by the Institute for Supply Management (ISM), U.S. manufacturing grinded to a halt last month.

As Bloomberg reports, the ISM’s index weighed in at 50.1 — “the weakest since May 2013, after 50.2 in September.”

Fifty is considered the dividing line between contraction and expansion, so U.S. manufacturing is essentially flat. Moreover, manufacturing employment contracted unexpectedly…

…Manufacturing isn’t only declining in the U.S. these days. Despite the extraordinary central bank interventions going on around the world, global manufacturing is going nowhere.

Massive monetary stimulus from European and Chinese central banks has done little to spark factory growth. Germany’s manufacturing sector grew at the slowest pace in three months in October, for example.

For German plant and equipment makers, total orders fell 13% year over year in September. And while domestic business rose 1%, export orders plunged a full 18%.

Not much to show for the European Central Bank’s (ECB) efforts. It’s been injecting 60 billion euros of new money a month over the past six months through its own version of QE. It plans to invite over a trillion new euros to the party before it’s over.

Meanwhile, Chinese manufacturing is contracting. Its manufacturing index weighed in at 49.8 for October, its third consecutive month in contraction territory.

This despite the herculean efforts of China’s central bank to pump life into the economy. It’s already cut interest rates six times in the past year. And China’s state-owned enterprises took on about 6 trillion yuan — about 1 trillion dollars — of debt in September.

But the patient isn’t responding like it used to. As Zero Hedge puts it:

The Bond Market Also Sees Low Odds of a US Fed Interest Rate Increase This Year

The talk may be of a rate hike in December. But the bond market sees just a 1-in-3 probability of a rate hike in December. Plus the odds are only 50-50 for a rate hike next March according to expectations from the bond market.

Author and trading teacher Van Tharp, also reckons the odds are low of an interest rate increase. With deflationary forces still prevailing he thinks it will be tough for the central planners to raise rates:

“Fed officials are still talking about possibly raising interest rates in November or December 2015. I’m not sure that’s going to happen.

Also notice in the chart below that banks are still not lending money — which is a deflationary force. This chart, from the St. Louis Fed’s website, shows the M-1 money multiplier at about 0.74 which means banks are lending about 75% of the money supplied by the Fed. The money multiplier actually needs to be much higher than that, however, to really stimulate the economy (and bring back inflation). To put the figure in perspective, the money multiplier was over 3 back in the mid to late 1980s and in the years leading up to the global financial crisis, it was twice as high as it is now.”

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Our sister site Emergency Food NZ is once again finally back in stock with all long term freeze dried food packages. We also have a few new emergency preparedness products in stock too. You can learn more about them here.

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $265 you can have 1 months long life emergency food supply.

Learn More.

—–

Jim Rickards: Global Trading Economy Shrinking – Recession Coming

Jim Rickards is also seeing similar evidence of a slow down in global trade:

“China is slowing and taking the world down with it.

Excluding the financial crisis years of 2008-09, Chinese growth is now at the lowest level in over 10 years. These are the official figures; most analysts estimate that actual growth is significantly lower than these figures show. China is over 10% of global GDP. If China slows by a third, that takes 3.3% off of global GDP.

That’s enough to put the entire world into a technical recession.

How will central banks stop the recession when they’ve used up their dry powder fighting the currency wars?

U.S. interest rates are already zero. Japanese interest rates are zero also. European interest rates are negative. All of these central banks have printed trillions of dollars in their respective currencies under various QE programs. They are at the point where they simply cannot print trillions more without risking political backlash or the collapse of confidence in their currencies.

What this means is that the recession cannot be stopped. It will have to run its course over the next year or so.

All sectors of the economy will be affected, but some sectors will be hit worse than others. The service sector may hold up slightly better. Manufacturing and tradable goods tend to get hit the worst.

One of the signals that IMPACT is picking up is the shrinkage in world trade. Investors tend to focus on trade deficits and surpluses, but those figures mask the fact that overall trade is shrinking.

You can have a reduced trade deficit but still find that exports and imports are both shrinking. The lower deficit sounds like good news, but the reduction of imports and exports is troubling. It means the global trading economy is shrinking: a sure sign of recession.”

NZ Job Numbers Also Point to Slow Down

Back here in New Zealand the latest numbers are also pointing to a slow down locally much more than most bank economists expected.

ASB yesterday reported on the latest labour force survey, which surprised them and others including the RBNZ with weaker than expected employment numbers:

“Employment contracted by 0.4% over the quarter, in contrast to widespread expectations for modest growth.

The unemployment rate ticked up to 6%, and would have been higher if it wasn’t for a 0.7% fall in the participation rate, to 68.6%. By our calculations, if the participation rate had remained at 69.3%, the unemployment rate could have been 6.8%!

Wage inflation is weak, and is expected to remain so. We think the RBNZ should cut the OCR again in December.

Last quarter we were surprised by soft 0.3% quarterly employment growth, which was at odds with several employment indicators. This quarter we were even more surprised by the 0.4% fall in employment, and the broad weakness in the Q3 employment data, even though we were factoring in some slowing in annual employment growth as employment indicators were suggesting.”

If you want a full run down here’s an article covering the NZ jobs numbers in full.

As noted earlier these numbers served to knock the Kiwi dollar over a cent lower.

Dairy prices falling again in yesterdays auction by 7.4% also didn’t help. According to this report the lower volumes here are being offset by more production in Europe so it’s likely prices will remain down for a while yet.

All this data suggests tougher times ahead. How will central bankers react?

Stand aside and let the chips fall where they may? Hardly!

As possibly our favourite financial writer Bill Bonner notes they likely have much more up their sleeves yet.

Sweden is shaping up to be the first country to plunge its citizens into a fascinating – and terrifying – economic experiment: negative interest rates in a cashless society.

The Swedish central bank, the Sveriges Riksbank, on Wednesday held its benchmark interest rate at -0.35%, the level it has been at since July.

Though retail banks have yet to pass that negative rate on to Swedish consumers, they face increased pressure to do so as long as the rates remain where they are. That’s a problem, because Sweden is the closest country on the planet to becoming an all-electronic cashless society.

Remember, Sweden is the place where, if you use too much cash, banks call the police because they think you might be a terrorist or a criminal. Swedish banks have started removing cash ATMs from rural areas, annoying old people and farmers. Credit Suisse says the rule of thumb in Scandinavia is: “If you have to pay in cash, something is wrong.”

A resistance is forming, and some people are protesting the impending extinction of cash. Björn Eriksson, former head of Sweden’s national police and now head of Säkerhetsbranschen, a lobbying group for the security industry, told The Local, “I’ve heard of people keeping cash in their microwaves because banks won’t accept it.”

Alert readers will recognize this negative interest story as one we have been following. We believe it won’t be long before we have negative rates in the U.S., too.The feds will pivot to even stricter controls on cash to gain more control over the economy and practically unlimited power to tax and spend – without congressional approval.

Sweden is ahead of the U.S. feds on this one. We can only hope it goes far ahead, fast, and blows itself up before the U.S. pivots down that path, too.”

What’s Next: Deflation, Inflation, or Hyperinflation?

We’ve also been reporting on negative interest rates and other new fangled ways to “help” economies out such as “People’s QE” or “helicopter drops”. But how will all this play out? There’s talk of inflation, deflation, hyperinflation. Heck we’ve even seen hyper-deflation mentioned!

During the week one of Bill Bonners readers had a stab at offering his or her 2 cents worth on how things could progress from here. (Sorry to double up on Bill, but we’ve been enjoying his musings a lot lately!)

“The current situation (with zero and even negative interest rates… and debt expanding much faster than GDP) can’t go on.

It had a beginning, in the early 1980s. It must also have an end.

Most of the guesswork is now focused on when and how that end comes.

Recently, one of our dear readers summarized the three major points of view, along with one minor one:

Harry Dent is in line with the Austrian Business Cycle Theory: Money printing causes financial bubbles, distorts the economy, and is therefore counterproductive.Like Bob Prechter (I don’t follow him closely, but his argumentation sounds similar), Dent bets on deflation and depression.Fighting debt deleveraging and demographics is like putting yourself in front of a tsunami.

In such an environment, the U.S. dollar would gain purchasing power, and gold would underperform significantly. (Harry sees it back to $700 in 2018-19.)

Cash/T-bills/short-term Treasurys are the place to be. Rates will stay low for very long.

Inflation Camp

Jim Rickards’ thesis – “inflate debt away via a massive issuance of SDRs after China has joined the club” – is also very credible.

World currencies are massively diluted via issuance of SDRs, which serve only the powers that be. Rather than a new gold standard, this is the solution to Triffin’s dilemma (more flexibility for the elite).

[Triffin’s dilemma describes the constant need for the global reserve currency issuer – in this case, the U.S. – to supply the world with reserve currency by way of a long-term trade deficit. Eventually, argued Yale economist Robert Triffin, this would lead to a loss of confidence in the reserve currency.]Citizens are excluded/not allowed to own SDRs. Their purchasing power shrinks. They don’t know who to blame.

The IMF does not consist of elected officials, and the majority of the population doesn’t even know it plays a role in creating inflation. And they can pretend that they have to save the world, too. (Remember the Greek bailout?)

Hyperinflation Camp

Shadow Stats’ John Williams is having a really hard time fighting for his ideas. He is right about the “CPI-CP Lie” and the current true state of the economy. But whoever invests along his ideas is running out of capital to stay in the game.

Peter Schiff and Mike Maloney are on a similar line. The problem with them is that they have a conflict of interest with their businesses. But I have no doubt about their integrity: They do/live what they say.

Deflation to Hyperinflation Camp

I recall an interview with Nassim Taleb on Bloomberg TV in 2009 when he said, “We will go from deflation to hyperinflation without seeing inflation.”

So what did Bill reckon about these various possible outcomes?

“Tokyo to Buenos Aires

Our view is that Taleb will be proved right.

Back in 2009, we predicted “Tokyo… then Buenos Aires” – a Japan-like deflation, followed by Argentine-like hyperinflation.

Most likely, there will be no stop in between for moderate levels of inflation.

Inflation, as economist Milton Friedman observed, is “always and everywhere” a monetary phenomenon. But hyperinflation is a political phenomenon.

It is caused by those same authorities the masses think they can trust. When they are threatened, they will protect themselves by printing money on a scale we haven’t seen since the War Between the States. (Consumer prices in Richmond, Virginia, had risen 6,700% by the end of the war.)

There are times when printing money seems like the best course of action – especially for the people running the printing press. It may not do the common man any good, but it gets the feds out of a jam.

But that is a long story… and one for the future.

We’re still in a Japan-like long, slow slump. And it looks as though we’re going to be there a while longer. “

So the overall view we’re getting is that things are slowing down across the globe. Here in NZ we’re also seeing the impacts of this. Who knows how long this will take to play out, but most won’t recognise it until after it has happened.

Meanwhile local prices of financial insurance (gold and silver) have pulled back and sit at levels that potentially offer a lower risk point of entry. Check out the charts again at the start of today’s email to see that.

So if you’ve been sitting on the fence, now could be the time to at least get a quote and see how much tangible wealth you can swap your dollars for.

Free delivery anywhere in New Zealand

With demand dropping off lately the premiums above spot for silver maples have come down.

So the price for a monster box of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, fully insured is $14,320. Delivery is now about 3 weeks away.

— Prepared for Power Cuts? —

[New] Inflatable Solar Air Lantern

Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

See 6 more uses for the amazing Solar Air Lantern.

This Weeks Articles:

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|