This Week:

- The Yield Curve Recession Predictor: Impact on Gold?

- The Next Gold Bull Market Looms

- Saxo Bank’s CIO: Now Is The Time To Be In Capital-Preservation Mode

Prices and Charts

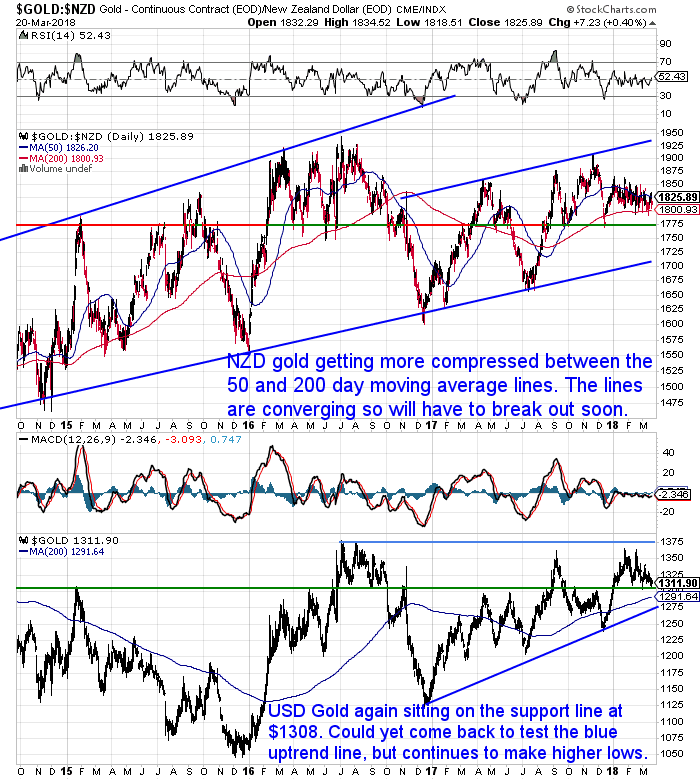

NZ Dollar Gold Still Drifting Sideways

NZ Dollar gold continues to bounce between the 50 and 200 day moving average (MA) lines. With the 50 day MA trending lower, gold is getting more and more tightly compressed within these lines. It will have to break out one way or the other soon.

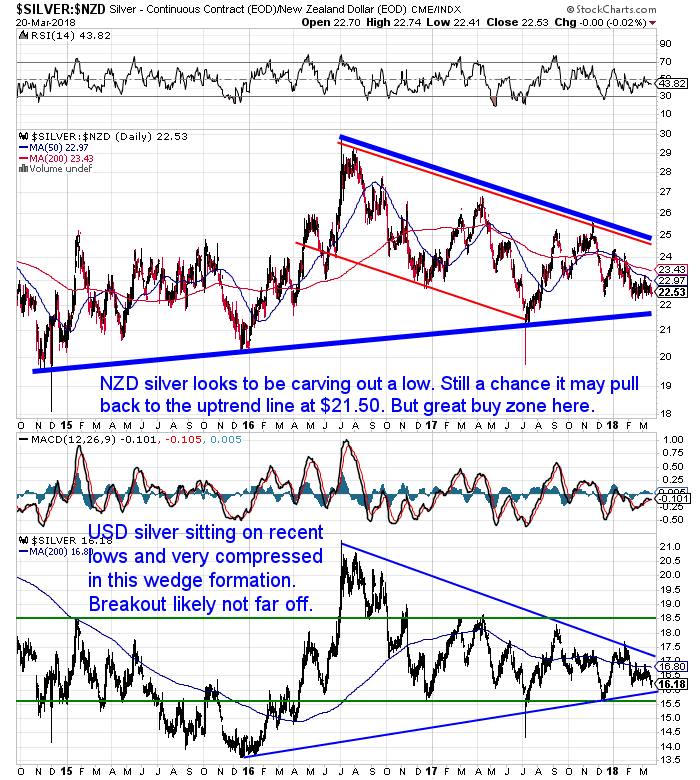

NZ dollar silver also continues to drift sideways, above $22. There remains a chance it could pull back to the uptrend line just below $22. But that is not far away now. Silver will have to break out of this wedge formation it has been in since 2016 soon. Although it could still drift sideways for a little longer and stay within the confines of this wedge formation.

Kiwi Dollar Dips Lower – More to Come?

The Kiwi Dollar dropped almost 2% this week. It also closed below the 0.72 level that has acted as support so far this year. But the Dollar is sitting right on the 200 day moving average (pink line). With the RSI overbought oversold indicator near neutral there is room for the Dollar to head lower yet.

From a longer term perspective the NZ Dollar looks to be in a large wedge formation. There is plenty of room for it to move back below 0.70 and stay with this formation. A falling NZ dollar will of course support local precious metals prices.

Unsure About Any Terms We Use When Discussing the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Do you have all the essentials on hand if you need to leave home in a hurry?

Get Your Own Emergency Survival Kit

Now Available. In Stock. Ready to Ship.

Grab Your Own Grab ‘n’ Go Bag NOW….

—–

This is the Best Predictor of a Recession – When is the Next One Due?

Odds are you may have heard talk recently that the USA is overdue a recession. When a recession hits the USA, it will impact the rest of the world including here in New Zealand.

The best predictor of a recession we have seen is the yield curve. While the yield curve may sound like something only economists would know about and discuss, it’s actually a surprisingly simple measure.

In this week feature article we cover:

- What is the Yield Curve?

- What is an Inverted Yield Curve?

- What Does an Inverted Yield Curve Mean?

- How Does the Yield Curve Predict Recessions?

- What is the Yield Curve Saying Today?

- Recession Indicator: How Far Away Might the Next Recession Be?

- What to Do to Prepare?

- The Yield Curve and Gold

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Now Is The Time To Be In Capital-Preservation Mode

On a related note, Saxo Bank’s chief economist is expecting a market correction and thinks now is the time to be in capital preservation mode. So check out his thoughts on what may be in store this year. He is sounding a clear warning of an arriving market correction & urges investors to exit leveraged positions and build cash.

The Next Gold Bull Market Looms

If a recession may be on the horizon, it’s perhaps not that surprising that gold may be close to continuing its ascent.

But it’s not just the threat of recession that might impact gold. There’s a number of other factors at play currently.

- There are political ructions globally.

- The debt cycle has entered its terminal stage.

- Central banks are changing their monetary policies – moving away from money printing and towards higher interest rates. Higher interest rates should put more pressure on the global financial system in the years ahead.

See more about those factors in this post:

No one knows when the next recession is due. Nor how bad it will be. Indicators like the yield curve can act as signposts along the way. But you need to be prepared before the trouble arrives.

Gold and silver continue to trend sideways at lower levels (silver in particular as we have discussed repeatedly in recent weeks). So we remain in excellent buying zones.

If you don’t have any silver in your possession yet, get in touch to discuss your options:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

— Prepared for Power Cuts? —

[BACK IN STOCK] New & Improved Inflatable Solar Air Lantern

Check out this cool new survival gadget. Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

See 6 more uses for the amazing Solar Air Lantern.

—–

|