This Week:

-

What’s Next for Gold and Silver in New Zealand Dollars?

-

Learn Directly from Doug Casey for Free

-

Trouble Brewing in Australia. How Will This Affect NZ?

What’s Next for Gold and Silver in New Zealand Dollars?

Well, big moves over the past week in both gold and silver in both US and NZ dollar terms. Gold in NZ dollars is up from $2010 to $2075 per ounce in 7 trading days. Up 3.35%. Silver is up from $35 to $38.47 over the same period, a gain of almost 10%!

Today instead of trying to cram our thoughts on the 2 metals into this email, we’ve got a full article on the website just published within the last few hours looking at:

What’s Next for Gold and Silver in New Zealand Dollars?

So head straight on over there and check that out while it’s still relevant. With the way the markets are moving, in a few days it might not be!

Learn Directly from Doug Casey for Free

In the past we’ve posted many an article from Doug Casey and a few short videos too. This week though we have 2 videos of a decent length each, covering all sorts of info and advice on the difference between saving, investing & speculating, the dollar, the Euro and why he shifted to New Zealand back in 1998:

Doug Casey: Why the Dam is Finally Breaking on the US Dollar

Also this week, if you own any gold mining shares (we sympathise with you of late!) this short article shows how we are likely in a similar period to 1976, a period that could make it a very good time to be buying mining shares.

Gold Stocks Got You Down? This History Lesson Will Pick You Up…

Australia in Trouble. How Will This Affect NZ?

Following on from last weeks newsletter where we discussed how Jim Rickards advice to Australia could equally apply to New Zealand, we’ve read a couple of not so rosy articles this week about Australia. Mish Shedlock who always has great stuff in his blog had some thoughts on Australia and the correction going on in house prices over there. He ended by saying:

“China has slowed, as predicted in this corner, and commodity prices, especially coal and iron ore are taking a hit. Growth in China will slow much further over the next decade and that pain has yet to be felt….

The housing bust coupled with a commodity bust and a commercial real estate bust is going to turn most of Australia into a disaster zone for [corporate] profits.”

So it’s not all beer and skittles in the lucky country. Obviously as our main trading partner it pays to keep and eye on what’s going on over the Tassie.

Then last night we read something with even more dire warnings for Australia from John Mauldin or rather written by his co-author Jonathan Tepper.

(It has since been posted now on various other sites here it is on ritholtz.com)

Some points that stood out to us, even at 11.45 last night!

The major risk to Australia is it’s high external debt…

“A total funding need from external sources at 40% of total funding is extraordinarily high. Moreover, about half of this external debt is short term. This increases risk yet further should Australia face a funding shock, driven either by events at home (a severely slowing economy), or abroad (eg a euro-driven credit event).”

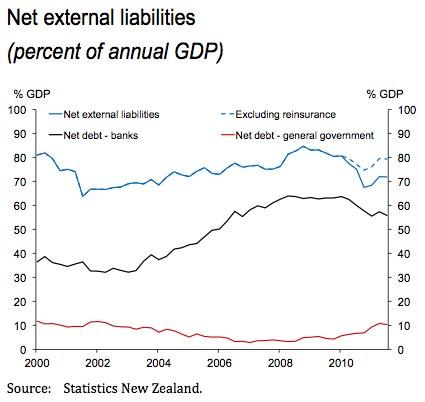

Glancing through the RBNZ Financial Stability Report (an enthralling read on a Wednesday morning!), we can see the net external liabilities for NZ while having fallen are still above 70% of GDP! (See chart below). We’ve mentioned this a number of times before as what we armchair economists believe remains NZ’s achilles heel.

Tepper actually refers to New Zealand too with respect to this external debt and even points out Australia may have to resort to QE of it’s own to support its banks (yes the same ones that own all of ours!). Here’s an excerpt, but it’s worth reading the whole article…

“Australia’s external finances: It looks like the European periphery

The European periphery is an economic basket case. Australia resembles the European periphery in many important ways. The Australian banking system is highly reliant on external funding and will likely become dependent on the central bank for liquidity in the near future. Our view is that the RBA will have to become much more activist in supporting its major banks as the structural slowdown in China and the housing market continues.

We believe the RBA will ultimately be forced to take similar action to developed market central banks either by aggressively cutting interest rates or propping up banks through domestic open market operations akin to the liquidity injections seen by the ECB. Quantitative easing is also a possibility if the RBA is forced to buy bank debt to try to stave off a financial crisis. Under such a scenario, the AUD would fall considerably.

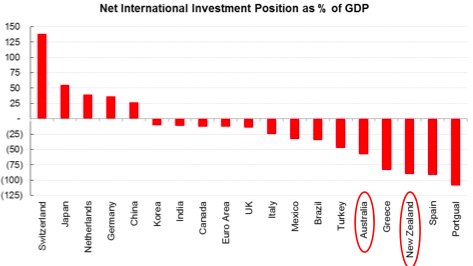

The crisis-stricken economies along the eurozone periphery share one key characteristic: their external debt is too high and their net international investment position (NIIP) – measuring the difference in stock value between assets held abroad and asset held domestically by foreigners – is deeply negative.

Yet, a closer look and you will find Australia and its neighbour New Zealand in the same company, with negative NIIPs well above countries such as Turkey and Brazil.”

Thanks Jonathan, back to us… It seems that many of these risks are shared by NZ. Granted as noted a few weeks back by Satyajit Das, New Zealand should be at a lesser risk than Aussie from a China slow down given our food production focus as opposed to Australia’s mineral exports. But troubles in our main trading partner won’t be good for us here.

Likewise a credit crisis will be just as bad for us with our external debt as bad as, or rather even worse than, Australia’s. We wonder if Jonathan Tepper might also think the chance exists that the NZ Reserve Bank might have to come to the aid of local banks as he suspects the Reserve Bank will in Aussie?

Of course you won’t be surprised to hear our answer. Don’t leave all your cash in the banks! Buy some gold and silver!

1. Email: orders@goldsurvivalguide.co.nn

2. Phone: 0800 888 GOLD ( 0800 888 465 )

3. or Online order form with indicative pricing

Have a golden week!

Glenn (and David)

Ph: 0800 888 465

From outside NZ: +64 9 281 3898

email: orders@goldsurvivalguide.co.nz

This Weeks Articles:

What’s Next for Gold and Silver in New Zealand Dollars?

2012-08-28 18:28:24-04 Just under 2 weeks ago we wrote in our weekly newsletter: When Boring (Precious Metals Price Movements) Can be a Good Thing The prices of gold and silver are almost boring at the moment with both trading in very narrow ranges particularly in NZ dollars…. However, we think this boring price action bodes well for […] read more…

Why Jim Rickard’s Advice to Australia Could Apply to New Zealand Too

2012-08-21 20:45:32-04 This week: Big Breakout for Silver Why Fractional Reserve Banking is Not the Problem Why Jim Rickard’s Advice to Australia Could Apply to New Zealand Too Big Breakout for Silver The last 2 days have seen a big move in silver and as we suspected might happen eventually, even a strengthening kiwi dollar has not […] read more…

Gold Stocks Got You Down? This History Lesson Will Pick You Up…

2012-08-26 23:32:07-04 How is now similar to the mid 1970′s? We’ll for one the gold price has fallen for the past year, much like it did in 1974-75. So given this it’s also no surprise to have seen gold mining stocks or shares also falling during this time. Read on and you can see what came next […] read more…

Doug Casey: Why the Dam is Finally Breaking on the US Dollar

2012-08-26 23:55:03-04 We’ve posted some short videos of Doug Casey in the past, but nothing as meaty as these 2. They’re both full of information In video 1 you’ll hear from Doug on his decidedly non-mainstream point of view on government, The US and coming elections, Europe and more. And you’ll learn specifically why he shifted to […] read more…

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Pingback: Gold to Silver Ratio: What Can We Expect Now After QE3? | Gold Prices | Gold Investing Guide