Prices and Charts

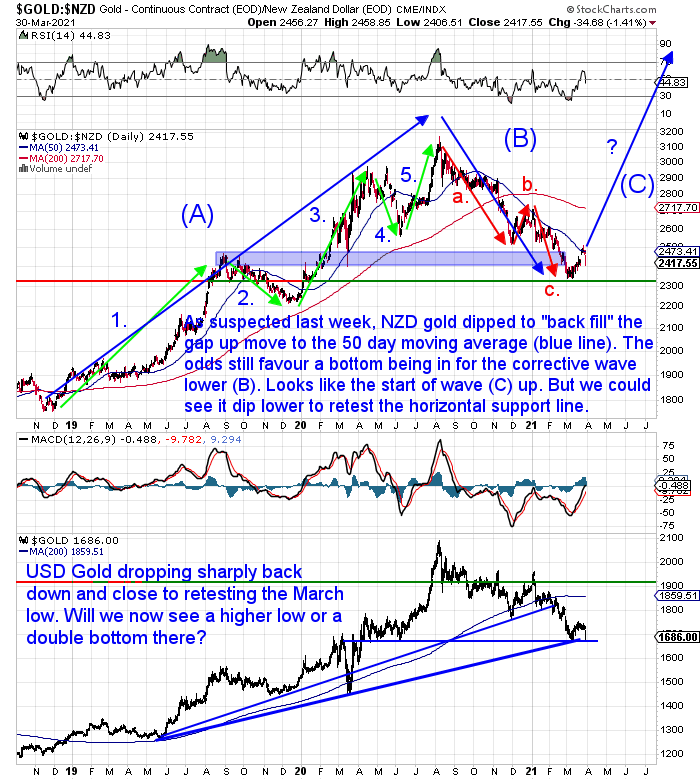

Gold Dipping as Expected

As we warned it might last week, gold in New Zealand dollars fell this week. Dipping to “back fill” the sharp gap up higher that occurred the week before. As a result gold is down over 2% from 7 days ago. We’d say the odds still favour the bottom being in. But we could see gold dip lower to retest the horizontal support line.

Whatever happens this area is likely to be a very good long term buying area.

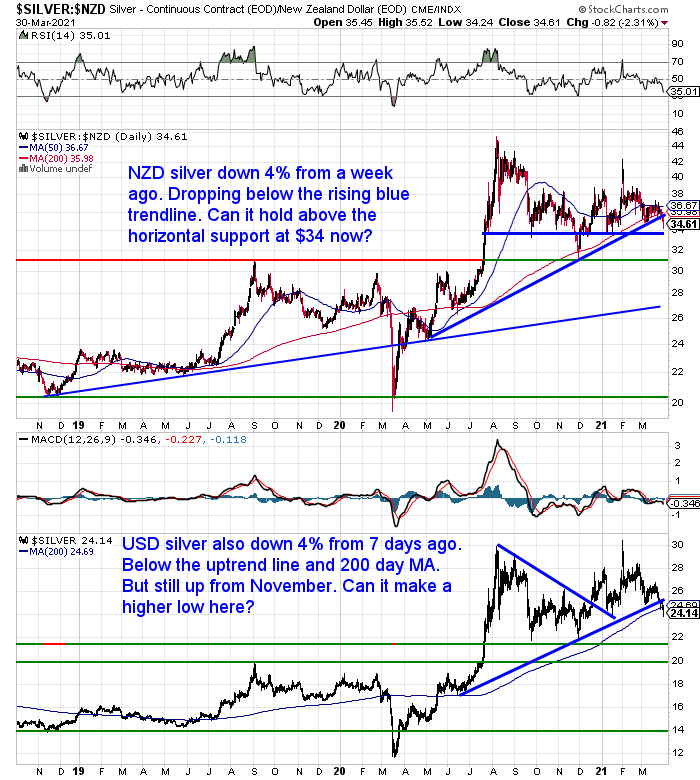

Silver Down 4%

Silver was down double that of gold. Dropping below the rising blue trendline and below the 200 day moving average.

Now we are watching to see if silver can hold above the horizontal support line at $34.

But like gold our guess is that anything in this region is likely to be very good buying in the long run.

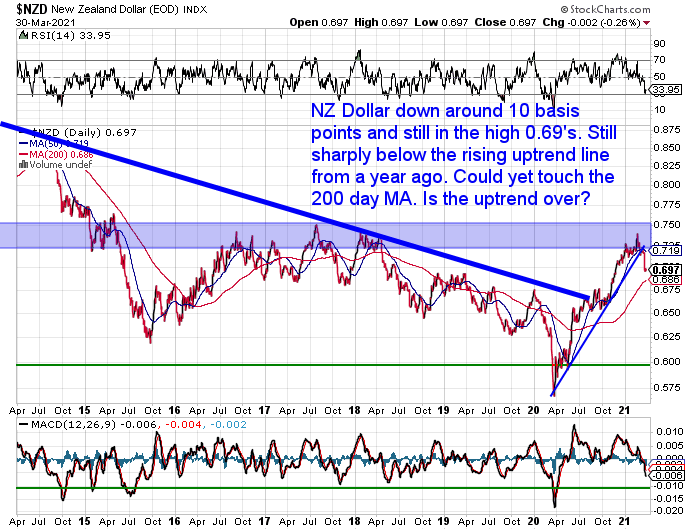

NZ Dollar Little Changed After Previous Week’s Plunge

For a change, there has been little change in the Kiwi dollar. It’s down just 6 basis points from a week ago. It is still sharply below the uptrend line from a year ago. We could yet see it dip lower to the 200 day moving average. It remains to be seen as to whether this is a reversal of the uptrend or just a pause.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

NEW: Certified Organic Long Life Emergency Food

This easy to carry bucket has 90 servings of organic breakfasts and mains

Free Shipping NZ Wide

Get Peace of Mind For Your Family NOW….

—–

How Much Might Gold Fall in the Next Crash?

There have been a few wobbles in global share markets lately. But so far nothing too significant. There are some wondering about the chance of a stock market crash.

That could be what prompted this question from a reader earlier this month.

“What might you imagine the % drop in the gold price might be after the next crash?”

Here’s what we cover in our answer:

- Why Does Gold Fall During a Stock Market Crash?

- How Much Has Gold Fallen in Previous Crashes?

- What Percentage Might Gold Fall in the Next Crash?

- Other Factors to Consider

- What If Gold Had Already Fallen?

- Central Bank and Government Response Gets Bigger Every Crash

- We Need to Consider Premiums Too

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

US Debt Clock’s Dollar to Gold and Silver Ratios are Much Higher Than Our Debt to Gold Numbers From Last Week. Why?

Last week’s article, How Much is All the Gold in the World Worth?, prompted a couple of questions.

In that we compared the value of the estimated total gold ever mined in the world to the current total debt.

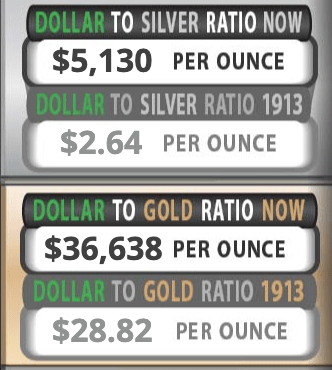

Reader RL then asked:

“When I checked last time this US debt clock (AD 2021/ February ) was

> 4 500$ / oz silver

>35 000 $ /oz gold

How much should the price of gold and silver be then?”

Yes the US debt clock numbers are a bit different. (See the US Debt Clock here)

They are based upon currency supply – US M2. And also based upon 100% gold backing. So that is the year over year increase in the US money supply divided by the yearly world gold production:

Whereas the numbers in last week’s article were for global debt versus all the gold ever mined. Plus they were also only based upon a 25% gold backing of this debt. The post we linked to was referring to US debt to gold ratios and the fact the gold price rose high enough in 1933 and 1980 to achieve a 25% backing of the debt.

We said gold would need to rise 7 times to achieve a 25% backing of global debt. So if we were to use a 100% gold backing of the global debt numbers then we would also get a similarly very high number.

i.e. 7 x 4 (as we need to multiply our number by 4 to go from 25% to 100% gold backing) = 28

Or $10 trillion worth of gold at current prices versus 281 trillion debt (i.e. a 28 times increase in gold price would be needed).

28 x $1,743.66 = $48,822.48

However, in past history the debt to gold ratio has only reached 25% gold backing.

But to be honest we just used the global debt as an indicator that gold is undervalued. We would not use this as the most accurate assessment. Why?

Simply because all the gold in the world ever mined is based upon an estimate only. Whereas US govt gold reserves are an actual figure (assuming they do still have it all of course!). So that would be a better figure to base any debt to gold ratio calculations off.

For more on this topic see: How Do You Value Gold – What Price Could Gold Reach?

All these numbers are of course just estimates of the potential value for gold. Our guess is it is much higher than today but who knows where exactly.

Buying anywhere near current levels is likely to be very good buying in the long run. We still think precious metals have likely bottomed out. Or if they haven’t, there is very little downside here compared to upside.

Silver Maple, Krugerrand and Britannia 1 oz silver coins are now back in stock.

Get in touch if you have any questions about buying or to request a quote…

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Here’s how to always have clean fresh drinking water on hand.

The Sport Berkey Water Filter Bottle – $69 Delivered

Ideal for travel. Driving, camping, backpacking.

Free Shipping NZ Wide.

—–

|

Pingback: Gold or Silver? Higher or Lower? - Gold Survival Guide

Pingback: Will Biden's Tax Increases Mean No Inflation? - Gold Survival Guide