This Week:

- War on Cash: Implications for New Zealand

- The Spreading Bondfire and the Rising Price of Gold

- Two Days with the Real and Wannabee Elite

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

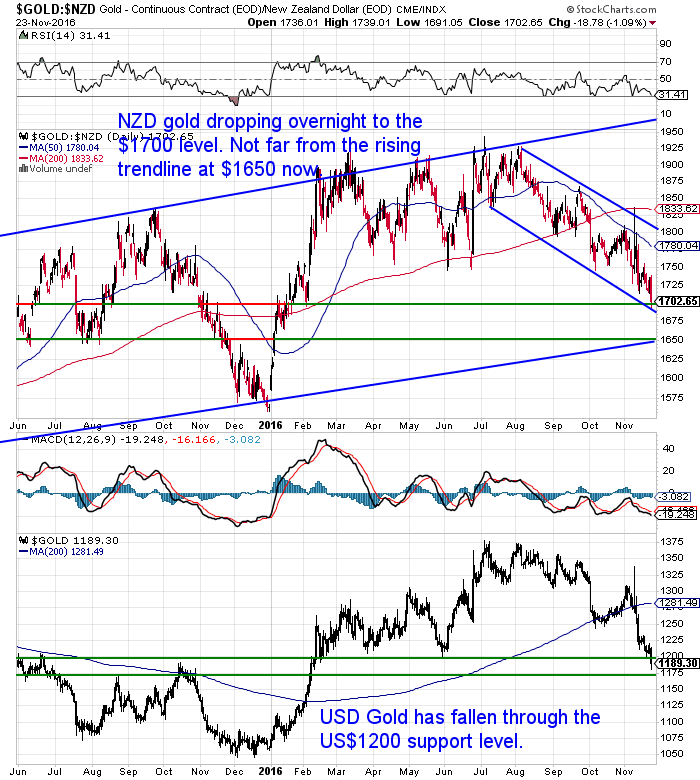

| NZD Gold | $1700.36 | – $36.57 | – 2.10% |

| USD Gold | $1189.40 | – $36.35 | – 2.96% |

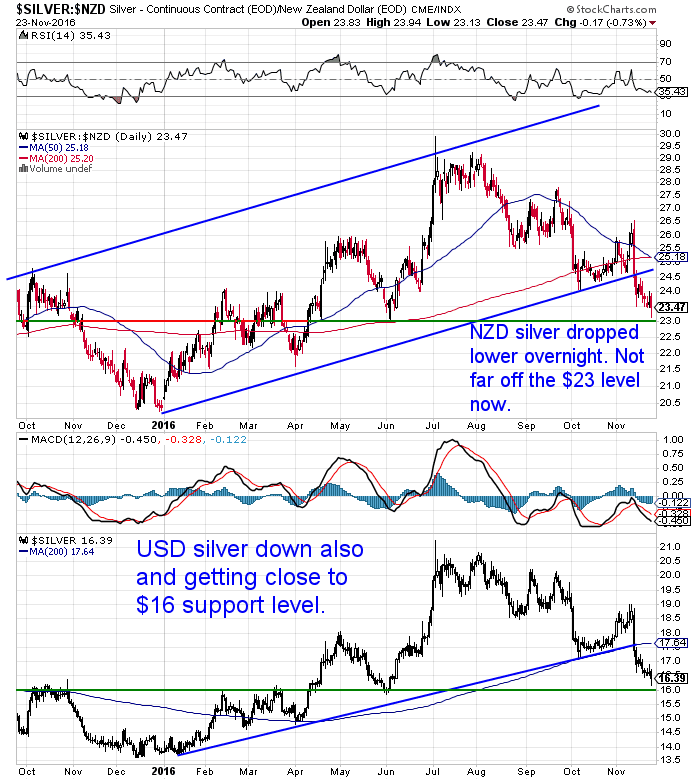

| NZD Silver | $23.44 | – $0.64 | – 2.65% |

| USD Silver | $16.40 | – $0.59 | – 3.47% |

| NZD/USD | 0.6995 | – 0.0062 | – 0.87% |

| Looking to sell your gold and silver?Visit this page for more information | |

|---|---|

| Buying Back 1oz NZ Gold 9999 Purity | $1631 |

| Buying Back 1kg NZ Silver 999 Purity | $714 |

We have a number of articles on the website this week. So we’ll keep today’s update brief. As usual scroll down to the end of this email to read them all.

Gold in NZ Dollars dropped overnight down to $1700. It is now getting close to the rising trendline which also coincides with the next level of horizontal support at $1650. So between here and there could be a good zone to spread out some purchases if you are looking to buy.

NZD Silver also fell lower during the week and again overnight. Closing in on $23 horizontal support. Both metals are quite oversold so should expect a bounce higher before too long.

The NZ Dollar has continued to weaken during the week which has given a little bit of support to local precious metals prices. It is close to horizontal support at around 0.6950. Like the metals it is quite oversold too and could due a move higher soon too.

War on Cash: Implications for New Zealand

The War on Cash has loomed large over the last week or two. You may have heard about the moves in India to try and force their citizenry to use bank accounts instead of cash.

Via Bill Bonner:

- Curtailing Cash

- “So, let’s begin by looking halfway around the world, where a dear reader updates us on India’s recent attempt to curtail cash:

- “My daughter is in India for a wedding and has personally been impacted by the lack of cash. ATM lines for five to six hours to get out the equivalent of about $20. No taxis because no one has any money. Hotels don’t have money either. Things have ground to a complete halt.”

- Not interested in India?

- But this story is a warning to us. There is not enough physical cash in the system. We rely on bank credit to fill the gap. And that means the credit system must not fail… credit must not contract… ATMs must work… credit cards must be honored…

- …the whole system has to work… or it will collapse into an awful mess.”

The Indian central planner’s moves certainly seem to have created an “awful mess” in India.

Our feature article this week looks at the drive to go cashless not just in India but closer to home too. Plus what the implications of these latest moves are for us here in New Zealand.

War on Cash: Implications for New Zealand

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Deal Extended Until 27 November…

Get a FREE bucket of freeze dried fruit or veges (Up to $316 value)

Get a FREE bucket of freeze dried fruit or veges (Up to $316 value)

When you purchase 2 buckets of Mains and Breakfasts.

The Spreading Bondfire and the Rising Price of Gold

We’ve been tracking the goings on in bond markets for the past few months. (See this from September: Has the Bond Bubble Popped? Interest Rates to Rise? Impact on Gold and Silver?)

Jared Dillian in his 10th Man eletter had strong comments on the bond market this week:

- “I will say with certainty: the bond bear market has begun. I will stake my reputation on it.

- I’m not the only one saying it. Ray Dalio said it also, on LinkedIn, in a post that you really should read.

- Ray Dalio, of course, runs the largest hedge fund in the world: Bridgewater, with well over $100 billion in assets. What Ray Dalio and Bridgewater do better than anyone else is study economic history. And what Mr. Dalio has identified is a very swift and sudden regime change—some of which we discussed last week, when we were picking sectors—but really, what this is about is that we are about to enter a prolonged period of higher inflation and higher interest rates.

- Donald Trump has stated quite clearly—many times—that he wants to lower taxes and spend money… on just about everything. We will be running much larger deficits, which means more bond issuance at auctions—and what we are now seeing is the bond market responding to the threat of increased supply (and inflation).

- If you don’t know how a bond auction works, I suggest you read up on it. When you understand how auctions work, you will understand intuitively the supply/demand dynamic that leads to higher interest rates.”

Long term bond prices have shot sharply higher since the US election so it would be expected that will pull back quite sharply soon too. However it does seem like the trend in longer term interest rates has changed.

The mainstream view is that rising interest rates are bad for gold. The theory being that gold pays no interest so therefore if the banks do, then people will hold their savings there instead.

However it is the after inflation or real interest rate that is key. And if inflation is also rising, as it seems we may be in the early stages of, then gold and silver will perform well. Just like they did in the 1970’s.

This article shows how the upcoming bear market in bonds (rising interest rates = falling bond prices), will be what sets off the next upleg in gold.

You’ll see how we “are now in capitalism’s third stage, what Hyman Minsky called the ponzi-stage, where borrowers pay what they owe only by borrowing more”. Plus how rising interest rates will make central banks much less effective.

THE SPREADING BONDFIRE AND THE RISING PRICE OF GOLD

There is very little buying going on at present with the price falling, so that may well be a contrarian indicator that we are close to a bottom. Factor in gold in NZ Dollars also getting close to the long term uptrend line running since 2014, this may make now a pretty decent entry point.

Get in touch if you have any questions about the buying process. David is only too happy to answer them.

** Urgent Message for All Car Owners **A compact, revolutionary tool can save your life.

We believe everyone who drives or rides in a vehicle must carry this tool.

The Keychain Car Escape Tool can save lives.

The Keychain Car Escape Tool can save lives.

For less than the price of 2 movie tickets you can get 2 of these.

One for each car in your family or give one to someone you care about.

—–

This Weeks Articles:

War on Cash: Implications for New ZealandWed, 23 Nov 2016 4:19 PM NZST  We written and shared multiple articles on the topic of the War on Cash over the past couple of years. Here’s a bunch of them if you need some background: http://goldsurvivalguide.co. We written and shared multiple articles on the topic of the War on Cash over the past couple of years. Here’s a bunch of them if you need some background: http://goldsurvivalguide.co.

|

THE SPREADING BONDFIRE AND THE RISING PRICE OF GOLDTue, 22 Nov 2016 6:04 PM NZST  In what will seem very counter intuitive given the recent sharp fall in the price of gold and the mainstream view of gold and interest rates, Darryl Schoon outlines why the current rising interest rates will in fact herald the next ascent of the gold price… THE SPREADING BONDFIRE AND THE RISING PRICE OF GOLD By […] In what will seem very counter intuitive given the recent sharp fall in the price of gold and the mainstream view of gold and interest rates, Darryl Schoon outlines why the current rising interest rates will in fact herald the next ascent of the gold price… THE SPREADING BONDFIRE AND THE RISING PRICE OF GOLD By […]

|

Doug Casey’s Two Days with the Real and Wannabee EliteTue, 22 Nov 2016 12:23 PM NZST  Here’s something you don’t get very often. An inside report directly from a large elitist gathering in New York. While it’s not exactly precious metals related, Doug Casey outlines where we might be heading due to the direction these elites are taking us. As usual what Doug has to say is likely controversial, especially concerning […] Here’s something you don’t get very often. An inside report directly from a large elitist gathering in New York. While it’s not exactly precious metals related, Doug Casey outlines where we might be heading due to the direction these elites are taking us. As usual what Doug has to say is likely controversial, especially concerning […]

|

This Is Where I Get OffTue, 22 Nov 2016 11:07 AM NZST  You have likely heard about the “war on cash” being waged in India after the government suddenly removed their 2 largest denomination notes. This has produced all sorts of problems for the average Indian citizen. This article outlines how the fact that the vast majority of Indian truck drivers have walked off the job might […] You have likely heard about the “war on cash” being waged in India after the government suddenly removed their 2 largest denomination notes. This has produced all sorts of problems for the average Indian citizen. This article outlines how the fact that the vast majority of Indian truck drivers have walked off the job might […]

|

This Upcoming “Black Swan” Event Could Wipe Out Your Life SavingsTue, 22 Nov 2016 10:21 AM NZST  This year has seen a couple of major surprises in the Brexit leave vote and the Donald Trump election win. Well surprises to anyone only following the mainstream media at least. But there is also another vote coming up that so far hasn’t garnered much attention. Read on to see what it is… This Upcoming […] This year has seen a couple of major surprises in the Brexit leave vote and the Donald Trump election win. Well surprises to anyone only following the mainstream media at least. But there is also another vote coming up that so far hasn’t garnered much attention. Read on to see what it is… This Upcoming […]

|

How Will Rising Bond Rates Affect New Zealand?Thu, 17 Nov 2016 6:55 PM NZST  This Week: Trump – Trojan Horse, Great Disruptor, or Something Else? The 35-Year Bull Market in Bonds Comes to an End How Will Rising Bond Rates Affect New Zealand? Mainstream Consensus Now Inflation Ahead – Problem? Prices and Charts Spot Price Today / oz Weekly Change ($) Weekly Change (%) NZD Gold $1736.93 – $14.17 […] This Week: Trump – Trojan Horse, Great Disruptor, or Something Else? The 35-Year Bull Market in Bonds Comes to an End How Will Rising Bond Rates Affect New Zealand? Mainstream Consensus Now Inflation Ahead – Problem? Prices and Charts Spot Price Today / oz Weekly Change ($) Weekly Change (%) NZD Gold $1736.93 – $14.17 […]

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuide Today’s Prices to Buy |

| Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

Our Mission

|

| We look forward to hearing from you soon.

Have a golden week! David (and Glenn) |

|

|

|

| The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

| Copyright © 2016 Gold Survival Guide. All Rights Reserved. |