|

Gold Survival Gold Article Updates:

Sep. 12, 2014

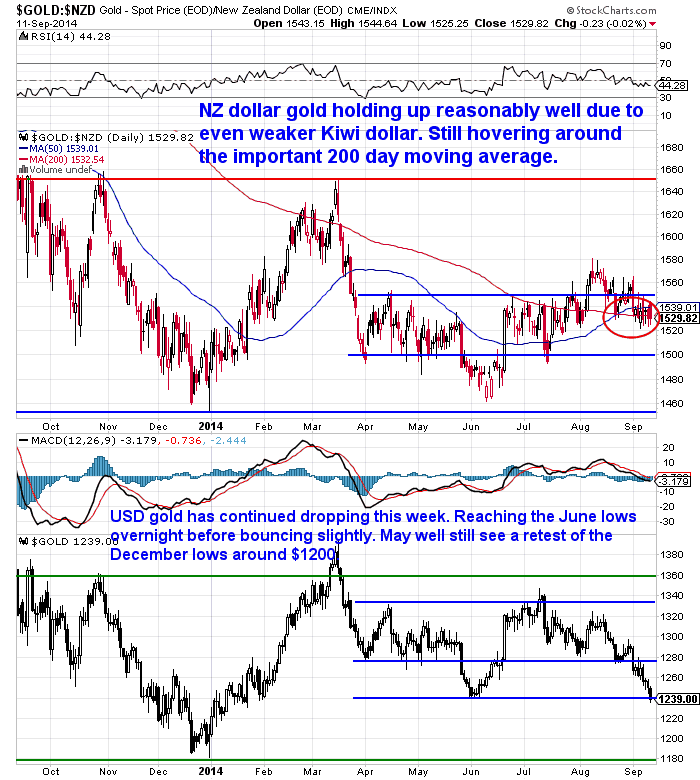

As we pondered last week, gold and silver have indeed fallen further this week.

US Dollar gold last week was $1261.68. Now down $20.93 or 1.65% since then to $1240.75.

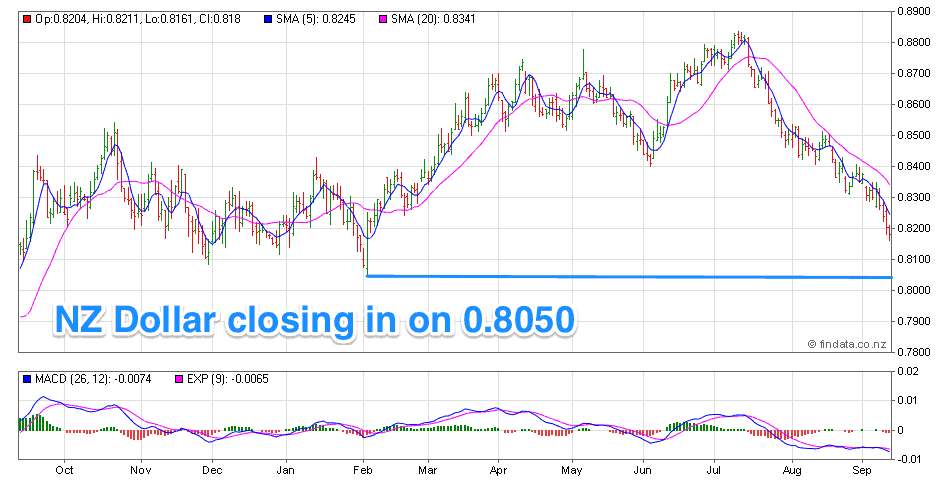

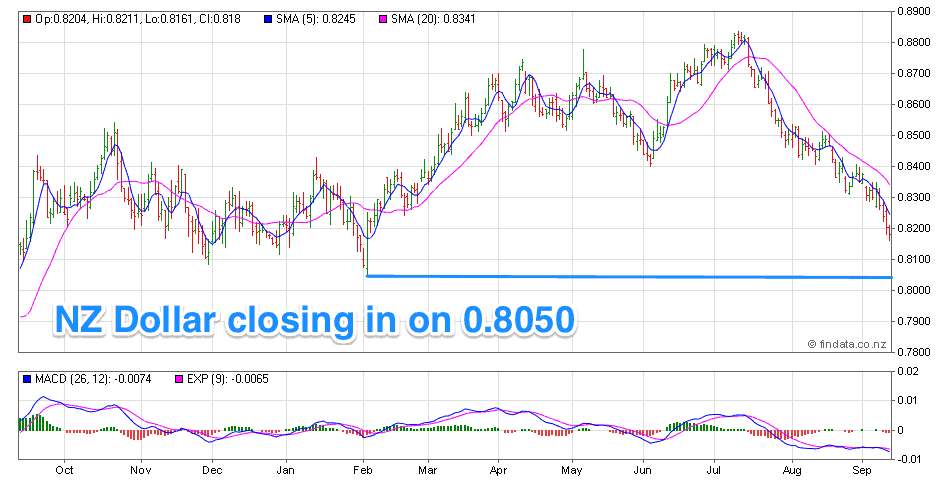

While by contrast NZD gold last week was $1519 and is down 70 cents or just 0.04% to $1518.30 care of the weakening NZ dollar. It has fallen from 0.8306 to 0.8172. Quite a tumble.

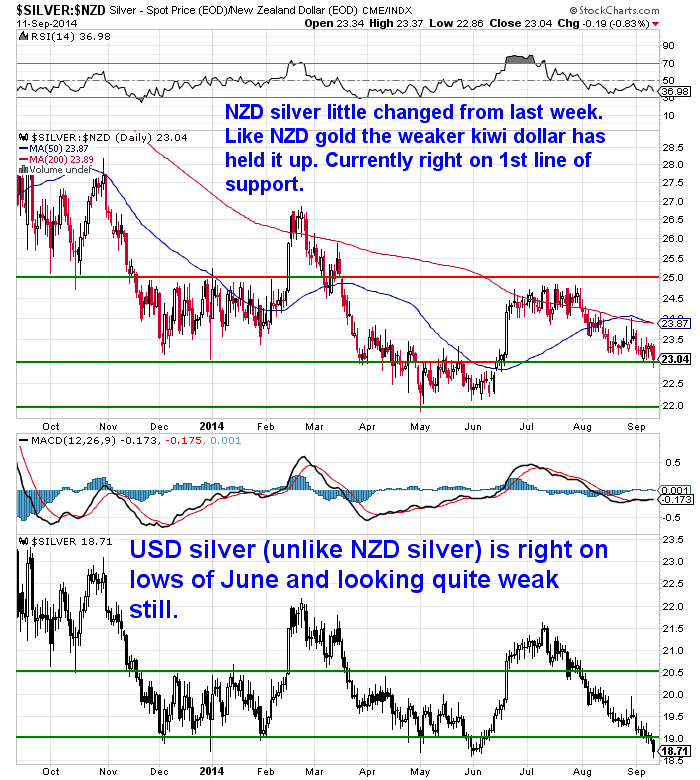

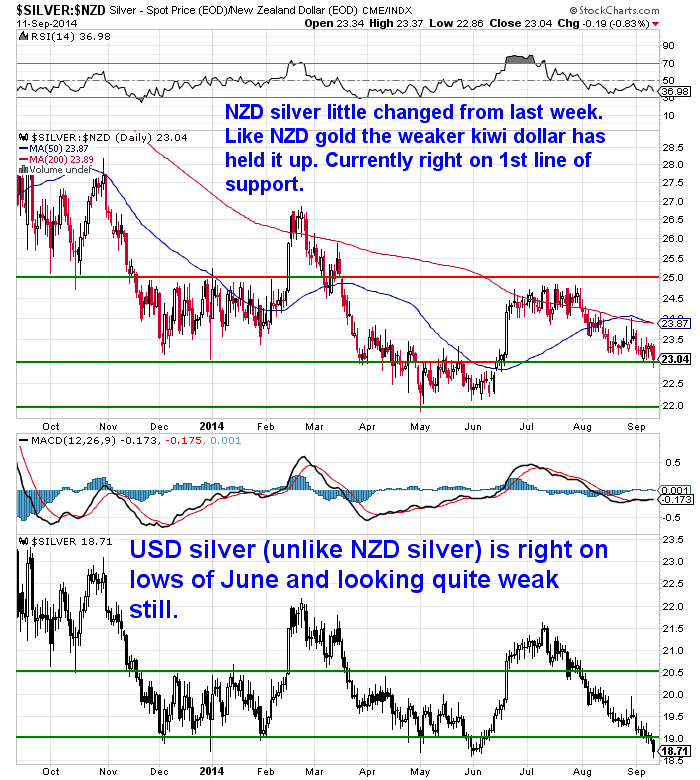

Silver in US Dollars is down 34 cents or down 1.78% to $18.73 from a week ago.

Meanwhile NZ silver is down just 4 cents or 0.17% to $22.91.

So as suspected the weaker kiwi has negated nearly all of the fall that has taken place. And odds are it will fall a little further at least yet.

So tough to guess what will happen from here. Both metals in US dollars are now into oversold areas so a bounce higher is likely. But neither are looking particularly strong here either.

However the trend also seems to be down at the moment for the NZ dollar. So we may not see new lows here for the metals in local currency.

Report From England

As we mentioned last week your editor is now in Europe for 6 weeks. Having been briefly in London we are now in beautiful Somerset. But our wifi is playing up where we’re staying so today will be brief and make sure this actually gets to you.

The news here is (apart from royal babies) all about the Scottish independence vote. No doubt you’ve seen the speculation over the likes of how much of the UK’s 310 tonne gold reserves the Scots might have claim to.

But given the Scots seem to receive more in taxes than they pay as part of the UK, they might want some gold – unless they are intending to tighten the purse strings.

Now Cameron & Co seem to be prepared to bribe them to stay by letting them have even more. Although the rest of the UK don’t seem to get a vote on how much they give up to have the Scots stay. It will be very interesting to see which way it goes.

Also of note in this part of the world is the ever falling bond rates. This week the ECB has made the rate they “pay” banks for “excess deposits” stored with them even more negative – now at -0.2%. That is the banks pay the ECB to keep excess reserves with the,. While crazily Irish and French bond yields have actually gone negative. So you are actually paying these (broke) governments if you want to own their bonds. Why?

Just another sign that the world is slipping into deflation. Money is moving into what are perceived safe havens.

Although you wouldn’t notice in and around Central London. Things were bustling. Lots of Eastern Europeans working in London. But lots of Spanish and Italians there as tourists it seemed to us. Thought they were all meant to be broke?

Dubai – Visa Gold Coin

We also stopped briefly in the phenomenal Dubai on the way here. That place is just out of this world, although a much better place to visit than to live – having to spend a quarter of the year in air conditioning due to the heat would not be for us. On our return we’ll be there for longer so will check out the gold markets and report back.

We did notice this ad in the newspaper while there though. Along with the Gold Vending Machines in the biggest shopping mall in the world – Dubai Mall – it was a sign of how much more gold is valued there than the west.

Even when applying for a credit card you still get a chance to win some gold! Can’t see that offer happening in NZ any time soon.

We’ll be back with more from Europe in the coming weeks.

In the meantime we’ll also be watching closely what the metals do from here. As we said last week, keep a close eye on what the NZ dollar does as we may not get too much of an opportunity to buy gold or silver at their lows if the downtrend of the dollar continues to cancel out the dips in gold and silver.

Let us know if you have a price level you want to buy at and we can notify you when it’s reached. Just reply to this email.

This Weeks Articles:

Gold Survival Gold Article Updates Sep. 4, 2014 This Week: Gold and Silver Dip Again JS Kim: We Called Tuesday’s Gold Plunge. What’s Next for Gold? How is Doug Casey Preparing for a Crisis Worse than 2008? Last day for Reduced Minimum Order Size Offer Gold and Silver Dip Again Well gold and silver did […]

read more…

The Price of Gold and the Art of War Part I |

2014-09-03 21:32:30-04

2014-09-03 21:32:30-04 2014-09-09 16:22:26-04Darryl Schoon is back with another history lesson. This time looking at gold from 1870 right through to the early 2000′s… The Price of Gold and the Art of War Part I If you wait by the river long enough, the bodies of your enemies will float by Sun Tzu, The Art of War, Fifth […]

2014-09-09 16:22:26-04Darryl Schoon is back with another history lesson. This time looking at gold from 1870 right through to the early 2000′s… The Price of Gold and the Art of War Part I If you wait by the river long enough, the bodies of your enemies will float by Sun Tzu, The Art of War, Fifth […] 2014-09-11 02:59:30-0408/17 Prof. A. Fekete: Self-liquidating credit This is the eighth video (7 minutes long) from Professor Fekete in a series of 17 short videos. (Here are links to the previous videos: Prof. Antal Fekete: The Banking System – Episode 01/17 Prof. Antal Fekete: Money creation – Episode 03/17) Prof. Antal Fekete: The Ignored Anniversary – […]

2014-09-11 02:59:30-0408/17 Prof. A. Fekete: Self-liquidating credit This is the eighth video (7 minutes long) from Professor Fekete in a series of 17 short videos. (Here are links to the previous videos: Prof. Antal Fekete: The Banking System – Episode 01/17 Prof. Antal Fekete: Money creation – Episode 03/17) Prof. Antal Fekete: The Ignored Anniversary – […] 2014-09-11 13:44:41-04While this advice from Doug Casey is clearly aimed more at an American audience, the content could be useful to anyone looking to get some of their wealth out from within the reaches of their home government… Doug Casey: “There Is a Rogue Elephant in Your House” By Doug Casey, Chairman One time when I was […]

2014-09-11 13:44:41-04While this advice from Doug Casey is clearly aimed more at an American audience, the content could be useful to anyone looking to get some of their wealth out from within the reaches of their home government… Doug Casey: “There Is a Rogue Elephant in Your House” By Doug Casey, Chairman One time when I was […]

Pingback: Live Report From Paris - Gold Prices | Gold Investing Guide - Gold Prices | Gold Investing Guide