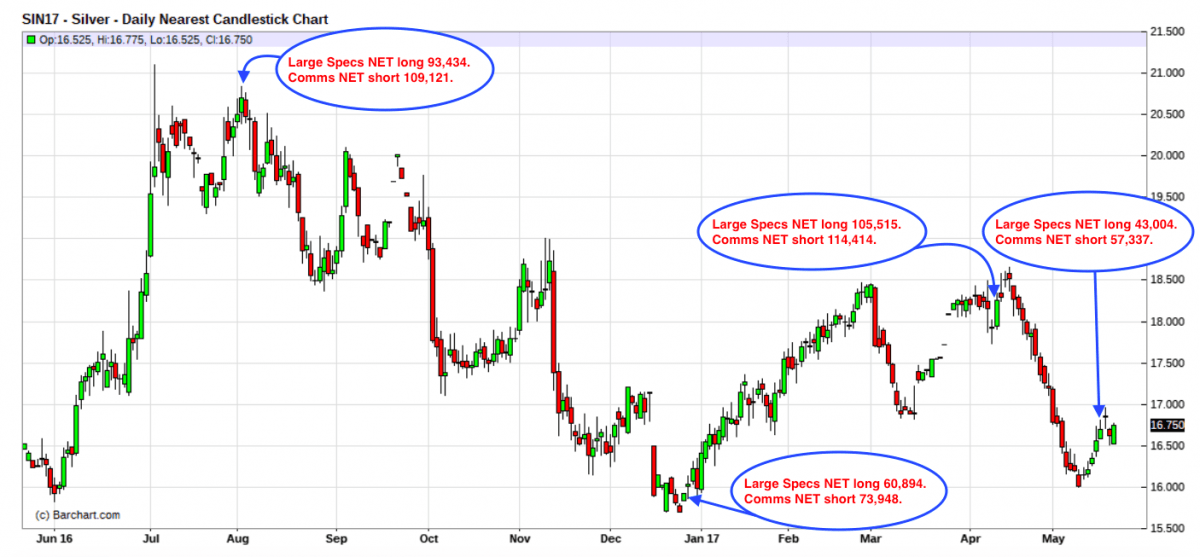

In last weeks feature article, NZD Silver Bottom is Here – Technical and Sentiment Analysis, one topic we touched on was how the silver futures Commitment of Traders (COT) report data was turning bullish.

“Last month speculative traders had become incredibly bullish on silver especially. But the silver sell off has caused many to reverse their position.”

There has been much more coverage of the COT data this week. Here’s a summary of what has been going on, what short covering means and what it could do to the price of silver.

A Quick Glossary of the COT Report Data

In case you’re new to this whole futures data thing here’s a (very) quick summary.

The COT report is published by the US Commodity Futures Trading Commission (CFTC).

Here’s an example of what this data looks like: http://www.cftc.gov/dea/futures/other_lf.htm

The report basically categorises traders (in this case of silver) into different categories and monitors the size of the positions taken. From this it can be determined whether these different groups are betting on the price of silver going up (long) or going down (short).

That is really an oversimplification. As some like silver miners or users or bullion banks might not actually be betting on the price falling when they “go short” but could just be hedging positions they have in actual physical silver.

But we’ll leave it at that to not overcomplicate things.

When analysts and arm chair writers such as us talk about “short covering”, this simply means futures traders have closed out their short positions (bets on the price falling). They have to actually “go long” in order to do this.

This is how a “short squeeze” can occur. When there is an extreme number of short positions being closed, often at a loss. So as a result the price can jump suddenly higher, as the shorts then buy in order to get out before their losses mount. Thereby driving the price even higher.

What is Going on in the Silver Futures Market Currently?

The TF Metals Report provided a good summary of the latest COT report.

The “Large Specs” they discuss are large speculators like hedge funds and money managers betting on silver prices.

While the “Commercials” are the likes of bullion banks, miners and actual users of silver, more often hedging their positions in actual metal.

- Over the past five weeks, price has fallen by $1.58 or about 8.6%.

- During this same time period, the Large Specs have reduced their NET long position by over 62,000 contracts or about 59%.

- As of last Tuesday, the Large Spec NET long position was just 43,004 contracts and the Commercial NET short position was just 57,337 contracts. These are the lowest NET positions since February 2, 2016.

- At 57,337 contracts, the NET short position of the Commercials has been cut almost exactly in half over the past five weeks from an alltime high total of 114,4141 contracts on April 11.

- …At 112,949 contracts, the GROSS short position of the silver Commercials is the smallest since the CoT of April 5, 2016.

- The GROSS short position of the Large Specs stood last week at 57,138 contracts, up from 26,454 contracts five weeks ago. But that’s not the interesting part. Consider this: At 57,138 contracts, this is the largest Large Spec GROSS short position in silver since the CoT Survey of August 4, 2015. Source.

The key point to consider in reading the above is that at the extremes the Large Specs are usually wrong about the price direction and the Commercials are usually right.

This is what the chart below shows historically.

Once again the Large Specs have a very small long position while the Commercials have a very small short position. In fact both are smaller than at the silver bottom in December.

So if again the Large Specs are wrong and the Commercials are right, silver could be expected to head higher from here.

NOTE: If you’d like some further visuals, then King World News also had some great charts illustrating the short covering taking place in the silver futures market currently in this post:

ALERT: All-Time Record Silver Short Covering Spree Continues! Also Covering Gold Shorts!

Video: Silver Set to FLY! COMEX Set-Up VERY Bullish for SILVER! (Bix Weir)

If you’d like to hear someone talking about this current set up in the silver futures market, you can listen to what Bix Weir had to say on the topic in the video below.

Why he believes the COMEX Silver COT set up is very, very bullish for the price of silver to head much higher soon.

From 2:53 on Bix discusses the change in structure of the COMEX silver shorts. And how the COT report shows the best set-up for silver in a long time.

A Short Squeeze Might be Developing in Silver Currently

Over at King World News James Turk believes that the behaviour of gold and silver in recent days indicates there is a good chance of a serious short squeeze developing.

He adds that central banks today are shorter in gold than they were when they had to close the London Gold Pool amid overwhelming demand in 1968. Eventually, Turk says, the central banks will have to concede defeat as they did back then.

What Does the Current Short Covering Mean for the Price of Silver?

So what to make of all this futures data?

Even if a short squeeze doesn’t develop from here, the set up shown in the COT report looks very positive for silver in the weeks ahead.

The TF Metals Report reckons:

“…given the similarities the current CoT structure has to the CoTs of late 2015 and early 2016, it seems safe to conclude that the prices of CDG and CDS are very close to…or have made…new bottoms. History suggests that the turnaround may not be immediate but the next price move from these lows could once again be substantial.”

This backs up our thoughts that silver has very likely bottomed now.

So now might be an excellent time to check out our current top deal on 500 ozs of Silver Kangaroos. Which are currently cheaper to buy than Canadian Silver Maples. Learn more about the Silver Kangaroos here.

Read more: Gold and Silver Commitment of Traders (COT) Report: A Beginners Guide

Pingback: Silver Short-Squeeze Potential - Gold Survival Guide