Gold Survival Gold Article Updates:

Feb. 20, 2014

This Week:

- Silver has started to outperform gold

- What’s driving prices up now?

- Kiwi Dollar 20% Overvalued?

Since our last email there have been decent moves upwards in precious metal land. Gold is up $31.17 per oz or 2.00% from a week ago to $1587.15. While Silver is up $1.85 per oz or a massive 7.58% to $26.07.

So silver has started to outperform gold in the past week.

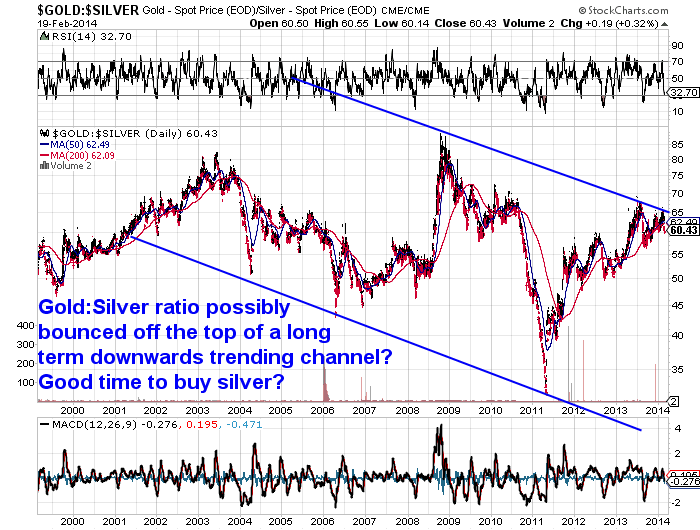

The gold/silver ratio (i.e. the number of ounces of silver it takes to buy an ounce of gold at current prices) has moved down from 65 at the end of January to be at 60 today. Quite a sharp move that can even be seen on the long term 15 year gold silver ratio chart below.

Is this a change in trend for silver versus gold? It’s still too early to tell but it looks promising. We’d prefer silver to be moving higher along with gold, so hopefully our comments from 2 weeks ago (Why is silver lagging gold?) about the lack of action in silver foreboding deflationary problems proves unfounded.

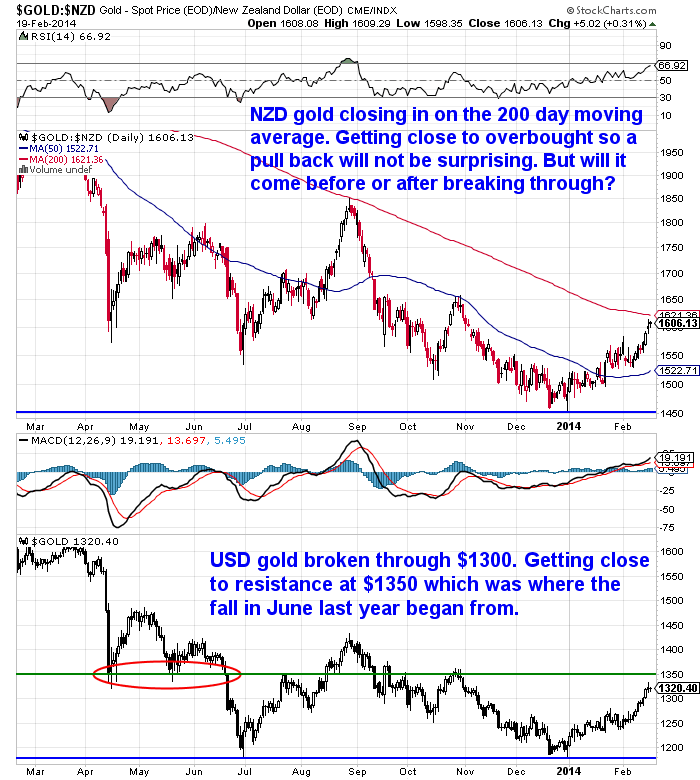

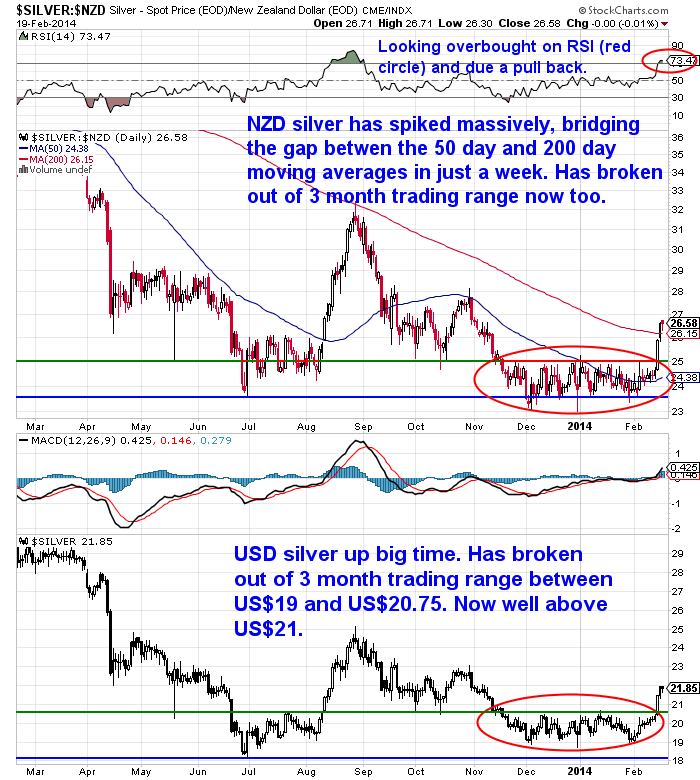

Both metals are above their 200 day moving averages in USD dollar terms. In NZD terms gold is almost touching this widely followed trend indicator and is just above it for silver.

So it seems we are seeing a change to a bullish trend

However given the sharp rise we are due a pull back. The RSI indicators are beginning to get into overbought territory too as can be seen below.

Reader Question: What’s driving prices up now?

As mentioned above there does seem to have been a trend change in precious metals in recent weeks. Yesterday we received a question from a reader who had also noticed this:

—–

“I have been receiving your price alerts for a couple of months and notice there has been a shift in the last week upwards. Can you give me any information on what you think is driving this price up now?”

—–

Here’s our guesses as to possible reasons for this:

1. Maybe even more money in China finding its way from risky investment trusts (of which a couple have been bailed out in recent weeks) into gold after recent troubles there. Evidence of this is that volume on the Shanghai Gold Exchange (SGE) hit a 3 month high and according to Koos Jansen January saw a record for deliveries on the SGE of 247 tonnes. So this demand could be factor. However last year the price fell even on record demand from China as we discussed in this article, probably because the COMEX and London OTC markets are where the price is set.

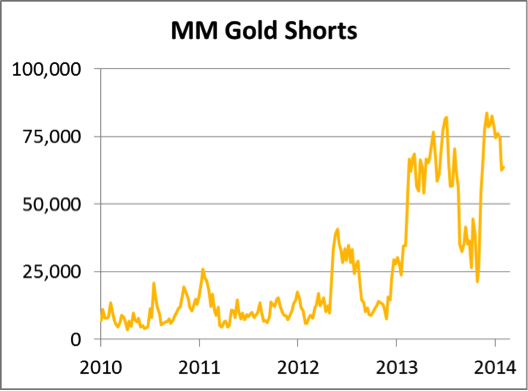

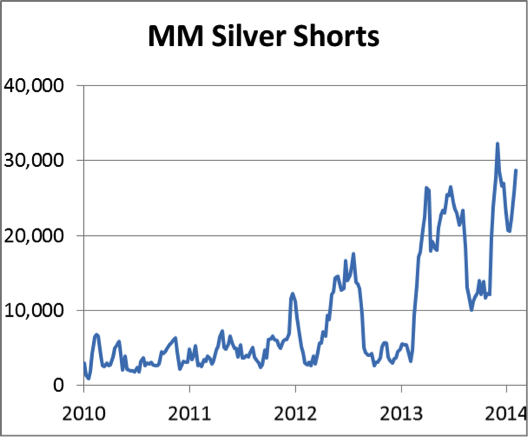

2. So perhaps the fact that sentiment had reached negative extremes in these markets is the more likely reason. When everyone is on one side of the ship it will have a hard time continuing in the same direction. You can see this in the charts below from Alasdair Macleod showing the gold and silver short positions of the Managed Money (i.e. hedge funds) on COMEX futures market.

At the end of 2013 they had reached extreme levels – so the majority of these guys were betting on further price falls. Once most are betting on one thing it leaves very little money left to add to these bets and therefore not much fuel left to push the price lower.

To exit a short position means someone else has to give up a long. But it would take higher prices to attract them to do this. So that’s what we are seeing now with the short positions falling. Although they still are a long way from when gold and silver were at their highs of 2011 so there is plenty of room to run yet on the upside.

Temporary Short Squeeze or Lasting Rise?

The next question is whether this is just a temporary short squeeze like we saw in July/August last year or whether this rise in price will temp long term holders to add to their positions because they believe a bottom is now in.

Our guess is the latter as we reckon most of the trend followers and late comers will finally have been shaken out by now. Of course that’s not to say we are going to see a straight run higher.

This Weeks Articles

First up we have a timely follow on to our piece from last week Why Has the Gold Price Been Falling? It covers some similar ground in terms of looking at the gold derivatives markets, but also touches on Bitcoin and has an alternative viewpoint in terms of what will drive the price of gold higher, and it’s not inflation…

First up we have a timely follow on to our piece from last week Why Has the Gold Price Been Falling? It covers some similar ground in terms of looking at the gold derivatives markets, but also touches on Bitcoin and has an alternative viewpoint in terms of what will drive the price of gold higher, and it’s not inflation…

Paper Gold Ain’t as Good as the Real Thing

The other article is a concise interview transcript with James Turk. He gives his opinion on the US dollar, China, and how a shrinking of peoples trust driven by the likelihood of further confiscation of assets like that which occurred in Cyprus, is likely to be the main driver of people into gold and silver…

The other article is a concise interview transcript with James Turk. He gives his opinion on the US dollar, China, and how a shrinking of peoples trust driven by the likelihood of further confiscation of assets like that which occurred in Cyprus, is likely to be the main driver of people into gold and silver…

James Turk: Erosion of Trust Will Drive Gold Higher

Kiwi Dollar 20% Overvalued?

You may have noticed this story during the week where “A London-based hedge fund manager says New Zealand is like Ireland in 2007 and it’s only a matter of time before the Kiwi dollar plunges”.

Two partners in the firm believe…

—–

“that while the “the case for kiwi seems compelling,” the reality is “quite different.” “New Zealand has severe structural weaknesses that are very similar to those of crisis-hit Southern European and Southern emerging-market economies. Kiwi may be 20 percent overvalued,” the pair said.

The economy has high growth, high terms of trade, and the currency is high-yielding. However, the case for kiwi is, in our view, much less persuasive.”

They said New Zealand’s economy resembles those in Europe and the emerging market just before they were engulfed by crisis – “a growth model based on debt and credit, low savings rates, and current-account deficits.”

According to Bloomberg Ireland went from Celtic tiger to European debt-crisis victim, requesting a 67.5 billion-euro bailout in November 2010 when the near-collapse of its banks meant bond markets were shut to the country.

New Zealand runs a relatively high current-account deficit and its economy has a “fragile core,” making it susceptible to external shocks such as slowing growth in China and the Federal Reserve’s withdrawal of monetary stimulus, the analysts wrote.”

—–

This report then prompted Finance Minister Bill English to respond that “NZ is No Ireland”.

—–

“The idea that New Zealand is somehow massively uncompetitive is wrong,” English told reporters in Parliament today.

“Every New Zealander in their workplace and household has been through quite a lot of change over the last five or six years as a result of the recession.

“They’re more conscious about debt, they’re careful about spending, their workplaces have had quite a big sort out so they can stay competitive and keep their jobs.

“That’s not what happened in those other countries.”

The comparison with Ireland was baseless. Ireland’s economy had been through a major banking crisis at a time when public debt was already high, English said.

New Zealand had a reasonably high exchange rate and household debt “but New Zealand’s in good shape to deal with the adjustments needed if the exchange rate comes down”.

In addition, New Zealand’s economy had a way of adjusting through a lower exchange rate “in a way that places like Ireland and the southern European economies can’t”, English said.

—–

That last comment by English is key and deserves some dissection.

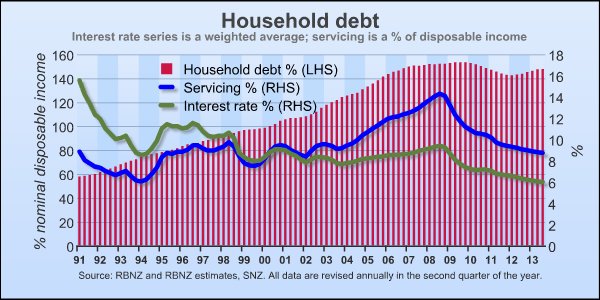

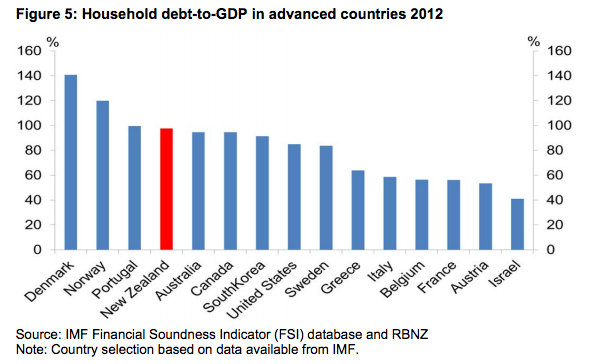

While he notes it as a good point, it also has negative consequences. Yes we can have our exchange rate adjusted down as we are not part of a much larger currency block (such as the Euro like Ireland is), and this would make our exports cheaper. But this of course also raises the cost of living here (by making imports more expensive) and given our high household debt (as shown in the chart below which we posted a couple weeks back), such an increase may not necessarily be so easily absorbed by many NZ residents.

So it is definitely a double edged sword.

Of course the fact the NZ economy can adjust “through a lower exchange rate” is pretty much what the hedge fund managers were saying anyway! It’s just that they expect it, whereas English say it is a possibility and a positive.

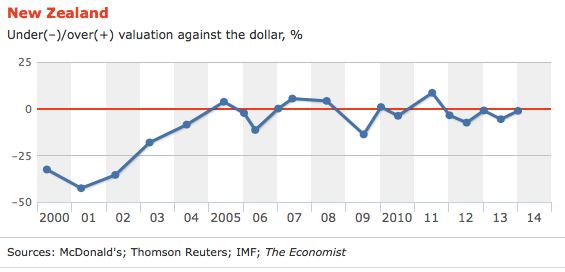

However bear in mind that the Economist Magazines latest “Big Mac Index” showed that the NZ dollar was at about where it should be – well actually 1.1% undervalued against the US dollar to be exact.

Here’s the historical chart of the Big Mac Index for New Zealand:

But then to confuse you even more economist also has an Index that is adjusted for the per capita GDP which shows the NZ dollar as 12.2% overvalued currently!

So who knows?!!

However another article by Roger Kerr backs up the Londoners view that there could be more downside risk than upside currently (which of course makes gold and silver at current prices a pretty good hedge on the kiwi dollar.)

We made mention of a Roger Kerr article a few weeks back that all the goods news may be priced into the NZ dollar. He has expanded on this point in his latest article discussing a couple of the factors that could send the NZD lower given that it “has failed to appreciate over a period when the economy has been close to “boom mode”. He thinks the risks are to the downside because “New Zealand relies heavily on voluntary capital inflows to fund the Balance of Payment Current Account deficit”. A loss confidence in New Zealand and hence our ability to attract capital to fund our current account deficit could occur due to either:

—–

1. Unintended consequences from an OECD-led crack down on tax avoidance

Local media reports are that NZ banks may find they are caught up in the global campaign against multi-national corporations shifting their profits to low tax regimes. Local banks fund wholesale offshore through tax conduits to minimise the 2% AIL (Approved Issuer Levy) on interest paid and these structures may be outlawed by the global rule changes.

Rule changes on taxation are the last thing foreign investors and foreign lenders to NZ banks want to see and if implemented the dollar could fall, even if interest rates increased as a consequence.

2. Political risk on a possible change of government in NZ

Should the Labour/Greens political combo start to lead in the political opinion polls come June/July, foreign investors in New Zealand may well start to hedge their bets by withdrawing their money.

Normally, general elections and even changes of Government come and go in NZ without risk of disinvestment as the foundation economic policies of monetary and fiscal policy are not changed or at risk of changing. The election in November this year could be different.

The stated manifesto of the Labour Party is that they will widen the brief of the RBNZ to not only keep inflation under control, however also have growth and employment objectives. Furthermore, the RBNZ will have wider powers to intervene directly in the NZ dollar FX markets to reduce volatility (good luck with that!).

More disturbingly for offshore investors, the decision making powers on moving official interest rates to set monetary policy will be shifted from the independent RBNZ Governor to the appointed RBNZ Board of Directors.

It is not hard to guess who will be on the RBNZ Board under a Labour/Greens coalition government.”

—–

So Mr English may get what he wants – a lower NZ dollar, if we suffer even a bit of a set back from the “rock star” economy picture. As already mentioned, this makes gold and silver at current prices a pretty good hedge on the kiwi dollar. Coupled with a likely change in trend would make this a pretty good time to buy. If you agree get in touch:

1. Email: orders@goldsurvivalguide.co.nz

2. Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

3. or Online order form with indicative pricing

Have a golden week!

Glenn (and David)

Ph: 0800 888 465

From outside NZ: +64 9 281 3898

email: orders@goldsurvivalguide.co.nz

This Weeks Articles:

| Gold Continues to Quietly Rise |

2014-02-12 21:43:43-05Gold Survival Gold Article Updates Feb. 13, 2014 This Week Why Has the Gold Price Been Falling? Debt ceiling “suspended” but not raised Gold has continued its slow but steady rise over the past week. If you take a look at the chart below, the current rise since the start of the […] 2014-02-12 21:43:43-05Gold Survival Gold Article Updates Feb. 13, 2014 This Week Why Has the Gold Price Been Falling? Debt ceiling “suspended” but not raised Gold has continued its slow but steady rise over the past week. If you take a look at the chart below, the current rise since the start of the […]

|

| Paper Gold Ain’t as Good as the Real Thing |

2014-02-13 15:49:59-05This article is a timely follow on to our piece from earlier in the week Why Has the Gold Price Been Falling? It covers some similar ground in terms of looking at the gold derivatives markets, but also touches on Bitcoin and has an alternative viewpoint in terms of what will drive the price of gold higher, and it’s […] 2014-02-13 15:49:59-05This article is a timely follow on to our piece from earlier in the week Why Has the Gold Price Been Falling? It covers some similar ground in terms of looking at the gold derivatives markets, but also touches on Bitcoin and has an alternative viewpoint in terms of what will drive the price of gold higher, and it’s […]

|

| James Turk: Erosion of Trust Will Drive Gold Higher |

2014-02-16 17:15:45-05This concise interview transcript covers James Turks opinion on the US dollar, China, and how a shrinking of peoples trust driven by the likelihood of further confiscation of assets like that which occurred in Cyprus, is likely to be the main driver of people into gold and silver… James Turk: Erosion of Trust Will Drive […] 2014-02-16 17:15:45-05This concise interview transcript covers James Turks opinion on the US dollar, China, and how a shrinking of peoples trust driven by the likelihood of further confiscation of assets like that which occurred in Cyprus, is likely to be the main driver of people into gold and silver… James Turk: Erosion of Trust Will Drive […]

|

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Today’s Spot Prices

| Spot Gold | |

| NZ $1587.15/ oz | US $1312.41/ oz |

| Spot Silver | |

| NZ $26.07/ ozNZ $838.26/ kg | US $21.56/ ozUS $693.16/ kg |

7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy

1kg NZ 99.9% pure silver bar

(price is per kilo for orders of 1-4 kgs)

$910.74

(price is per kilo only for orders of 5 kgs or more)

(Fully insured and delivered)

Note:

– Prices are excluding delivery

– 1 Troy ounce = 31.1 grams

– 1 Kg = 32.15 Troy ounces

– Request special pricing for larger orders such as monster box of Canadian maple silver coins

– Lower pricing for local gold orders of 10 to 29ozs and best pricing for 30 ozs or more.

– Foreign currency options available so you can purchase from USD, AUD, EURO, GBP

– Note: Your funds are deposited into our suppliers bank account only. We receive a finders fee direct from them only.

2. To simplify the process of purchasing physical gold and silver bullion in NZ – particularly for first time buyers.

Copyright © 2011 Gold Survival Guide. All Rights Reserved.

Pingback: Demographics Mean a Housing Crash for Aussie (and NZ) | Gold Prices | Gold Investing Guide