Prices and Charts

Gold Up 1.5% For the Week

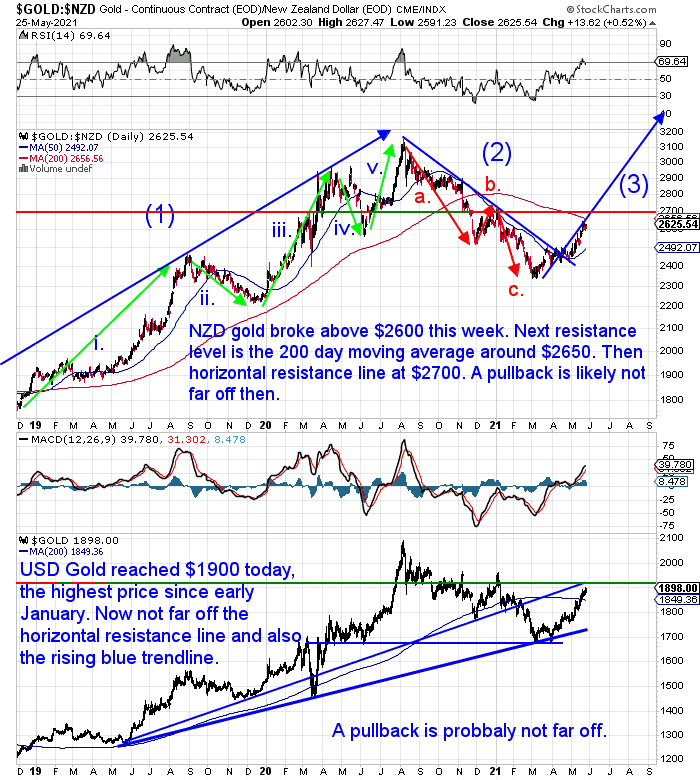

Gold in both NZD and USD were up just over 1.5% this past 7 days. With NZD gold breaking above $2600, the next resistance levels to watch for are the 200 day moving average (MA) at $2650 and then the horizontal resistance line at $2700.

But with the RSI overbought/oversold indicator still hovering close to overbought (>70), a pullback might not be far away now. We could potentially see a return to the $2500 level in that case.

But as we’ve been saying, any such pullback will be a buying opportunity in what is now a clear uptrend since bottoming at $2350.

Silver in a Clear and Strong Uptrend

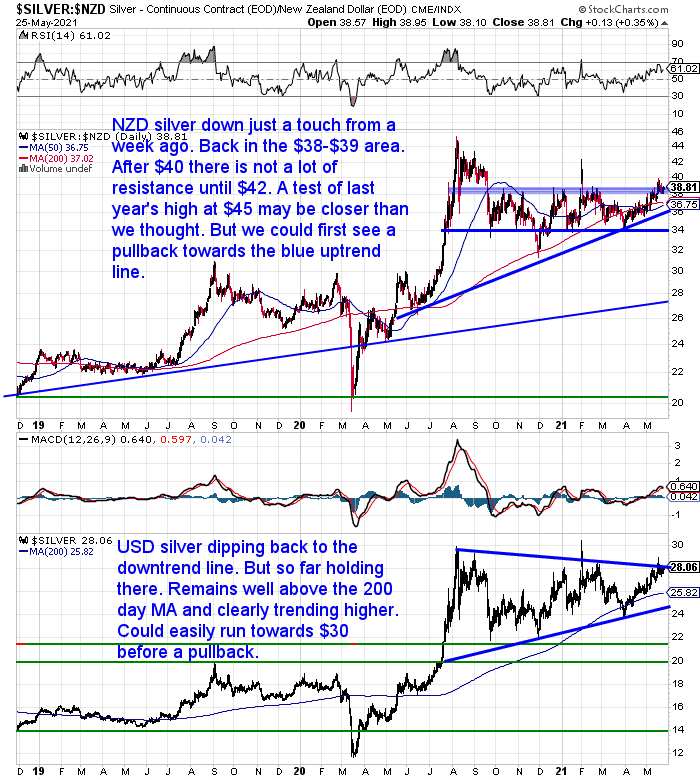

Silver in New Zealand Dollars is down just a touch from last week. It’s back in the $38-$39 band that it had poked above last week

After $40 there is not a lot of resistance until $42. So silver could run a little higher yet with the RSI still not in overbought territory.

However if gold were to see a decent pullback, then silver could follow and potentially return down to the blue uptrend line. But silver is clearly in an uptrend, so higher prices seem likely in the long run. Like gold, any dip we’d consider a great buying opportunity.

NZ Dollar Basically Unchanged

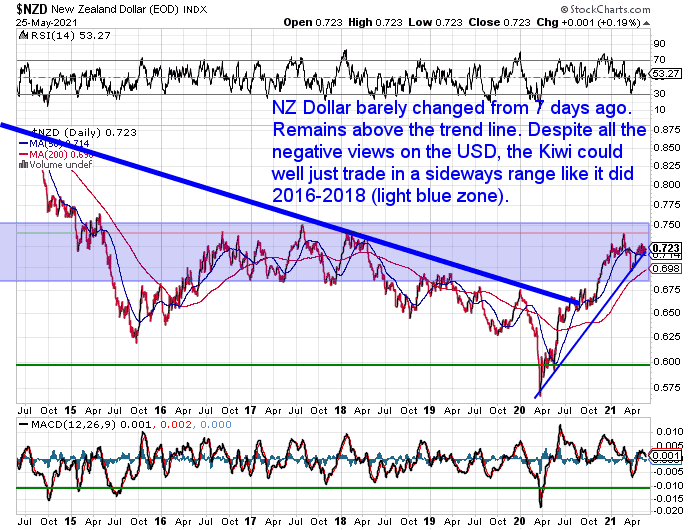

The New Zealand dollar has jumped around this week, but the net result is the Kiwi has barely changed from a week ago. It remains just above the uptrend line. There remains a large sideways trading range that the Kiwi could potentially stay within. Just as it did back in 2016-2018.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

NEW: Certified Organic Long Life Emergency Food

This easy to carry bucket has 90 servings of organic breakfasts and mains

Free Shipping NZ Wide

Get Peace of Mind For Your Family NOW….

—–

Reader Question: In a Reset or a Devaluation, or Crash, will Gold be More Valuable?

A question or rather a couple of questions from Phil this week. The first one is in relation to our newsletter from last week.

“I have a question regarding the quoted passage from your article:

Here was the quote from ANZ’s chief economist Sharon Zollner who said people were seeking the certainty of gold in uncertain times.

“Dramatically higher government debt in many countries funded by expanding money supplies has perhaps raised question marks for some about the endgame, and in particular the ultimate trustworthiness of fiat money in terms of holding its value through thick and thin,” she said.

If there is a reset or a devaluation, or even (I hope not) a crash,

Would the number of ounces of gold or silver required to buy a house, become more or less valuable after the reset?”

Here’s our reply:

If there is a reset or dollar devaluation, we would expect that the number of ounces required to buy a house would drop. That is the “price” of gold and silver in dollars would rise as the dollar was devalued. Or as you put it gold and silver would become more valuable after a reset took place.

In a crash situation we could see gold and silver fall in the short run. But history shows they bounce back much faster than the stock market does.

Also bear in mind that a reset could come in 2 forms…

A “hard” reset such as in 1934 where the US dollar was devalued by presidential decree. Or a “soft” reset such as in 1980 where the US dollar was devalued over a number of years prior to this.

See this article which shows the “price” of gold went up substantially at both of these times: Gold Backing to Debt Ratio: A Reset Like in 1934 and 1980 Would Mean $28,000

Also check out this article from last year on the subject of a gold revaluation:

Does a Gold Revaluation to US$10,000 Make Sense? Will it be Good or Bad? [2020 Update]

When Did New Zealand Switch to Fiat Currency?

Then Phil’s next question was:

“The second thing is, when did NZ switch to Fiat currency?

When I was a kid, the pound note ‘NZ Reserve Bank promises to pay £1 on demand”.

Thanks in anticipation of your reply.”

We had somewhat covered this topic before. However with Phil’s prompting we have now updated that article to include more about the NZ dollar/NZ pound becoming a fiat currency. Along with an in depth history of the pound sterling. It’s lengthy but as you’ll see even a currency as young as ours has gone through significant changes in the past century….

It covers:

- How Has the New Zealand Monetary System Changed Over the Past Century?

- A Key Date in New Zealand Monetary History

- The Return to the Gold Standard

- The New Zealand Currency Is Fiat Once Again

- NZ Dollar Devalued 7 Times in 17 Years!

- The Interesting History of the Pound Sterling

- Prepare for the Demise of the New Zealand Dollar

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Rocket Shaped Inflation Expectations

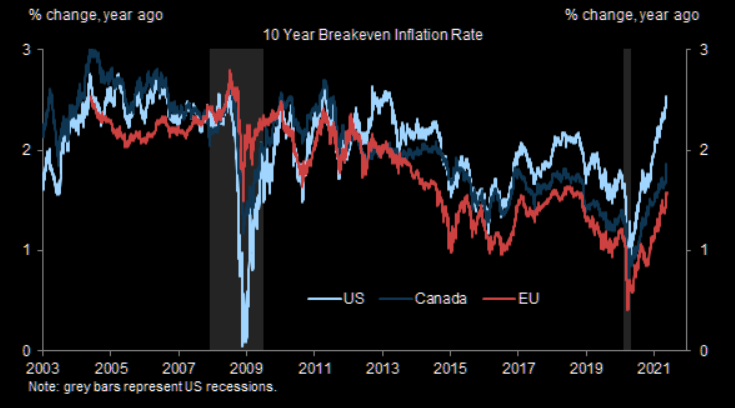

From the Market Ear comes this chart of inflation expectations.

“Stating the obvious….market inflation expectations have risen further following jumps in US average hourly earnings in April, the largest increase in US core CPI in 40 years, a sharp increase in the University of Michigan’s measure of long-term household inflation expectations, and an ongoing surge in commodity prices”

Rickards: Here’s Why We Won’t See Inflation

However, Jim Rickards has a counter view to this “inflation is coming” talk.

In a recent Incrementum board meeting his point of view was summarised as:

Jim Rickards:

- The data does not show that we have entered an inflationary environment. I expect the environment to remain broadly deflationary until around 2023. Position yourself for short-term deflation, with the prospect of a sudden uptick in inflation.

- The market expects inflation in the short term, but I think the market is wrong.

- When inflation comes it will be with us for the long term.

- Money printing is not necessarily linked to inflation. We have not yet seen an uptick in money velocity, which is what determines inflation most directly

Source.

He calls it “The Inflation Head Fake”…

The Inflation Head Fake

Because of the massive stimulus, many people believe we’re finally going to see significant price inflation. The market is apparently forecasting it. Inflation expectations are rising, which means higher interest rates.

…going back over the last 10 years, we’ve seen multiple rate spikes. All three times, rates went down sharply. They went up on the same scenario markets are seeing today — because of inflationary expectations.

But, the inflation never came. Experts say, “Oh, just give it a little more time. Inflation’s right around the corner.”

But it hasn’t materialized. The higher rates actually slowed the economy instead.

If there’s real growth, people borrowing, and high demand for funds, interest rates are going to rise to accommodate that demand. But if interest rates are going up on inflation expectations and the expectations don’t materialize, rates will fall back down again, very sharply.

It’s happened three times in the last 10 years. And it’s happening again now.

Killing Jobs Isn’t Inflationary

Why aren’t we going to get the inflation? You have to look at the rest of the Biden administration policies.

Biden killed the Keystone Pipeline. That immediately cost 20,000 high-paid union jobs with benefits. It’s going to cost over 100,000 jobs when all the ripple effects are done.

…Democrats are also going to raise the minimum wage to $15. It didn’t make it into this bill, but they’re going to find a way to get it in some other bill, even though the Congressional Budget Office estimates it would kill 1.4 million jobs.

Yes, some people would get a raise out of it, but 1.4 million people would be without jobs.

When you add it all together, the economy is actually going to slow down. We’re not going to get the inflation. The inflation expectations are a mirage.

So what’s going to happen? Exactly what has happened three times in the last 10 years.

Gold Wins Either Way

For the next six months, rates are going to go higher based on inflation expectations. The stock market should continue higher. But by later this year, all of that will turn around. Interest rates are going to come back down, and stocks are going to stall out.

I’m not saying the stock market’s going to crash immediately. It will happen sooner than later; it definitely has all the hallmarks of a bubble. But I’m not saying we should expect this in the short run or necessarily this year.

Gold is going to rally as the economy weakens. Yields are going to plunge again, which makes gold attractive. Gold at today’s prices is a steal.

Longer-term, we’re going to get inflation. A lot of it. Obviously, that’s going to be very good for gold also.

Regardless, gold emerges a winner either way.

Source.

So really the disagreement seems to be around the timing of inflation. A case of when, rather than if. The good thing is that with gold you probably don’t need to get this timing right yourself. As Rickards points out, gold wins either way. Like all insurance, just make sure you have it before you need it.

Silver remains hard to come by at the moment. Local suppliers have no 1kg silver bars available even for back order currently. The only local silver available are 5oz bars, but there is a 4-8 week wait for them.

But we currently have ABC serial numbered 1kg bars on a 2 week back order. These are actually cheaper than comparable bars we’ve seen advertised lately in the USA.

Now just in are 10oz and 500g ABC bars too. Phone or email to order them.

However there are plenty of options if you’re after some gold.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Here’s how to always have clean fresh drinking water on hand.

The Sport Berkey Water Filter Bottle – $69 Delivered

Ideal for travel. Driving, camping, backpacking.

Free Shipping NZ Wide.

—–

|

Pingback: Why it Will Be Very Difficult for the RBNZ to End Currency Printing - Gold Survival Guide

Pingback: Why Even if Inflation is “Transient” It Won’t Be. Huh? - Gold Survival Guide