Deciding when to buy gold is helped by looking at the historical data. The data show that certain months and times within an economic cycle increase your chances of reaching your gold investment goals. Whether you’re investing for profit or security also influences your decision.

1. The best time to buy gold: Historical indications (which months are best to buy)

It’s often said that timing the market is a fool’s game, and you won’t find many investment experts who disagree with this sentiment. However, if we look at the average monthly gain and loss for gold since 1975, we see that some months are historically, on average, better times to buy gold.

Since 1975, the average monthly gain or loss for gold is shown to be at its lowest point for the year in early January, with a similar low experienced in mid-March and early April. The next best time to buy gold, according to the data, is mid-June to early July, when, on average since 1975, gold has rallied around 8% to reach its highest point for the year in late December.

Similarly, if we look at gold’s average monthly price change, the historical data show that, on average, March is when the price of gold has historically fallen the most (−0.9%). Therefore, March can be seen as the best time to buy gold, as historically, this is when gold is the most undervalued. Other months where the average monthly price change is negative are June (−0.1%) and October (−0.2%).

Whether it’s January, March, June that you decide to buy gold, the most important take-away from the historical data is that you have bought your gold before August, as the second half of the year (except for October) is historically when gold is at its strongest.

What’s the gold price today?

2. “Best time to buy gold is before a crisis”

As a general rule, but one that’s supported by historical data, gold has the most dramatic price increases during times of crisis, when other investment options suffer. At these times, investors look to gold’s proven stability to avoid seeing their wealth depreciate. Therefore, the best time to buy gold is before a crisis happens.

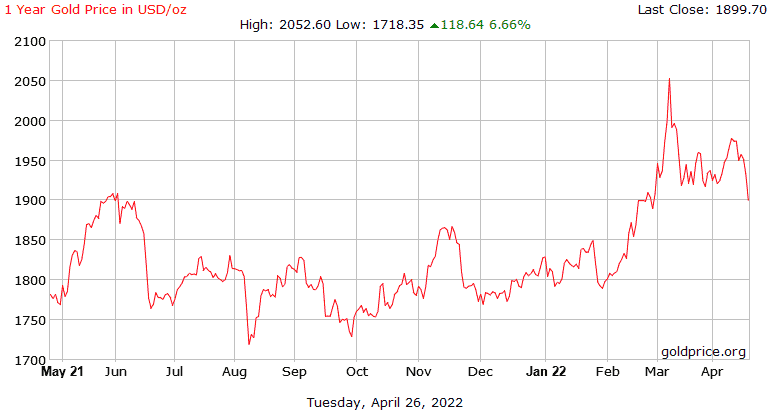

If we look at the price of gold during the recent economic downturn and war in Ukraine, investors who bought gold before the effects were felt have made substantial gains. For example, when warnings of high inflation and interest rate increases emerged in mid-2021, the price of gold began climbing, rising from around $1750 in July and September to $2050 in March 2022. While the price of gold has recently fallen back to $1900, it still shows a price gain of around $150.

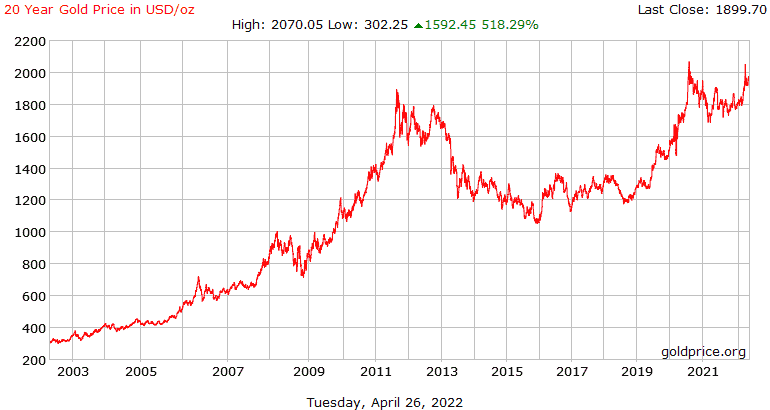

Furthermore, the chart below shows that the price of gold increased dramatically when the 2008 financial crisis and the 2019 Covid-19 pandemic hit. Therefore, if you’re looking to maximise the benefits of investing in gold, you want to add gold to your portfolio before a crisis happens.

If you can’t wait to invest in gold, you can buy gold online today at Gold Survival Guide.

3. It depends on your investment strategies (Profit or Security?)

Every investor is ultimately seeking profit; what differentiates them is the time horizon and level of risk they’re willing to take. Investing in gold does offer opportunities to profit quickly and handsomely. However, it’s not as easy as it may seem.

If you’re investing in gold for profit, you’re trying to buy low and sell high, which means predicting the market. While resources are available, such as indicators and investment books, to improve your knowledge and chances of success, the reality is that even experts still struggle to pick the right time to buy and sell. As Warren Buffet said, “The only value of stock forecasters is to make fortune-tellers look good.”

It’s important to note that investing in gold for security and the long term is recommended by the experts as the best way to make a profit while also protecting your wealth. For example, if you’re investing for security and the economy experiences a downturn, you can almost rest assured that gold will retain its value and most likely even increase as a result.

The long-term trend for the price of gold also provides assurances that even if the price of gold falls, it will most likely rebound and continue on its upward trajectory. Therefore, if investors commit to gold as a long-term investment, the best time to buy gold is essentially anytime.

Gold Survival Guide is your NZ gold merchant.

The bottom line

Gold’s average monthly price and percentage gain data point to early January, mid-March, and late June, as the best months to invest in gold. The historical data also show that it’s best to invest in gold before a crisis happens; and that the best strategy is to buy gold for security in the long-term, which reduces the need to find the perfect entry point.

For more information and to get started on your gold investment journey, talk to the experts at Gold Survival Guidetoday!

Related Posts:

- Does Gold Seasonality Affect the NZ dollar gold price?

NZD gold prices instead of USD: https://goldsurvivalguide.co.nz/does-gold-seasonality-affect-the-nz-dollar-gold-price/

- Gold is Seasonal: When is the Best Month to Buy?

Another post with USD prices: https://goldsurvivalguide.co.nz/gold-is-seasonal-when-is-the-best-month-to-buy/