Prices and Charts

Gold Close to a Break Out

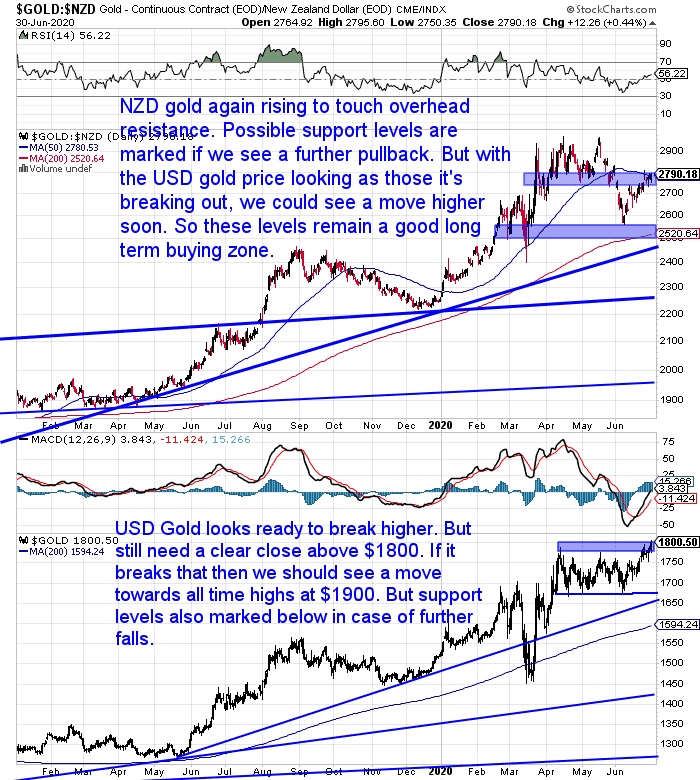

Gold priced in New Zealand dollars was up just over 1% this past week. It is now hovering around the resistance zone just below $2800.

While in US dollars gold again came close to $1800 but has so far not broken above that key level. If it does, then we should see a test of $1900 before too long. The all time USD high at $1920 may prove difficult to break through on the first try.

So our guess is we see gold break out and head towards that mark. But then likely pull back from $1920.

A breakout towards $1920 will likely push the local NZD gold price up above $2900 and see it test $3000.

Why Boring is Good

In our daily price alerts yesterday, we discussed how this boring sideways action in precious metals since April, is likely a good sign.

“Gold and silver are rather boring at present. They continue to trade in these sideways patterns. As a result there is very little focus on precious metals. There is also reduced buying currently. These are the times a move higher often follows.”

Considering how well gold has performed since the start of the year (regardless of which currency you use), it’s surprising there hasn’t been more focus on gold.

But as noted above these are positive signs for a bull market. It’s called climbing the “wall of worry”. This is when a market continues to move higher, even while most people can come up with reasons why it should be pulling back.

There has been a noticeable drop off in buying of gold and silver in the past 2 weeks or so as well. We know from experience this is often when gold and silver can make decent moves.

So that’s why we are guessing we see a USD gold price break out before too long.

Silver up 2% This Week – Outperforming Gold

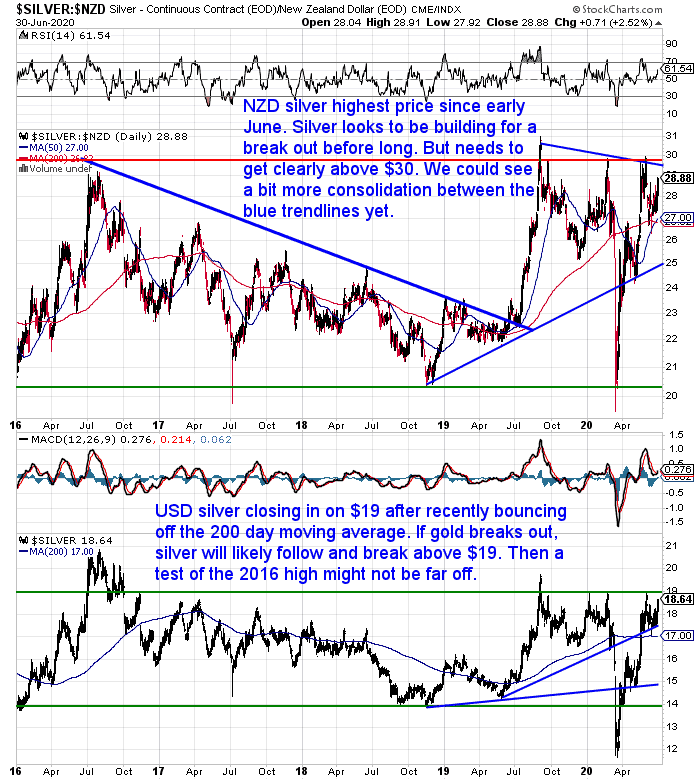

Silver outperformed gold this week. Rising over 2%. In both NZ and US dollars, silver is close to overhead resistance.

It now probably comes down to what gold does. If the breakout for USD gold occurs, then silver will likely follow gold higher.

In NZ dollars we’d then see a move above $30. While in US dollars we’d look for silver to move above $19. Then a test of the 2019 high just under $20 or even the 2016 high at $21.

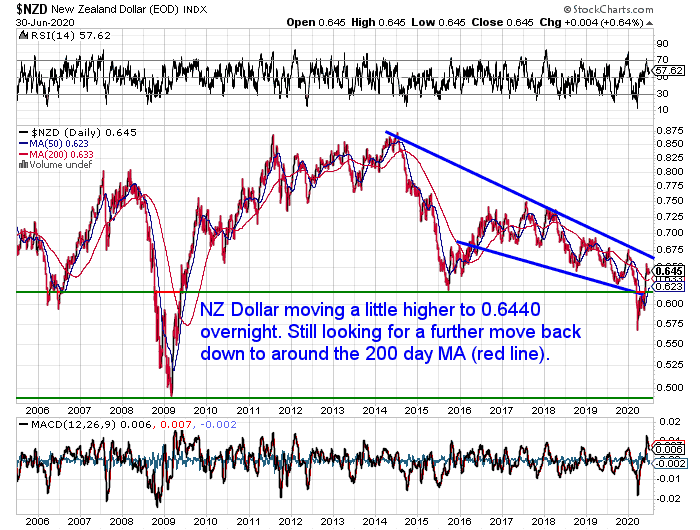

NZ Dollar Dipping a Little

Meanwhile the Kiwi dollar is down for the week. But still hovering around the 0.64 mark. We have been expecting a further move lower to test the 200 day moving average (red line in the chart). But maybe we’ll see the NZ dollar tread water here for a bit longer.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

NEW: Certified Organic Long Life Emergency Food

This easy to carry bucket has 90 servings of organic breakfasts and mains

Free Shipping NZ Wide

Get Peace of Mind For Your Family NOW….

—–

The Gold Standard & A Free Market For Money: How Could This Work?

Last week’s article on The Fourth Turning proved very popular. If you didn’t catch it see: The Fourth Turning and Gold: What’s Still to Come in This Crisis?

We argued that maybe along with the end of nation states we will also see the end of national currencies too.

But what might this look like exactly? How might it take place?

So this week we cover 200 years worth of monetary history including the gold standard. But also mull over how a free market for money just might look too…

Ultra-Wealthy Moving Into Gold

Last week we reported that:

“more institutional investors are preparing for possible higher inflation down the track…

“Gold, forests, property stocks, inflation-linked bonds – these are just some of the assets investors are pouring money into on the view that the recent explosion of government spending and central bank stimulus may finally rouse inflation from its decade-long slumber.”

It seems investment banks are now catching on and recommending their ultra-wealthy clients also add gold to their portfolios…

World’s ultra-wealthy go for gold amid stimulus bonanza

“As stock markets roar back from the coronavirus-led rout, advisers to the world’s wealthy are urging them to hold more gold, questioning the strength of the rally and the long-term impact of global central banks’ cash splurge.

Before the COVID-19 pandemic, most private banks recommended their clients hold none or just a tiny amount of gold.

Now some are channelling up to 10% of their clients’ portfolios into the yellow metal as the massive central bank stimulus reduces bond yields – making non-yielding gold more attractive – and raises the risk of inflation that would devalue other assets and currencies.

While gold prices have already risen 14% since the start of the year to $1,730 an ounce, many private bankers bet that gold – a hedge for both inflation and deflation – has further to run.

…Nine private banks spoken to by Reuters, which collectively oversee around $6 trillion in assets for the world’s ultra-rich, said they had advised clients to increase their allocation to gold. Of them, four provided forecasts and all saw prices ending the year higher than they are now.”

Source.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Central Banks – Also Preparing For When Confidence in Their Money Collapses Across the Board

We’ve been following the purchases of gold by central banks for many many years now.

Jim Rickards this week points out the massive significance of these central bank purchases. It’s more than simply diversification…

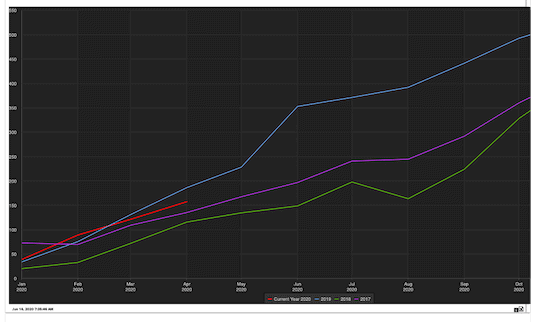

“One of the most important fundamental factors forcing gold higher is shown in Chart 1 below. This shows central bank purchases of gold bullion from 2017 to 2020 (each year is shown as a separate line measured in metric tonnes on the left scale).

Chart 1 – Central Bank purchases of gold

(in metric tonnes) 2017 – 2020

Chart 1 shows significant purchases of gold with 2019 running ahead of 2017 and 2018 at about 500 metric tonnes.

The chart also shows over 150 metric tonnes of gold purchases through April 2020, which puts 2020 on track to show 450 metric tonnes purchased for the year if present trends hold.

Of course, the actual result could be higher or lower. Cumulative central bank purchases from January 2017 to April 2020 are approximately 2,050 metric tonnes.

In fact, central banks went from being net sellers to net buyers of gold in 2010, and that net buying position has persisted ever since. The largest buyers are Russia and China, but significant purchases have also been made by Iran, Turkey, Kazakhstan, Mexico and Vietnam.

Here’s the bottom line:

Central banks have a monopoly on central bank money. Gold is the competitor to central bank money and most central banks would prefer to ignore gold. Yet, central banks in the aggregate are net buyers of gold.

In effect, central banks are signaling through their actions that they are losing confidence in their own money and their money monopoly. They’re getting ready for the day when confidence in central bank money will collapse across the board. In that world, gold will be the only form of money anyone wants.

Central banks are voting with their printing presses in favor of gold. What are you waiting for?

Here’s a once in a lifetime opportunity to front run central banks and acquire your own gold at attractive prices before the curtain drops on paper money.”

This also ties in with what we wrote last week in covering The Fourth Turning. There is likely a time approaching this decade when the monetary system changes.

So we now have the ultra wealthy joining central banks in purchasing gold. Both likely “getting ready for the day when confidence in central bank money will collapse across the board. In that world, gold will be the only form of money anyone wants.”

As Jim Rickards says: “What are you waiting for?”

Please get in touch if you have any questions about buying gold or silver.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Here’s how to always have clean fresh drinking water on hand.

The Sport Berkey Water Filter Bottle – $69 Delivered

Ideal for travel. Driving, camping, backpacking.

Free Shipping NZ Wide.

—–

|

Pingback: No Escape: The Fed Bail Out of the Entire Global Dollar System Will Destroy the Dollar as the Global Reserve Currency - Gold Survival Guide

Pingback: Why Even if Inflation is “Transient” It Won’t Be. Huh? - Gold Survival Guide