It would be hard not to notice that gold and silver have risen sharply in price recently. So is a precious metals correction now due?

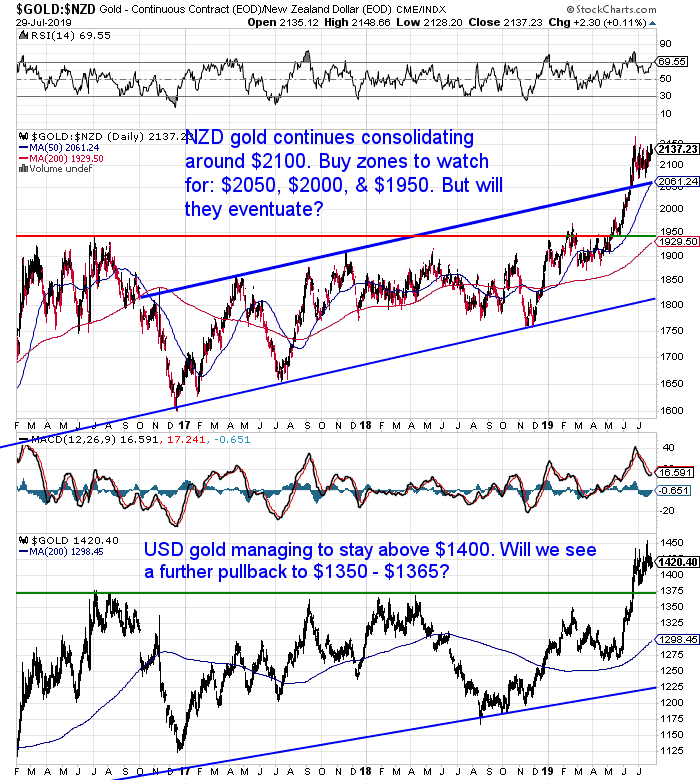

Here’s the recent move in gold. Top chart priced in NZ dollars. Bottom is in USD.

While here is the NZD silver price move.

Both metals have experienced short sharp moves higher. These likely have caught most people by surprise.

Why?

Because both metals have just been moving sideways over the past few years. The “recency effect” says most people therefore expected them to continue to behave the same way.

However, they didn’t. Now it’s likely many people are sitting and waiting for what may seem likely after such a sharp run up in prices…

A correction in gold and silver.

We have been keeping an eye out for the very same thing.

However a number of factors are leading us to consider an alternative.

Namely that we won’t see a sizeable correction in gold or silver in the immediate future.

Gold and Silver Correction Contrarian Indicator No. 1 – No One Buying Right Now

There is very little buying right now. We did see a pick up in interest as gold and then silver broke out and moved higher.

However now both metals are holding up after their sharp run ups, there is again very little interest.

To us this indicates most people expect a correction. They are waiting on this before making a purchase. We know of a number of people interested in buying that have not yet done so.

Maybe they won’t get a chance?

Gold and Silver Correction Contrarian Indicator No. 2 – Increase in People Selling in July

So far in July we have seen a noticeable increase in people looking to sell gold and silver. With a split of about 3 to 1 for gold versus silver.

In fact, of all the requests to sell gold or silver we’ve received so far in 2019, 27% have occurred in July. So this 1 month out of 7 has had over a quarter of the years requests to sell.

Percentage of Total 2019 Gold and Silver Sell Requests Received in Each Month

| January | February | March | April | May | June | July |

| 10% | 20% | 6.67% | 10% | 20% | 6.67% | 26.67% |

Not surprisingly, the other months where the price has risen – such as February and May – are when more people also chose to sell.

We also looked back further and compared 2019 to 2018 to date.

As of today we are just 7 months into 2019. But we have already received 81% of the total requests to sell gold and silver received in 2018.

Learn more about selling gold or silver.

Why Are More People Selling Gold and Silver in 2019?

Here’s a few guesses…

- They don’t believe this is a real bull market in precious metals. They expect prices to fall again.

- Trying to break even. Gold is not too far below it’s 2011 peak. So for anyone who bought in 2010 or the first half of 2011, gold is in positive territory. Again they may be dubious as to whether there are higher prices ahead.

- Cash strapped – of course some people may also be selling even when they don’t want to. With the New Zealand economy slowing, they may simply be in need of some cash.

- They expect better returns elsewhere. Again they don’t believe there are higher prices ahead. They’re just happy to get all or at least some of their original purchase back. However with real estate and share markets at or near their peaks, the old adage of “past performance is no indicator of future returns” might be worth paying heed to.

What Might Happen Instead of a Correction in Gold or Silver?

So we think the above factors point to there being no – or very little – correction in gold and silver in the immediate future.

What might happen instead?

We think there could instead be a sideways consolidation to build a base of support. Before we then witness the next run higher.

We also wonder whether this next move higher might happen faster than most would expect.

A bull market likes to run with as few people on board as possible. So perhaps most potential buyers will sit on the sidelines waiting for a correction that never arrives.

This is why we recommend splitting your purchase into a number of tranches.

Then buy at regular intervals. Spreading the purchases out over a series of weeks or even months.

So if you’re yet to buy gold or silver, consider at least getting a “stake in the ground” now. Then if a correction does come you can buy more at lower prices. But if instead prices run higher from here, then at least you will still have a position at the previously lower prices.

Pingback: RBNZ Slashes OCR - The Race to the Bottom is Speeding Up and NZ Won’t Be Left Behind! - Gold Survival Guide

Pingback: Yes the “Small” NZ Banks Are Still Subject to Bail-In - Gold Survival Guide

Pingback: RBNZ Slashes OCR - The Race to the Bottom is Speeding Up and NZ Won’t Be Left Behind! - Gold Survival Guide

Pingback: NZD Gold Makes New All Time High - Rising With Hardly a Pause - What to Do? - Gold Survival Guide

Pingback: It’s Societal Collapse and Doomsday Week! - Gold Survival Guide

Pingback: The Anatomy of a (New) Gold Bull Market: Prices Rises. Short Correction. Bigger Rise to Come? - Gold Survival Guide