Given that we hear the price of gold quoted each day in the financial news, it’s not surprising that most people buy gold with the expectation it will go up in price? Perhaps this isn’t the best way to think of gold. See why you should think in terms of wealth protection first, profit potential second.

Table of Contents

We prefer not to talk about gold being an investment. Investing is what you do with any money you have that you don’t put into gold and silver.

Rather we look at gold as financial insurance. That is, as an insurance policy that protects you when your other assets aren’t performing or may even be failing.

You certainly wouldn’t own a house or a car without having an insurance policy to cover you for potential risks such as theft or fire.

In much the same way if you have money in the bank, then you should have some financial insurance to cover you. Particularly here in New Zealand where there is no deposit insurance for any savings you hold in the bank. So if a bank fails you risk losing some or all of your savings.

Let’s continue the analogy and compare gold as financial insurance to say a house insurance policy…

Why Hold Gold for Wealth Insurance?

You have your house insured to cover against the likes of fire, earthquake, water damage and theft.

So why have financial insurance in the form of gold?

1. To Remove Some of Your Wealth From the Banking System

Reason number one is to remove some of your wealth from the banking system and protect against systemic risk. In 2018, Deutsche bank failed a US banking stress test. Recently the Bank of England ordered HSBC, Lloyds Banking Group and Standard Chartered to “fix issues including how they would fund themselves if they ran into trouble and how they would smoothly serve customers.” Those are just a few of many possible dominoes that could set off another global financial crisis.

2. Protection Against Bank Failure and Bail-ins

As noted already, in a bank failure 100% of your deposits are potentially at risk in New Zealand. Plus with such a concentrated banking sector in New Zealand, if one bank failed there is a likelihood that others would be affected. So it makes sense not to keep all your eggs in one basket. Remove some wealth from the banking system. This bail in is exactly what took place in Cyprus back in 2013.

Read more: Bank Failures: Will New Zealand be Cyprussed?

3. No Counter-Party Risk

Gold (and silver) is the only financial asset with no counter-party risk. Or put another way gold is the only financial asset that is not at the same time someone else’s liability.

Compare this to other financial products:

- Bank account – you rely upon the bank remaining solvent. Your savings are the banks liability.

- Shares or stocks – you reply upon the company to continue trading and pay you a dividend or remain of value so your can eventually sell to someone else.

- Bonds – you rely upon the company or government to remain solvent and pay you the coupon amount at maturity or each year.

- Property – usually has a mortgage holder against it. You are also relying upon the leasee or renter to pay the agreed amount of rent each month.

- Exchange traded funds, options, futures, CFD’s – all these financial products involve another counter-party. Such as the broker, or dealer who you rely upon to remain solvent and pay their side of the investment upon due date.

- Kiwisaver Funds – your Kiwisaver is not government guaranteed. See this for more on the risk to Kiwisaver in the case of a bank failure: Kiwisaver and Bank Bail Ins: If a Bank Fails, Are Kiwisaver Funds Affected by the OBR?

On top of this, many of these financial products may be further complicated by the method in which you own them. For example many shares are held in custodian by a broker or bank. So if that financial institution were to fail you may find your shares are actually held as liabilities on their books.

Read more: Gold Mining Shares vs Physical Gold Bullion – Which to Buy? >>

4. Gold Won’t Go to Zero

Unlike all the above mentioned financial assets gold has never in all of history “gone to zero” and been worth nothing. Odds are that despite technological changes gold will be worth something in the future.

5. Protection Against Asset Confiscation

While this may seem extreme in New Zealand, there are countless historical occurrences where gold has provided wealth protection from asset confiscation. Where an authoritarian government has confiscated property and it is the gold insurance “policy” that has allowed families to escape.

What Are You Covered For?

When you take out an insurance policy you need to give some thought as to what you are covered for. Sometimes you pay a higher premium to get greater coverage for less likely but potentially very costly risks.

So How Does Your Golden Financial Insurance Cover You?

Firstly gold protects you from all the risks mentioned above. Most of those are systemic type risks. The risk of a complete failure of a bank or even the local or global financial system.

However gold also covers you from less extreme risks:

1. Inflation and Loss of Purchasing Power

Over the long term gold will protect the purchasing power of your savings from the silent thief that is inflation. While the quoted “price” may fluctuate, over the long run gold still buys much what it did a couple thousand years ago. The often quoted but still valid example is an ounce of gold in roman times bought a fine toga and sandals. Today an ounce of gold still buys a fine mens suit and shoes.

2. Non Correlated Asset

Gold acts as “investment insurance” as it is an asset that is non correlated with many other assets. So when the likes of shares/stocks, bonds and property are performing poorly gold can often smooth out your overall returns. Many studies have proven gold’s counter cyclical qualities:

“Gold’s qualities as a hedging instrument and safe haven asset have been thoroughly examined in recent years. Sherman (1982) suggested a weighting of 5% in an equity portfolio resulted in lower risk and higher return.

…Studies by Bruno and Chincarini suggest allocating 10% of the portfolio to gold for non-US investors. Scherer recommends a 5-10% weighting of gold for sovereign wealth funds. For high net worth individuals and family offices, Klement and Longchamp (2010) suggest an allocation in the range of 5% to 10% by weight to gold in an equity portfolio.

Lucey, Poti et al. (2006) examine portfolio choice where the investor is concerned with downside protection and find an optimal weight of between 6% to 25%, depending on the time period and the other assets included. Baur and Lucey (2010) provided the first statistical test of when gold acts as a safe haven and when as a hedge.”

Source.

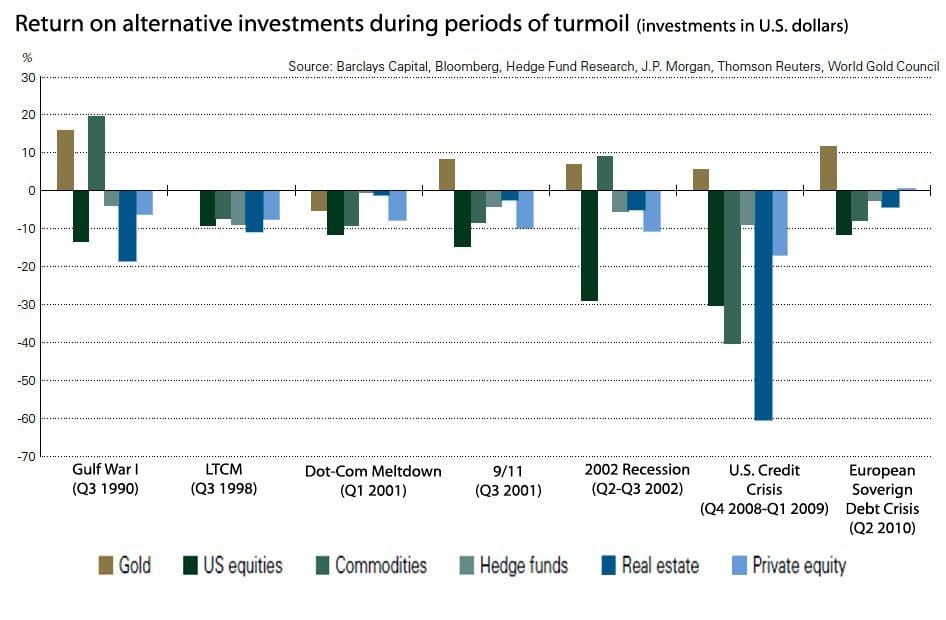

3. Diversification / Hedging in Times of Economic and Political Crises

“As this graph illustrates, gold has consistently outperformed U.S. stocks, commodities, hedge funds, real estate, and private equity through seven major economic shocks and political crises since 1990.”

What are the “Exclusions”?

When purchasing a car or house insurance policy you need to read the fine print and see what the exclusions are. What aren’t you covered for? There are often exclusions for the likes of “acts of god”.

What Doesn’t Your Gold Insurance Cover You For?

Gold is very forgiving, there are no exclusions. Gold may not perform so well at times. But as said already it won’t go to zero. History says it will always be worth something. And most likely when you really need it is when it will be worth the most.

However you do still need to “read the fine print”.

How so? The type of gold you buy is key.

Hold the Right Type of Gold

For your financial insurance policy to be “valid”, it needs to contain the right product. A product with no counter-party risk. It should be physical gold – not paper gold or any product whose value relies upon a counter-party remaining solvent.

You need to buy physical gold held in your own possession, in order for there to be no counterparty risk.

So if you want gold as wealth insurance you should avoid any of the following that have counterparty risk:

- Gold mining shares

- Exchange Traded Fund’s (ETF’s)

- Gold futures

- Gold options

- Contracts for Difference (CFD’s)

Are we saying don’t buy any of the above? No, just don’t confuse them with physical gold as financial insurance. A share in a gold mining company is a speculative investment. Not financial insurance.

In a worst case scenario, like a financial crisis even worse than the last, gold derivatives could well be totally worthless. Trading rules could be altered stopping you gaining maximum profits. Or the counterparty could default leaving you with nothing at all.

Read more: Paper Gold vs Physical Gold – What Should You Buy? >>

The Risk With Gold Futures, Even if the Gold Price Rises

If gold rises massively, margin requirements could rise massively too. When trading futures you are required to put a certain amount of cash up and then this is leveraged.

However there are historical examples in other commodities where there has been a large jump in price. The futures exchange hiked margins massively, meaning traders had to deposit large amounts of capital in order maintain their position. Even though the price had risen! Source.

Key Differences Between a Standard Insurance Policy and Gold as Financial Insurance

We’ve been comparing gold financial insurance to standard home and property insurance policies. But there are some key differences between gold financial insurance and normal fire, house and car insurance.

With a standard insurance policy if you don’t make a claim the premiums you’ve paid could be looked at as being “for nothing”.

With gold as financial insurance, even if you don’t need it and the worst case scenario doesn’t eventuate, your gold will still be worth something. You can effectively “cash in” your insurance policy at a later date.

Unlike other insurance premiums, you don’t lose if you don’t claim. You can still “sell” your insurance later.

Wealth Insurance With Upside

With a standard home insurance policy, you know how much your payout will be – the replacement value of your property.

But the beauty of gold as financial insurance, is that gold is wealth insurance with upside potential.

If you bought financial insurance 20 years ago it would be worth around 5 times as much today. But you’d also still own it and have the benefit of its protection.

As we outline in our how to value gold and silver articles, precious metals still have a lot higher to run to reach their potential maximum historical valuations. Read more: How Do You Value Gold | What Price Could it Reach?

So just like planting a tree, the best time to buy gold for financial insurance was 20 years ago, but the next best time is today.

Head on over to our online store and see what gold and silver financial insurance products are available today: Buy gold and silver.

For a video presentation on this topic see: Presentation – Gold & Silver: Wealth Insurance with Upside

Editors Note: This article was first published 4 July 2018. Last updated 20 September 2022.

Pingback: Owning Gold Is the First Step to “Freedom Insurance” - Gold Survival Guide

Pingback: Insure Your Wealth Against Fake Valuations! - Gold Survival Guide

Pingback: Reminder: There is no deposit insurance in NZ banks

Pingback: Latest on the NZ Housing to Gold Ratio - Gold Survival Guide

Pingback: NZX50 Near Highs But This Indicator Says the NZ Economy is Slowing Sharply - Gold Survival Guide

Pingback: Is There a Kiwisaver Gold Fund or Gold Investment Option? - Gold Survival Guide

Pingback: Net Migration Falling - Could This Tip NZ into Recession? - Gold Survival Guide

Pingback: Paper Gold vs Physical Gold - What Should You Buy? - Gold Survival Guide

Pingback: Why Buy Gold? Here's 14 Reasons to Buy Gold Now

Pingback: Why Buy Gold? No Fiat Currency Lasts Forever - What About the NZ Dollar? - Gold Survival Guide

Pingback: Gold Confiscation - Could it happen in New Zealand?

Pingback: Why the NZ Super Fund Should “Invest” in Gold - Gold Survival Guide

Pingback: Buy Silver in New Zealand

Pingback: What Good is a Bar of Gold When the Shelves are Empty?

Pingback: Paper Money in Circulation in NZ vs Total Bank Deposits

Pingback: When to Buy Gold or Silver: The Ultimate Guide - Gold Survival Guide

Pingback: Dow Gold Ratio: How Does Gold Compare to Shares For the Past 100 Years? - Gold Survival Guide

Pingback: 10 Inventive Hiding Places To Store Your Gold, Silver & Valuables

Pingback: How Many People Own Gold? New Zealand vs Other Countries - Gold Survival Guide

Pingback: Gold Mining Shares vs Physical Gold Bullion - Which to Buy? - Gold Survival Guide

Pingback: What Percentage of Gold and Silver Should Be in My Portfolio? - Gold Survival Guide

Pingback: Rickards: Gold Price Has Been Locked to SDRs and Global Monetary Reset is Under Way - Gold Survival Guide

Pingback: Confusing Investing with Wealth Protection: The Risks of Paper Gold

Pingback: What, Where and How to Buy Gold

Pingback: Bank Capital Changes: What is the RBNZ Preparing For? - Gold Survival Guide

Pingback: Should I Pay Down Debt or Buy Precious Metals? - Gold Survival Guide

Pingback: Buying Precious Metals: Common Questions from First Time Buyers

Pingback: Biggest Threats to Auckland and Wellington - According to Lloyd's of London

Pingback: Gold vs Bitcoin/Cryptocurrencies - Which Should You Choose? - Gold Survival Guide

Pingback: Derivatives - a Beginner's Guide to “Financial Weapons of Mass Destruction”

Pingback: Update: RBNZ Bank Financial Strength Dashboard - How Helpful is it? - Gold Survival Guide

Pingback: Is Now a Good Time Buy Gold in New Zealand? - Gold Survival Guide

Pingback: Why Sleeping Beauty Should Own Some Gold or Silver - Gold Survival Guide

Pingback: Gold - Once Again Best Friend in a Bear Market - Gold Survival Guide

Pingback: NZers: Do You Hold Cash or Gold in the Coming Crisis?

Pingback: Negative Interests Rates in NZ by November? - Gold Survival Guide

Pingback: Silver Bouncing Off Trendline - Gold Survival Guide

Pingback: NZ Government Bonds Go Negative - A Taste of What’s to Come - Gold Survival Guide

Pingback: New Zealand Bank Deposit Protection Scheme - Does N. Z. Have Bank Deposit Insurance? - Gold Survival Guide

Pingback: The Fourth Turning and Gold: What’s Still to Come in This Crisis? - Gold Survival Guide

Pingback: First Time Buyer Question: How is Gold Going to Trend in the Next 6 Months? - Gold Survival Guide

Pingback: How to Safely Hold Dollars, Remain Liquid, and Seize Short-term Opportunities - Gold Survival Guide