This Week:

- Gold and Silver Bounce Back

- Why Gold Could Do Well Even if There Isn’t a Crisis

- Gold, Cheap, Hated and in an Uptrend

- The Yield Curve Recession Predictor: Impact on Gold?

Prices and Charts

Final Reminder: Digital Currencies Webinar 1pm Thursday

First up a final reminder about the online event we have with brokerage firm Caleb & Brown tomorrow.

If you have any interest whatsoever in digital currencies, then we’d highly recommend you sign up and come along on Thursday 1pm.

You’ll be sure to learn something regardless of your level of knowledge on the subject. Go here for more information.

Gold and Silver Bounce Back

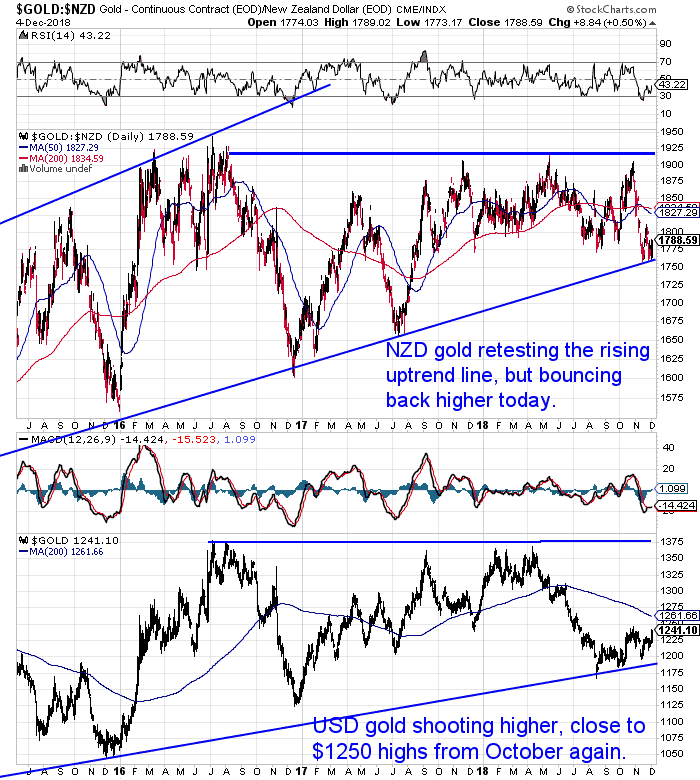

A lot of action in the markets this week. The Dow Jones industrial average dropped nearly 800 point this morning. The NZ Dollar continues to bounce back sharply. But so do gold and silver.

NZD gold is up about half a percent this week. It once again tested the rising trendline, but has now bounced back and is close to $1800 per ounce again.

So NZD gold remains in a very good buying zone. Sitting just above the long term uptrend line.

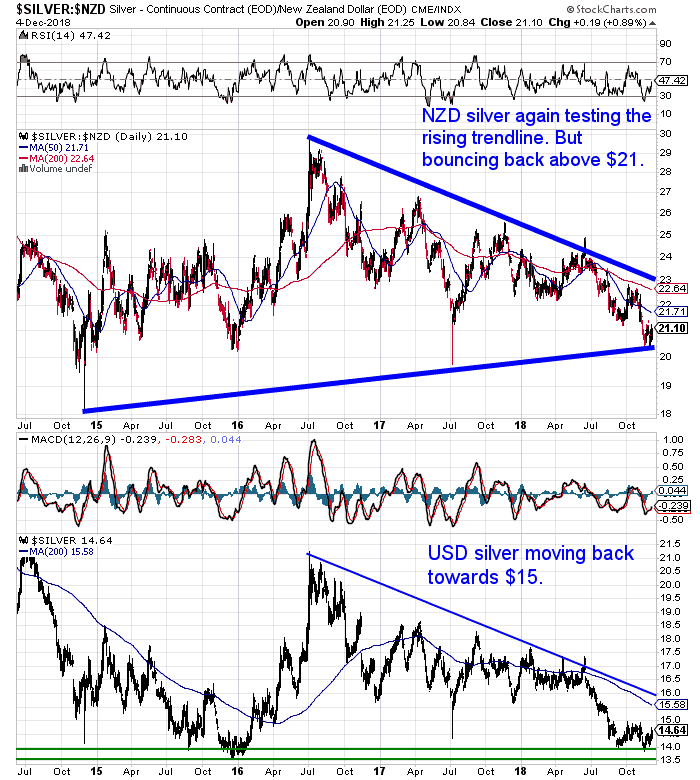

NZD silver also did the same thing. Touching the uptrend line before moving higher. So it too is in what looks like a very good buying zone.

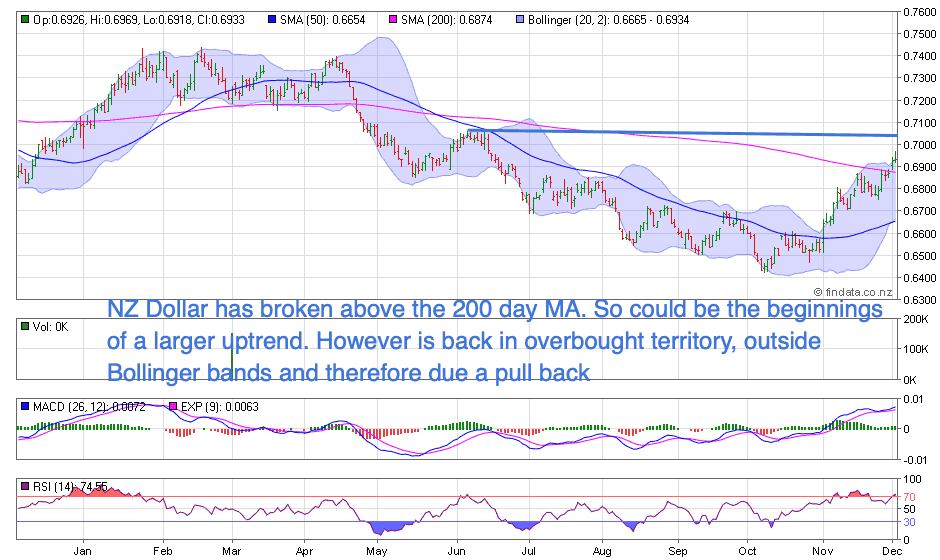

The NZ dollar continues its recent strength. This week moving above the 200 day moving average. So this could be indicating a change to an uptrend, in the medium term anyway.

But the Kiwi is also now outside the Bollinger bands (purple shaded area). Also back in overbought territory on the RSI. So with 0.7050 looking like tough resistance above us, we should see a pullback before too long.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—–

How Many People Own Gold? New Zealand vs Other Countries

Following our feature article last week reader D.P. sent us a link to an excellent and closely related video.

So we’ve added the video to the article.

It shows that there is only enough gold in the world for each adult in the world to hold 1oz of gold on average.

The video also explains how today while not exactly simple, it is far easier to obtain 100oz of gold than to attain $5-10 million. Interestingly the video creator also has a theory that if all the world’s gold was distributed in the same proportion as other wealth, then all it would take is to own just 18 ounces of gold to push you into the top 0.8%!

If you read last weeks article, you’ll want to watch that (only 10 mins long). Or if you didn’t read it, check it out below.

Yield Curve Inverts – Sort Of

We read some reports of the US stock market fall being attributed to rising bond yields and therefore a falling spread between shorter term and longer term US government bonds.

So we’ve updated our look at the yield curve. As this is an indicator that suddenly everyone seems to be paying attention to.

It is pointing to a US recession not being too far away now.

In this post we cover:

- What is the Yield Curve?

- What is an Inverted Yield Curve?

- What Does an Inverted Yield Curve Mean?

- How Does the Yield Curve Predict Recessions?

- What is the Yield Curve Saying Today?

- Recession Indicator: How Far Away Might the Next Recession Be?

- What to Do to Prepare?

- The Yield Curve and Gold

Also another interesting indicator of a pending US recession comes from Mike Maloney.

He recently found that an interesting correlation when you compare US tax revenue to the timeline of past recessions, particularly tax receipts on corporate income.

“You might think that tax revenues would fall after a recession starts – but what the data show is that tax revenue in most cases has fallen before a recession.

As Mike shows, in 14 of the last 17 times that corporate tax receipts have begun to roll over and decline, a recession started not long after. In other words…

A drop in corporate tax receipts has frequently predicted a recession.

And guess what? Corporate tax revenue has started to fall.

Given how high the stock market has climbed, this source of tax revenue will drop hard when the stock market crashes. Indeed, the second-longest bull market in stocks could mean a bigger crash than normal — and a nastier recession than many expect.”

Watch the Video here.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Why Gold Could Do Well Even if There Isn’t a Crisis

But contrary to what most people would think, gold may not need a full blown crisis to do well.

Nick Hubble of the Daily Reckoning Australia points out:

“…there’s a different reason why now might be the time to buy gold.

Gold does well when real interest rates are falling. In other words, when inflation is rising faster than monetary policy can keep up.

In the run-up to the global financial crisis, gold had an enormous bull market. A bull market which made our publishing company’s founder wealthy and his writing about gold renowned.

We may be entering the same sort of market in most of the world.

A world where central bankers struggle to keep up with rising inflation.

Because if they raise rates too fast, they’ll trigger the next crisis. So they’ll err on the side of sluggishness.

The world has taken on huge amounts of debt. Interest rates can’t go up much without that debt becoming unaffordable.

This could leave us with an inflationary surge that can’t be reined in.

That’s an ideal environment for the gold price to surge.

Usually, you read about gold as a crisis hedge in the Daily Reckoning Australia.

And yes, the gold price can perform well when other assets are tumbling. Not to mention you can own gold safely outside the financial system, which is true diversification.

What I’m trying to show you here is that gold could be a good investment in coming years even if you don’t believe there will be a crisis.

It could be the sort of period between 2003 and 2007 when gold surged in value.

Gold is like the safety net under the central bankers’ tightwire act.

It doesn’t matter which way they fall off; gold still has you covered.

Inflation or financial crisis, gold should benefit.”Source.

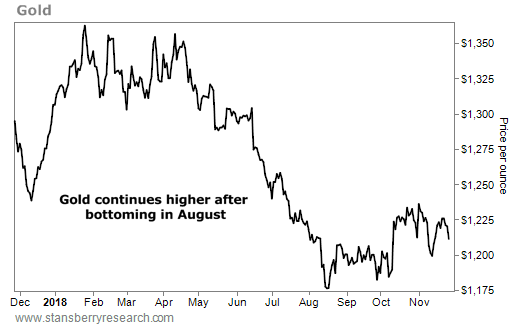

Gold, Cheap, Hated and in an Uptrend

After struggling so far in 2018, we may be about to see a change in trend for gold.

Steve Sjuggerud highlights how gold is now meeting his 3 key criteria for purchasing any investment:

“…these three principles [cheap, hated and in an uptrend] point to gold as a fantastic opportunity right now.

You see, gold has spent the better part of seven years falling in price. It’s down by more than a third over that period. So clearly, the metal is cheap.

Investors also hate the idea of owning gold. And it’s easy to see why.

The precious metal has been in free fall most of 2018, losing roughly 11% of its value since its January peak. And this year’s performance is a continuation of the longer-term trend.

Gold is disaster insurance. It goes up when the global economy goes south. And we haven’t had a disaster in more than a decade.

The result is that investors have moved on to greener pastures… They’ve given up on gold. The metal recently hit its most hated level in 17 years, as I explained in a recent DailyWealth essay.

I love to see this setup. It’s the kind of sentiment extreme that contrarian investors dream of. And right now, it’s kicking off the beginning of an uptrend. Take a look…

Gold has slowly been trending higher since August. The metal is up a little more than 3% since then. And prices appear to be hitting what analysts describe as “higher lows.”This might not seem like a major rally. But it’s exactly the setup we want to see.Gold prices have been falling for years. Investors recently hit their most extreme negative sentiment levels in nearly two decades. And now, the price is starting to move back up.Said another way, gold is cheap and hated… And it’s finally starting an uptrend.I’ve built my career looking for these kinds of opportunities. It’s how I’ve found my biggest winners. And right now, gold fits this investment philosophy perfectly.”Source.

Gold has slowly been trending higher since August. The metal is up a little more than 3% since then. And prices appear to be hitting what analysts describe as “higher lows.”This might not seem like a major rally. But it’s exactly the setup we want to see.Gold prices have been falling for years. Investors recently hit their most extreme negative sentiment levels in nearly two decades. And now, the price is starting to move back up.Said another way, gold is cheap and hated… And it’s finally starting an uptrend.I’ve built my career looking for these kinds of opportunities. It’s how I’ve found my biggest winners. And right now, gold fits this investment philosophy perfectly.”Source.

Stop the Press: Late Deals Just in

In case you missed them at the start, we have some silver deals from one supplier just in today. None of these are on the website yet, so just call or email if you’re interested. These are all selling for the same as or not too much more than local silver prices:

1kg Silver Bars from:

Perth Mint (very limited stock)

Southern Cross

10 oz Silver Bars from:

APMEX

Perth Mint

NTR

Get in touch for a quote or to get your questions answered.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

—– —–

|