See why Russia slashed its US treasury holdings by 84% in the past 2 months. While increasing its central bank gold reserves yet again.

Russian Slashes Its US Treasury Bond Holdings

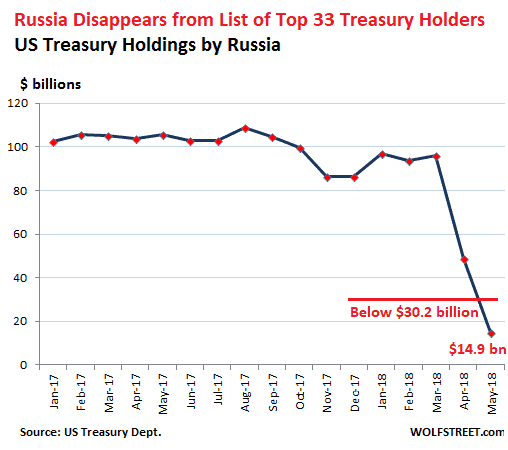

The central Bank of Russia’s holdings of US Treasury Bonds fell $81.2 billion during April and May to a total of just $14.9 billion. A dramatic 84.5% reduction in only 2 months is quite unheard of. As Bloomberg noted:

“Since the start of 2017, no country’s holdings have fallen more, either on an absolute or percentage basis.”

US Treasury filings show Russia is no longer present in the list of the major nations holding US government bonds. And there are 33 nations in the list!

Russia Gold Reserves Rise to a New Record in June

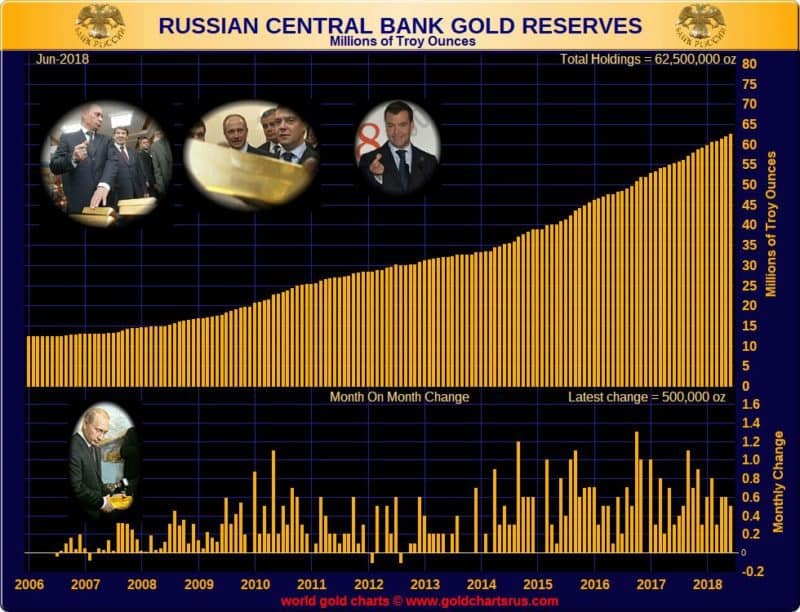

Meanwhile the Russian gold holdings rose yet again.

“Russia’s gold holdings have been steadily increasing, bringing its share of the precious metal to its highest level in nearly two decades. Russia’s gold holdings in May grew by one percent to 62 million troy ounces, worth $80.5 billion, according to the CBR.” Source.

In June the Russian Central Bank gold reserves increased by another 500,000 ounces to 62.5 billion as per the chart below from GoldChartsRUs.com. Another US$610 million worth of gold added to the Central Bank of the Russian Federation coffers.

So Russia now holds only around $15 billion worth of treasury bonds, but has over $80 billion in gold reserves!

Why is Russia Selling US Treasuries?

Why is Russia selling such a vast amount of US treasury bonds?

The official word from the head of their central bank, Elvira Nabiullina, was that:

“…slashing of the holdings was result of the systematic assessment of all kinds of risks, including financial, economic and geopolitical.” Source.

Russian Senator Alexei Pushkov said that:

“…Russia’s move to dispose of a half of US securities was a step to reduce the country’s financial dependence on the United States.” Source.

Natalia Orlova, chief economist at Alfa Bank, said:

…that the Bank of Russia could reduce investment in US treasury securities, because the further dynamics of the US dollar in the conditions of trade wars was causing concerns. Source.

Some might argue that Russia sold US government bonds to bolster the Ruble. However

Why is Russia Increasing Its Gold Reserves?

Again RT reports that the central bank head said that:

“gold purchases helped to diversify reserves.”

While Sputnik News said:

“…in an era of global economic instability stemming from geopolitical crises and fears of a global trade war, precious metals are seen as instruments providing security and a diversification of risk.”

“…gold is seen by many economists as a reliable store of value which, while also subject to fluctuations, cannot be drastically depreciated, or suffer an artificial collapse. The same cannot be said of treasuries (American or otherwise), which can collapse in value if a large debt holder were to suddenly dump its holdings.”

…Keith Neumeyer, chairman of the board of First Mining Gold, a Vancouver-based development firm, said that the reason for Moscow’s rush to pull out of US T-bills and grow its reserves of gold was obvious.

“I’m certain that a global reset will take place when the governments of the world need to rid themselves of debt, and that they will tie everything to the price of gold. That’s why countries like Russia and China are accumulating gold – they know what may happen a few years from now,” he said.”

PravdaReport had an even more specific quote from the Russian central bank boss:

“We are diversifying the entire structure of currencies … We are pursuing a policy so that they are safely stored and diversified, and we assess all the risks: financial, economic and geopolitical ones,”

While Vice-president of the Golden Mint House, Alexey Vyazovsky said that in buying gold the Central Bank of Russia:

“…protects itself against the possible seizure of foreign currency reserves abroad. Sanctions become tougher, and everything may eventually develop on the basis of the Iranian scenario, when Teheran’s reserves invested in treasury bonds were arrested.”

and to:

“…support the gold mining industry.”

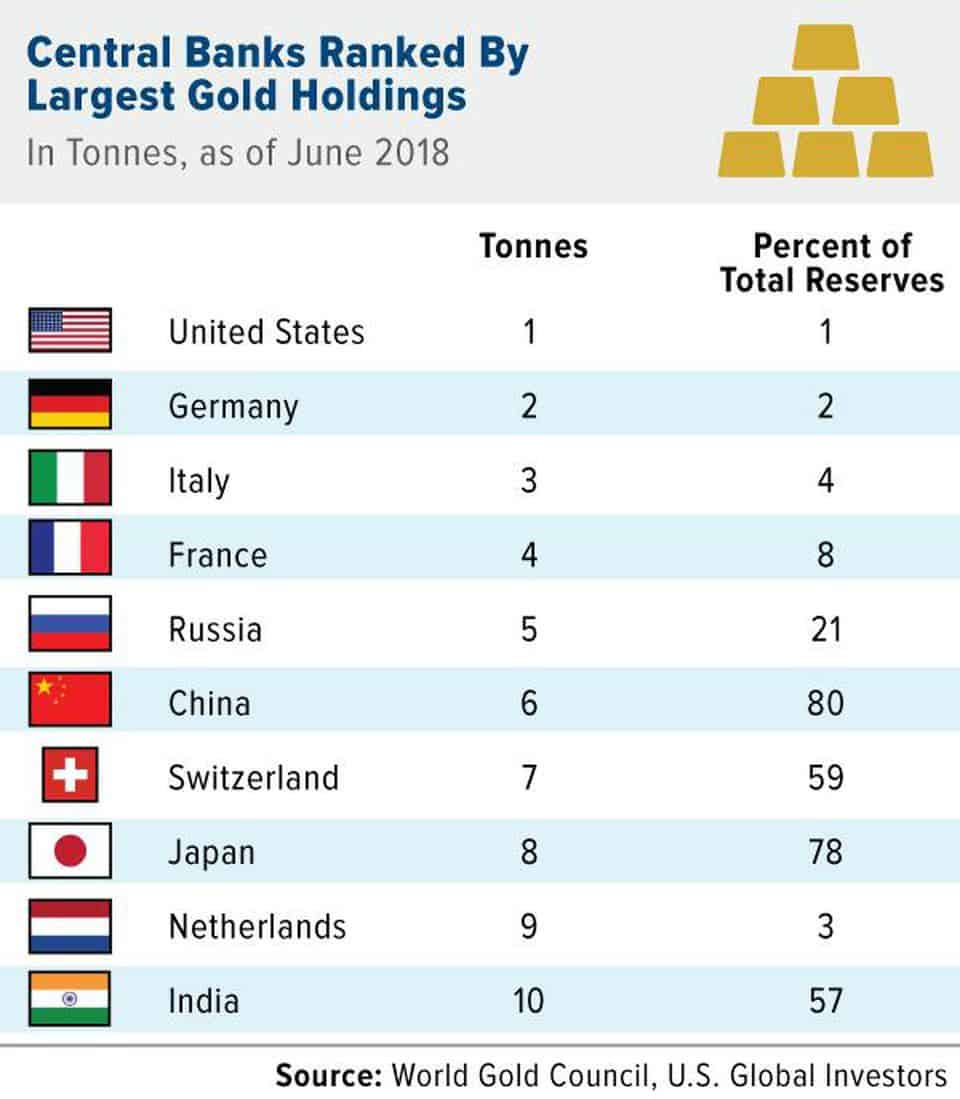

Russia Has the 5th Largest Gold Reserves

Russia sits at number 5 in the world in terms of the total size of its gold reserves. But at 21% they are the highest in the top 5 by proportion of total reserves.

Putin the Prepared: Dollar Winter Is Here

Chris Duane recently published a video on this very topic. In it he covers:

- Why the news that doesn’t get the most attention is the most important.

- Why we should ignore the “Trump is Putin’s lap dog” stories.

- Central Bank of Russia dump the majority of their US treasury Bond holdings.

- And how they doubled their gold reserves from 2014. From 30 million to 62 million ounces of gold.

- Why Putin is the oligarch he most respects.

- How he manhandled a number of the oligarch’s.

What We Can Learn From Russia and Their Reserves

Chris makes the point at the end that we can learn a thing or two from following Russia and Putin. That is

You should be your own central bank. Dump the dollar and paper assets and instead build real tangible wealth. Buy gold and silver.

In the same way Putin is prepared. We need to be prepared.

For more information on how to invest in silver see: How to Buy and Invest in Silver >>

Full video below.

>> Read more: Why Does Gold Demand Remain Strong in the East?

Pingback: Why Buy Gold? Here's 14 Reasons to Buy Gold Now

Pingback: How Will the Global Monetary System Change Take Place? Will China Take over the Reserve Currency Role? - Gold Survival Guide

Pingback: Why You Should Become Your Own Central Bank - Even if Your Nation’s Central Bank Has Gold Reserves - Gold Survival Guide