Prices and Charts

Late Update: RBNZ Raises OCR to 1%

As we are about to hit send the RBNZ has raised interest rates and the Kiwi dollar jumped higher. So prices are now up from what are shown in today’s price table and charts.

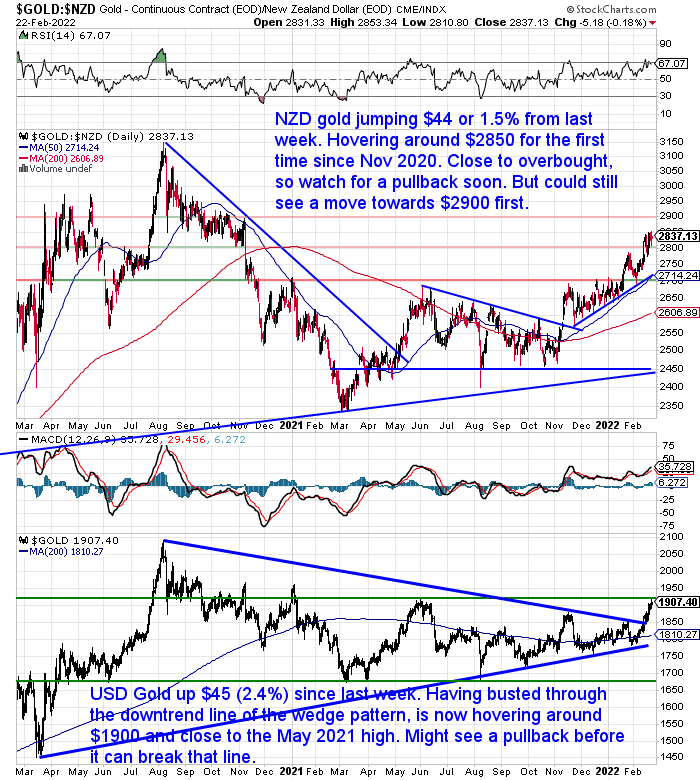

NZD Gold Highest in Almost 16 Months

Gold in New Zealand dollars this week jumped to the highest price it has reached in almost 16 months. It is up $44 dollars from 7 days ago and is hovering around just under $2850. The RSI overbought oversold indicator is also hovering just under overbought (see the top of the chart below where overbought is 70). So this indicates a pullback is getting more likely. But we could also still see a further move higher to say $2900 before this happens.

Where are the buy zones to watch for if a pullback occurs?

We’d guess the 50 day moving average, which also coincides with the blue rising trendline around $2714, would be a good one to watch out for.

In US dollars, gold is also hovering near the high from the middle of 2021. So likewise could be due for a pullback fairly soon.

But once a pullback is over, the all time highs in both NZD and USD could be within sight over the coming year.

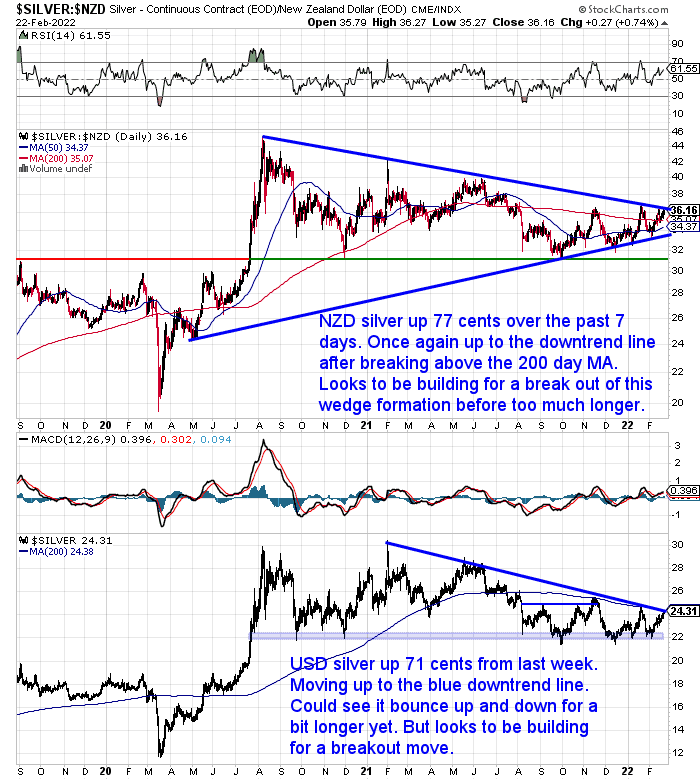

NZD Silver Once Again Bumping up to the Downtrend Line

Silver in New Zealand Dollars is once more bumping up against the downtrend line. NZD silver rose 77 cents from 7 days ago after breaking through the 200 day moving average. So silver looks to be building for a breakout of this wedge formation before too much more time passes. But there is still space within the wedge for silver to dip lower again yet. That is probably the more likely short term move.

Silver in USD is also sitting right under the downtrend line today. Likewise building for a breakout.

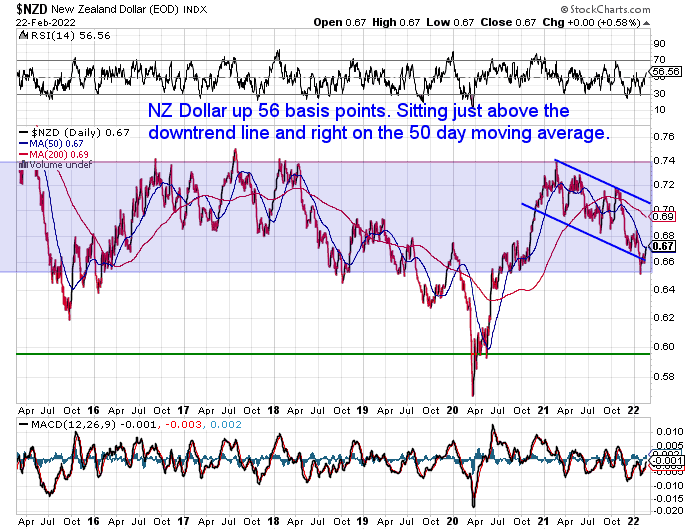

NZ Dollar Back Up to the 50 Day Moving Average

The New Zealand dollar also bounced back this week. Up 56 basis points to be back above the downtrend line and right on the 50 day moving average.

The RBNZ is expected to raise the official cash rate again today. So we will have to see if that has already been built into the pricing for the Kiwi dollar.

LATE UPDATE: Maybe not since the NZD has jumped higher after the RBNZ increased rates by 0.25%.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Measuring House Prices in Gold

Last week we did a presentation for our friends at Defi Freedom. We need to update various charts for the presentation, one of which was an old favourite of ours, the housing to gold ratio chart.

(Stay tuned next week as we should have the video of the presentation to share with you too then.)

But in preparing our presentation we realised we hadn’t updated this post since last March. If you’re a new reader you’ll learn a lot. If you’re an old hand you’ll be interested to see how the ratio has moved since then. This is during a time when the median NZ house price has shot from 825,000 in March 2021 to 905,000 in December 2021.

Here’s what’s covered:

- How to Calculate the Housing to Gold Ratio

- Comparing the NZ Housing to Gold Ratio to the UK and USA

- Could NZ House Values Drop by 85 Percent?

- Key point: It’s the proportional drop in the value of housing to gold that is the key factor.

- Comparing Some Numbers: If the Ratio Falls What Price Could Gold Reach?

- Summary – Using the Housing to Gold Ratio

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

War With Russia – The Next Distraction?

There was debate overnight about whether Russia has “invaded” two breakaway regions of Ukraine. Or whether they are there to offer “support”.

To be honest we don’t have great knowledge about the situation in Ukraine. But what we all have is the ability to look back and see how war has often been used historically as a means to blame the foreigners for the problems at home.

With perhaps the end in sight for Covid, maybe things are being set up to be able to blame inflation and rising fuel prices on those pesky foreigners?

Hopefully this will all die down as many recent pressure points between the USA and other nations have. Think, Iran and North Korea for example.

Investment Bank UBS sees ‘short-lived’ strength for gold. They expect prices to drop to $1,600 by year-end if the Ukraine tensions amount to not too much.

“Gold prices have been buoyed in recent weeks as investors seek safe-havens amid fears of Russia invading Ukraine, but in the longer term, UBS Investment Bank’s Joni Teves predicts that recent strength in gold prices will be “short-lived.”

Source.

We think UBS is making the mistake of putting gold’s recent rise solely down to geopolitical issues. Whereas gold has been rising for months well before things started to boil over in Ukraine. Sure in the short term gold may pull back. But we believe it’s monetary issues that are the key driver for gold. We also have our doubts that real (after inflation) rates will rise as UBS says they will. We doubt that central banks will be prepared to raise rates significantly to slow inflation rates enough.

Russian Gold Holdings – What is Putin Preparing For?

Mr Putin appears to have been thinking the same thing for the past decade. The Market Ear shared this chart of Russia’s US bond holdings versus their gold holdings.

Clearly Russia has reasons for exiting the US Dollar and moving into gold…

Putin’s hedge waiting for the break out

Russia has been switching “hedges” for the past decade, and it looks like Putin is waiting for the gold break out. First chart shows Russian UST and gold holdings. Second chart shows holdings of gold vs the gold price. Some guys are just better at playing chess than others…

Refinitiv

RefinitivWhy is the Federal Reserve Balance Sheet Still Increasing? Didn’t they start Tightening in November?

Pam Martens and Russ Martens have been doing some fantastic investigative journalism (remember when it wasn’t an oxymoron to use those two words together to describe most journalists!) into the goings on at the US Federal Reserve and on Wall Street.

Their latest post is titled:

Since the Fed Announced It Was “Tapering” Last November, It’s Actually Added $332 Billion in Liquidity with New Debt Security Purchases

“What the Fed actually announced in its November 3 FOMC statement was that instead of buying $80 billion in Treasury securities and $40 billion in MBS in November, it would buy $70 billon in Treasury securities and $35 billion in MBS. That was a negligible “taper” of $10 billion in Treasurys and an inconsequential $5 billion in MBS. The November 3 statement also indicated that in December the Fed would “taper” another $10 billion from Treasury purchases and another $5 billion from MBS.

But buried in the fine print of the announcement were these two additional mandates for the New York Fed’s Open Market Desk:

“Increase holdings of Treasury securities and agency MBS by additional amounts as needed to sustain smooth functioning of markets for these securities.”

And this:

“Roll over at auction all principal payments from the Federal Reserve’s holdings of Treasury securities and reinvest all principal payments from the Federal Reserve’s holdings of agency debt and agency MBS in agency MBS.”

The Fed announced further cuts to the amounts it was buying in Treasury securities and MBS in January and February, but the bottom line is that it was still buying up debt instruments (a form of easing) as inflation raged.”

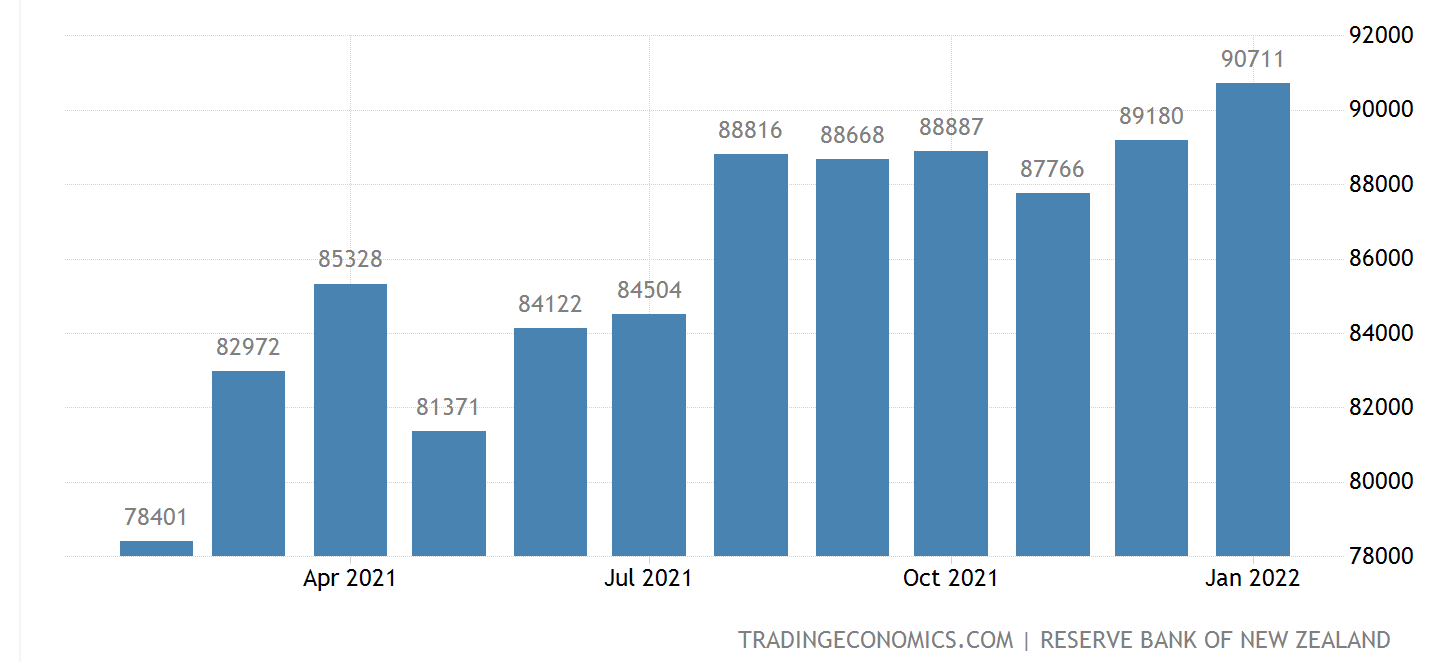

What Has Happened to the RBNZ Balance Sheet Since They Ended QE Last July?

How about here down under?

Last July the RBNZ announced an early end to its QE or currency printing program.

So what has happened to the central bank balance sheet since then? Has it dropped back a bit?

Quite the opposite in fact.

Central Bank Balance Sheet in New Zealand increased to 90711 NZD Million in January from 89180 NZD Million in December of 2021.

Will the RBNZ Be Successful in Reducing its Balance Sheet?

As we go to hit send on this email, the Reserve Bank just announced they have increased the OCR today to 1% and there will likely be more increases to come yet.

However the key thing is not whether the rates are going up, but whether they go up enough to put a dent in inflation rates? As already noted, we think not. Particularly as the RBNZ today stated:

“Headline CPI inflation is well above the Reserve Bank’s target range, but will return towards the 2 percent midpoint over coming years. The near-term rise in inflation is accentuated by higher oil prices, rising transport costs, and the impact of supply shortfalls.”

Hmmm. We’re not sure about the return to 2%.

The RBNZ also announced:

“The Committee also agreed to commence the gradual reduction of the Reserve Bank’s bond holdings under the Large Scale Asset Purchase (LSAP) programme – through both bond maturities and managed sales.”

So the RBNZ plans to reduce its balance sheet. The question is whether they will have any more success at doing so than the US central bank has done since the Fed announced their tightening in November?

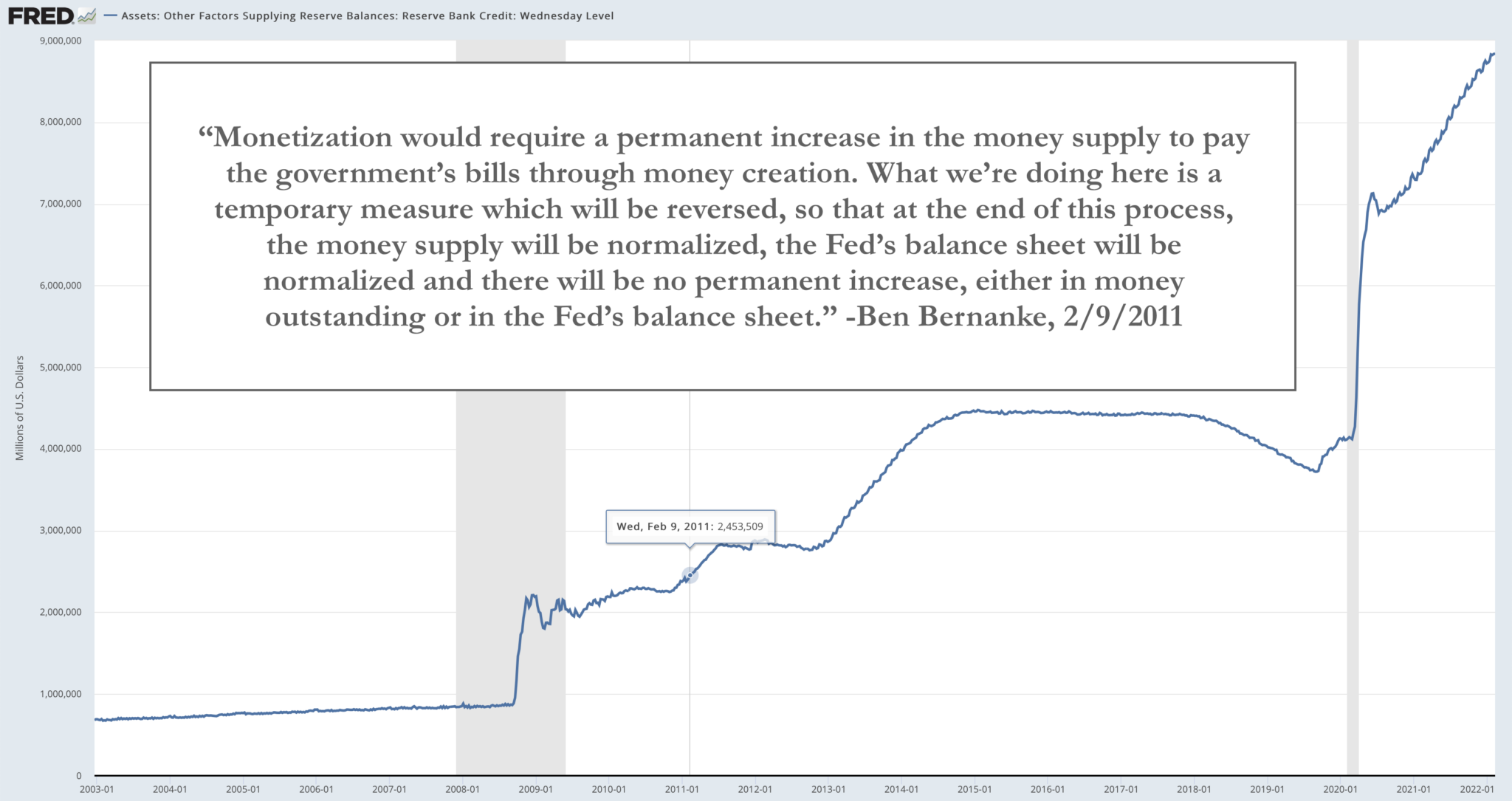

Jesse Felder asks Former US Fed head Ben Bernanke a very good question:

“Eleven years ago, shortly after the onset of QE 2, Ben Bernanke gave us his definition for “monetization” of the debt, telling Congress (hat tip, Grant’s):

Monetization would require a permanent increase in the money supply to pay the government’s bills through money creation. What we’re doing here is a temporary measure which will be reversed, so that at the end of this process, the money supply will be normalized, the Fed’s balance sheet will be normalized and there will be no permanent increase, either in money outstanding or in the Fed’s balance sheet.

At the time, The Fed’s balance sheet was approaching $2.5 trillion. Today, it stands at nearly $9 trillion, more than triple the figure from a decade ago.

And so it only seems fair to ask, ‘Is it monetization yet, Dr. Ben?’

So we guess we could pose the same question to RBNZ head Adrian Orr?

If the huge increase in the RBNZ balance sheet due to the currency printing kicked off during Covid to push interest rates lower is still there in the years to come, will that also be classed as debt monetisation?

i.e. Creating currency to fund the country’s debt?

We watch with interest as to how this “gradual reduction of the Reserve Bank’s bond holdings” progresses. We have our doubts that they’ll do much better than the Federal Reserve has done since they started in 2008…

Expect this temporary inflation to perhaps not be so temporary…

Have you got some inflation protection yet?

So get in touch if you’d like a quote.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|