Prices and Charts

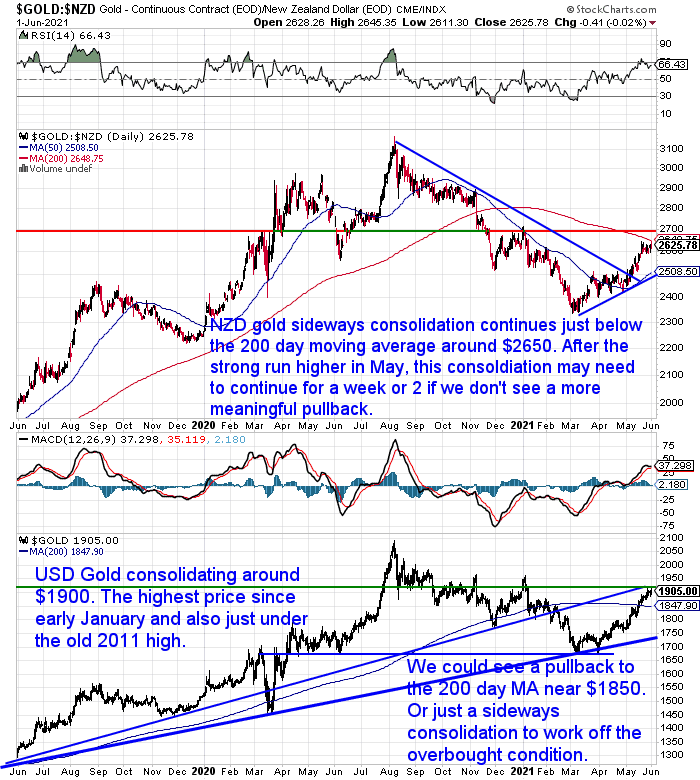

Gold Consolidating Recent Gains

Gold in New Zealand dollars continues in the sideways consolidation just below the 200 day moving average. As a result the RSI overbought/oversold indicator has now dipped down below the overbought level of 70.

Our guess is we may need to see this consolidation continue for another week or 2. Because after such a strong run higher in May, it is normal to expect, if not a pullback, at least a sideways move to solidify the gains.

However gold in US dollar remains overbought. It is above the 200 day MA and just under the old 2011 high (green overhead resistance line). A pullback to the 200 day MA would not be a surprise. But we may just see a lengthier sideways consolidation around current levels.

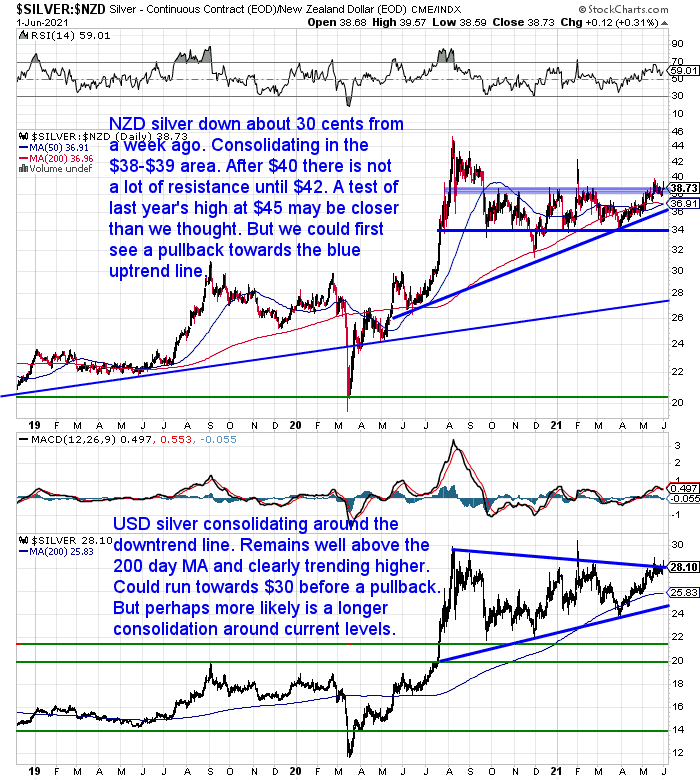

Silver Also in a Sideways Consolidation

Silver in New Zealand dollars is down just 29 cents from 7 days ago. It continues to consolidate in the $38-39 region.

We could see a pullback to the 50 and 200 day MA’s or even down to the blue uptrend line.

However with the RSI still in neutral territory, perhaps a more likely scenario is just a further sideways consolidation around current levels?

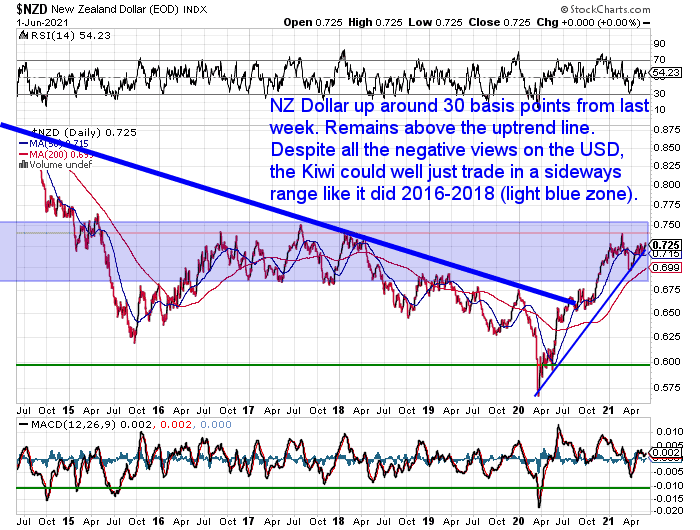

NZ Dollar Holding Above Uptrend Line

The New Zealand dollar was up just under half a percent from 7 days ago. It remains just above the blue uptrend line. It could move all the way up to 0.7500 and still be within the confines of the 2016-2018 sideways trading range.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

NEW: Certified Organic Long Life Emergency Food

This easy to carry bucket has 90 servings of organic breakfasts and mains

Free Shipping NZ Wide

Get Peace of Mind For Your Family NOW….

—– Reader Question: Is There a Relationship Between Copper and Gold/Silver Price Movements, If So is it Relevant?

Another good question in from reader Gary:

“While not advocating storing copper bars under the bed, as a lifelong engineer I have always been an avid scrap collector and the red metal in all its forms has always been a steady earner. I’ve never kept records as such but anecdotally my opinion is that copper should be, at least, about half as much again to be at an average.

The copper price has been rising quite well recently and being referred to Dr Copper given that it is the first metal to move when economic activity picks up, there is currently a body of thought that the manufacturing cycle is picking up post covid. I wondered if you had an opinion on the relationship of what this will have to the more traditional bullion.

All this talk recently of the bullion to house ratio caused me to think, is there a relationship between copper and gold/silver price movements, if so is it relevant?

Be interested in your opinion.”

Indeed there is such a thing as the Copper/Gold ratio. In fact famed bond investor Jeffrey Gundlach calls the copper-gold ratio and US Treasury bond yields, one of his favoured indicators.

Here’s what we cover:

- The Different Factors Driving Copper Compared to Gold

- How the Copper to Gold Ratio Correlates with Long Term Interest Rates

- Our Opinion on the Copper/Gold Ratio

Question of the Month Winner for May

Congrats to the winner of silver coin for the month, Phil, who asked last week’s question “when did NZ switch to Fiat currency?”

A silver coin is on its way to you Phil. Here it is again in case you missed it last week…

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Why it Will Be Very Difficult for Central Banks to End Currency Printing

File all these news items under the heading: “Welcome to the Hotel California – you can check out but you can never leave”…

Because once you start quantitative easing, large-scale asset purchases (LSAP), currency printing or whatever the central planners choose to call it, it is very difficult to exit.

Why?

Because the whole idea behind this is to artificially lower interest rates with a view to this “stimulating” the economy.

However, what really low interest rates do really well is to encourage people to go into even more debt. At the same time governments across the planet are also increasing their debt levels massively.

So we just won’t handle any significant rise in interest rates.

Here’s 3 guests at the Hotel California and why they might have trouble leaving…

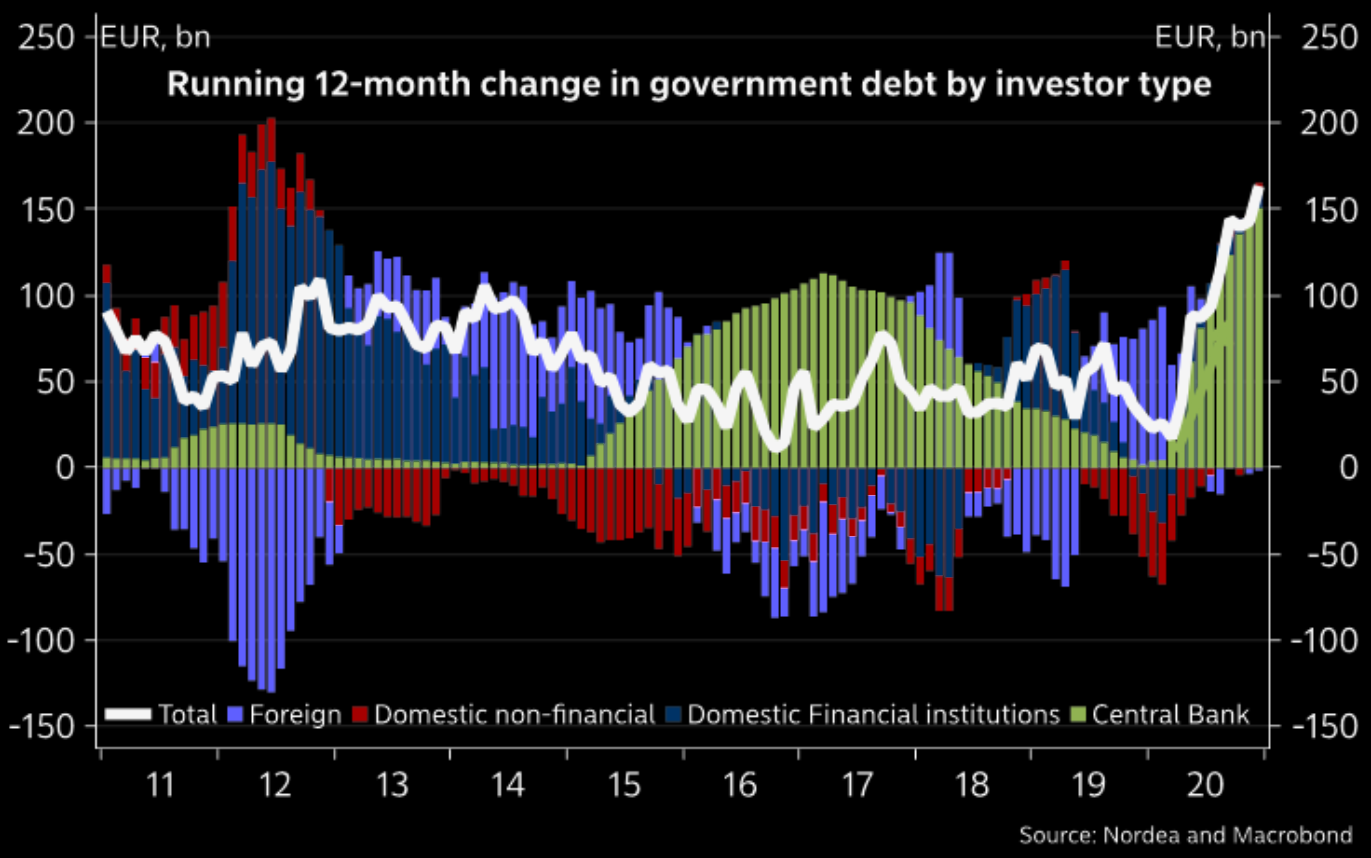

Hotel California – Room 1: Good Luck Tapering ECB

Here’s our first Hotel California guest, the European Central Bank…

The chief strategist at Nordea Mr Andreas Steno Larsen points out how difficult it will be for the European Central Bank to scale back its currency printing when the likes of Italy are completely dependent upon it:

“Banca d’Italia is net/net the sole new owner of all Italian government debt issued over the past 12 months. Good luck tapering ECB….”

In other words the Italian Central Bank is buying all the Italian Government bonds that are issued. No one else is. How can the ECB taper while that is going on?

Source.

Hotel California – Room 2: US Federal Reserve

The above chart clearly shows the Italian central bank is directly financing Italian government spending, by being the sole purchaser of Italian government bonds.

We’ve recently read a couple of arguments explaining how the US Federal Reserve is doing the same thing in a roundabout sort of way. What the economists call “debt monetisation”.

Why does this matter?

Because it is what has led to hyperinflation in countries such as Zimbabwe. Where instead of reigning in government spending or dramatically increasing interest rates or taxes, the central bank instead funds the government through currency printing.

It may not quite be Zimbabwe, but this is another sign that of the end of the Dollar as the global reserve currency…

The Fed’s Argument That It’s Not Directly Financing Government Debt Finally Fails

The Fed is directly financing the government and monetizing its debt at whatever level the government demands–with almost no restraint on the government..

What the Fed is doing now CLEARLY has nothing at all to do with executing monetary policy. That argument vanished completely this month because the Fed’s purchases of treasures are now actually driving monetary reality totally out of whack from the Fed’s own stated policy goals.

The Fed’s absolutely massive treasury purchases in recent months are driving interbank lending rates to press below the zero bound that the Fed has set as its target. As a result, the Fed is now having to do half a trillion dollars in overnight reverse repos (effectively reselling those treasuries to banks at record levels) just to keep foundational interest rates from going negative due to all the treasuries the Fed is soaking up.

That leaves not even a hint of room for the Fed to claim it is only buying treasuries as a way of setting market interest rates. The Fed, is in fact, doing it SOLELY to finance government debt (“monetize” the debt) because the government switched to Modern Monetary Theory without discussion at the start of the COVIDcrisis, distributing bucket loads of helicopter money straight to the masses and directly to corporate aid, which it demands its banker (the Fed) finance.

Source. A Zerohedge article expands upon how this process works:

“Pozsar noted on Monday, “use of the [overnight reverse repurchase (ON RRP)] facility has never been this high outside of quarter-end turns, and the fact that the use of the facility is this high on a sunny day mid-quarter means that banks don’t have the balance sheet to warehouse any more reserves at current spread levels.”

Translation: the Fed is taking Treasurys out of the market through QE purchases and putting them right back in via the RRP

Not only does this impair the proper functioning of the repo market which is rapidly running out of collateral and is forced to unwind what it just got from the Fed back to the Fed, it also means that while the Fed still has plenty of assets to monetize courtesy of the Treasury’s breakneck debt issuance spree, the banks that end up holding the resulting excess reserves are running out of space and are forced to park these brand new reserves right back with the Fed in the form of the O/N RRP.

In short: the US financial system is starting to groan at every incremental new reserve created by the Fed’s QE… and considering that there is at least $1 trillion more in QE to go, even with tapering, things could turn ugly soon.

This, much more than any flip-flopping commentary from the Fed, confirms that we are rapidly approaching a critical moment when the Fed will no longer be able to conduct $120BN in QE every month, as sooner or later someone will figure out that the Fed buying up hundreds of billions in securities only to turn around the then repo out the resulting reserves each and every day, amounts to outright debt monetization with potentially calamitous consequences for yields and the US dollar.

Source. Hotel California – Room 3: RBNZ

Our final guest is our very own RBNZ…

Back at home even the RBNZ Chief Economist this week said the central bank might continue buying government bonds for some years, even once its LSAP programme ends in 2022.

He also “couldn’t say whether the RBNZ would seek to hike interest rates via the OCR, all the while continuing to try to put downward pressure on rates via bond buying and by providing banks with cheap funding.”

In other words they could keep the currency printing going (which holds down interest rates) while also increasing interest rates via the Official Cash Rate (OCR). Even though they are meant to do the exact opposite of each other!

See: RBNZ Chief Economist says the central bank might continue buying government bonds for some years, even once its LSAP programme ends in 2022

The mainstream narrative is that inflation will be temporary or transient, interest rates will rise a bit from next year or 2023 due to the economy doing well .The currency printing programs across the globe will be wound back and everything will be just hunkydory.

But that’s not a narrative we’d like to bet on. How about you?

Silver remains hard to come by at the moment. Local suppliers have no 1kg silver bars available even for back order currently. The only local silver available are 5oz bars, but there is a 4-8 week wait for them.

But we currently have ABC serial numbered 1kg bars on a 2 week back order. These are actually cheaper than comparable bars we’ve seen advertised lately in the USA.

Also now in stock are 10oz and 500g ABC bars too. Phone or email to order them.

Still plenty of options if you’re after some gold.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Here’s how to always have clean fresh drinking water on hand.

The Sport Berkey Water Filter Bottle – $69 Delivered

Ideal for travel. Driving, camping, backpacking.

Free Shipping NZ Wide.

—–

|

Pingback: Academic: RBNZ Currency Printing Will “End in a Train Wreck”. Modern Monetary Theory Would be Better? - Gold Survival Guide

Pingback: Why Even if Inflation is “Transient” It Won’t Be. Huh? - Gold Survival Guide