We’ve been “banging the drum” on silver lately. Pointing out in our weekly newsletter for the last couple of weeks here and here, that silver is currently very cheap compared to gold.

But that may not last too much longer if the technical analysis in this post proves to be correct. While silver may have had no momentum lately, that could soon be about to change.

See why the charts, volume of buyers and futures traders reports are currently all quite bullish towards silver.

More interest brings more buyers which leads to higher prices…

Silver Market Update

By Clive Maund – Published at silverseek.com

Silver is completely “off the radar” for most investors right now which is just the way we like it when we are buying, however, as we will see, there are good reasons to believe that this will not be the case for much longer.

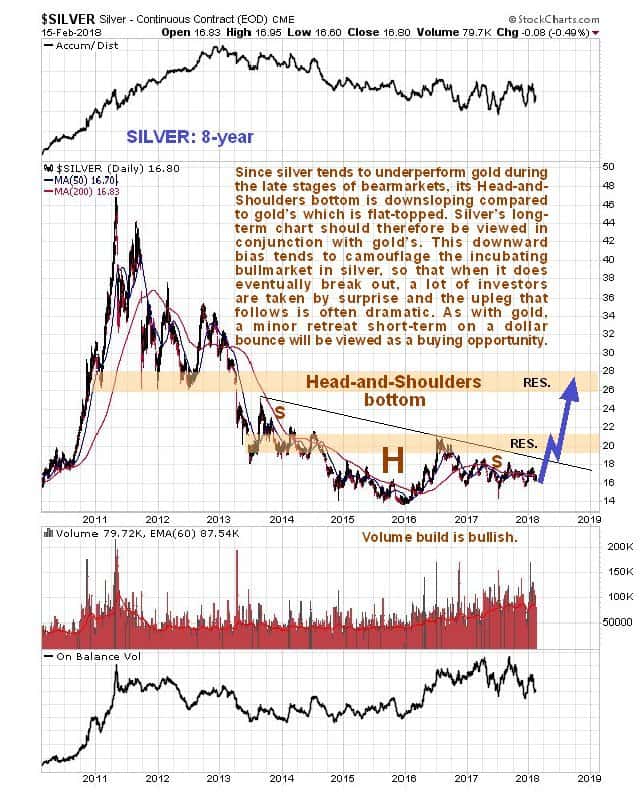

On its latest 8-year chart we can see why silver has zero appeal for momentum traders now – it ain’t goin’ nowhere, or so it would seem, if you project past performance into the future, but as we have repeatedly observed in recent months, it is marking out a giant Head-and-Shoulders bottom, which is quite heavily disguised compared to the concurrent flat topped H&S bottom forming in gold, because it is downsloping. A key bullish point to observe on this chart is the steady volume buildup over the past 2 years, which is a sign that it is building up to a major bullmarket. This hasn’t had much effect on volume indicators so far, but such is not the case with gold, where a more marked volume buildup has driven volume indicators strongly higher so that they recently made new highs, which bodes well not just for gold, but obviously for silver too.

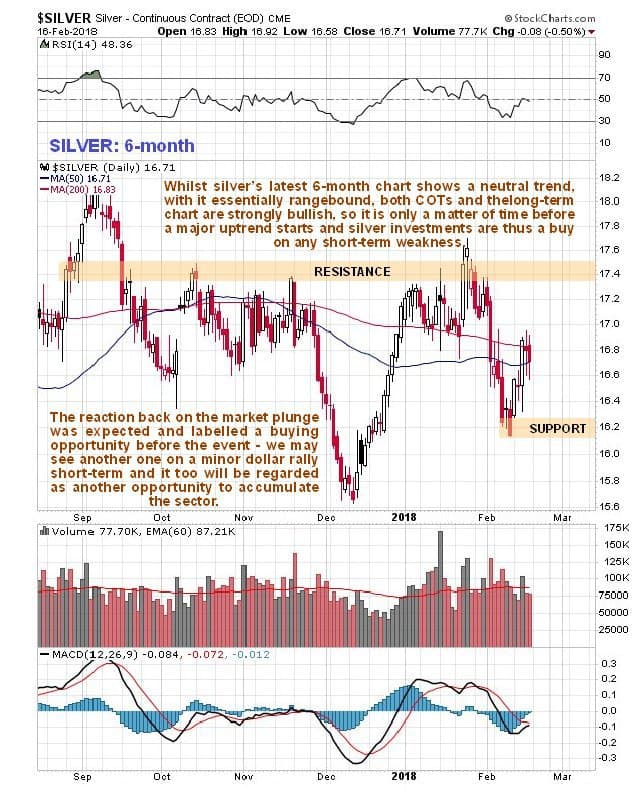

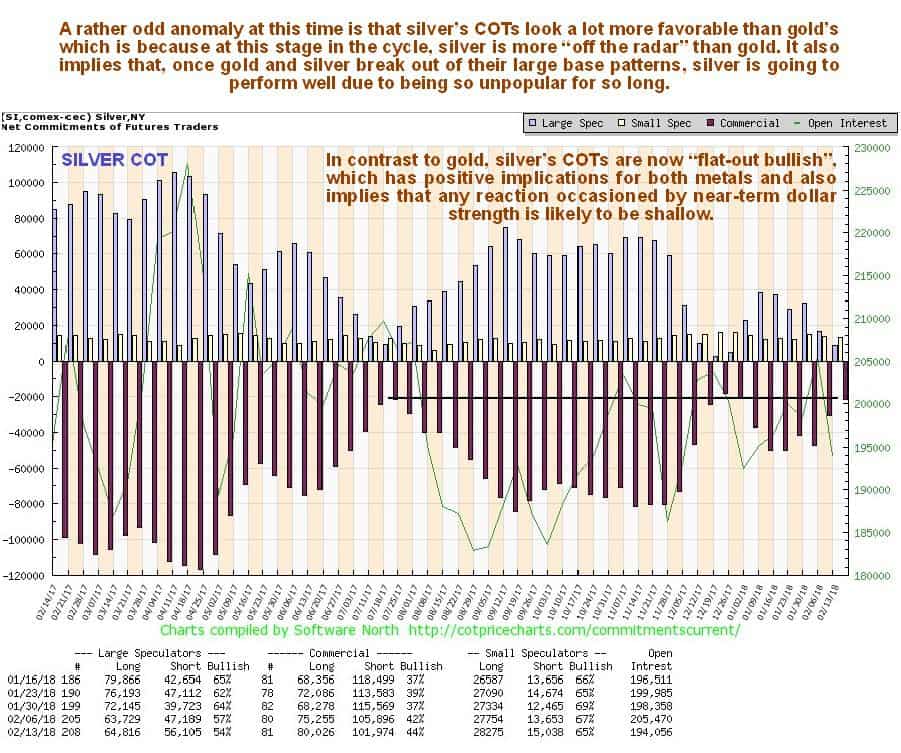

Moving on to observe recent action in more detail on the 6-month chart, we see that silver dropped back further than predicted in the last update, which is hardly surprising considering what happened to the broad stockmarket. No technical damage was incurred, however, and it has already clawed back a part of the loss. What now? – like gold, silver may drop back again short-term on another modest dollar rally, which appeared to have started on Friday, and any such drop will be viewed as presenting another opportunity to accumulate more silver and silver related investments, especially given silver’s latest COTs which are “flat-out bullish” as we will now proceed to see.

The latest COTs show that the Large Specs have “thrown in the towel” on silver and gone home – great! – that’s what we like to see. This extremely low level of Large Spec long positions is very bullish indeed for silver and also implies that gold could soon rally too, despite its COTs not being so positive, although as mentioned above both metals are likely to have to weather a modest dollar rally first.

Click on chart to popup a larger clearer version.

In summary, whilst a minor short-term dip on a modest dollar rally looks likely, silver’s chart are very bullish overall as it appears to be readying to break out of it giant Head-and-Shoulders bottom. Any near-term weakness will therefore be viewed as presenting an excellent and possibly final chance to accumulate silver and especially silver stocks at very low prices ahead of major sectorwide bullmarket commencing.

Read more: Could Silver Be Worth More Than Gold? and When to Buy Gold or Silver: The Ultimate Guide

About Clive Maund

The years following 2005 saw the boom phase of the Gold and Silver bullmarket, until they peaked in 2011. While there is ongoing debate about whether that was the final high, it is not believed to be because of the continuing global debasement of fiat. The bearmarket since 2011 is viewed as being very similar to the 2-year reaction in the mid-70’s, which was preceded by a powerful advance and was followed by a gigantic parabolic ramp. The Precious Metals should come back into their own when the various asset bubbles elsewhere burst, which looks set to happen soon now. http://www.clivemaund.com/