Table of Contents

Estimated reading time: 8 minutes

By now you’ve likely heard about the short squeeze that may be under way in silver.

These same traders who have initiated this move were first doing the same in stocks. Jim Rickards had a great summary of this yesterday:

“GameStop shares went from $20.00 on January 12, 2021, to a peak of $468 on January 28, producing spectacular profits for some and billion-dollar losses for hedge funds that had shorted the stock.

…a flash mob of Millennial and GenX retail traders using the Robinhood brokerage app (with no commissions) and trading with borrowed money or stimulus checks, in many cases, engaged in a frenzy of call option buying. The buying was prompted by a Reddit message board account called r/WallStreetBets (WSB).

Apart from the usual stock touting, WSB suggested it was time to teach Wall Street and big hedge fund traders a lesson.

The Big Short

The hedge funds had been shorting GME. Because heavy buying drives up the stock price, the mob buying caused billion-dollar losses for the shorts. Some threw in the towel and covered their shorts, which meant more buying, higher prices and more pain for the hedgies.

Business Insider estimates that hedge funds Point72 (run by legend Steve Cohen), Melvin Capital, Citron Research, D1 Capital and Maplelane Capital collectively lost over $5 billion on the GameStop rally. Things got so bad that Citadel and Point72 had to inject $3 billion into Melvin Capital to keep it afloat.

Then last Thursday, Robinhood abruptly suspended buying in GME. The stock crashed to $193.00, down 45% from the top. The stock was back up again in Friday trading but lost another $85 today.

…Robinhood Gives To the Rich

What [these reddit traders] did not know was that Robinhood made money not by charging commissions, but by sending order flows to mega-hedge funds like Citadel.

This allowed Citadel to front-run the Bros [reddit traders] with its high-speed trading technology. However, Citadel also had close relations with the major hedge funds that were losing billions by being short GameStop.

Then on Thursday, Robinhood suddenly announced that customers could no longer buy GameStop. Other brokers followed suit. The Bros lost much of their profits as GameStop collapsed.

…The big banks, brokers and hedge funds know how to circle the wagons to protect their own interests when the time comes.

…Basically, the hedge funds, clearinghouses and Robinhood banded together to crush the retail mob that was bidding up the stocks that hedge funds had shorted.

Robinhood was bailed out with loans from JPMorgan and Goldman Sachs, while mega-hedge fund Citadel pulled strings behind the scenes to cause Robinhood to hurt its retail clients with the trading suspension.

For now, this GameStop fight looks like a draw. The hedgies lost $5 billion, but the Bros also lost billions when GameStop tanked.

The legal fallout was quick to follow. Robinhood was hit with a class action lawsuit on behalf of all the day traders who were disadvantaged by the partial shutdown of retail trading.

They may be liable for billions of dollars of damages under the class action lawsuit and may have blown up their chances for a billion-dollar-plus IPO in the near future.

But there’s a major lesson here for investors in other markets:

When you rely on exchanges and paper contracts for your profits, the rules can always be changed to terminate your bets and rob you of future gains. Beware.”

Reddit Traders Move From GameStop to Silver

It seems many of these same Reddit Traders have now moved into silver. Driven by a well written post on the message board just last week, arguing how they could force silver to $1000.

We have been watching with interest to see if they would have the same impact on silver as they did on Gamestop shares.

At the end of last week and then over the weekend it seems that indeed they are having an impact.

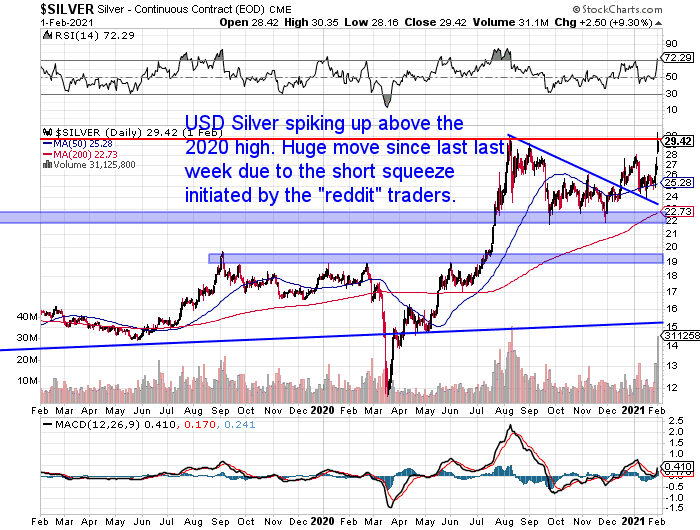

Silver was up around 10% from Friday, having already jumped a couple of percent the day before. In US dollar terms silver briefly reached an 8 year high on Tuesday.

Prices of some silver mining companies had surged by 40%.

Major precious metals retailers in the USA were sold out of many products over the weekend. Some wholesalers also briefly halted trading Monday (Sunday US time) until markets in Asia reopened.

These Reddit “raiders” were aiming to force a short squeeze in silver mostly by buying shares in silver exchange traded fund SLV and some of the major silver mining companies. But this also looks to have boosted retail buying in precious metals too.

The short positions in the silver ETF SLV are not to the same degree that they were in Gamestop. So they may have difficulty creating an equivalent sized move in SLV. But it will be interesting to watch. Just as it has been fantastic to see the power of the many in action against the powerful few.

Will the Reddit Traders Cause a Silver Surge to $1000?

While this makes for a great story and it will be interesting to watch, we have our doubts that this will cause a huge move in silver to anywhere near $1000 in the short term.

Of course, we would love to be proven wrong!

The silver market and price setting mechanism is much more complicated than what is one relatively small stock like Gameshop. And as already noted current short interest in silver is much smaller than it was in Gamestop.

Unlike buying Gamestop shares there is no central marketplace that sets the price for physical silver. Rather the price for physical is taken from the futures markets in London and New York with a premium added. So the price is driven by paper trading rather than physical buying and selling. Currently the physical premiums have spiked up. This has happened in the past – as recently as last year. Now the question is will premiums continue to rise? Or will demand subside as it has done in the past and allow the market to settle down again?

Read more on how gold and silver prices are set: What Does Gold Spot Price (Or Silver Spot Price) Mean?

Also if all the current buying does cause a huge move, it wouldn’t be a surprise to see a correspondingly large fall back down.

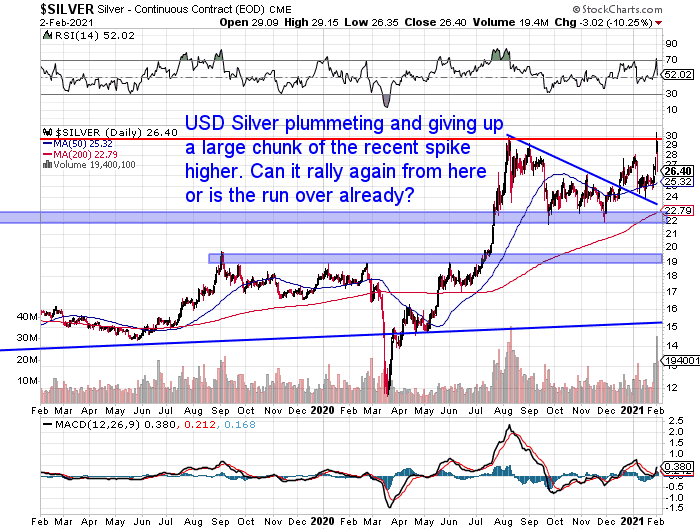

3 Feb 2020 Update: That may have happened today with silver down sharply:

The Financial Powers That Be Will Be Sure to Look Out for Themselves

One reason why we don’t think the Reddit raiders will be successful in the short term is that the powers that be who set the rules, will likely change them when it suits. Just like they did by restricting RobinHood traders from buying Gamestop.

In 1980 this is exactly what happened when the Hunt Brothers were buying silver on the futures exchanges.

The COMEX changed the rules in the middle of the trading day as to how much leverage you could have. Forcing the Hunt Brothers’ to sell.

Read more: The Real Hunt Brothers Silver Story

The same thing could happen again.

Update 3 Feb 2020: In a small way it already has. Yesterday the Chicago Mercantile Exchange (CME) hiked silver margins by 18%. This has happened many times previously in heightened demand situations.

Or maybe say these Reddit traders try to buy silver futures contracts and then request physical delivery. Something that hardly anyone does currently. There is an out clause where the futures market can call a “force majeure” and instead of delivering the metals they can instead settle in cash at the current spot price.

So 6 million small traders may be enough to cause a surge in silver. But they may not be enough to completely change the silver market – well not yet anyway.

The Free Market Will Win in the End

You may be thinking, if we are doubtful that the current goings on will cause a permanent change in silver, and if the powers that be will just change the rules, what is the point in buying?

Because in the end the free market will win out. While the powers that be may change the rules, this only distorts things further. Inevitably we believe the market will win. It’s just not a guarantee that it will be this week.

These Reddit traders should all be buying physical silver if they want to have biggest impact in the long run. That is what will eventually cause the complete disconnect between the spot and futures price and the actual price for physical metal.

Silver is a Great Buy in the Long Run – Regardless of How this Attempted Short Squeeze Plays Out

Regardless of how this current situation plays out, silver is still a great buy for the long run. What other asset is still below it’s high from 1980?

We’d just rather be a buyer for the long run than someone expecting to make short fast gains in silver and then getting out.

But regardless of what happens in the short term, the greatest thing is this Reddit Group will likely be bringing many more new people into silver and also gold.

So our guess is that even if we see a surge and then a corresponding pull back, it likely may not be down to the level silver was previously at.

If buying for the long run, then looking back a year or 2 from now, people will likely have few regrets buying silver.

Editors note: This article was first written 2 February 2021. Updated 3 February 2021 to include latest news and charts.

Pingback: Silver Plunges 8% Overnight But Still Up 5% on a Week Ago - Gold Survival Guide

Pingback: What's Next for Gold and Silver in New Zealand Dollars?

Pingback: An Excellent N.Z. Silver Buy Zone is Here - Charts Update Apr 2021 - Gold Survival Guide