A very bullish Stewart Thomson discusses the impacts of Indian demand, a looming US government debt crisis, and how inflation is set to surprise to the upside.

And how these factors are all combining to boost gold and silver higher currently and into the future too…

Debt Endgame And Gold Bull Era

Graceland Updates

By Stewart Thomson

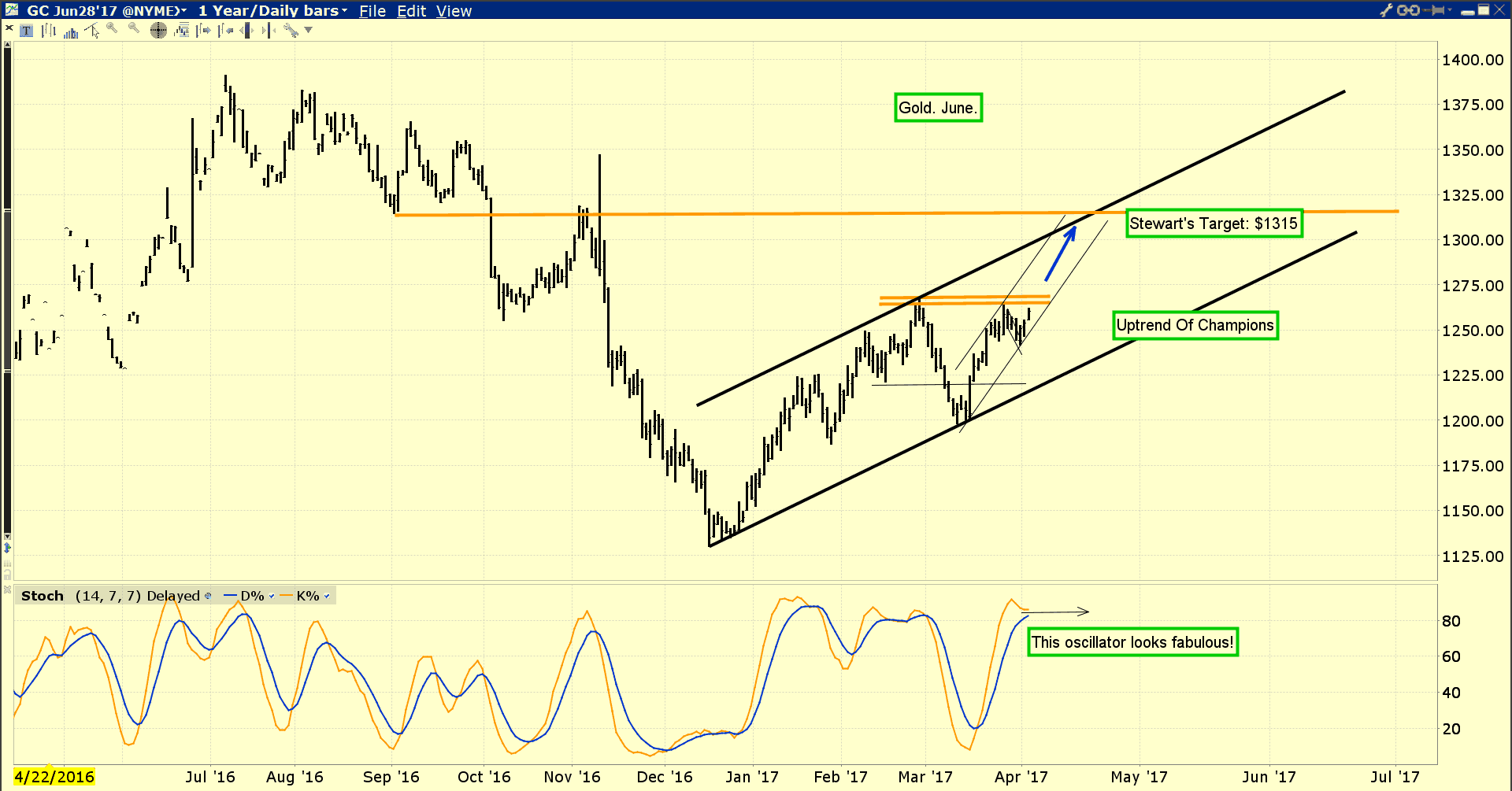

- The spectacular price action of gold within what I’ve dubbed the “Uptrend of Champions” continues to be impressive. I’ve suggested that the rally is poised to accelerate, and that’s clearly in play.

- Please see the image below. Double click to enlarge.

- Gold is poised to surge through the minor $1270 area highs and race to my $1315 target.

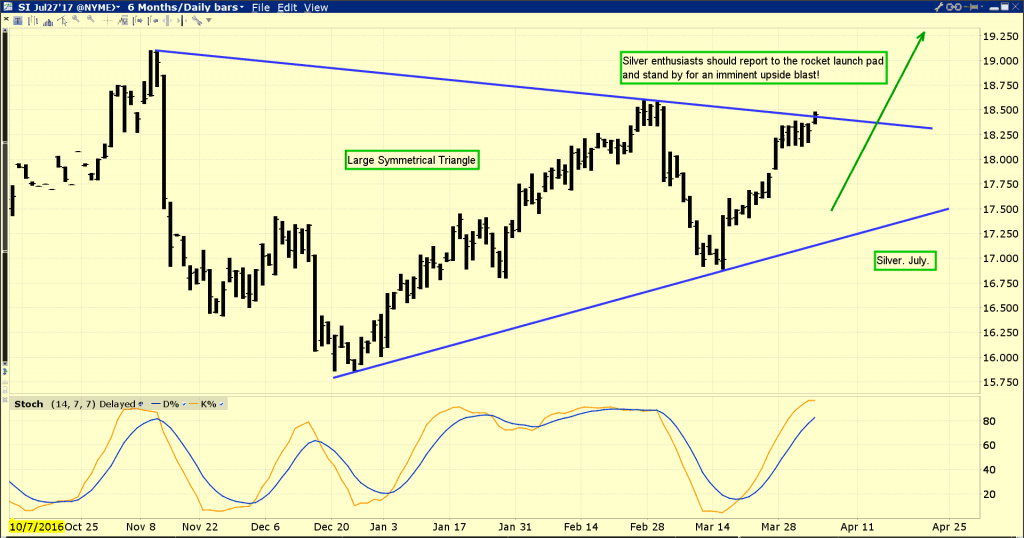

- All lights are green for gold, and for silver the lights are even greener. Please see the chart below. Double-click to enlarge.

- I think the caption on that chart says all that any silver investor needs to know right now. There’s a beautiful symmetrical triangle pattern in play. While the bears are probably sleeping this morning, silver is attempting an upside breakout!

- I would ask the entire Western precious metals community to think hard about how positive most institutional analysts are about gold right now.There’s a reason for their confidence, and for their very positive liquidity flows into the precious metals sector:

- Fundamentally, gold is being powered higher by excellent demand in India (the world’s biggest wedding season is in play), institutional investor concerns about the US debt ceiling (the next deadline is April 28), strong growth in China, and by the populism wave that is sweeping through most of the Western world.

- That wave of populism is lead by the charismatic leader of America, Donald “The Golden Trumpster” Trump. The Golden Trumpster has differentiated himself from other politicians by attempting to do things he said he would do…after being elected.

- Most Trump fans are focused on his charisma and his purported ability to overcome the peaking business cycle with tax cuts for ageing Americans who currently can’t afford a $1000 trip to the hospital emergency room.

- To put it mildly, I’m a bit skeptical about that, but I’m very interested in his campaign promises to make US government debt creditors take a “haircut”. I’m also focused on his clear commitment to a lower US dollar.

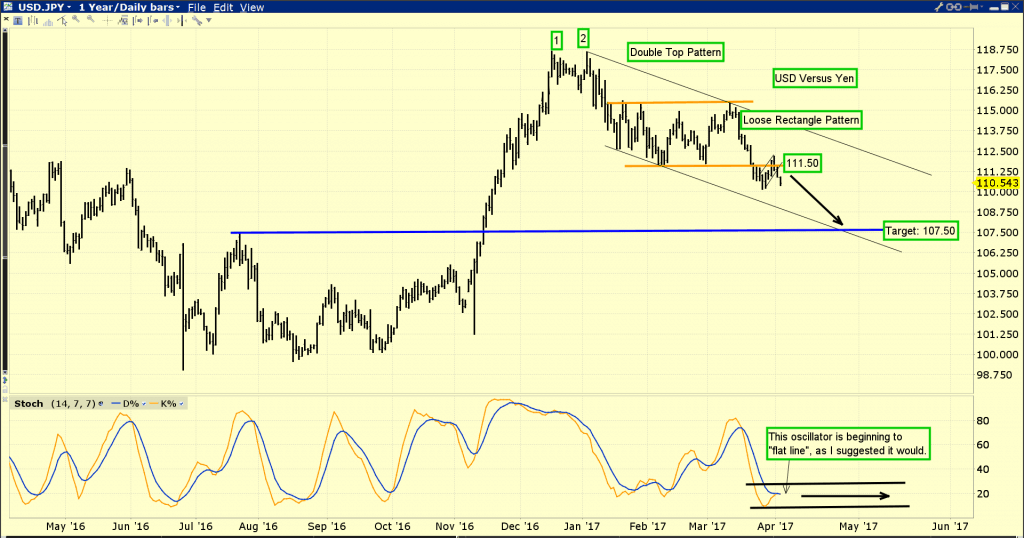

- On that note, please see the chart below now. Double-click to enlarge.

- The “risk-on”US dollar is disintegrating against its risk-off counterpart, the Japanese yen. The world’s biggest liquidity movers are big bank FOREX traders. Clearly, they are showing major concern not just about the dollar, but about the general level of global markets risk.

- Gold is benefiting, and as inflation becomes bigger on their list of concerns, silver will move relentlessly higher. I refer to gold as the world’s ultimate asset and I speak of silver as “gold’s energetic little brother”. That’s because when inflation is in the air, silver tends to act like a well-behaved kid in a candy store!

- In time, the Japanese central bank will be forced to abandon QE like America did, and raise rates too.

- When that happens, I expect the dollar to go into literal free fall, and gold should blast above $1900 with ease.

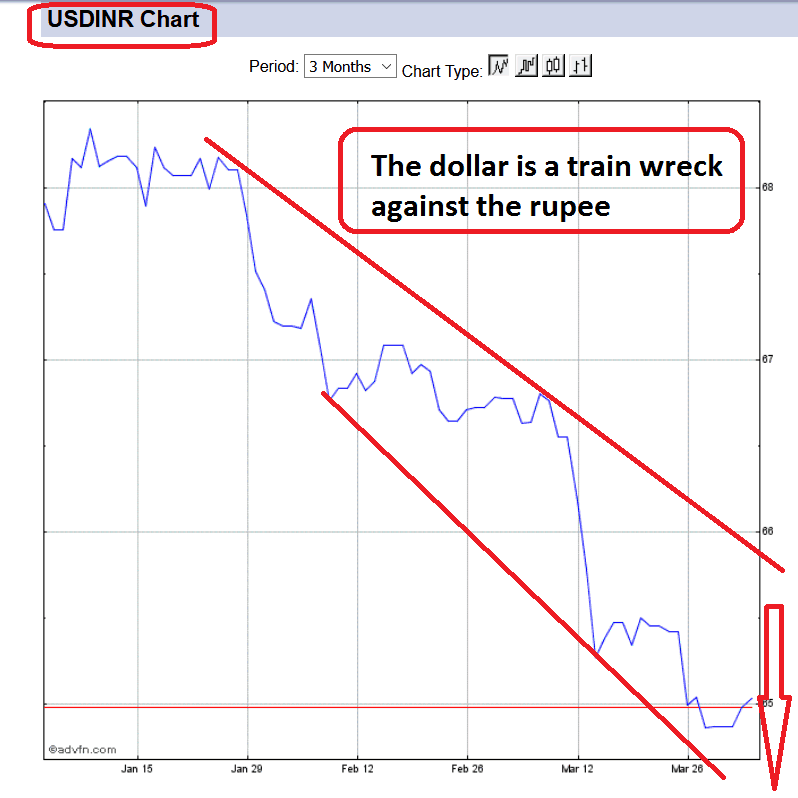

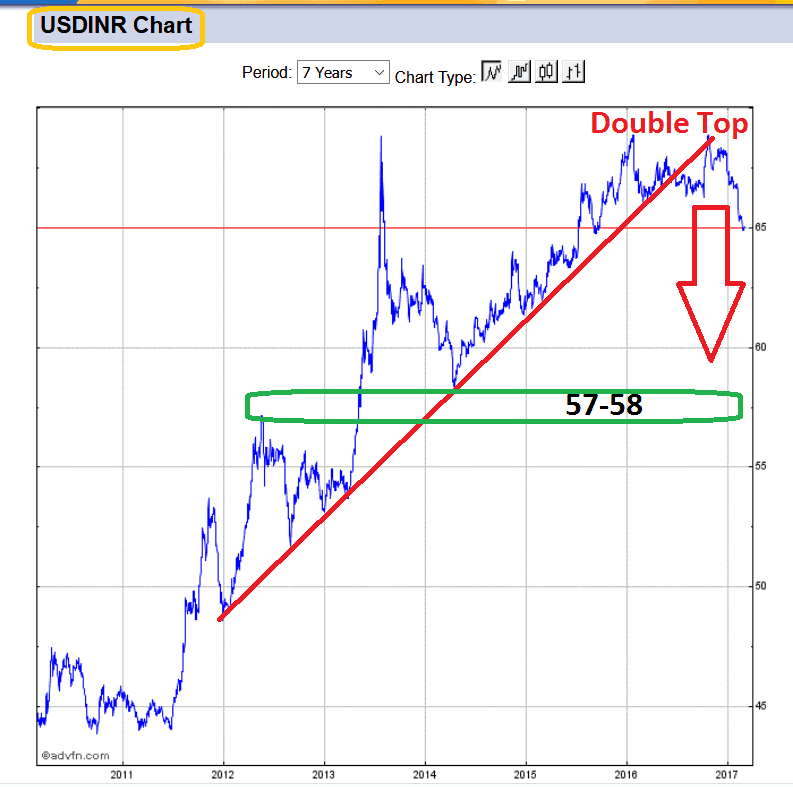

- To view another key dollar chart, please see the chart below now. The only FOREX chart that is arguably more important to gold investors than the dollar-yen chart… is the dollar-rupee chart.

- That’s because the world’s most powerful gold buyer class are India’s “titans of ton” citizens. The dollar has been tumbling against the rupee since late 2016, and that’s when gold began its “Uptrend of Champions” price action against the dollar.

- The bottom line is that the tumbling dollar increases the gold purchasing power for Indians. They are using that power now, to buy more gold!

- Please see the chart below now. Double-click to enlarge. That’s a big picture dollar-rupee chart. It’s probably the most horrific looking chart on planet Earth right now. The US dollar is ready to incinerate against the rupee, creating a massive surge in Indian gold purchasing power.

- India’s government is lead by a Napoleon-like figure, Narendra Modi. He will come under immense pressure to cut the gold import duty as the rupee mauls the dollar, and the trade deficit becomes the surplus I have predicted. My statement that “All lights are green for gold!” may go down as the 2017 understatement of the year.

- A cut in the duty combined with the rise of the rupee should push Indian demand towards the 150 – 200 tons a month marker, powering gold towards the $1900 area highs in the next few years. I expect the US debt crisis to enter its “endgame” stage just as that happens. That should create a short term parabolic price blast above $1900, to about $2500.

- I’ll talk more about that $2500 target price in the weeks ahead. As demand rises relentlessly both in the West and the East, there’s more great news for gold stock enthusiasts, which is this: Mine supply appears to be near a peak! “2016 marks the third consecutive year of falling year-on-year growth rates and we maintain our near term forecast for mine supply to decline in both 2017 and 2018”.– GFMS Gold Survey 2017.

- Against this background, gold stocks and silver stocks are poised for a truly spectacular year in 2017, and even more so in 2018. The price action so far is likely just a taste of the coming upside fun.

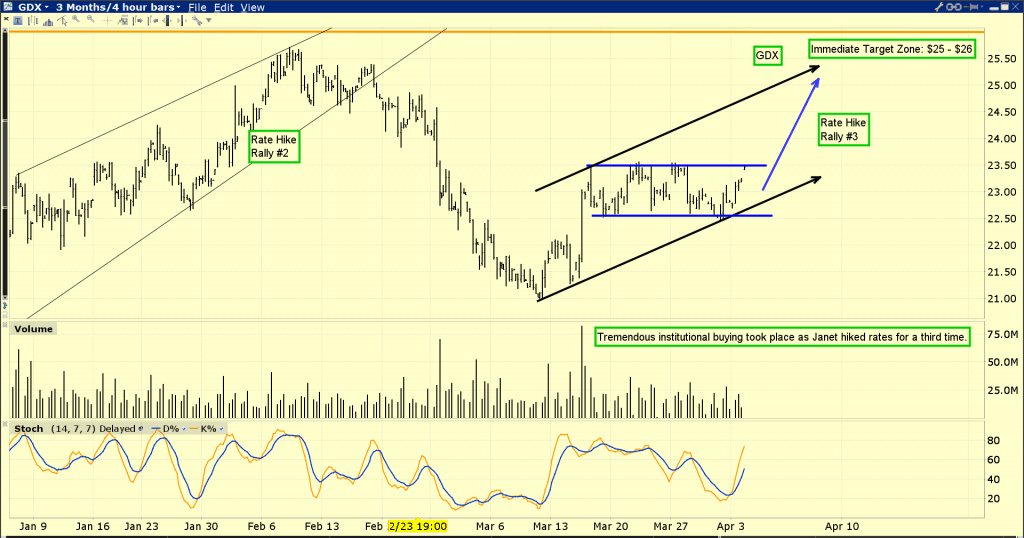

- Please see the chart below now. In early morning trading, GDX has raced to the upper part of a rectangle. It seems poised for an imminent breakout and rally to my $26 target. I’m a relentless buyer of GDX on every $1 decline. Here’s why: Inflation is set to break out to the upside. Indian demand is empowered by the now-mighty rupee and the world’s greatest gold investor demographics. A looming US government debt crisis endgame lurks horrifically in the shadows. The bottom line: A rally to $26 for GDX will not mark the end of the gold stocks price action on the upside. It’s only the beginning of what I have suggested is not just a bull market, but a real bull era!

Thanks!

Cheers

Stewart Thomson

Graceland Updates

Note: We are privacy oriented. We accept cheques, credit card, and if needed, PayPal.

Written between 4am-7am. 5-6 issues per week. Emailed at aprox 9am daily.

https://www.gracelandupdates.com

Email:

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?

Pingback: Gold Stocks Portfolio Fuel - Gold Survival Guide