Darryl Schoon shows us that rather than using complex mathematical formulae, the economy can be explained in a much easier fashion. See how inflation, deflation and hyper-deflation can be more easily understood when the economy is compared to a toilet…

Gold and Silver, Up Down, Sideways and UP

In mid-march, just as the coronavirus was gaining momentum, the price of gold began to rise. After trading sideways from 2015 to 2019, gold rose from a low of $1,471 in mid-March to $2,069 on August 6th, a spectacular 40% rise in five months.

During that same period, silver rose from $11.94 to $29.14 on August 6th, an even more spectacular 114% increase.

Three days later, on August 9th, as gold and silver continued to trade close to their respective highs, I wrote, …In August 2020, gold and silver are both rising even as central bankers still hope to slow their ascent. Whether gold and silver will continue to ascend or be forced lower as they were in 2011 when central bankers flooded markets with gold bullion offered at negative interest rates remains to be seen.

The next day gold and silver prices plunged with central bankers reminding speculators and investors that they would battle to the death to keep their profitable franchise of credit and debt afloat; a 325-year old franchise whose demise is now within sight.

CENTRAL BANKING: THE PROBLEMS THEREOF

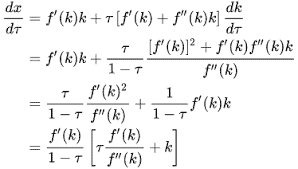

Much as medieval priests wrote in Latin to keep the general public ignorant of the true meaning of the scriptures, central bankers utilize mathematical equations to obfuscate the inner-workings of their obscenely profitable ponzi-scheme of credit and debt.

For example, from Wikipedia entry, Mathematical economics:

…Von Neumann’s model of an expanding economy considered the matrix pencil A – λ B with nonnegative matrices A and B; von Neumann sought probability vectors p and q and a positive number λ that would solve the complementarity equation

pT (A - λ B) q = 0,Also:

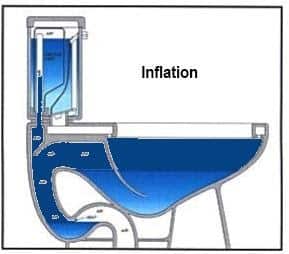

I believe that central banking and its present problems are more easily understood when a toilet represents the economy, instead of obtuse mathematical formulae.

Usually, when the toilet, i.e. economy, does not work, jiggling the handle, i.e. raising or lowering interest rates, is sufficient to restore balance.

If the water level rises in the toilet, it indicates too much money (circulating credit and debt) is being printed causing inflation.

If too much money continues to be printed, inflation is followed by hyper-inflation where the toilet overflows, prices explode upwards and money loses all value.

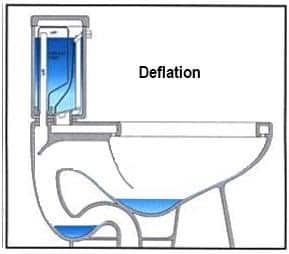

However, if the water level is too low, it indicates deflation where money is no longer circulating as before. This often happens after speculative bubbles collapse, debts default and credit is scarce.

In a severe deflation, it becomes necessary to pour in water, i.e. quantitative easing, in order for the toilet to function, i.e. flush.

Quantitative Easing

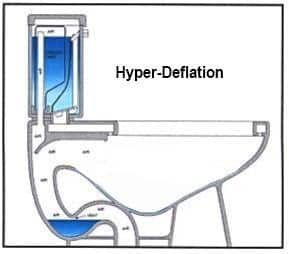

Hyper-deflation is an even more extreme state when the water in the toilet completely drains and the toilet can no longer be flushed

In 2020, we are in a severe deflation where central banks are printing more and more and even more money to replace that being rapidly lost. Whether this ends in hyper-deflation or hyper-inflation is not yet known. Soon, it will be.

On Sunday, September 13, I will be answering questions on a livestream Q&A at 4 pm (USA ET). The URL for the event is https://youtu.be/QTYY0CcDiX8

Buy gold, buy silver, have faith.

Darryl Robert Schoon

www.drschoon.com

Pingback: Gold is a Composting Toilet? - Gold Survival Guide