Yesterday in a Daily Reckoning email we read an interesting summary of opinions from Jim Rickard’s gold industry contact. A man whom Rickards calls “Goldfinger”.

Now this was a summary of part of a webinar event being used to sell a new gold stock newsletter service – likely a well timed release too given that gold stocks look to have finally resumed their bull run higher this year.

So given this it’s not surprising they would have positive things to say about gold.

Here’s an excerpt from the email:

Jim first noted in his 2011 best-seller, Currency Wars, that gold has been moving from west to east, reflecting overall global wealth transfers. China has been the largest buyer, in keeping with its surging economic might. But as Goldfinger revealed, a hinge appears to have given way in the international gold market…

“As you know, Jim, for the past five years, gold has been flowing from west to east. China has been the main buyer. The demand has been massive. The refineries have had a hard time keeping up with all of it.”

Just so. But here’s the joker in the deck…

But in 2016, China (and India) have backed off. And the West has really picked up its buying. Since January, there’s been a huge amount of gold buying in the West. And so there’s actually been a reversal of the gold flow. Over the past few months alone, over 170 tons of gold have flowed back into London, instead of going from London to Swiss refineries and then on to China. China and India are backing off a bit, and gold is starting to flow back into London.

China’s taking the pedal off its massive gold purchases. And demand from the West is accelerating.

“From 2013–15, China’s been buying up to 1,000 tons a year. And that’s caused a chronic tightness in the availability of gold at the Swiss refineries. So what happens if China steps back into this market and starts buying at the same levels they were buying before if the West is buying as well? Where is that gold going to come from?”

Where indeed, Goldfinger?

The only place it can come from is from those who already own gold. And that may require much higher prices in order to clear the market for that gold to become available.

The gold would have to come from existing owners, willing to sell at a higher price. Goldfinger paints a dramatic portrait of higher gold prices due to surging demand and dwindling supplies. Jim adds his own licks:

If the West continues to buy and China gets back into the game, I don’t know where this gold is going to come from. The miners have not been increasing the supply of gold… What most people don’t realize is that mining production has at least a five-year lag time. From 2011–15, a lot of gold mines have been shut in due to falling prices. Mining production is certainly not going to expand enough in the short term to meet this increased demand. So if Western buying is increasing… countries like China pick up their buying… and the miners can’t produce the gold to meet the demand… it’s not at all clear where the gold’s going to come from.

Meaning:

Basically, there’s only one way to resolve that. And that’s for gold prices to increase.

Or as Goldfinger styled it: “The most important thing to understand is that price action creates market action. So this dynamic can feed on itself and cause the price to move very rapidly.”

The “fact” that China seems to have eased up on buying lately is not something we’ve heard widely reported elsewhere.

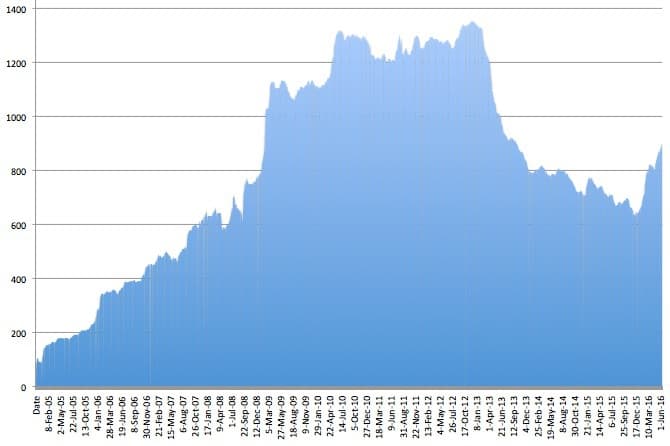

Certainly there has been a significant and measurable flow of gold back into the Exchange Traded Fund GLD this year.

Check out the chart below showing the total gold holdings in Tonnes in GLD.

These peaked in December 2012 at 1353 tonnes. Since then it has been falling steadily down to bottom out at 630 tonnes last December. But since the start of the year it has jumped significantly to be at 902 tonnes today. So an increase of around 270 tonnes!

So this backs up what the delightfully named “Goldfinger” is saying about more gold flowing into the west of late.

The angle that Rickards took in the webinar was that the Federal Reserve announcement yesterday would likely put a floor under the gold price.

His guess then was that the Chinese would resume buying as the Fed putting a hold on interest rates would indicate a bottom is in for gold. So over the medium term this will boost the gold price higher.

Why?

Because as “Goldfinger” explained above if this return to buying of the Chinese comes on top of the increased buying in the West, the only way to encourage more gold out will be higher prices.

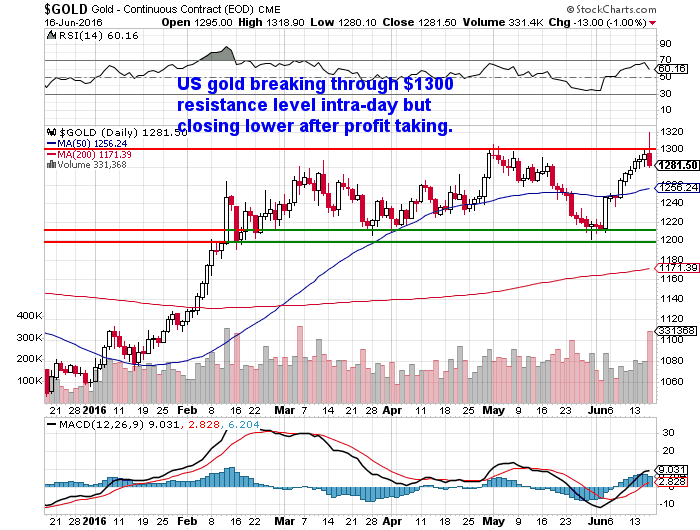

So what happened yesterday in the end?

Well the Federal Reserve surprised no one by not hiking interest rates. However the thinking is that they sounded less likely to raise rates in the future now too.

How did this impact gold?

Overnight gold jumped higher getting well above the key US$1300 mark. However late in US trade it fell sharply back down below the $1300 level to around $1280.

So we’d still like to see a close above the $1300 level but it looks positive. USD Gold had gotten close to overbought so a bit of a pull back here will give it a good chance to have another crack at the $1300 level.

Have the Chinese buyers reappeared already then?

Who knows, but our feeling is that the gold bull market has returned even in US Dollar terms. So even if it’s not right now, the gold price will head higher again soon enough.