This Week:

- 3 Reasons Why Gold Doesn’t Have to Fall when Interest Rates Rise

- How About Interest Rates in NZ?

|

LIMITED QUANTITY GOLD SPECIALS GOLD KIWI 1 oz COIN

1oz NZ Mint 99.99% Gold Kiwi Coins Normally priced at Spot + 5.7% at NZ Mint. Through us: Packaged Gold Kiwis: (Approx $1736) (40 in Stock) ***** PERTH MINT 1 oz GOLD BARS 1oz Perth Mint 99.99% Gold Bars In Green Packaging Approx $1756 (9 green in stock; black sold out) Ph 0800 888 465 and speak to David or reply to this email. |

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1657.81 | – $26.59 | – 1.57% |

| USD Gold | $1085.20 | – $22.80 | – 2.05% |

| NZD Silver | $21.89 | – $1.08 | – 4.70% |

| USD Silver | $14.33 | – $0.78 | – 5.16% |

| NZD/USD | 0.6546 | – 0.0032 | – 0.48% |

After a couple of days out of town we’ll be trying to keep it brief this week.

As you can see in the table above gold and silver are in the red again over the past 7 days.

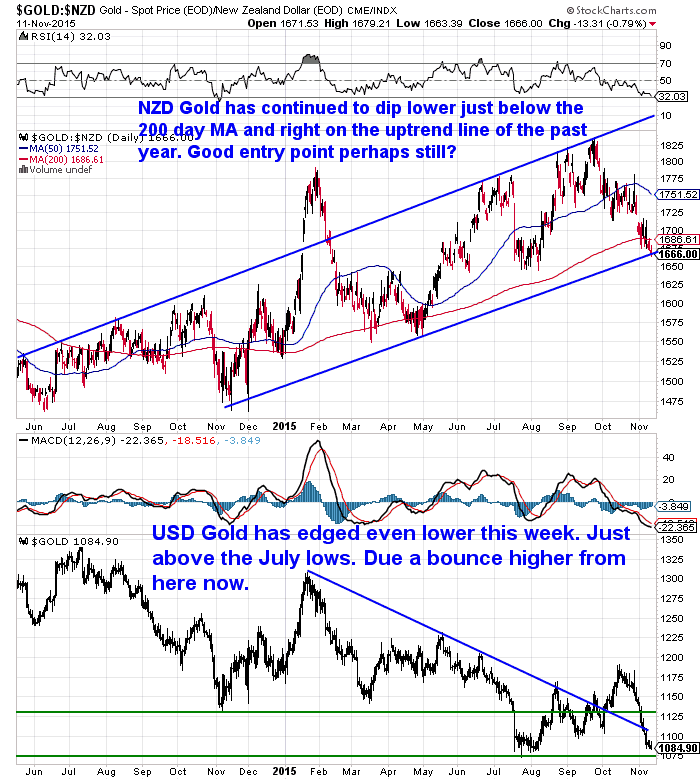

We’ve extended out the timescale on the usual gold chart as we were starting to lose the beginning of the current uptrend. We’ve also slightly tweaked the trendlines as a result.

NZD gold is just edging through the lower uptrend line currently after dipping below the 200 day moving average (MA) line this week. We are getting into oversold territory on the RSI indicator. While the MACD indicator is the most oversold it has been for some time. It might be getting close to turning up too. So this could end up being a pretty good buying zone.

Of course we can still go lower from here. But just like NZD gold broke above the current uptrend line back in February, it could dip below the current uptrend line and yet still move back up before too long.

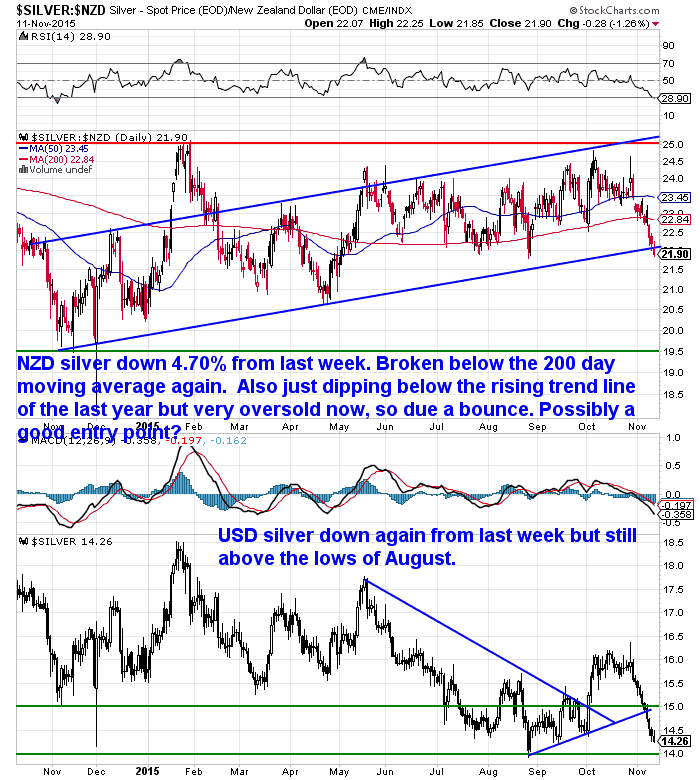

NZD silver like gold has also moved below the 200 day moving average line this week. It is also dipping just below the uptrend line of the past year. But as we just said this is no guarantee of anything. Just like previous 2 times NZD silver got above the upper trend line over the past year, only to return back down to it, it could also dip lower from here before bouncing back.

With the RSI indicator below 30 now it is getting very oversold, so a bounce higher is likely, but of course not guaranteed.

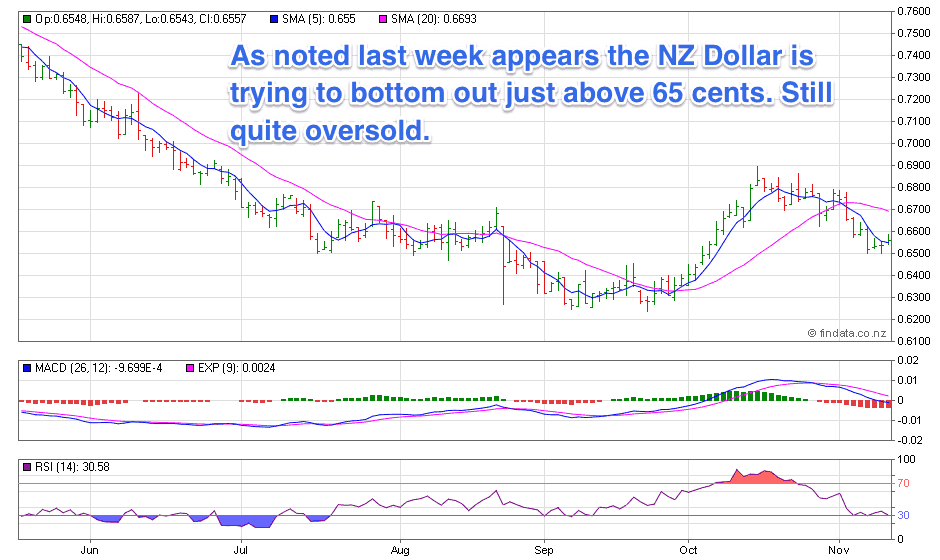

Turning to the Kiwi dollar now, it looks to be trying to eek out a bottom around 65 cents as we noted it might last week.

Of note in the lower part of the gold and silver charts above, is that the US Dollar prices of the metals are now very close to their lows from July/August this year.

The further drop lower seems to have been caused by the supposedly very good US jobs numbers out last Friday. The expectation being that because of these the US central bank will finally after years of warning finally raise rates in December. Maybe. Possibly.

Our favourite newsletter writer Chris Weber shared some ‘wise words” from James Howard Kunstler’s recent column on the jobs numbers:

“For more than a year, the fate of the nation has hung on whether the Fed might raise their benchmark interest rate one quarter of a percent. They talk about it incessantly, and therefore the mob of financial market observers has to chatter about it incessantly, and the chatter itself has appeared to obviate the need for any actual action on the matter. The Fed gets to influence markets without ever having to do anything. And mostly it has worked to produce the false narrative of an advanced economy that is working splendidly well to the advantage of the common good…

“The latest installment of the disinformation game was Friday’s employment release from the US Bureau of Labor Statistics. It was a “blockbuster,” implying blue skies everywhere from Montauk to Malibu. Except that no one with a remaining shred of critical faculty can be expected to believe it. 80 percent of the new jobs numbers were attributed to the mystical birth-death model, a pseudo-scientific fantasy of hypothetical new business starts and associated hypothetical new hires. Demographically, the most new jobs went to the over-55 age cohort – grocery baggers and Walmartgreeters – and the fewest to men 25 to 54 (that bracket substantially lost jobs). The official unemployment rate fell to 5.0 rate, with no meaningful discussion of the huge numbers of discouraged people who have dropped out of the workforce.”

After crying wolf for so long about raising interest rates, we’ll believe it when we see it.

However the futures markets seem to be pricing in an expectation of a rate rise in December now. So who knows maybe they will?

Because precious metals took a dive at the release of these US jobs numbers, this implies that people are seeing a strong US economy, so interest rates will now begin to rise and so precious metals will fall.

However even if the Fed does raise interest rates by 0.25% this doesn’t mean that precious metals will fall.

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $265 you can have 1 months long life emergency food supply.

Learn More.

—–

3 Reasons Why Gold Doesn’t Have to Fall when Interest Rates Rise

As we discussed a few months ago, there is evidence from the 1970’s that gold can rise in tandem with interest rates. Checkout reason 2 in this article for more on that.

The World Gold Council also has published some research showing how gold can also rise in a rising interest rate environment. See this old article of ours for more on that.

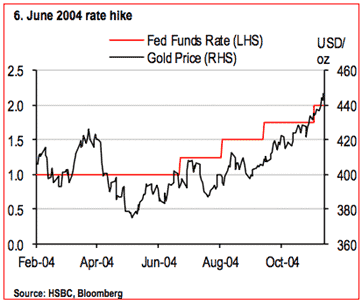

On top of these 2 reasons, HSBC also published some research back in July that shows that the price of gold actually goes up when the US Fed raises rates.

An article by The Reformed Broker explains:

Source.

So while most investors assume that higher rates will hurt gold, data and history show that rate hikes have actually been good for gold in the recent past. The chart below from the HSBC report mentioned above shows the last time the Fed raised rates and the clear postive impact on gold.

Read more: Interest Rates and Gold: If Interest Rates Rise What Happens to Gold?

Gold and Silver Could Still Fall Further Yet

Of course we are not saying that gold (and silver) could not fall further yet. Back in September 2011 we wrote how a 50% correction would not be unheard of for gold. That would take the US dollar price right back to around $950. That still remains on the cards.

However given the price in US dollar terms currently is only just above US$1080 we are not so very far from that mark anyway.

Also factor in that in NZ dollars (which is what matters if you’re buying here in NZ), gold is already up over $200 from last years lows. If the Fed was to raise rates and gold was to fall further in expectation of this, then the NZ dollar would likely fall further too.

Why?

Because higher interest rates would make US bonds more popular and so more money would move into the US dollar pushing it up versus other currencies such as the NZ Dollar.

Therefore we may see the local price of gold (and silver) not change too much from where it sits now.

So what to do?

Well, this still looks alike a pretty good entry point if you’re looking to buy. We are still (just) in the steady uptrend of the past year but well down from the highs.

So maybe take a position but keep some powder dry in case of a final capitulation. We’ve seen one client do just that this week. Taking a half postion of what he wanted to convert into bullion and keeping some back just in case.

More Will They? Won’t They?

We’ve seen a number of opinions on whether the Fed will hike this year or not.

“Bond King” Bill Gross reckons there’s a 100% chance they will according to this interview.

However his luck has been off of late. So maybe not so fast….

Anthony Wile makes a good argument that negative interest rates are perhaps more likely in the not too distant future.

“We went through a period when the Bank of England in aggregate burbled happily about an ongoing “recovery.” But recovery has been flushed down the so-called memory hole. Remember the “green shoots” of yore? It is all fiction, gas-baggery, monetary propaganda. There is no recovery. If the Fed raises rates it will be a tiny move upwards. But frankly, I’d be surprised even by that.

Just a few days ago, Yellen was quoted as saying the Fed would consider negative rates if the economy soured. Here, from Reuters:

“The Federal Reserve would consider pushing interest rates below zero if the U.S. economy took a serious turn for the worse, Fed Chair Janet Yellen said on Wednesday. “Potentially anything – including negative interest rates – would be on the table.”

Yellen said the idea would have to be carefully studied but indicated that banks might be apt to lend more money if they were receiving payment for money stored with them.

Source.

How About Interest Rates in NZ?

So there is plenty of discussion about the direction of interest rates in the USA. Back here in NZ it seems a bit more of a one way street at the moment.

Our Reserve Bank Governor says he won’t be hiking the OCR to ‘lean against’ the over-valued Auckland housing market.

Source.

With reports of Chinese buyers turn away from NZ house hunting, there is a bit of debate starting to appear of late on whether the Auckland house market has peaked.

“Falling house sales in Auckland are just “regulatory clouds” that crossed the city’s property boom, according to one property expert.

But an economist says Tuesday’s data from the Real Estate Institute showing a sharp fall in Auckland house sales could be the first firm sign that the market is on the turn.

Auckland house sales in October dropped more than 19 per cent on the previous month and median prices fell 3 per cent.

Westpac senior economist Dominick Stephens said it was clear the market was suffering “quite a hangover” as buyers rushed to beat new tax and lending rules in October and November.

What had been surprising was not the drop in sales but the price declines.

He put more store in the REINZ housing index than median prices, and when they were seasonally adjusted, Auckland house sales fell 15 per cent in October and prices by 4.7 per cent.

The biggest fall had been the 4.2 per cent decline in national house prices, the biggest decline since records began in 1992.

“You routinely take a single month of data with some caution but in this case, we’ve had very firm anecdotes that auction rooms have nothing clearing and mortgage approvals are well down,” Stephens said.

‘Is the start of something big or just a hangover? Experience does suggest a notable short-term impact on the market and that that wanes with time.”

Source.

So if housing is starting to slow that will be yet another reason for the RBNZ to follow just about everyone else and keep cutting interest rates.

The latest numbers from the biggest residential mortgage holder ANZ (who holds almost 32% of the market), show some interesting although not that surprising trends.

Source.

So while the RBNZ can provide all the warnings they like about how the risks facing NZ have increased in recent years, they cannot afford to let the bubble deflate.

We’d have to agree with Vern Gowdie out of the Daily Reckoning Australia edition on the likely result of the…

“…low and getting lower interest rate policy. This policy has failed in Japan, Europe and the US, yet we [Australia] play follow the leader.

Why? Because it is all about debt, debt and more debt. Their thinking is we need to make money cheaper to accommodate more borrowing and spending.

Here’s a novel idea; low interest rates haven’t worked so why not try higher interest rates? Take us back to a 3% cash rate for starters, and gradually increase from there.

The mainstream response would be, ‘Are you crazy, you’ll slow down the economy, household budgets will be slugged $X per month in higher mortgage costs.’

Perhaps a little reality check on the perils of over-indebtedness and living beyond your means is what’s in order for today’s society. Better to do it in a semi-controlled environment than to get to the situation Greece did and have market forces plunge you into what is shaping up to be a two-decade long depression.”

But of course that is almost certainly not going to happen.

Slowly but surely there are more and more whispers in the wind of the coming next wave of problems for the global financial system.

Meanwhile gold and silver continue to languish. Seems like a good time to get insurance when there are troubles on the horizon, and the “insurance premium” is low.

Please get in contact if you have any questions on how to go about buying (and storing) gold or silver here in NZ.

Free delivery anywhere in New Zealand and Australia

We’ve still got free delivery on boxes of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, fully insured.

Todays price is $13,790 and delivery is now about 3 weeks away.

— Prepared for Power Cuts? —

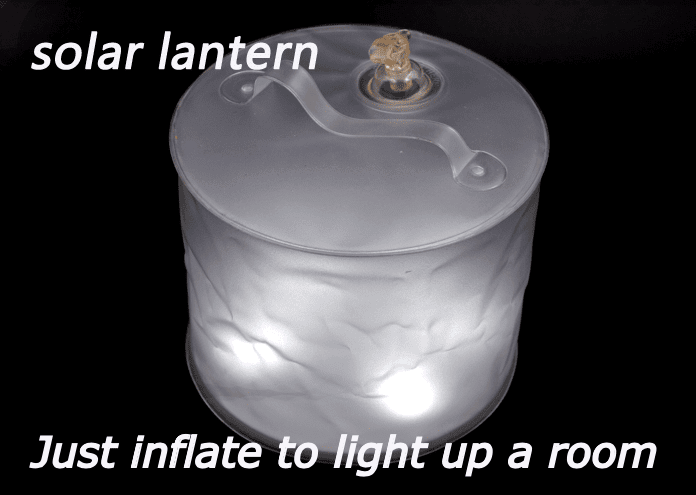

[New] Inflatable Solar Air Lantern

Check out this cool new survival gadget.

It’s easy to use. Just charge it in the sun. Inflate it. And light up a room.

6-12 hours of backup light from a single charge! No batteries, no wires, no hassle. And at only 1 inch tall when deflated, it stores easily in your car or survival kit.

Plus, it’s waterproof so you can use it in the water.

See 6 more uses for the amazing Solar Air Lantern.

This Weeks Articles:

|

||||||||||||||||||||||||

|

Pingback: Gold & Silver: COT Report Nirvana - Gold Survival Guide