An IMF report this week on the state of the New Zealand banking system, recommended the government implement a $10,000 “de minimis” exemption to the current Open Bank Resolution (OBR) scheme (a.k.a. bank depositor haircut scheme).

This would mean that each bank depositor would get $10,000 exempt from the Reserve Bank of New Zealand’s (RBNZ) depositor “haircut” policy if a bank were to fail.

(To learn more about the Open Bank Resolution and what will happen to your bank savings in the case of a bank failure in New Zealand check out this article and video: RBNZ Bank “Bail In” Scheme for Bank Failures: The Open Bank Resolution (OBR))

The IMF pointed out that the RBNZ “considers deposit insurance to be challenging in a highly concentrated banking system like NZ, and that it’s not well suited to dealing with systemic failures.” A decent point given only 5 major banks is not a lot to spread the “insurance premium” of deposit insurance out across.

But the IMF went on to say:

“The introduction of a deposit insurance framework is the first-best element to complete the financial safety net. OBR involves freezing a portion of balances – including deposits – to cover any losses beyond what the bank’s capital position could absorb. As the authorities have reiterated their long-standing opposition to deposit insurance, it is recommended, as a second best option, to introduce limited deposit preference to provide a clear legal foundation for a de minimis exemption from freezing and haircutting deposits in OBR,” the IMF says.

“The RBNZ public consultation has suggested a de minimis [minimum] exemption of NZ$500, but it is recommended that a higher amount, established in legislation, would provide some of the benefits of deposit insurance – such as mitigating against runs and reducing the political pressure to bail out depositors. Authorities’ analysis suggests that NZ$10,000 per depositor would exempt the full amount of 80 percent of the number of bank deposits, while still leaving the bulk by value of deposits at risk. Moreover, the issuance of additional capital instruments with write-down and convertibility features could be considered, to provide a further buffer of bail-inable liabilities. However, caution is needed as the majority of these instruments have been purchased by individual investors who may not fully appreciate the assumed risks,” says the IMF.”

Government May Make Some “Tweaks” to OBR

In response Finance Minister Steven Joyce said the government is looking at making some “tweaks” to the current OBR set up. But given the RBNZ has consulted on only a $500 exemption these tweaks may not be that significant.

Significant however is that New Zealand is the only OECD country to not have bank deposit insurance. For example Australia has coverage up to AU$250,000. In the US it is up to US$100,000.

So in the event of a bank failure all you bank deposits are at risk currently. In the future this may change to a small amount not being subjected to a hair cut.

How to Set Up Your Own Personal Deposit Insurance

Here at GoldSurvivalGuide we’ve made the argument that deposit insurance, bank bail outs, and bank bail-ins are all a bad thing. These are, as is always the case with government solutions, simply “band aid” fixes for much deeper problems that run to the heart of the global monetary system itself.

We continue to think holding your own “personal deposit insurance” is the way to go. Don’t be like the masses and leave all your savings in the bank. Consider some gold or silver bullion. The only financial assets that are not at the same time someone else’s liability.

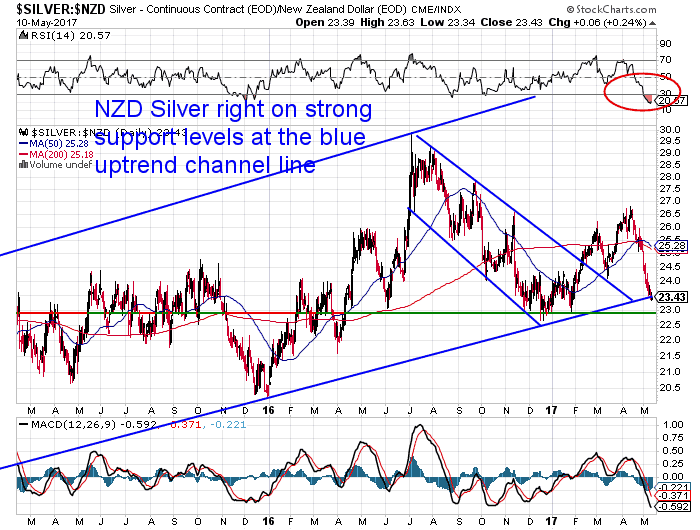

Silver in particular this week is looking like a very good price for a long term purchase as insurance. Go here for a quote.

While we’re on the subject of the IMF, have you also seen this?…

Here’s Proof the NZ Government is Following the IMF’s “War on Cash” Doctrine

To learn about what happens to your money if a bank fails in New Zealand see: Bank Failures | Could they happen in NZ | The Reserve Bank thinks so

Adding insult to injury.

Pingback: RBNZ Deputy Confirms Our Thoughts: Any Bank Depositor Bail-In Exemption Likely Minimal - Gold Survival Guide

Pingback: RBNZ Bank Dashboard: Why it May Not Help You Pick a Safe Bank - Gold Survival Guide