Prices and Charts

Gold Up Just Under 1% From a Week Ago

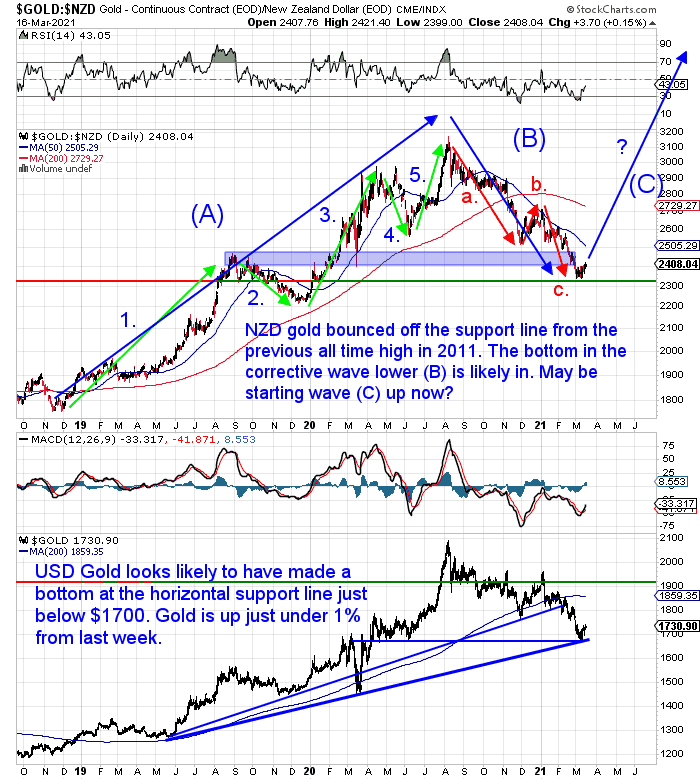

Gold in New Zealand dollars is up 0.74% from 7 days ago. The bottom that was set last week, so far at least anyway, looks to be holding well. Same with the USD gold price.

Odds are favouring the bottom being in and this being the start of the 3 wave (C) up for gold in NZ dollars.

Silver Unchanged

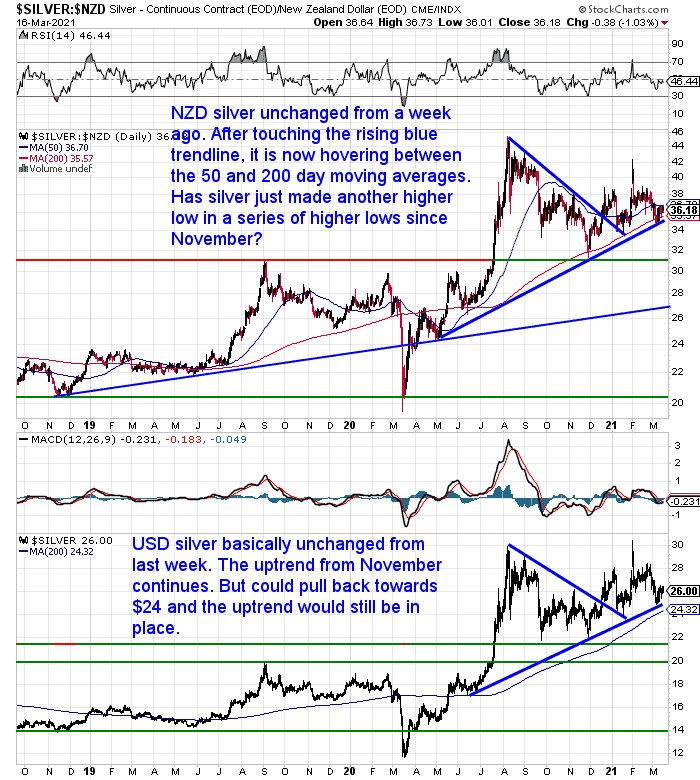

Silver is pretty much at exactly the same price as it was last week. Both in NZ and US dollars. The uptrend from November continues. Silver looks like it made a higher low when gold bottomed out last week.

Kiwi Dollar Also Unchanged

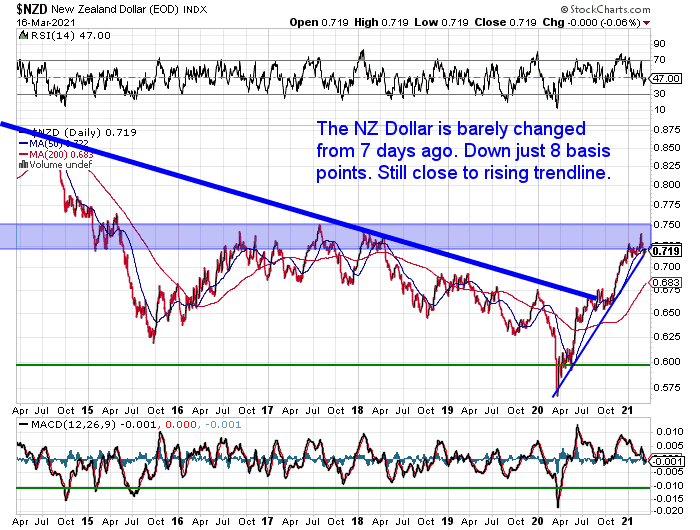

The New Zealand dollar is also pretty close to unchanged from 7 days ago. Down just 8 basis points from then. The Kiwi continues its sideways trading range from recent days.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

NEW: Certified Organic Long Life Emergency Food

This easy to carry bucket has 90 servings of organic breakfasts and mains

Free Shipping NZ Wide

Get Peace of Mind For Your Family NOW….

—–

Contrarian Indicator Even Stronger This Week

In last week’s feature article we mentioned how there had been a noticeable drop in buying of gold and silver with the recent further dip in prices.

“After the large surge in February, we have seen a much reduced interest in buying gold and silver over the last week or so. We have noticed this often happens around important bottoms. Unfortunately many people get their timing wrong and don’t buy when prices have been falling.”

See: Have Silver and Gold Bottomed? What’s Next for Gold and Silver in NZ Dollars?

This contrarian indicator is even stronger this week. With the least amount of buying that we have seen for some time. This makes us even more confident that yes, the bottom is in.

Website Visitors Down: Another Contrarian Buying Indicator

Here’s another possible contrarian buying indicator we spotted this week.

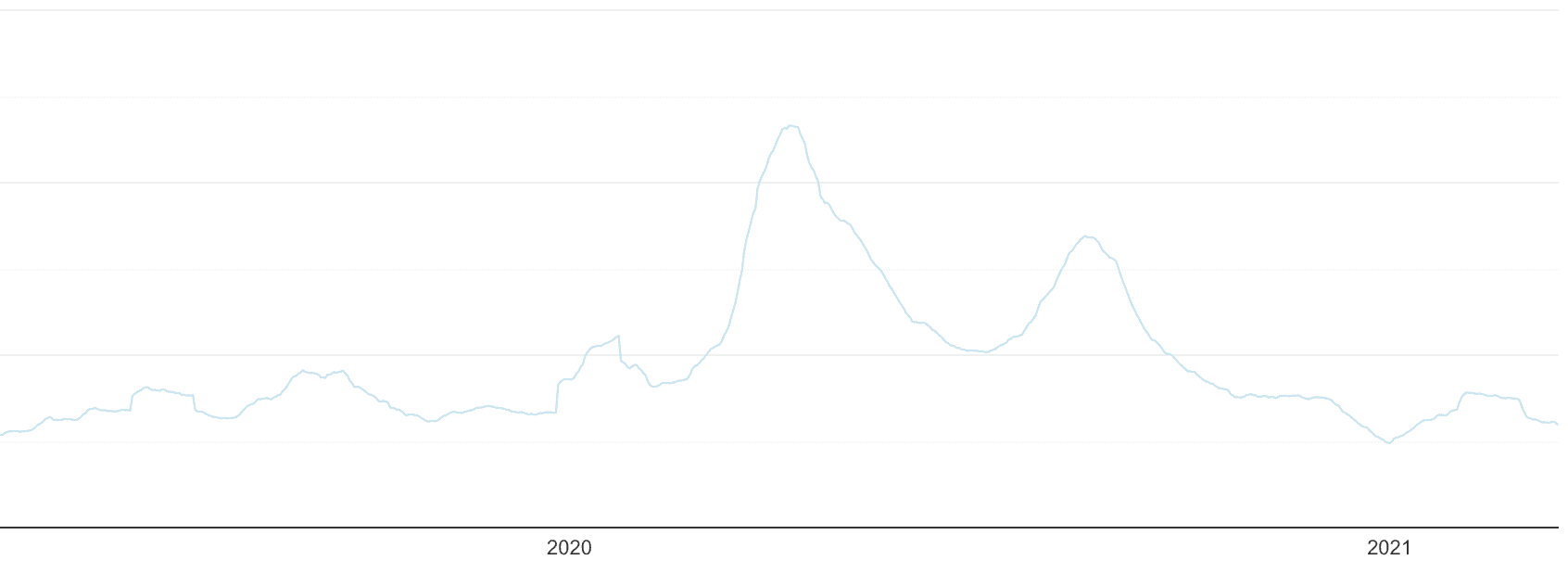

We track the monthly active users of our website. Looking back, the current rolling average is back down to similar levels as it was in December 2019.

Perhaps not too coincidentally, December was also the month when gold bottomed in 2019, after correcting since August.

This is not a big surprise. People lose interest as the price falls. So there are less people researching and reading about gold and silver. Maximum pessimism generally coincides with the price bottoming. As when most people are negative on gold and silver, this means there are no more sellers. So the price begins to head up.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Is Now a Good Time to Buy Gold in New Zealand?

As mentioned already, we are seeing a lack of buying interest currently in gold and silver. And this is likely indicating now is a good time to buy.

But there are a few other indicators and reasons to also back this up. We run through them in this week’s feature article:

- NZ Dollar Gold Price Has Corrected – Good Time to Buy?

- Longer Term – The Trend is Also Up

- Other Indicators Showing Now is a Good Time to Buy Gold

- New Zealand Dollar is Close to Major Overhead Resistance

- Property and Stock Markets Have Recently Made All Time Highs

- Seasonality: Closing in on the Time of Year When Gold Often Rises

- Futures Market Commitment of Traders Positions Indicate a Gold Bottom is Likely Close

Reader Question: If Physical Supply of Gold and Silver Runs out, Could The Price of Physical Increase More Than Gold and Silver Miners?

Here’s a question from a reader received earlier this month:

“I am keen to purchase some gold but I have a question I have been thinking about. I know that gold mining stocks offer more leverage on your investment than what owning bullion does, but what would happen in a scenario where the available physical supply of gold and silver runs out, could this mean that physical bullion will actually increase more? Wait times on physical are already very long and I’m sure they will run out when the time comes that Gold and Silver starts rising rapidly.”

Here’s our reply:

Physical gold and silver may not “run out” as you put it, but rather at a given price there may be no one prepared to sell. So in this situation it would be likely that the price would have to rise much higher in order to encourage holders to part with their metal.

As for whether physical would increase more than shares in this scenario that is hard to predict. It would likely depend upon the situation that has occurred by which the demand for metal has increased. If it was some sort of crisis then yes perhaps the metal could increase more in price than shares.

You’ll see in the article below since the current bull market in metals began in 2000 both asset classes have risen a fairly similar amount. There might also be some information in there to assist you in making a decision…

Gold Mining Shares vs Physical Gold Bullion – Which to Buy?

As the article says you could always get a bit of both too.

Also note that currently it is mostly just silver where there are delays in delivery. Gold is still readily available.

Get in touch if you have any questions about buying…

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Here’s how to always have clean fresh drinking water on hand.

The Sport Berkey Water Filter Bottle – $69 Delivered

Ideal for travel. Driving, camping, backpacking.

Free Shipping NZ Wide.

—–

|

Pingback: Better to Buy Gold by the Ounce or the Gram? - Gold Survival Guide

Pingback: US Debt Clock’s Dollar to Gold and Silver Ratios vs Our Debt to Gold Numbers - Gold Survival Guide

Pingback: An Excellent N.Z. Silver Buy Zone is Here - Charts Update Apr 2021 - Gold Survival Guide