Prices and Charts

Gold Down Sharply For the Week – Close to Bottoming?

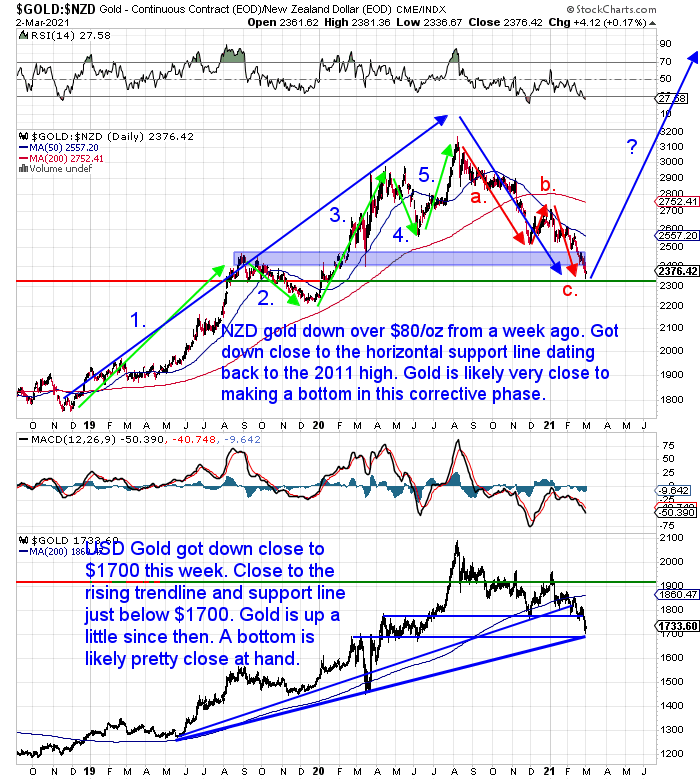

Gold in New Zealand dollars took a dive even lower this week. It’s down over $80 per ounce from 7 days ago. It was briefly even lower than this. Getting down close to $2300 and the horizontal support line dating all the way back to the 2011 high.

The Relative Strength Index (RSI) is now into very oversold territory below 30. If the bottom isn’t in here our guess is that it’s likely not too far away.

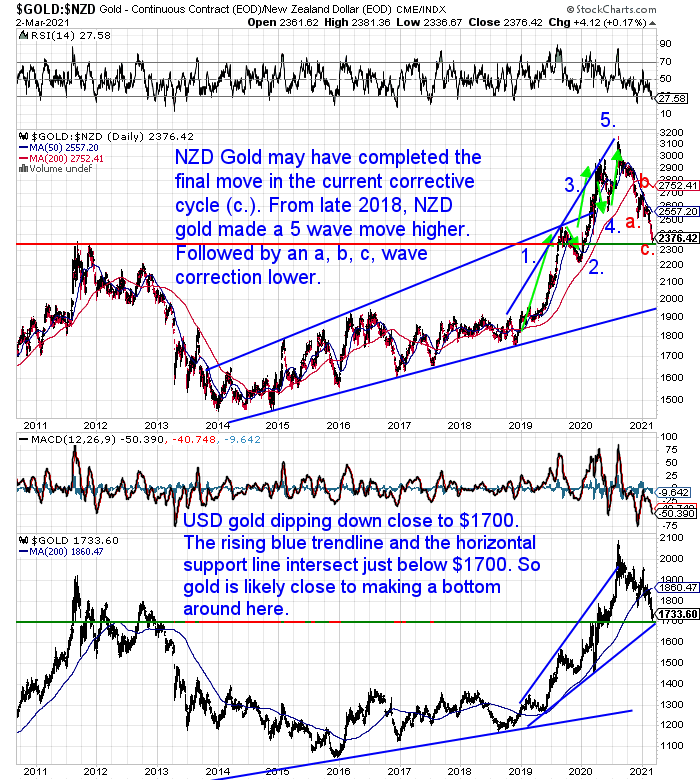

Below is a long term view of gold in NZ dollars. It shows the horizontal support line mentioned above. Dating all the way back to the previous all time high in 2011.

We’ve also marked on both these charts, 5 waves up (labelled 1-5) and 3 waves down (labelled a, b, c).

This is using Elliott Wave theory, which says in a bull move there are 3 major waves of a move up. An up phase, a down phase, and another up phase. These 3 waves are shown by the 3 blue arrows in the chart above.

In the first major up wave, we saw 5 smaller waves: Up, down, up, down, up. Then in the major wave down we have seen 3 minor waves: down, up, down. This is likely where we are now. If Elliott wave theory proves correct, then we will soon see the start of the third major wave up. This too would be made up of 5 minor up and down waves. This major wave up would take NZD gold much higher than the high from last year.

You may not place much weight on technical analysis. But at the end of the day markets involve millions and millions of people. People often act in herd behaviour. So patterns will take place and these patterns will repeat.

Of course there are no guarantees this Elliott Wave theory will play out. But for what it’s worth, we think the odds favour gold being very close to a bottom here.

For more thoughts on whether technical analysis is of any worth see:

Is Gold and Silver Technical Analysis of Any Use if Markets are Manipulated?

Silver Once Again Outperforming Gold

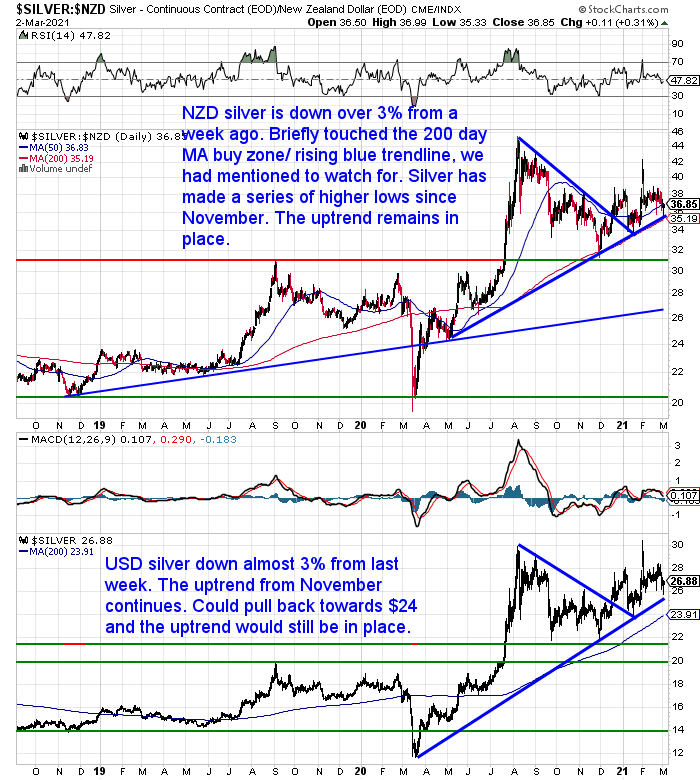

The prevailing trend from last month is continuing. While NZD silver was down for the week, it was still down around 0.5% less than NZD gold. NZD silver briefly touched the 200 day moving average (MA) and rising blue trend line. This was the buy zone we said to watch out for.

But the uptrend from November is still clearly in place. Keep your eyes peeled in case a final dip lower for silver is still to come. It would likely not last for long if there is.

NZ Dollar Down As Quickly as it Was Up

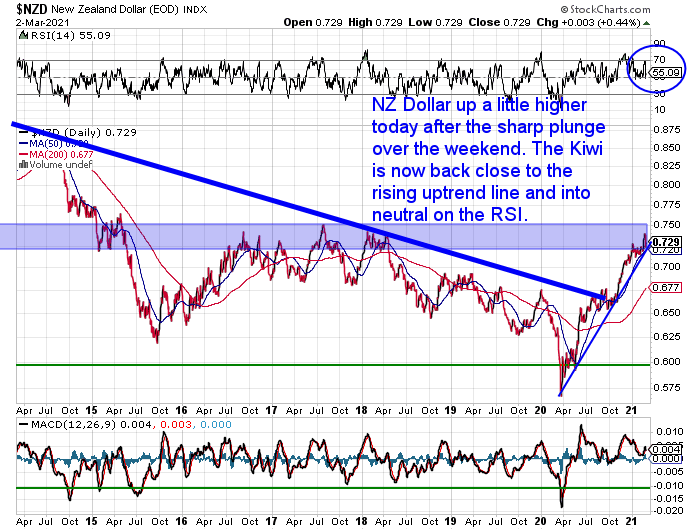

There was huge volatility in the New Zealand dollar this past 7 days. The NZD got as high as 0.7465 last Thursday. But then was slammed down to the low 0.72’s on Friday night.

We’re now back into the sideways trading range that the Kiwi has been in since the start of the year. So maybe it will bottom out around here?

Although Roger Kerr makes a good argument here why it may move back down to as low as 0.68-0.69.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

NEW: Certified Organic Long Life Emergency Food

This easy to carry bucket has 90 servings of organic breakfasts and mains

Free Shipping NZ Wide

Get Peace of Mind For Your Family NOW….

—–

Rising Long Term Interest Rates Give Markets a Scare

We’ve seen the yields on long term government bonds rising worldwide. Remember, central banks are unable to control these long term rates with their bond buying programmes. They can only influence the short end of what is called the “yield curve”.

Dan Denning pointed out in the Rum Rebellion that:

“…the Reserve Banks of Australia and New Zealand find themselves on the frontlines of trying to hold back rising yields and fight higher inflation. The scary thing? If the market regains control of price discovery — if interest rates can’t be controlled by central banks — then we will all find out very quickly whether government debt is safe and whether stocks are overvalued.”

Yikes – things could get real interesting real fast if that happens. Odds are some day it will too. Maybe a case of when rather than if? But who knows exactly when.

As a result, the RBNZ has been hard at work in damage control.

With Assistant Governor Christian Hawkesby observing ‘pockets of dysfunction’ in bond markets, saying the RBNZ could do more to put downward pressure on interest rates if necessary. This would include ramping up its currency printing program and even taking rates negative if necessary. Source.

Meanwhile the Aussie central bank has done more than just talk. The RBA this week doubled the size of its daily bond purchases from $2 billion to $4 billion. Solely to try and nudge rates back down. Source.

With debt levels so high worldwide, central banks cannot allow interest rates to rise too much. That’s why they’ll err on keeping them too low for too long. Expect more imbalances and bubbles to come yet.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Interest Rates and Gold

These rising interest rates are being blamed for the recent weakness in gold. The argument is inflation rates remain low (well at least according to government statistics), but interest rates are rising. So the real interest rate (after inflation) is falling. This makes gold less attractive.

This may be a factor. However gold is in a corrective phase after a strong run higher last year. So gold could be just going where it needed to in order to shrug off the weak hands.

Also as we reported last week, inflation expectations are increasing both here and abroad. And so are the prices of key goods such as food and commodities. But government CPI figures do not reflect this, as all the non essential goods in the CPI measures water down the price rises in these necessities.

An ANZ survey last week showed: Business confidence is flat – but inflationary expectations are not. There is “Little sign of inflationary pressures abating”.

ANZ Business Outlook survey shows a ‘jaw-dropping’ 67% of retailers expect to increase their prices. Source.

So measures of actual inflation may simply be lagging the increase in interest rates. Gold will likely turn higher once investors realise interest rates have been ticking higher due to inflationary fears.

These moves in interest rates mean this week we take a look at real interest rates in New Zealand. These are the interest rates after inflation. And while they have come back down from last year’s highs, you’ll see they are still negative.

Here’s what’s covered:

- How Do Real Interest Rates Differ From the Overnight Cash Rate (OCR) that the Reserve Bank Fiddles With?

- Why is the “After Inflation” Interest Rate So Important?

- So What is the Real Interest Rate in New Zealand Currently?

- How do you Calculate the Real Interest Rate?

- The Relationship Between Gold and Real Interest Rates

- But What if We Get Higher Inflation and So Interest Rates Start to Rise?

- Where to Next for Real Interest Rates in New Zealand?

Repeating what we said at the top. Odds favour the bottom in gold not being too far away now. So get in touch if you’d like a quote.

Current Stock Levels Update

Stock levels have not changed much from a week ago.

We still have some silver coins available to order where the premiums have hardly changed since this recent surge in demand began. See the deal at the top of this email on the limited mintage 2021 Cayman Islands Marlin 1 oz Silver Coins, if you want to avoid paying higher premiums.

Otherwise in silver coins we only have Royal Mint Britannia available (see below). We now also have South African Krugerrand’s on back order. Along with Silver Maple monster boxes once again available on back order with a 4 week estimated ship time.

Silver bars can be locked in but there is a 4 week wait on ABC bars and a 2 week wait on local silver bars.

There are a lot more options available in gold.

Get in touch if you have any questions about buying…

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Here’s how to always have clean fresh drinking water on hand.

The Sport Berkey Water Filter Bottle – $69 Delivered

Ideal for travel. Driving, camping, backpacking.

Free Shipping NZ Wide.

—–

|

Pingback: What's Next for Gold and Silver in New Zealand Dollars?

Pingback: Gold - a Leading Indicator for Bond Yields Topping Out? - Gold Survival Guide