How might an expanded war between Israel and Hamas/Iran affect the gold and silver price? See what can be learnt from past wars and how they impacted precious metals prices… War and Gold and Silver Prices There have been a number of wars started or threats of war in recent years. So how have each […]

Category Archives: When to Buy Gold and Silver

Timing is helpful in ensuring you get the best price when buying gold and silver. This category covers topics such as seasonality and how this affects the gold price. Along with some guides on technical analysis (simple indicators on gold and silver charts to help you choose better times to buy), along with understanding the relationship between the NZ Dollar, US Dollar and gold and silver.

This is also the place where you’ll also find us writing about what we think the prices of both precious metals may do.

If you’d like more guidance on picking lower risk times to buy, then you should definitely get free access to our gold and silver daily price alert email service.

Must read articles about When to Buy Gold and Silver

When to Buy Gold or Silver: The Ultimate Guide

Learn about fundamental reasons for buying such as how the economy is doing, the risk of financial panics or currency devaluations. But also technical reasons or rather just purely timing when to buy gold or silver depending on the price. Plus finally whether to choose to buy gold over silver or vice versa.

Gold Cycles vs Property Cycles: When Will Gold Reach Peak Valuation?

This article covers: Has NZ property peaked? The 18 Year Real Estate Cycle, the gold bull market 1970’s vs 2000 to date. When will gold and silver reach their peak valuations? And how property cycles and gold cycles might play out in the years to come.

Gold and Silver Technical Analysis: The Ultimate Beginners Guide

Once you’ve read this ultimate guide here’s what you’ll know: What is technical analysis? What are the benefits of technical analysis in gold and silver? Is technical analysis any use in manipulated markets? The different types of charts available and where to get them for free. Plus 6 different types of technical indicators for use in gold and silver analysis.

Where Are We in the Psychology of the Silver Market Cycle?

This article looks at the phases of investor psychology in market cycles. Then compares these phases to the silver market cycle over the past 8 years or so, to see where the silver market is currently. Therefore helping to indicate where silver is going from here and aiding with deciding when to buy silver…

The Yield Curve Recession Predictor: Impact on Gold?

The best predictor of a recession we have seen is the yield curve. While the yield curve may sound like something only economists would know about and discuss, it’s actually a surprisingly simple measure. In this post we’ll cover how the yield curve predicts recessions, how far away the next one may be and how the yield curve impacts gold.

Interest Rates and Gold: If Interest Rates Rise What Happens to Gold?

This post will help you if you’re worried about the impact of rising interests rates on gold. It covers: A common misconception about gold and rising interest rates; Rising interest rates in the 1970’s and the effect on gold; How the last 6 Federal Reserve Interest rate hikes have impacted the gold price; What might the future hold for interest rates and gold?

Latest Articles

Last week we wondered if NZ Dollar silver might have broken out of the multi-year consolidation pattern it had been in: “With the price today getting clearly above the downtrend line in this wedge or pennant formation. A clear break about the horizontal resistance line around $45 will confirm the next leg up in silver […]

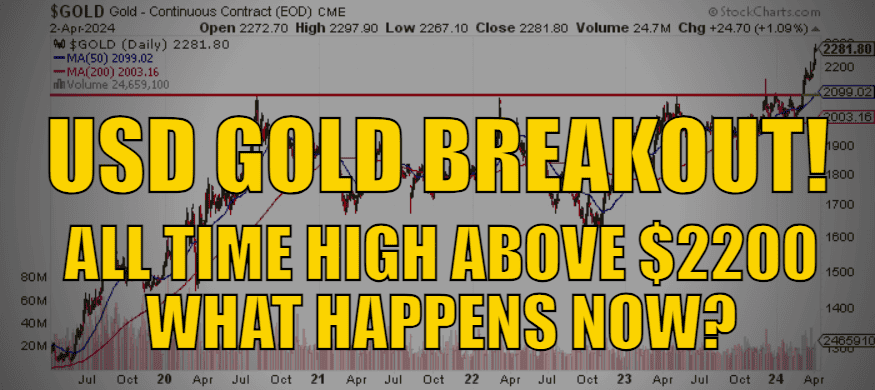

USD Gold just broke above the key level of US$2200 reaching another new all time high on Friday night. Just under a month ago it broke above $2100, setting what was then a new all time high. What happens now? Prior to this breakout, gold had attempted to break through this overhead resistance just below […]

The housing to silver ratio shows that when priced in silver, New Zealand median house prices have fallen almost 29% since 2003. But you’ll also see how history shows you could potentially buy a median priced house in New Zealand for only $48,404… You may have read our article on the NZ housing to gold […]

The housing to gold ratio shows that when priced in gold, New Zealand median house prices have fallen 49% since 2005. See how history shows New Zealand house prices could fall 79% further yet… There’s always plenty of discussion in the mainstream media about where house prices are going. Given New Zealanders predilection for property […]

Once again it’s time for our annual review of the performance of gold and silver in New Zealand dollars. We’ll also look back on our predictions from the start of 2023. Because it’s no point making predictions if you don’t check back and see how you did. Then finally we’ll finish off by making a […]

When to buy gold or silver is a question that can have multiple meanings. Firstly you might ask it from the point of view of when is a good time to buy precious metals (gold and silver) in general. This in turn could depend on fundamental reasons for buying gold and silver. Such as how […]

Gold and silver technical analysis can be a very large and confusing subject. Technical analysis can seem far too difficult to the new gold and silver buyer. So many people just ignore the topic altogether. But it needn’t be this complex. We’ve written this Gold and Silver Technical Analysis Ultimate Beginners Guide to simplify this […]

What is the gold silver ratio? Why is the gold silver ratio still at very high levels? In this post you’ll learn: What is the Gold Silver Ratio? The gold silver ratio is simply the price of an ounce of silver divided into the price of an ounce of gold. The resulting number shows how […]

One of the most common questions people ask is: “Is now a good time to buy gold in New Zealand?” We have written in our FREE eCourse (which you can access here) how the time to buy is on dips not when the gold price is reaching or close to reaching new highs. So what is the gold price […]