How might an expanded war between Israel and Iran affect the gold and silver price? See what can be learnt […]

Category Archives: Why Buy Gold and Silver

The first step on the precious metals path is to consider the questions Why buy gold and Why buy silver? You might then consider reading about protection from a bank failure and the escalating war on cash, or even the risk of derivatives.

The first step on the precious metals path is to consider the questions Why buy gold and Why buy silver? You might then consider reading about protection from a bank failure and the escalating war on cash, or even the risk of derivatives.

Plus check out our free Gold Ecourse, to learn more about gold and silver’s role as your financial insurance policy.

Must read articles about Why to Buy Gold and Silver

Why Buy Gold?

Your reason for buying gold is the first thing to consider. This article outlines 8 reasons to buy gold today. Plus another 6 timeless reasons to buy gold.

Why Buy Silver?

There is a lot of commonality in the reasons to buy gold and silver. But in this post you’ll discover 6 reasons you should specifically buy silver. Also learn about 3 factors that indicate silver should have more upside than gold.

Bank Failures: Could they happen in NZ? The Reserve Bank thinks so

See how a bank failure could occur in New Zealand. Learn how the Reserve Bank of New Zealand open bank resolution will affect you and put your savings at risk. Plus how you can prepare for a bank failure in New Zealand.

Kiwisaver and Bank Bail Ins: If a Bank Fails, Are Kiwisaver Funds Affected by the OBR?

Find out how Kiwisaver and bank bail ins work. See if your Kiwisaver funds would be affected if a New Zealand bank fails and customer accounts undergo a bail-in or “hair-cut”.

War on Cash: Implications for New Zealand

What are the real reasons for going cashless? What are the implications for New Zealand? See why hoarding something other than cash may be a good idea for emergencies…

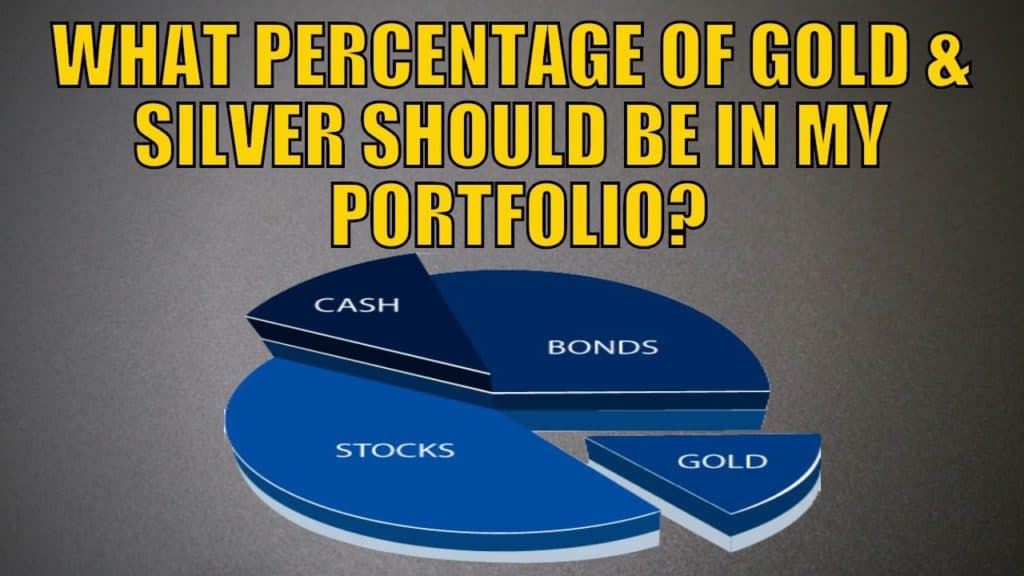

What Percentage of Gold and Silver Should Be in My Portfolio?

Here are factors to consider in deciding how much you should invest In precious metals. Plus some examples showing how specific percentages of allocation to gold can help balance and protect your portfolio…

Latest Articles

A surprising report from the European Central Bank (ECB) has caught even seasoned gold analysts off guard. Euro area investors […]

Introduction: Gold’s New Phase Begins Gold recently surged to a new all-time high of nearly $3,500 — before pulling back […]

For decades, US Treasuries and gold have stood on opposite ends of the investing spectrum. Treasury bonds are seen as […]

1. Introduction: Why Silver’s Strength Is Turning Heads Again Silver has been quietly outperforming in 2025, and some analysts believe […]

Here’s an excellent question from a reader: Should you pay down debt or buy precious metals… Pay Down Mortgage Debt […]

Ray Dalio, founder of Bridgewater Associates, warns about risks from inflation, currency devaluation, and rising global debt. He recommends holding […]

Once you’ve decided to buy some gold or silver, a common question to then ask is: How much should I […]

We recently looked at all the reasons we could think of as to why to buy gold. So it seems […]

“Haven’t gold prices gone up quite a lot in the last year or so? So why buy gold now? Isn’t […]