Here’s an excellent question from a reader: Should you pay down debt or buy precious metals…

“My specific question relates to whether to pay down debt or stack metals?

Obviously high interest debt is bad, but lower rate mortgage debt? I’m torn. Firstly, I don’t think many people ever regret paying off debt, but on the other side, if the governments continue to print money, the real value of the debt decreases?

I’m aware that you could calculate that an investment could return more than the loan interest rate, but I think we are in uncertain times and high investment returns are less likely/reliable?

Your thoughts would be appreciated.”

Pay Down Mortgage Debt or Buy Gold and Silver?

This really is a tough one. Of course we are not investment advisors. But if we were, we’d need to know a great deal more about an individual’s situation to even have a stab at answering this.

Information such as:

- How big is the mortgage?

- What is the interest rate that you need to “beat” with your investment returns?

- What level of other savings/investments someone already has.

So probably the best we can offer is some guidelines to take into consideration.

An email from Jared Dillian of “The 10th Man” on a similar topic is a helpful place to start. Here’s what he had to say on the question if you have some extra money: “Do you pay down the mortgage, or do you invest in the stock market?”

He highlights some points that we think you should also take into consideration when mulling over whether to pay down debt or buy some precious metals.

“You can use math to make this decision, but math is not much help, because there is uncertainty.

– The stock market allegedly returns 8 percent, but sometimes a lot less.

– Your house will hopefully appreciate, but by how much? Nobody knows.

– And what are interest rates going to do?

– It also mostly depends on where you live in the country.

– There are tax implications to residential mortgages.

– At issue also is your risk tolerance—

– Your optimism about the economy—

– And your fear of the downside.There is a third consideration. How much do you keep in cash? How much liquidity do you need?

Most personal finance people like to say this is an easy decision. But it’s not an easy decision. There is a lot of nuance.

The answer is likely to be a balance of the three possibilities, based on qualitative factors such as your opinion on the direction of stocks, interest rates, and real estate.

…And if your opinion is right, you will probably be right by accident.

There are no easy answers. There is no silver bullet. The point is to avoid getting too wound up about it. There are consequences to being really wrong, but there are no consequences to being a little bit wrong.…Stick to principles.

Source.

Principle 1: Avoid Debt

To summarise Dillian says avoid debt in the first place unless you “have a plan on how to pay it off in 3-5 years. Maybe 10 years in the case of a mortgage.”

Principle 2: Save

Again summarising, he says other personal finance people believe it is the accumulation of small decisions that gets you to save.

But he says it is one or two big decisions that make a difference. “Skipping the coffee doesn’t do any good if you then buy a Lexus SUV.

If you get a $400,000 house instead of a $300,000 house, quitting Starbucks for a lifetime wouldn’t make up the difference.

You have to get the big decisions right: going to college, buying a car, buying a house. If you get those wrong, it’s going to be difficult to recover.”

Principle 3: Manage Risk

Again to summarise he says we usually spend a lot of time “thinking about returns and not a lot of brainpower thinking about what those returns cost in terms of volatility.”

In short he says most people take too much risk. “People have too many stocks and not enough bonds.”

Perhaps in New Zealand it might be that most people have too much property and not a lot of anything else?

Paying Down Debt vs Buying Stocks – What Can We Learn in the Debt vs Gold Decision?

So from Dillian’s guidelines on paying down mortgage debt vs buying stocks, we can extract a few things to consider for the paying down debt vs gold and silver question.

- How much might gold and silver return?

- Your house will hopefully appreciate, but by how much?

- And what are interest rates going to do?

The short answer to all these is to ask nobody. Why? Because nobody knows!

What Has Gold Returned in Recent History?

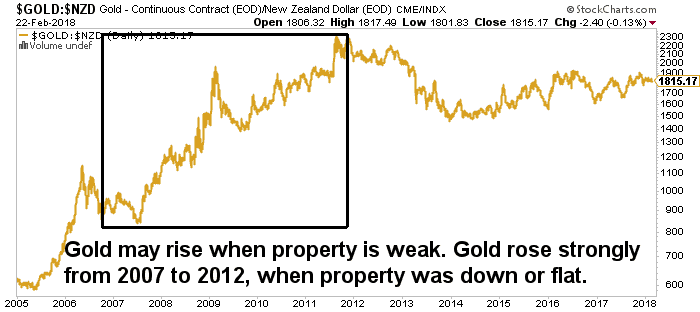

But we can look at what gold in NZ dollars has returned since 2000.

In our 2019 in review article we noted that NZD gold was up 17.14% in 2019. Plus gold is up a cumulative 309% in the 20 years since 2000. So that is around 15% per year.

So far in 2020 gold in NZ dollars is up another 26% (from $2277.69 to $2874.15).

Of course, there have been down years too for gold. Although all but one of these have been in the low single digits (2013 was -27.7%).

What are Interest Rates Going to Do?

Currently you can lock in mortgage rates for 12 months as low as 2.55% with the main banks. Even floating rates are as low as 4.44%. It would seem to be a decent bet that interest rates could yet go even lower.

At some point people will be surprised and rates will rise. But that could be a little way off yet.

Of course it’s not quite as simple as just calculating the difference between the expect mortgage rate and the expected return from gold. Then saying gold is expected to return more – so buy gold. Because the outstanding loan balance will determine what savings there are in paying down any debt.

However in the long run it seems a reasonable bet to expect gold to do better than the current record low mortgage interest rates.

But still – nobody knows!

Some Different Scenarios to Consider in Deciding Whether to Pay Off Your Mortgage or Buy Gold and Silver

Perhaps it’s also worth looking at a couple of scenarios to see how holding precious metals might play out.

Scenario 1: Buy Gold – SHTF

Say we get a “S*** Hits The Fan” (SHTF) scenario. Say that includes high inflation. This would be good for your debt. The debt would stay the same size. But the dollars you use to pay it down would be worth less. However it’s likely your gold would be worth more. So you could potentially pay your debt off with only a small portion of your gold.

Scenario 2: Buy Gold – No SHFT

Alternatively, let’s say things get better from here. House prices continue to go up, so do shares. Maybe gold doesn’t go anywhere (granted this scenario doesn’t seem that likely right now, but consider it anyway). Meanwhile interest rates and therefore debt repayments stay low. Eventually you may choose to sell your gold and pay off your mortgage debt.

So this would seem to fit into Jared Dillian’s scenario where there are no major consequences to being a little bit wrong.

Scenario 3 – Don’t Buy Any Gold – SHTF

Conversely holding no gold might fit into the scenario of being very wrong.

Say you simply pay down your mortgage debt. So you own your house outright. There is a major financial crisis. House prices drop substantially – at least 25%. You still own your house but it is worth significantly less. You now own no gold – which would have been expected to rise in value. Likely any other investments such as shares, kiwisaver etc will have also lost value – maybe even up to 50% or more? So you don’t have any debt but you also have very reduced savings and most of your “eggs” in housing basket alone.

Of course there are many other scenarios in between all these. Again nobody knows how things will play out.

Pay Down Debt AND Buy Gold

So if you have some extra money, perhaps do a bit of both. Pay down some debt and also buy some gold and silver if you don’t have any (or enough). But how much gold is enough?

How Much Gold is Enough Comes Down to Many Personal Factors Including:

- What other investments you hold?

- What the level of risk and volatility is in your portfolio?

- How much income do you require from your investments?

- How much liquidity do you require?

- How long do you intend to hold your precious metals for?

- The level of risk for a major financial crisis in your home country and globally.

Learn more: What Percentage of Gold and Silver Should Be in My Portfolio?

That way you’ll have a financial insurance policy. But you’ll also have reduced your debt and lowered your repayments. The best of both worlds.

Perhaps also consider what your “sleep at night” levels are? That is, what amount of gold and silver, and what level of debt allows you to sleep soundly without worry about either?

No one knows this level but you.

And maybe as Dillian says keep some cash on hand still too. 2 or 3 months worth of living expenses in cash will never do you any harm.

Check out our range of gold and silver in our online shop.

Editors note: This post was first published 30 April 2019. Last updated 8 September 2020 with latest interest rates and performance of gold number.

Pingback: The Ugly Truth About New Zealand Household Debt - Gold Survival Guide

Pingback: Here’s What Happens When the World Overdoses on Debt - Gold Survival Guide

Pingback: Mortgage Debt and Risk to NZ Banks and the Wider Economy

Pingback: Could an Aussie Owned NZ Bank Take Deposits From its NZ Customers if the Parent Bank Failed? - Gold Survival Guide

Pingback: RBNZ Currency Printing Continues on Schedule - Gold Survival Guide