Two questions from readers recently on the topic of a New Zealand Central Bank Digital Currency (CBDC) and how an implementation of this will affect gold…

Suzanne: With this new digital currency system they are talking about, how will gold or silver be useful ?

Chris C: If NZ were to introduce a CBDC, how will precious metals be valued and how will one use them?

Table of contents

Estimated reading time: 7 minutes

Where is New Zealand With a CBDC?

But before we answer the reader questions, let’s first look at the latest developments in the CBDC in New Zealand…

Back in July we gave a summary of the Reserve Bank of New Zealand’s work on a central bank digital currency.

In that article we covered the following:

- RBNZ Previously Said It Was “Too Early” For a Central Bank Digital Currency:

- RBNZ Latest Views on CBDC: No Longer “Too Early”

- Reading Between the Lines: Where Are We Heading With CBDC’s?

- Clues From Elsewhere – What Are Other Central Banks Up To?

- Watch This Space: CBDC’s Inevitable?

Since then the RBNZ has released in September a wide range of information under the heading: Future of Money – Te Moni Anamata.

Future of Money

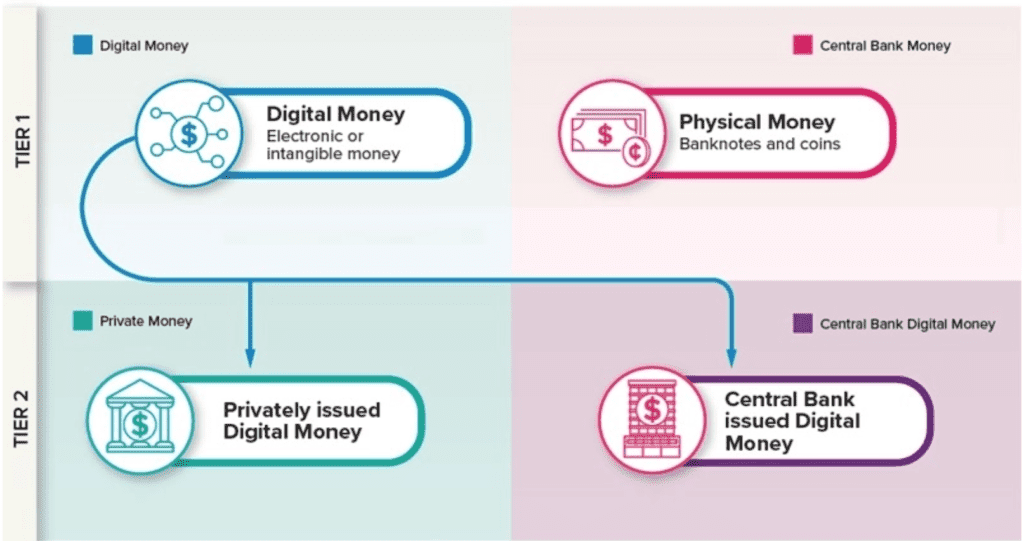

On that page is a simplified explanation of what “money” is – well, according to the RBNZ anyway.

They outline how the fall in the use of cash means they need to come up with another way to ensure everyone has access to their “central bank money”.

They explain the difference between current central bank money (i.e. cash) and private money (currency held in a commercial bank account).

The RBNZ explainer then outlines how a new central bank digital currency would work alongside cash.

They end with this statement:

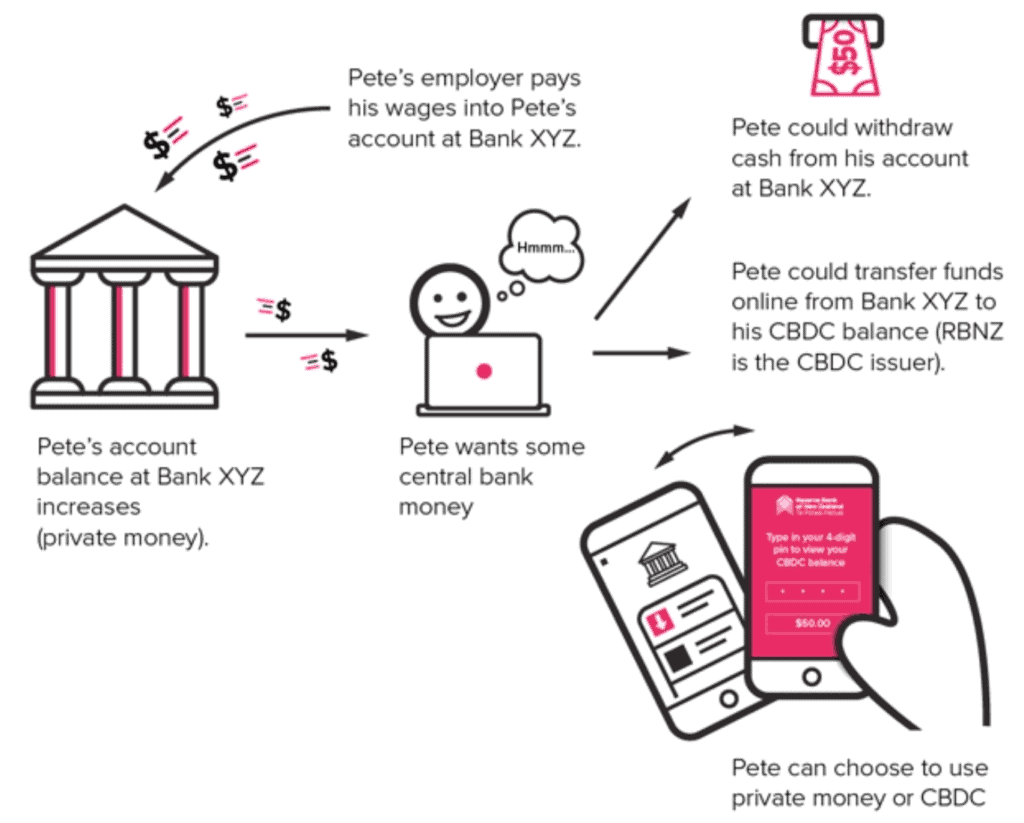

“If New Zealand was to have central bank digital currency (CBDC) it would exist alongside cash. People could choose to access their CBDC balance, rather than their private money account, to make online payments. CBDC would be similar to private money because it would be digital, but would be less risky than private money. CBDC could be accessed and viewed digitally, for example, it might be accessed using a phone app.”

Why Would People Choose a CBDC Over Commercial Bank Currency?

However they don’t really get into why people would choose a CBDC over the current private money, other than to say it is “less risky”. As Mike Maloney alludes to in the video below, there is a very real risk to commercial banks if a CBDC were to exist. They may find they are simply not necessary!

What They Aren’t Admitting About the Digital Dollar…

Interestingly just last week, Mike Maloney of GoldSilver.com, featured this “future of money” release from the RBNZ in a video discussion with Jeff Clark.

He explains the “voodoo” of fiat currency IOU’s, that requires us all to believe in it. Maloney rightly points out, just as we did back in July, that you need to “read between the lines” when it comes to what central banks are saying about CBDC’s.

Here’s a link to the other article that Mike and Jeff discuss about the implications for a digital dollar in the USA depending upon who Biden appoints as the next chair of the US central Bank. Note: Since the video was released, current chair Jerome Powell has actually been reappointed. So a move to a digital dollar may now not be so quick in the USA, compared to if the other possible appointee, Lael Brainard, had been selected.

Far-reaching decision on Fed digital currency awaits next chair

If New Zealand Introduces a CBDC, How Will Precious Metals be Valued and How Will One Use Them?

A CBDC May Be Inevitable – But That Doesn’t Mean it Will Work

So it seems likely a CBDC of some sort will arrive eventually. As we said back in July, it seems they are inevitable. But, just because CBDC’s are implemented, it doesn’t mean they will “work”. They are merely a change in the current fiat currency environment. Not a fix. As to us it seems the system is on its last legs anyway.

The RBNZ Future of Money release unwittingly explains the issues with fiat currency when they say:

“Why is central bank money so special?

…central bank money underpins the trust and confidence in private money. We call this acting as a value anchor for private money. This value anchor is the reason everyone, irrespective of the money they use, is able to transact in New Zealand dollars with confidence and the reason we can use monetary policy to help keep prices stable and employment at the maximum sustainable level.Secondly, because everyone can use it, cash contributes directly to financial and social inclusion.

Value anchor

Central bank money is a value anchor because:– It allows people to easily work out what their private money is worth

– People know they can convert their private money 1:1 into cash whenever they want, so they are willing to trust the private IOU that underpins private money.

This “value anchor” is exactly where fiat currency fails! $10 may always be $10. But $10 earned today is not likely to buy the same amount of stuff 10 years from now. That is what more and more people are starting to realise. That is why the RBNZ definition of money falls short. They are talking about currency – as in a unit of account and medium of exchange. But the New Zealand dollar fails in the other feature that money needs – that of a store of value.

So that leads us into the first part of our reader’s question…

If a CBDC Exists How Will Precious Metals be Valued?

In much the same way as they are now we’d say. That is, an oz of gold or silver will still have an NZ dollar “price” attached to it. This price is likely to rise as it has been since the early 2000’s, as the central bank currency continues to be devalued. A CBDC will be an alternative to cash. Supposedly it will be available to use at the same time as cash. It would seem unlikely that it will affect how gold or silver is valued. Just as implementing a CBDC won’t really affect the pricing of everyday goods and services. Well not any more than the inflationary effect we already have anyway.

So we don’t see there being much impact on how gold and silver is valued. But it may increase the demand for gold and silver (and therefore the price) as a CBDC may be even easier to inflate through helicopter drops direct from the central bank.

Therefore, valuing gold and silver would still be best done by comparing them to other tangible assets such as property, shares etc. Rather than an elastic measure in dollars.

For more on this topic see:

Dow Gold Ratio: How Does Gold Compare to Shares For the Past 100 Years? Where to From Here in 2021?

NZ Housing to Gold Ratio 1962 – 2021: Measuring House Prices in Gold

NZ Housing to Silver Ratio 1968 – 2021 – Measuring NZ House Prices in Silver

If a CBDC is Created How Will Precious Metals be Used?

Again our answer is much like they are currently. That is, as a store of value and as an insurance against financial crisis and loss of purchasing power.

As explained above, a CBDC is likely to come with the same issues that cash currently faces – loss of purchasing power.

So it’s likely people will continue to buy gold and silver as a hedge against this. You will simply swap your CBDC for physical gold and silver, just as you do your commercial bank currency in your bank account currently.

When you want to “spend” your gold or silver you could exchange them back into a CBDC or alternatively swap them for another asset you’d like to own. Or maybe you will wait until the monetary system completely changes (as we think it will) and then “spend” your precious metals.

In summary, we think a CBDC is in fact likely to speed up the inevitable change in the monetary system. As it will awaken more people to the problems of a centrally controlled currency.

Related: Why New Zealand Won’t Have Any Say in a Global Currency Reset

I am hoping to learn more and buy gold ASAP. Any help will be greatly appreciated!

Hi Richard, You can email us via our contact page https://goldsurvivalguide.co.nz/ask-us-a-question/ or phone 0800 888 465 with any queries you have. Cheers

Pingback: The Queens Death and N.Z. Currency - Gold Survival Guide

Thanks for all your helpful articles! I just wonder – given the way we are hurtling towards ever more losses of choice and rights (WHO Pandemic Treaty, the very recent potential “Ministry of Truth” censorship tyranny etc – that they might simply outlaw private ownership of metals and demand we relinquish them. Especially if they haven’t been bothered to store any themselves. In which case, preparing and becoming one’s own bank won’t help us. What are your thoughts on this level of risk? Many thanks!

Sophie

Hi Sophie, We have written on this subject previously. So check out this article for our thoughts on confiscation: https://goldsurvivalguide.co.nz/gold-confiscation-could-it-happen-in-new-zealand/