Prices and Charts

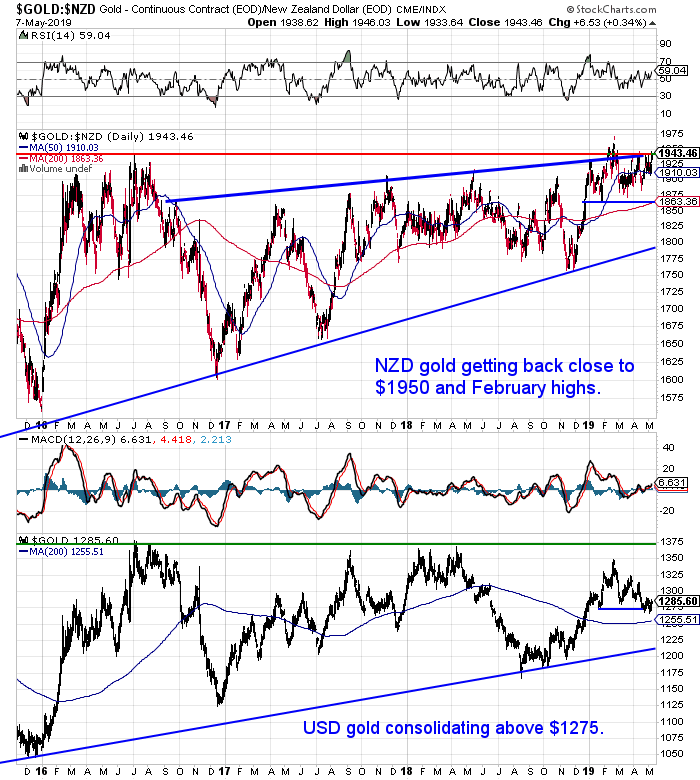

NZD Gold Closing in on February Highs

Gold in NZ dollars was up over 1% this past week. Mostly care of the weakening Kiwi dollar. As we write NZD gold is sitting right on $1950 as we await today’s interest rate decision from the RBNZ.

The February highs above $1950 are not too far away right now. And NZD gold has the look of wanting to move higher.

A potential rate cut from the RBNZ this afternoon may help NZD gold do just that.

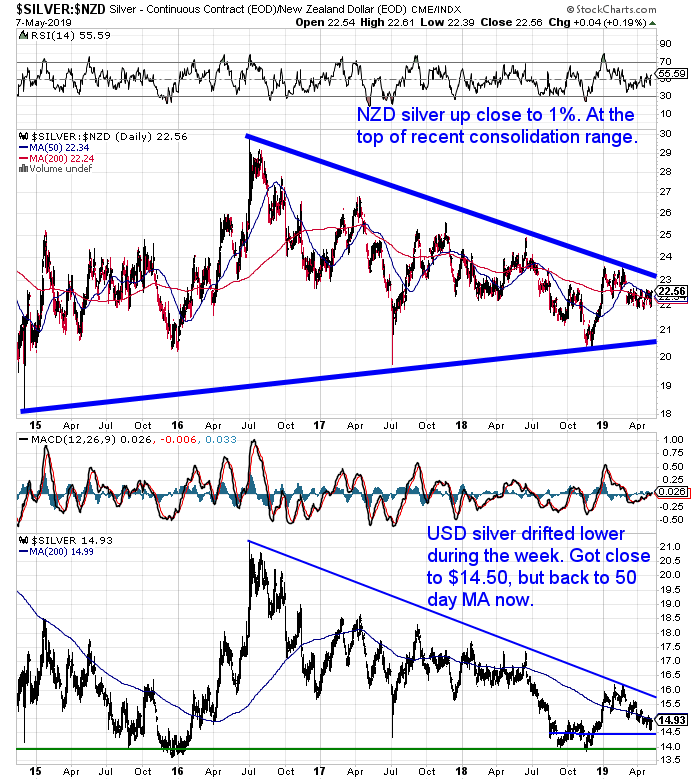

Silver Also Up

NZD silver is up just under 1% this week. It now sits at the top of the consolidation zone it has traded in since March. But is not showing any clear direction presently.

NZ Dollar Breaks Even Lower

The NZ Dollar is where the action is though. This past week the Kiwi has fallen another percent.

Currently it is sitting just under horizontal support at 0.6600, as we await the RBNZ decision. A rate cut (which the likes of ASB are picking) will probably nudge the NZ dollar even lower. Just as we’ve been saying to watch out for recently.

Our post from 2 weeks ago still holds true as far as what levels to look for next. Check that out if you missed it last week.

LATE UPDATE: As we’re about to hit send the RBNZ has cut the Official Cash Rate (OCR) to a record low 1.5% (0% interest rates here we come!).

In response the Kiwi dollar plunged below 0.6600. 0.6400 looks to be on the cards in the not too distant future.

LATE UPDATE: As we’re about to hit send the RBNZ has cut the Official Cash Rate (OCR) to a record low 1.5% (0% interest rates here we come!).

In response the Kiwi dollar plunged below 0.6600. 0.6400 looks to be on the cards in the not too distant future.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $240 you can have a 56 serving emergency food supply.

Free Shipping NZ Wide.

Aussie (and NZ?) Dollar Set to Dive…and Take Your Wealth With it

Shae Russell writing for the Daily Reckoning Australia made some points about the Aussie dollar and the Reserve Bank of Australia. She says it’s not whether the RBA cuts rate today (they didn’t). But what the longer term impact of the interest rate decisions are for you as an individual.

We’d say these almost all of these pretty much apply to the Kiwi dollar and the RBNZ too:

“My concern — and it should be yours as well — is the long-term impact of the RBA’s policies.

Low interest rates will cripple the Aussie dollar.

You see, Aussies have been lulled into a false sense of security the last few years.

Compared to the rest of the world, Australia’s 1.50% cash rate seems ‘juicy’ to international investors.

The US had zero rates at one point. The EU followed suit in 2014. Japan has negative rates. And the Bank of England has kept interest rates below 0.8% since 2010.

So, the return on investment for parking cash in Australia was nothing short of incredible for yield-seeking punters.

And with China buying large amounts of Australian commodities, the Aussie dollar stayed fairly resilient.

No matter what was happening around the world, the Aussie economy defied the odds.

Our $1.6 trillion mortgage debt — roughly 80% of which is held with the big four banks — didn’t seem to drag our banking sector down.

To outsiders, our country is nothing short of an economic miracle.

And all of this sunny news brought investors to our shores.

Yet today, Aussies find themselves in a precarious position.

China is slowing its purchases from us. The US has raised rates.

The serviceability of a large chunk of Aussie mortgages is being called into question.

If people can’t make those payments on their mortgages, the Aussie banking sector will look pretty dicey to outsiders.

In the midst of all that, the biggest contributor to the Aussie economy — the consumer — is vanishing.

The good times are well and truly over, leaving our central bankers scrambling to keep things as they are.

A rate cut — whether it happens next week or a month or two after — is inevitable. Our central bankers will yank down on this lever in the hopes of maintaining the status quo.

But…these decisions will have a long-term impact on you.

The impact of a rate cut isn’t obvious at first.

And it’s highly unlikely that it will ‘juice up’ the consumer and encourage them to spend more money. It may not even prop up the housing sector like our bean counters hope.

Essentially, low interest rates will lead to the long-term erosion of your wealth.

The first sign will be even lower interest rates for the cash held at the bank.

The second sign will be the declining value of the Aussie dollar.

The third sign will be that the Aussie dollar buys less than it used to.

And this can happen quietly…in the back ground over the next few months.

The point is, the decisions the RBA makes this year aren’t going to save the Aussie economy.

They will destroy the Aussie dollar. And sink your wealth with it.”

Could an Australian Owned NZ Bank Take Deposits From its NZ Customers if the Parent Australian Bank Failed?

Speaking of Aussie, we had a few of questions in this week from someone thinking of buying gold…

“I am looking to buy gold as a means of deposit protection after learning about the banks “haircut” policy when it comes to bail ins. I have lost trust with the banks some time ago and have been “red pilled” in the corruption of the monetary systems for some time along with the governments and Politicians.

I have never looked at precious metals as a form of insurance for my deposits. However, as I see the state of the huge debt bubble and the massive debt crisis versus the state of the Aussie economy, it has me concerned. Can the Aus banks e.g ASB take deposits/haircut from NZ customers if the Australian economy fails?

What would be a good ratio of silver to gold if I were to buy?”

Here’s our response:

Yes the New Zealand bank bail in scheme is quite concerning for deposit holders. Especially since unlike most other western nations there is no bank deposit insurance protection for any level (as you may or may not know, most other countries have at least $100k deposit insurance).

So 100% of our deposits are potentially at risk were a New Zealand bank to fail. And as we’ve written previously, if one bank is in trouble here it’s likely others will be too. Here’s a bunch of articles we’ve written on this subject including: If a Bank Fails, Are Kiwisaver Funds Affected by the OBR?

Bank Failure Articles

This reader knew all about the RBNZ’s bank bail in scheme called the Open Bank Resolution (OBR).

But in case you don’t we’ve updated this post from 2011 with all the details:

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Now on to the rest of his questions…

In answer (as best we can anyway!) to your questions (and remembering we are not financial advisors – just giving our opinions):

Can the Australian banks e.g ASB take deposits/haircut from NZ customers if the Australian economy fails?

Not really. As it is the RBNZ that implements the bail-in, if a bank is in trouble, not the bank itself. The RBNZ would shut down the bank and see what assets it had left and work out how much it needed to haircut depositors to keep the bank afloat.

However the parent banks in Aussie could extract capital from their New Zealand subsidiaries if their Australian balance sheets needed shoring up. Potentially this could make the NZ banks weaker and therefore more susceptible to failure themselves.

If the Australian banks end up in that much trouble we’d guess the local banks here would also be in difficulty given how closely our economy is connected to Australia.

So, if the Australian economy was to take a dive and an Aussie bank got in trouble because of this, it wouldn’t directly affect the customer deposits of a subsidiary bank in New Zealand.

But, the New Zealand economy and therefore New Zealand banks might be under similar strains anyway.

We’ve answered his other question previously “What would be a good ratio of silver to gold if I were to buy?”.

It’s right here in this Common Questions From First Time Gold and Silver Buyers.

If you’re thinking of buying there are a bunch of other Q and A’s in there including:

- What is the Spot Price of Gold or Silver?

- If Precious Metals Markets Are Manipulated Why Should I Buy Gold and Silver?

- How Much Gold and Silver Should I Purchase?

- Do I Have to Pay Upfront? (50% deposit option)

- How Do I Pay?

- How is Bullion Shipped? Can it Go to My Work or Home Address? Is it Insured?

- How Soon After Payment Will I Receive My Bullion?

- Will Some Products Be Easier to Sell Such as Coins Versus Bars? And Local NZ Bullion Versus Imported Bullion?

- How Can I Be Sure There Will Be Buyers For My Gold and Silver When I Want To Sell?

- Is There a Difference in Price Between Buying and Selling?

- Once I’ve Bought, Where Should I Store My Gold and Silver?

- I Read in One of Your Articles That Gold or Silver Coins of 99.9% Purity Are GST Free – Does That Apply to Bars as Well?

- How Can I Be Sure of the Purity of the Gold or Silver Supplied?

If you’re looking to buy and have any other questions then get in touch by any of the methods below.

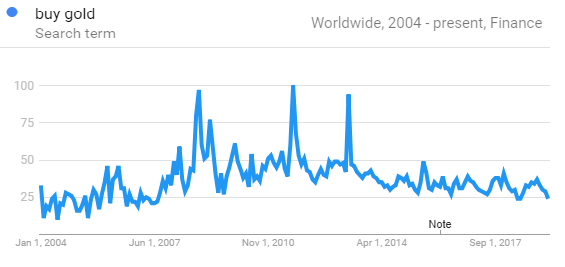

You certainly won’t be joining the masses in buying. Internet searches from investors worldwide wanting to “buy gold” fell last month to their weakest volume since last summer’s 11-year low.

If you’re looking to buy and have any other questions then get in touch by any of the methods below.

You certainly won’t be joining the masses in buying. Internet searches from investors worldwide wanting to “buy gold” fell last month to their weakest volume since last summer’s 11-year low.

But history also shows that the best time to buy is when no one else is interested!

Given the state of the New Zealand Dollar, buying some gold looks like a pretty good hedge right now.

But history also shows that the best time to buy is when no one else is interested!

Given the state of the New Zealand Dollar, buying some gold looks like a pretty good hedge right now.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Big Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Royal Berkey Water Filter

Shop the Range…

—–

|