It’s time for our annual review of the performance of gold and silver in New Zealand dollars. We’ll also look back on our predictions from the start of 2019. Then finish off by making a few guesses as to what 2020 could have in store for us...

2019 saw a complete reversal from 2018 overall in the markets. Unlike 2018 when gold was almost the only asset to rise. Just about every asset went up in price over the course of the year.

Share markets rose. Bond Markets rose. Cryptocurrencies such as Bitcoin rose overall too.

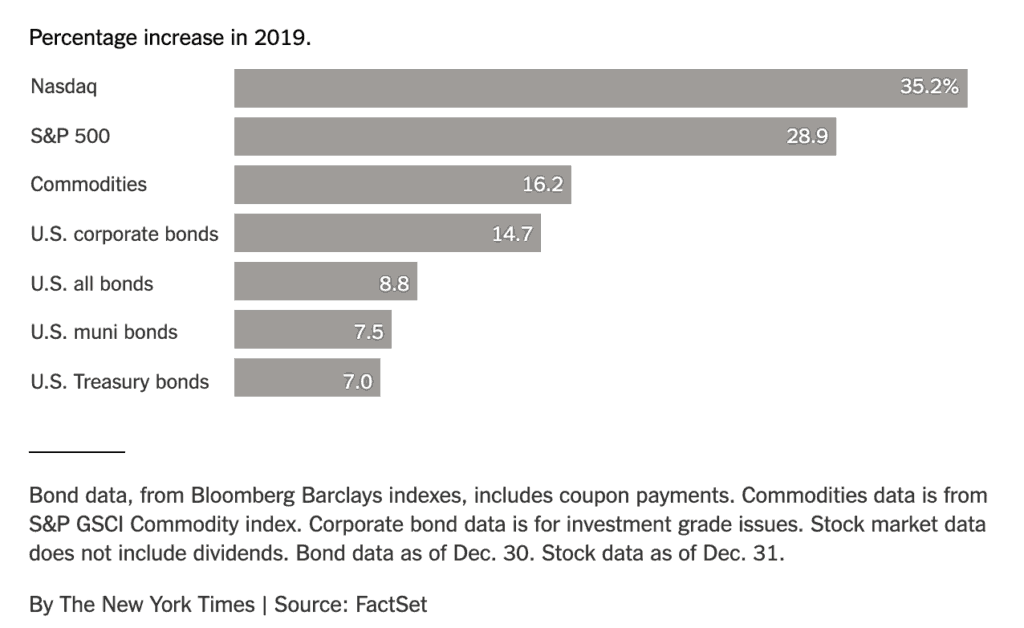

Here’s a table from The New York Times showing everything rising…

It’s likely that the US Federal Reserve reversing course on its balance sheet reduction and ceasing to raise interest rates was the major factor in all boats rising.

So how about gold and silver? When everything else was rising surely we’d expect gold and silver to fall?

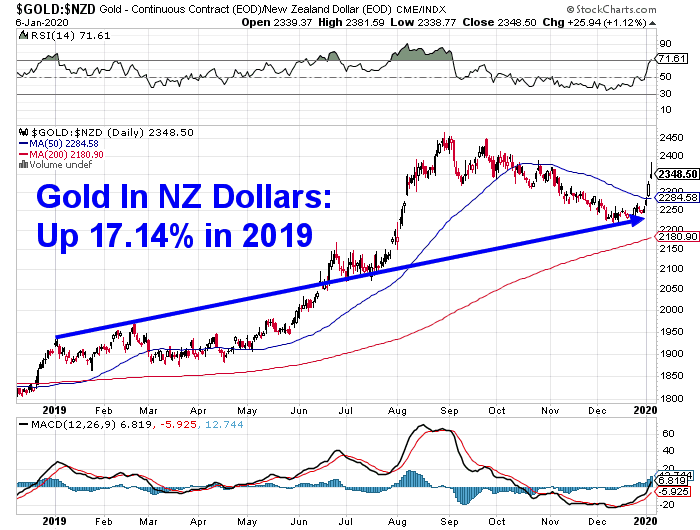

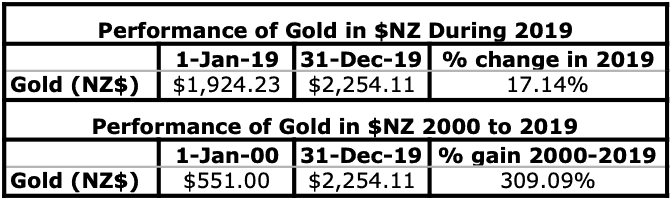

Gold in $NZ – Performance During 2019

Gold priced in NZ dollars quietly edged higher from January to June. before boosting sharply higher to hit a new all time record high in August. spent the first few months of the year in a sideways trading range. But then moved up close to a multi-year in May, before again heading lower. Gold then fell sharply in late October/early November.

After such a meteoric rise it wasn’t a surprise to see gold spend the latter months of the year in consolidation mode.

Then surprisingly again like it did in 2018, gold moved higher during December.

Even though gold spent the last third of the year in correction mode, it still managed to gain a healthy 17% for 2019. In a year when everything else also went up that was a very good performance.

Looking back much further to the start of the millennium, gold is up a solid 245%.

Gold has risen sharply since Christmas and then surged after the killing of the Iranian General in Baghdad over the weekend.

So it’s likely we’ll see a decent pull back before too long.

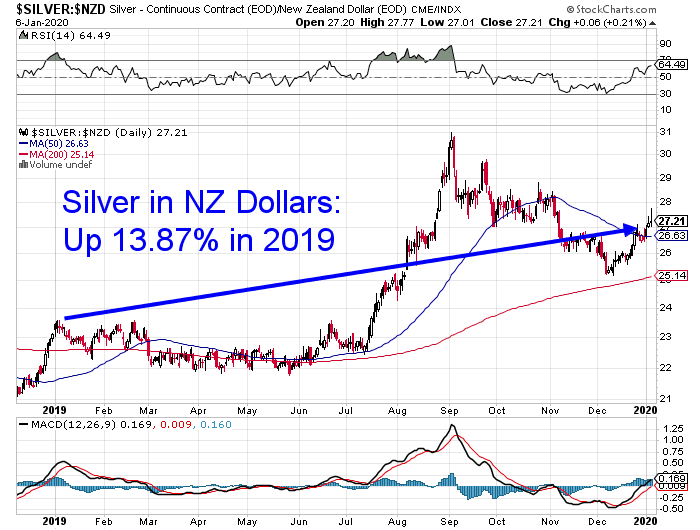

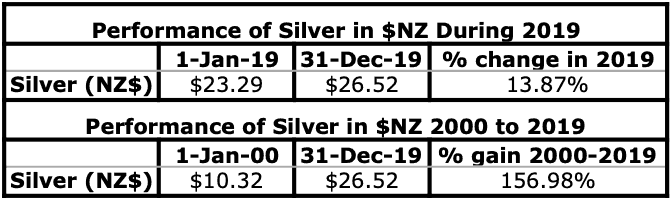

Silver in $NZ – Performance During 2019

Just as has done for the past couple of years, silver again underperformed gold during 2019. Although last year silver wasn’t far behind gold.

Silver followed as similar pattern to gold. As is also often the case silver rose faster but then in the latter part of the year also fell more than gold.

Despite this silver still rose almost 14% over the year in 2019.

Over the much longer term silver continues to also underperform gold. With silver up 156% since the year 2000.

Early in a bull market silver does often underperform gold. Silver is also less of a “safe haven” that gold is. Which is why silver isn’t rising as much as gold after the Iranian killing.

How Did We Go With Our 2019 Predictions?

Now, let’s see how accurate we with our 2019 predictions or perhaps more accurately “punts”? No point making any if we don’t take a look back!

Here were our 2019 predictions:

1. We think both gold and silver will end 2019 higher than where they began the year.

We got that one correct. With both gold and silver up fairly decent percentages in 2019.

2. Silver will at last outperform gold and make up for the last couple of flat years.

No cigar on that one. Although silver wasn’t very far behind gold last year.

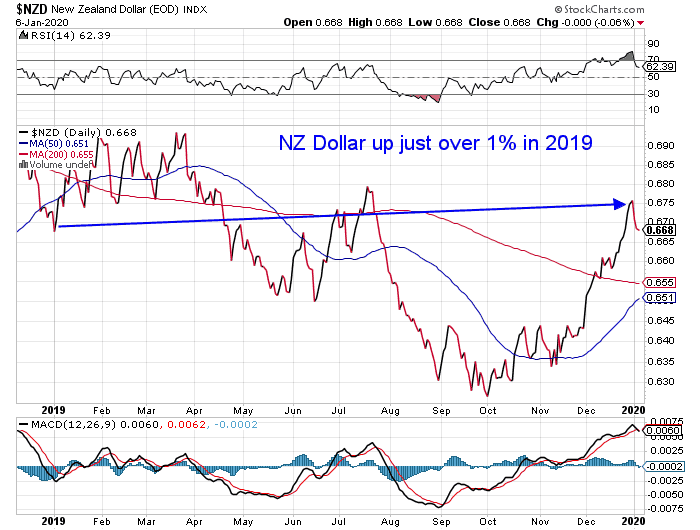

3. The performance of the Kiwi dollar is a tough one to predict this year. Despite the rise in October and November, the NZ dollar remains in a longer term downtrend. However with US interest rates rising, the yield on the US dollar is now higher than the Kiwi Dollar. A very rare occurrence. For foreign investors they can earn more on a 1 year fixed term in the US dollar than they can in the NZ dollar. So this should mean money leaving New Zealand and heading to the USA. Thereby the US dollar should be more popular and the US dollar may end the year slightly higher than the Kiwi. But it could go either way this year. Maybe there won’t be much change.

We didn’t quite get that one right. Although our final line was accurate – as there wasn’t much change at all in the exchange rate. With the Kiwi dollar up just over 1% for 2019.

So we missed a couple. Although our misses were near misses if that makes any difference!

Our “Punts” for 2020

We’ll again have to stick to a couple of last years predictions.

- We think both gold and silver will once again end 2020 higher than where they began the year.

- In 2019 silver only slightly lagged gold. So lets have a crack again and say that 2020 will finally be silvers year. Silver will at last outperform gold.

- Now the performance of the Kiwi dollar. The last quarter of the year saw the Kiwi rising versus the USD. We’re going to say this will continue in 2020. So the year will end with the NZD/USD exchange rate higher than it began. So gold and silver may “rise” more in USD terms than in NZD in 2020. Check this post out for more on how a rising NZD might affect gold and silver prices in NZ: In a US Dollar Collapse Won’t The Rising NZ Dollar Cancel Out Any Gold/Silver Gains?

Let’s see if we can go 3 for 3 in 2020!

But it’s pretty hard to predict the markets over a defined timeframe. A better bet is to use dollar cost averaging and make regular purchases of gold and silver throughout the year.

Or use some technical indicators to time your purchases after a pull back in the precious metal prices.

After the short sharp rise gold and silver have had since Christmas, we’re picking a pull back may not be too far away in early 2020. So sign up to our daily price alerts if you want to hear when this next pull back is over.

Pingback: Gold and Silver Surging After Iranian Missile Attack on US Base in Iraq - Gold Survival Guide

Pingback: Why Buy Gold? Here's 15 Reasons to Buy Gold Now

Pingback: The Crack-Up Boom and Gold & Silver - Gold Survival Guide

Pingback: Could the Virus Cause a Financial Panic? - Gold Survival Guide

Pingback: Comparing NZ Money Supply, Government Inflation Statistics, Property Prices, and Gold Prices for the Last 19 Years

Pingback: Should I Pay Down Debt or Buy Precious Metals? - Gold Survival Guide

Pingback: Gold & Silver Performance: 2020 in Review & Our Guesses for 2021 - Gold Survival Guide