It’s time for our annual review of the performance of gold and silver in New Zealand dollars. We’ll also look back on our predictions from the start of 2018 and then finish off by making a few guesses as to what 2019 may hold for us.

2018 was quite a change from 2017 overall in the markets.

A Deutsch Bank study reported that 94% of all assets lost ground in 2018. The same study also said that 2018 took first place from the old ‘winner’ of 84% way back in 1920!

Bitcoin and cryptocurrencies plummeted after being all the rage in late 2017. Sharemarkets fell across the globe too.

So how did gold and silver fare in this environment where most assets were falling in value?

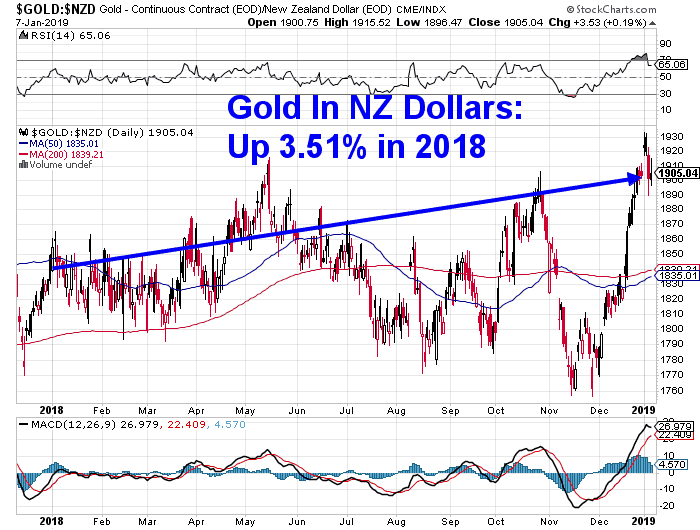

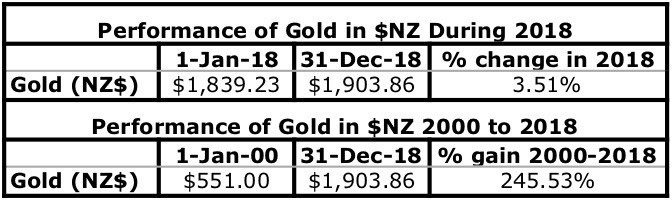

Gold in $NZ – Performance During 2018

Gold priced in NZ dollars spent the first few months of the year in a sideways trading range. But then moved up close to a multi-year in May, before again heading lower. Gold then fell sharply in late October/early November.

Then to prove there is an exception to every rule, gold launched higher during December back to the May high (in the previous 7 years, gold actually moved lower during December).

This late surge resulted in gold finishing 2018 up 3.51%. Which was quite a decent performance given the fact that just about every other market fell during 2018.

Looking back much further to the start of the millennium, gold is up a solid 245%.

After such a big surge in December we’d expect to see a decent pull back now in the early part of 2019.

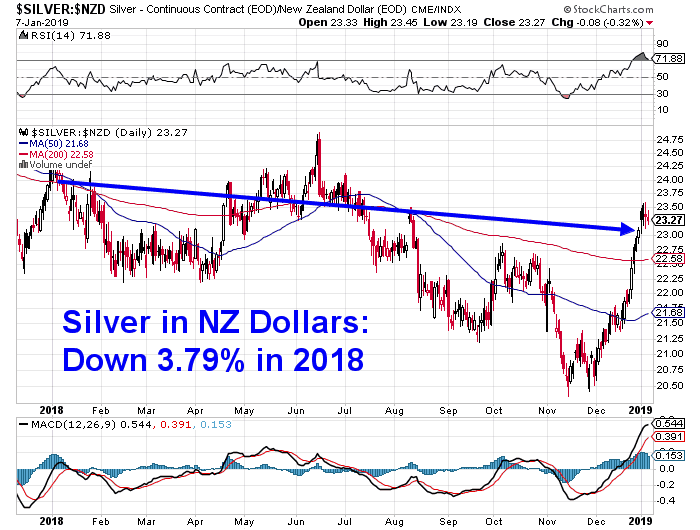

Silver in $NZ – Performance During 2018

Just as it did in 2017, silver again underperformed gold during 2018.

Silver followed the same pattern as gold during the year. But unlike gold, silver in NZ dollars failed to rise much in October. Resulting in a larger fall in November.

Despite a very solid rally in December, silver fell 3.79% overall in 2018.

Over the much longer term silver is also under performing gold. With silver up 124% since the year 2000.

In a year where most other assets were falling, this underperformance of silver was perhaps a surprise. But early in a bull market silver does often underperform gold. Silver is also less of a “safe haven” that gold is.

How Did We Go With Our 2018 Predictions?

So how successful were we with our 2018 predictions or perhaps more accurately “punts”?

Here were our 2018 predictions:

We expect both silver and gold to again end the year higher than they began. Given they seem to have bottomed out and be rising, perhaps not a huge call to make.

We were only half right with prediction number 1. Gold ended the year higher than it began, while silver fell slightly.

Silver and gold will perform better than they did in 2017. So silver up more than 1.59% and gold up more than 10.57%.

Complete strike out with that one. Both metals underperformed compared to 2017.

Silver will this year outperform gold. A turnaround from 2017 year.

Again a strike out. Silver fell compared to gold’s rise in 2018.

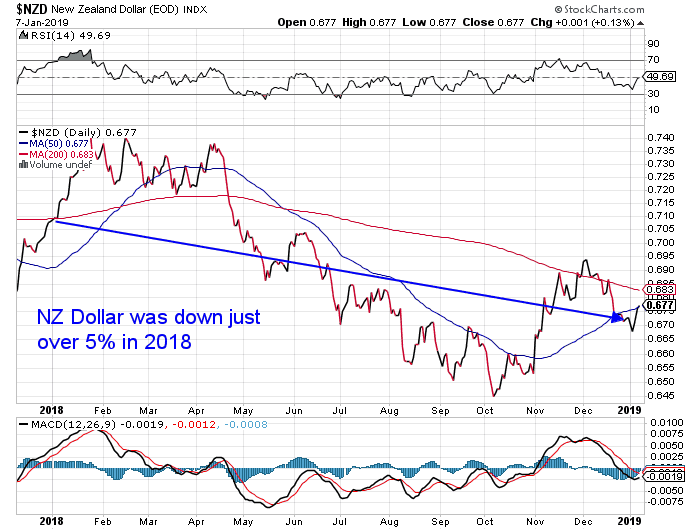

The New Zealand Dollar will end the year lower than the US Dollar this year. In 2017 it was only the rally at the end of the year that saw the Kiwi Dollar end the year higher. We think the dollar is actually already in a downtrend and the current rally is likely just a short term move before the longer term downtrend resumes.

Finally we got one right! A sharp rally in October and November wasn’t enough to stop the Kiwi dollar falling a pretty hefty 5% for 2018.

So overall we didn’t quite make 50/50.

Hopefully we can do better with our 2019 predictions!

Our “Punts” for 2019

We’ll double down on a couple of last years predictions that we didn’t get 100% right.

- We think both gold and silver will end 2019 higher than where they began the year.

- Silver will at last outperform gold and make up for the last couple of flat years.

- The performance of the Kiwi dollar is a tough one to predict this year. Despite the rise in October and November, the NZ dollar remains in a longer term downtrend. However with US interest rates rising, the yield on the US dollar is now higher than the Kiwi Dollar. A very rare occurrence. For foreign investors they can earn more on a 1 year fixed term in the US dollar than they can in the NZ dollar. So this should mean money leaving New Zealand and heading to the USA. Thereby the US dollar should be more popular and the US dollar may end the year slightly higher than the Kiwi. But it could go either way this year. Maybe there won’t be much change.

Let’s hope we do a little better than our 2017 guesses with those!

But it’s pretty hard to predict the markets over a defined timeframe. A better bet is to use dollar cost averaging and make regular purchases of gold and silver throughout the year.

Or use some technical indicators to time your purchases after a pull back in the precious metal prices.

We’d guess we have one of those pull backs coming in the first few weeks of 2019. So sign up to our daily price alerts if you want to hear when this next pull back is over.

Pingback: Federal Reserve Balance Sheet Reduction: What Impact Will it Have? - Gold Survival Guide

Pingback: Should I Pay Down Debt or Buy Precious Metals? - Gold Survival Guide

Pingback: Here's Why Not to Believe the NZ Government’s Inflation Statistics

Pingback: Gold & Silver Performance: 2019 in Review & Our 2020 Guesses - Gold Survival Guide