In September 2017 the US Federal Reserve announced that it would finally begin shrinking its $4.5 trillion balance sheet. So how has the Federal Reserve balance sheet reduction affected asset prices since then? How has the Fed stance on its balance sheet changed so far in 2019? What will happen next?

Firstly, What is the Federal Reserve Balance Sheet and How Did it Get So Huge?

“When the Global Financial Crisis started in 2008, the Federal Reserve (along with just about every central bank in the world) took the unprecedented step of conjuring trillions of dollars out of thin air.

In the Fed’s case, it was roughly $3.5 trillion, about 25% of the size of the entire US economy at the time.

That’s a lot of money.

And after nearly a decade of this free money policy, there is more money in the financial system than ever before.

Economists have a measure for money supply called “M2”. And M2 is at a record high — nearly $9 trillion higher than at the start of the 2008 crisis.

Now, one might expect that, over time, as the population and economy grow, the amount of money in the system would increase.

But even on a per-capita basis, and relative to the size of US GDP, there is more money in the system than there has ever been, at least in the history of modern central banking.

And that has consequences.

One of those consequences is that asset prices have exploded.

…Why are investors paying more money for shares of a business that isn’t much better than before?

There’s really only one explanation: there’s way too much money in the system.

All that money the Fed printed over the years has created an enormous bubble, pushing up the prices of assets to record highs even though their fundamental values haven’t really improved.

…Investors are paying far more than ever for their investments, but receiving only marginally more value in return. And they’re actually excited about it.

This doesn’t make sense. We don’t get excited to pay more and receive less at the grocery store.

But when underperforming assets fetch top dollar, people feel like they’re wealthier. Crazy.

[On 20 September 2017 the Fed formally announced] that after nearly a decade, it’s going to start vacuuming up a lot of that money it printed in 2008.Bottom line: they’re going to start cutting the lights and turning off the music.

And given the enormous impact that this policy had on asset prices, it would be foolish to think its reversal will be consequence-free.”

SovereignMan: Today the music stops – 20 September 2017

The Federal Reserve Tried to Convince the Public that “Quantitative Tightening” Would Have No Impact

Also back in 2017, Jim Rickards pointed out how the Fed wanted us to think that the reduction of its balance sheet – a.k.a. quantitative tightening (QT) – would have no impact:

QT1 Will Lead to QE4

“The Fed wants you to think that QT will not have any impact. Fed leadership speaks in code and has a word for this which you’ll hear called “background.” The Fed wants this to run on background. Think of running on background like someone using a computer to access email while downloading something on background.This is complete nonsense. They’ve spent eight years saying that quantitative easing was stimulative. Now they want the public to believe that a change to quantitative tightening is not going to slow the economy.

They continue to push that conditions are sustainable when printing money, but when they make money disappear, it will not have any impact. This approach falls down on its face — and it will have a big impact.…The decision by the Fed to not purchase new bonds will be just as detrimental to the growth of the economy as raising interest rates.

The Fed’s QT policy that aims to tighten monetary conditions, reduce the money supply and increase interest rates will cause the economy to hit a wall, if it hasn’t already.

…Because they’re getting ready for a potential recession where they’ll have to cut rates yet again. Then it’s back to QE. You could call that QE4 or QE1 part 2. The Fed has essentially trapped itself into a state of perpetual manipulation.

…Is this thing ready to pop? Absolutely, and QT could be just the thing to do it.

Via Jim Rickards at The Daily Reckoning

So What Impact Did the Federal Reserve Balance Sheet Reduction Have in 2018?

Here’s a chart tracking the Fed quantitative tightening so far. The drop during 2018 is clearly visible.

Total Federal Reserve Assets

How Did This Fall Impact Other Asset Prices?

As we noted in our 2018 in review:

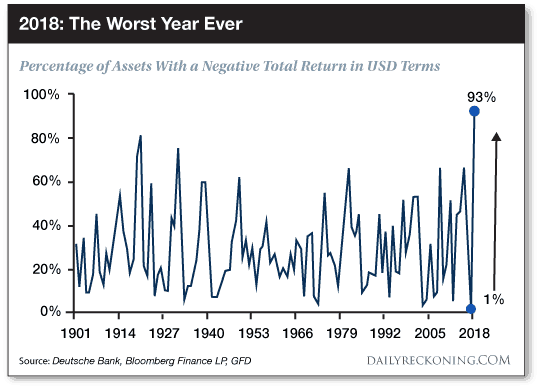

“A Deutsche Bank study reported that 94% of all assets lost ground in 2018. The same study also said that 2018 took first place from the old ‘winner’ of 84% way back in 1920!

Bitcoin and cryptocurrencies plummeted after being all the rage in late 2017. Sharemarkets fell across the globe too.”

Deutsche Bank concluded:

“This is what happens when the vast majority of global assets are expensive historically due to extreme monetary policy… It’s perhaps not a surprise that in this time major… central banks have moved from peak global QE to widespread QT.”

The Daily Reckoning

What Effect Has the Fed Balance Sheet Reduction Had in 2019?

In the 12 months to 12 September 2019, the Fed took US$464 billion in cash out of the financial system. In the week to 12 September, US$30.7 billion in cash disappeared.

This kind of extreme balance sheet reduction is entirely experimental.

It has never been attempted before in the 106-year history of the Federal Reserve.

The effects of this ongoing withdrawal of assets seems to have continued to have a detrimental affect on the US stock market.

From January 2016 to January 2018, the S&P rose 45.5% – continuing its huge run-up that began in 2009.

However, since January 2018 – a few months after the Fed started tightening – the S&P is now up by only 6.3%. This is a sharp deceleration which dovetails the sharp deceleration in the growth of Fed credit [hat tip to Chris Weber for those numbers].

But it Wasn’t Only the Fed Reducing its Balance Sheet

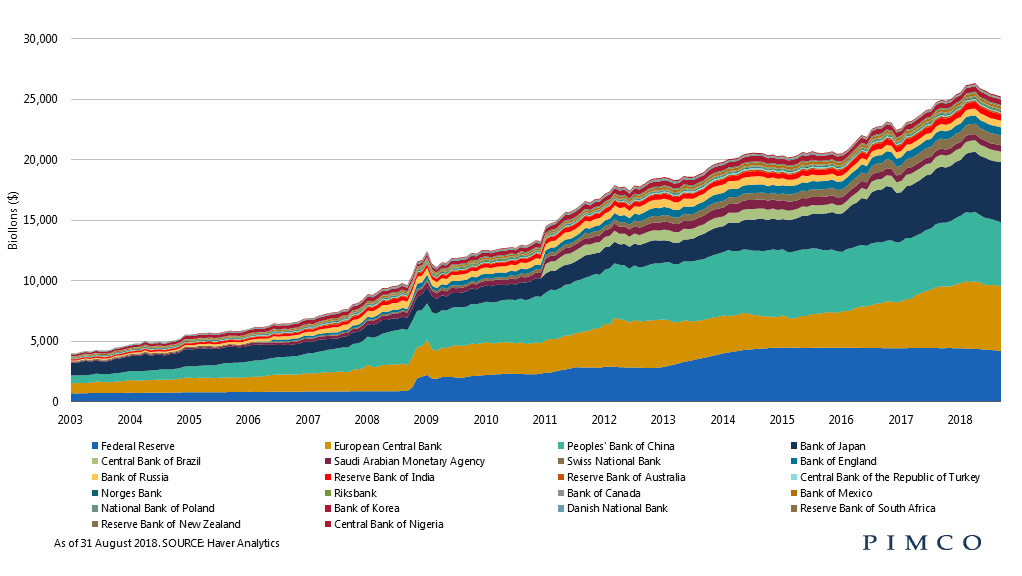

But it wasn’t just the US Federal Reserve that was unwinding its quantitative easing.

In 2018, 43 central banks tightened their monetary policy…while 32 banks eased.

That reversed the pattern of the previous 10 years, when the number of central banks cutting rates outshone the number daring to raise as everyone tried to juice their economies.

The below chart from PIMCO clearly shows many other central banks had also been reversing course and reducing their balance sheet size during 2018.

Global Central Bank Balance Sheets Since 2003

Protecting Yourself from the Impacts of the Fed Balance Sheet Reduction?

So the data from 2018 seems to show that the Federal Reserve Balance sheet reduction or quantitative tightening had a detrimental effect on many markets.

With other central banks also now following suit, we pointed out at the start of the year that 2019 could be a volatile year.

Jim Rickards advised what to do to protect yourself:

“For now, it’s not clear which way things will break next.

Volatility is back and markets are still in a precarious position.

Fed chairman Jay Powell threw markets a bone two Fridays back when he basically said all rate hikes are off until further notice and that he’s willing to scale back QT ‘if needed’.

Markets have naturally rallied since Powell’s remarks.

If you still need proof that today’s rigged markets still require support from the Fed, here it is.

But it’s far from clear the next crisis can be avoided at this point.

You don’t want to be heavily exposed to these markets.

It’s far better to get out too early than too late.

You should not be the last to get ready. Start now to decrease equity allocations and increase your allocations to cash and gold so you can weather the coming storm.

Preparation means 10% of your invistable [sic] assets in gold or silver and another 30% in cash.

That allocation should preserve wealth and provide dry powder for bottom-fishing in the crisis to come.”

The Daily Reckoning

Related: What Percentage of Gold and Silver Should Be in My Portfolio?

Balance Sheet Reduction is Over

That advice from Rickards proved to have been spot on. As the Federal Reserve announced on 20 March 2019 that there would be no further interest rate hikes in 2019.

But on top of this, that the Fed would also cease its balance sheet reduction at the end of September. Source.

What Has Happened Since March?

Back in April we figured that before too long the central bankers will likely have to reverse course and reopen the money spigots.

We also said “Perhaps they will also come up with even more new ways to interfere and prop up markets. As Rickards points out, this is the sort of environment that will likely be gold positive.”

The latest numbers from the Fed show they indeed appear to have finished their balance sheet reductions.

But not only has the great “unwind” now ended, the total assets held by the US Federal Reserve have actually grown larger for 3 weeks in a row. On top of this, the Fed balance sheet is also now larger than it was 3 months ago.

Why is the Fed Now Expanding its Balance Sheet Again?

Could it be because there is now not enough cash in the system? Legacy Research summarised nicely the recent shenanigans in the lending markets…

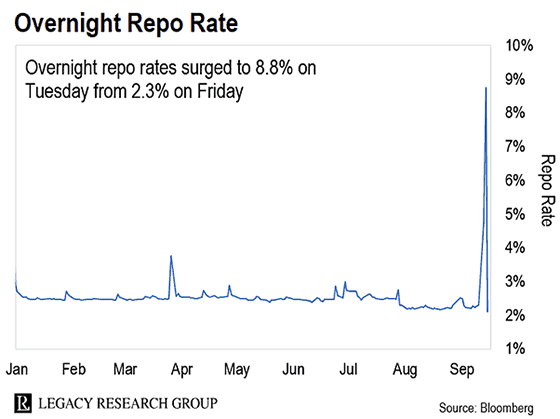

As you probably heard if you were tuned into the financial news… the Fed lost control of interest rates.

Banks ran low on the dollar cash balances – or “reserves” – they need to settle transactions with each other. And the Fed was forced to step in with emergency liquidity.

You can see the chaos it caused in the chart below.

It shows something known as overnight repo rates. These are the rates at which banks lend reserves to each other overnight… and a key lending rate for the entire economy.

These rates spiked to as high as 8.8% on Tuesday, up from 2.3% on Friday.

…the credit crunch we saw this week in the overnight repo market means the Fed will be forced to restart its “quantitative easing” (QE) program. Tom [Dyson stated]…

“For the last three months, I’ve been warning about a shortage of dollars in the market for short-term (one- to three-day) loans. Banks use the funds they borrow to match their obligations with their assets on a minute-by-minute basis. Trillions of dollars change hands every day in these markets.“

You don’t need to bother with terms such as repos (repurchase agreements) or effective fed funds rate. You don’t need to grasp the ins and outs of how the banking system works.

All you need to know, Tom told readers, is that there aren’t enough dollars in the system… And the situation keeps getting worse.

“Any moment now,” Tom says, “the Fed is going to open the liquidity spigots.” That’s when we’ll get more QE. “If it doesn’t, things are going to start blowing up.”

Source: Legacy Research

Perhaps this is what the rising gold (and more recently silver) price has been forecasting this year? That there are troubles brewing and the central banks are going to fight it the only way they know. With more easy money.

As Jim Rickards pointed out some months ago, gold (and in our view silver too) are the best shield you have in such an environment.

Browse the available options to buy gold here.

To learn more about the role gold may play in the global monetary system check out this article: If/When the US Dollar Collapses, What Will Gold be Priced in?

Editors Note: This article was first published 26 September 2017. Updates 15 January 2019 to include the sections: What Impact Did the Federal Reserve Balance Sheet Reduction Have in 2018?; What Effect Will the Fed Balance Sheet Reduction Have in 2019?; and, But Now It’s Not Just the US Federal Reserve Reducing its Balance Sheet. Last updated 25 September 2019 with balance sheet now growing again.

Pingback: Bill Bonner: Get Ready for the ‘Crack-Up Boom’ - Gold Survival Guide

Pingback: Why Buy Gold? Here's 14 Reasons to Buy Gold Now

Pingback: Here’s How Inflation Could Surprise Everyone - Gold Survival Guide

Pingback: Fed Will Blink - Gold Survival Guide

Pingback: Gold and Silver Bouncing Back Strongly This Week - Gold Survival Guide

Pingback: New: The Beer to Gold Ratio! - Gold Survival Guide

Pingback: Are the Federal Reserve’s “Temporary” Money Injections Becoming Permanent? - Gold Survival Guide

Pingback: Central Bank: "If The Entire System Collapses, Gold Will Be Needed To Start Over" - Gold Survival Guide

Pingback: ILLIQUIDITY & GOLD AND SILVER IN THE END GAME - Gold Survival Guide

Pingback: Gold & Silver Performance: 2019 in Review & Our 2020 Guesses - Gold Survival Guide

Pingback: Why Fractional Reserve Banking is Not the Problem