Learn some little known history about the birth of fractional reserve banking from silver storehouses and the importance of matching time deposits with loan duration…

The failure (and subsequent bail out) of Silicon Valley Bank (SVB) has brought to light the significant weaknesses in the global banking system. A system where central banks determine the amount of capital a bank must hold. Today you’ll see how banking used to operate and why there will be further failures and bailouts to come.

Table of contents

- Why SVB Failed

- SVB Failure Highlights Problems with Modern Fractional Reserve Banking

- Silver and the Birth of Fractional Reserve Banking

- How Much Did the Silver Storehouses Keep on Demand?

- How This Concept of Fractional Reserve Banking has Degraded Even Further Over the Centuries

- What Lies Ahead

- Why Modern Fractional Reserve Banking Means Any Bank Can Be at Risk

Estimated reading time: 10 minutes

Why SVB Failed

Here’s a short and somewhat simplified version of why SVB failed.

SVB bank invested in long dated US treasury bonds back before interest rates started to rise. They held a significant portion of their reserves in these bonds. These long dated bonds meant they would get a return of their investment along with some interest at the maturity of the bond. Which could have been as long as 10 years away.

They foolishly hadn’t considered that interest rates could rise. Because when they did the value of their bonds fell. This makes sense because if you wanted to sell say a 2% bond before it matured and there were other bonds now paying say 5%, you would have to sell your bond for less than the newly issued bonds which pay a higher interest rate. But this was still okay because the rules allowed SVB to value the long dated bonds at the value they would have at maturity. Not at the current market value. So everything is fine. Nothing to see here.

But the trouble arose when SVB’s depositors needed their cash. Being mostly Tech companies their funding was drying up as stock markets fell in 2022 and so they started to withdraw funds. SVB had to sell some of their bonds – at a loss – in order to return their customers currency to them. They then sought extra funding. Word spread that this was happening and eventually led to a bank run. So to paraphrase Earnest Hemingway, SVB went broke in two ways: Gradually and then suddenly. In these modern days the suddenly is even more sudden, thanks to social media and information spreading so fast.

SVB Failure Highlights Problems with Modern Fractional Reserve Banking

These events reminded us of some important background on fractional reserve banking that we learnt from Sandeep Jaitly. Recent events show that modern banking relies totally on the confidence of depositors. This wasn’t always the case…

We previously posted a video interview with Sandeep Jaitly of Feketeresearch.com.

Sandeep covered many points but one in particular reminded us of a lecture of his we were privileged to hear in Auckland a number of years ago.

In the video interview Sandeep stated that the fractional reserve banking system extending credit does not cause boom and bust cycles.

But rather it’s when you extend credit beyond the duration for which it was intended that the problems occur. What is known as “borrowing short to lend long”. You don’t match the purpose for which the credit was taken with the purpose for which the credit was granted.

He went on to say that it is fraud to borrow short to lend long, as you are disobeying the principles of a bailment which is that a demand deposit must be accessible at all times. [Definition of Bailment from wikipedia: – Bailment describes a legal relationship in common law where physical possession of personal property, or chattel, is transferred from one person (the ‘bailor’) to another person (the ‘bailee’) who subsequently has possession of the property. It arises when a person gives property to someone else for safekeeping.]

So you can’t have your money available at all times and earn interest on it. The two don’t make sense and yet that is what depositors at banks believe they have today, with on call accounts that pay interest.

Anyhow, as we mentioned this reminded us of a lecture of Sandeep’s and so we dug out our notes from then with the hope or rediscovering a few gems of info that we could share with you.

First up, perhaps we should attempt to explain some of Sandeep’s terminology above:

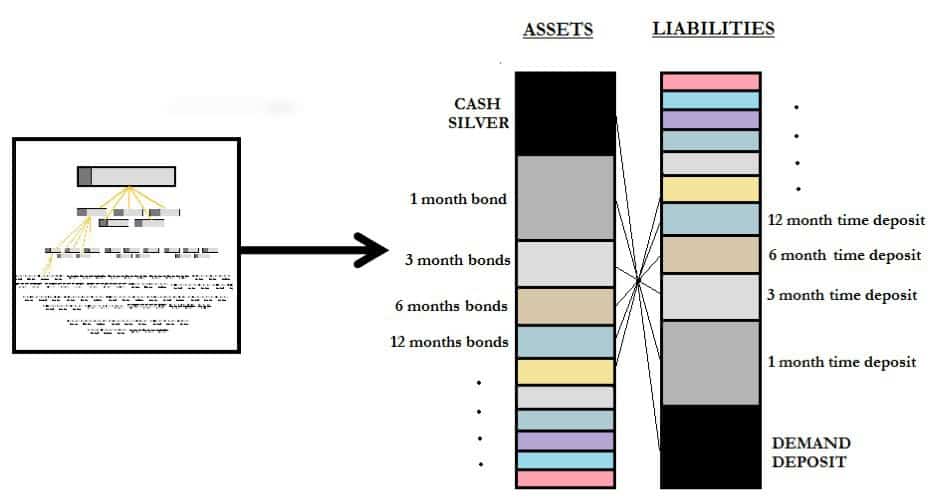

Demand deposit – This is where funds deposited with a bank are available on demand. i.e. You can withdraw them at any time without waiting and so can everyone else with funds deposited on demand. This is the opposite of a term deposit, where you agree to lend your money to a bank for a fixed period of time and receive interest – quite rightly – in return.

As the bank runs in 2009 and subsequent government guarantees have proven, in the current banking system the funds deposited in your “on call” account are not really demand deposits at all. If everyone shows up at the bank at the same time to “demand” their on call deposits – you get a really long queue and unhappy customers. As the bank does not hold in reserve enough funds to repay everyone “on demand”. We have seen a similar situation with SVB last week except the run occurred mostly electronically as depositors attempted to withdraw their funds en masse.

Borrow short to lend long – This is how the modern banking system works. They borrow from you in the short term to lend out to other customers with say 5, or in some countries like the USA even 10 and 20 year mortgages.

So the modern banking system doesn’t match the purpose for which the credit was taken with the purpose for which the credit was granted. There is a duration mismatch.

Now below we have written up our lecture notes. Hopefully expanding on this concept further. And apologies to Sandeep if we make any errors or missteps in our retelling of his tale as it was a while ago!

For more of Sandeep on video see: Sandeep Jaitly: Here’s where Ludwig von Mises was Wrong on Gold

Silver and the Birth of Fractional Reserve Banking

- Content below reproduced from notes taken in a lecture given by Sandeep Jaitly in Auckland, 19 November 2010

In the beginning silver was money. A conundrum was what to do with your hoard when you had built up a decent excess that you didn’t need for daily use [a nice problem to have!].

A large business could have very large holdings of silver so the need arose for a safe storehouse. But not just any old fellow on the street with a lock and a warehouse would do, you had to be noble and ethical to store someone else’s money.

So initially temples were preferred, as the priests had sacrificed material gain and so were trusted more than merchants.

You were charged for the storage of your silver and given a receipt, which you could “cash in” at any time and get your money back in the form of silver coins.

How Much Did the Silver Storehouses Keep on Demand?

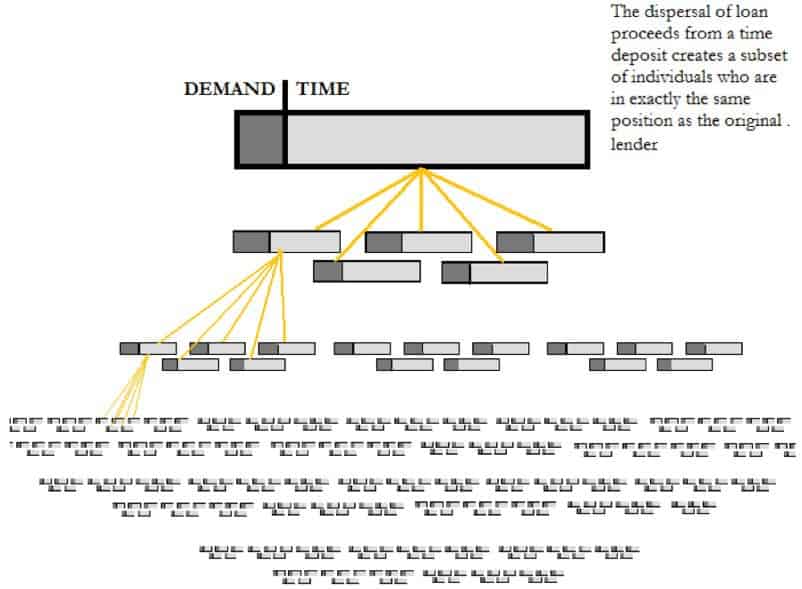

You would only need a portion of your silver holdings to cover day-to-day expenses such as food and clothing and the like. Say you determined you only needed 10% of your reserves on demand for day-to-day use. The other 90% was put to use to create a silver bond and a time deposit. But it would be you who determined this amount not the silver storehouse. And for the time deposit you would determine how many months or years you were willing to have your cash silver tied up for. i.e. how long it could be lent out for.

Key point: This amount is an entirely subjective decision by you the depositor. It is not determined by the storehouse (and certainly not by any central bank!).

A loan could be created for a business owner from the non-demand or time deposits. When the borrower spends the loan this would result in a subset of people whose overall increase in physical silver would not be greater than the amount initially lent.

Expand this out and you get a system made up of demand deposits and time deposits of widely different maturities, but so that the respective assets and liabilities match perfectly in their duration.

As opposed to modern banking where there is a dictat of say 10% to be kept on demand by the authorities [i.e. central banks] regardless of the depositors time preference.

Economists observed the above process but instead of allowing at each stage each person to decide how much of their savings to keep on demand, and how much could be lent out, they decided on a fixed arbitrary percentage.

Whereas this overall percentage should vary day to day as peoples needs varied. That is…

The people control the supply. [We are sure the likes of Bernanke, Yellen, Powell and Co may have trouble with this concept, as they seem to think they can and should determine the supply of money and credit.]

So it’s not necessarily that fractional reserve lending is “bad” per se, but rather the complete removal of the subjective depositor matching of time deposits to loans that is the problem.

How This Concept of Fractional Reserve Banking has Degraded Even Further Over the Centuries

Obviously an unethical and dishonest storehouse owner could fraudulently lend out the “on demand” silver.

If demand deposits were (fraudulently) lent out and people then wanted more cash silver than was available (i.e. their demand deposits back)

Then…

Assets would have to be liquidated. This would happen very fast and so as a result there would be falling prices. A.K.A deflation.

Recall 2008, this is what was happening then. If governments hadn’t stepped in and nationalised the deposits of savers, prices would have collapsed. Actual physical cash would have regained 90 years of devaluation incredibly quickly but most people would have been made destitute.

Couple this with the complete removal of silver and gold as the units of account and then the lending to governments with debt rolled over and over in perpetuity, has given banks the ability to paper over the cracks.

Read more: If the US Dollar Was Again Linked to Gold, How Would This Affect New Zealand?

What Lies Ahead

This nationalisation of the deposit system means no persons deposits will be at risk, almost anywhere in the world. The system should have imploded under the massive debt burden in 2009 but the nationalisation meant this wasn’t allowed to happen. So now no one’s time deposit is at risk.

An economic expansion is now likely to occur at some point in time due to the much greater monetary base but it will not be a real recovery just a nominal one. Stock prices will likely soar, not because productivity has increased but rather because the collapse was not allowed to occur and the greater monetary base will eventually find its way into the system.

Editor’s Note in 2023

This has proven to be the case. Quite foresightful of Sandeep given he said this back in 2010. Since then we have seen sharemarkets and real estate prices rise steadily the world over.

With the US central bank switching back to cutting interest rates and increasing its balance sheet via renewed money printing during the Covid-19 lock downs, we likely entered the final phase of the “crack up boom”. We saw sharemarket and house prices jump significantly from 2020 to 2022. Gold and silver did rise early on in this phase. But now in 2023, with interest rates rising, we seem to be entering the inevitable bust phase. Central banks may react with more currency printing and create even more inflation. Gold and silver will likely offer protection during this period whether from collapse and defaults. Or from inflation. We are seeing that already with gold in particular rising sharply over the past week or so.

Check out the range of gold and silver to buy.

Why Modern Fractional Reserve Banking Means Any Bank Can Be at Risk

The key point we think should be taken from Sandeep’s explanation is that with modern fractional reserve banking any bank can be at risk. No matter how good their capital base and how conservative their lending has been. Because they operate under duration mismatch, if many depositors want their funds back at the same time, they simply won’t have them available. So contagion can easily cause a banking crisis. Even into banks that would have been seen as “stable” and “safe”.

Note: First published 21 August 2012. Last updated 22 March 2023.

Pingback: Sandeep Jaitly: Here's where Ludwig von Mises was wrong on gold | Gold Prices | Gold Investing Guide

Pingback: Why Jim Rickard's Advice to Australia Could Apply to New Zealand Too | Gold Prices | Gold Investing Guide

Pingback: What’s Wrong With the RBNZ's Bank Failure Plans? | Gold Prices | Gold Investing Guide

Pingback: Bank Failures: Will New Zealand be Cyprussed? | Gold Prices | Gold Investing Guide

Pingback: The Validity of Bimetallism - Sandeep Jaitly | Gold Prices | Gold Investing Guide

Pingback: Unsound Banking: Why Most of the World's Banks Are Headed for Collapse - Gold Prices | Gold Investing Guide

Pingback: Sandeep Jaitly: Interest Rates Could Go Negative - Gold Survival Guide

Pingback: The Gold Standard: What Do We Think About it?

Pingback: Bank Capital Changes: What is the RBNZ Preparing For? - Gold Survival Guide

Pingback: Greatest Period of Currency Destruction Underway - Gold Survival Guide

Pingback: Gold and Silver Surging After Iranian Missile Attack on US Base in Iraq - Gold Survival Guide

Pingback: What Will the Long Term Impacts of SVB and Signature Bank Bailouts Be? - Gold Survival Guide

the article on fractional lending ok is a joke, really.

how can you lend and pay back with 10% of money in coffers if required?

go back to the old days when you got a receipt for gold you put in a warehouse and expected to get in return and then the holders frequently issued more receipts than that they had. = run

Pitkin will get back the territory’s that Russia lost soon and with china hopefully we get back to normal/ stable money = gold standard =-0

Pingback: Another Economist: RBNZ Should Shift Inflation Goalposts - Gold Survival Guide

Pingback: Huh? Fed Hikes Interest Rates While Injecting Billions - Gold Survival Guide

The point of the article is to explain that the duration matching and lending of only term deposits means that the lended out funds would not be required. As the lender has agreed to lend them out for a specific period. The demand deposits would effectively be a vault where these are not lent out at all. if they were then this would become known and a bank run would occur.

The main point of the article is show the dangers in the current banking system. We do not have a particularly strong opinion on what and new and improved monetary system would look like. How banks would be involved. If there would be any fractional lending etc. Merely that markets should be the ones to decide this not governments.