Prices and Charts

NZD Gold Consolidation Continues

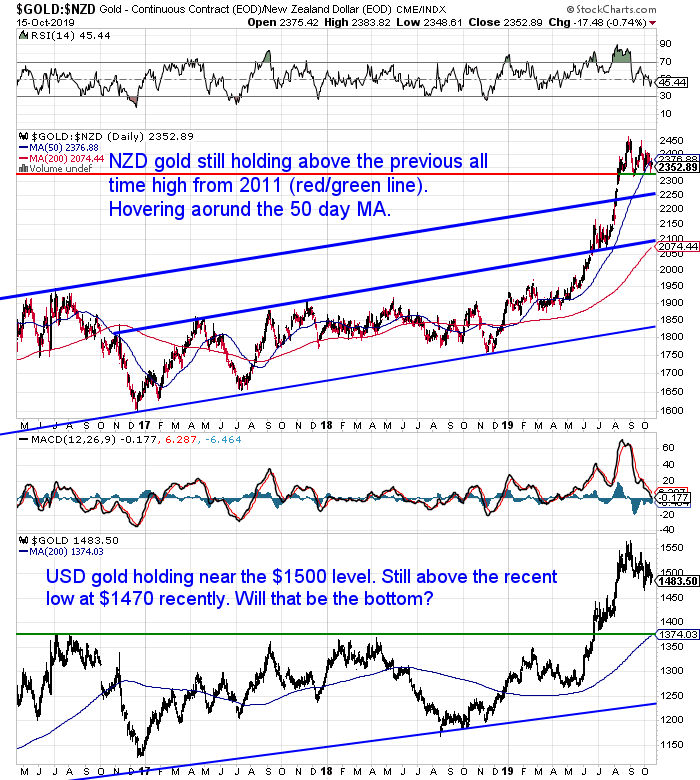

Gold priced in New Zealand dollars continues its consolidation above the previous all time high. See the red and green support/resistance line in the chart below. The price is down just over 1.5% from a week ago. It continues to hover around the 50 day moving average line.

If you look back over the past few years, gold has at times traded above or below the 50 day MA. But generally for not too many months before moving back close to it.

So this consolidation is healthy. Gold looks to be building for the next move higher. Any dip back towards the 2011 high in the low $2300 looks like a buy the dip opportunity.

Of course never say never. There is always the chance of a larger pull back. But it’s just not something you want to count on if you’re looking to buy currently.

Silver Still Holding at the 50 Day MA

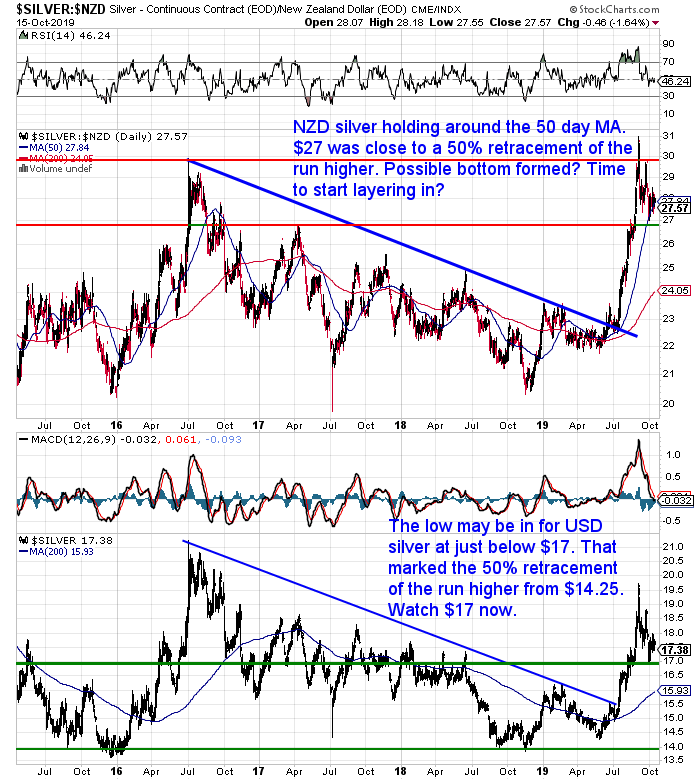

NZD silver is also sitting on the 50 day MA. It too has tracked this line fairly closely in recent years. Silver got a long way above it about a month ago. So it’s a good thing to see it back there now. So far NZD silver is holding above the $27 mark. We may have seen a bottom form around there already.

But we don’t hold a crystal ball – so this is a good place to start layering in your purchases. You should get a decent overall price that way.

NZ Dollar Holding Above 0.6200

The NZ Dollar is largely unchanged from a week ago. It bounced off 0.6200 and is currently just under the 50 day MA. We may just see the Kiwi consolidate around these levels for a bit yet. But there doesn’t seem to be a lot of support for much higher prices currently.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $240 you can have a 56 serving emergency food supply.

Free Shipping NZ Wide.

Why Sleeping Beauty Should Own Some Physical Gold or Silver

With interest rates falling and returns from fixed deposits dropping correspondingly, we’re starting to notice a definite pick up in interest in gold and silver in recent months.

But buying gold and silver is still seen as a fringe or alternative investment. So this week we’ve put together what is more of an “entry level” article.

Here are 5 reasons why sleeping beauty should have bought some gold or silver before she dozed off for her lengthy nap.

Even if you’re well versed in gold and silver we’d encourage you to scan it at least. Then consider: Who do you know that is getting poor returns on their investments currently? Who has complained about lack of returns in the bank?

You can share this article with them via social media or just email it to them. See the “Share the Knowledge” icons at the end of the post.

Odds are the returns are only going to get worse. So do them a favour now and let them know there are alternatives.

QE or Not QE?

Greg Canavan passes on a Bloomberg report on new “not QE” by the Fed:

‘The Fed said Friday it will begin buying $60 billion of Treasury bills per month — with maturities ranging from five weeks to a year — at least through the second quarter of 2020 to improve its control over the benchmark rate it uses to guide monetary policy. It’s the central bank’s latest measure meant to prevent a repeat of the mid-September turmoil that rocked money markets.’

The ‘turmoil’, you may recall, was when repo rates surged for a few days in September. It was a sign of the Fed losing control of interest rates. Apparently, there weren’t enough reserves in the system to cover demand spikes.

The Fed wants to rectify that by pumping US$60 billion a month into the markets for the next six months or so. But it’s doing so by buying short-term treasury bills, which are cash like instruments.

In other words, it’s changing the mix of cash in the system in order to boost bank reserves. Is this stealth QE (Quantitative Easing)? The best explanation I read was from James Mackintosh from the Wall Street Journal:

‘Many people are confused about how money works, and think banks lend based on reserves, somehow multiplying the amount of reserve money the Fed creates. Quite apart from the dismal failure of Japan’s early experiment with boosting reserves, a simple fact should help destroy this myth: from their 1988 peak to the 2000 low, Fed reserves fell 87% while bank lending rose by a quarter. The U.S. monetary system is based on the price of reserve money, not the quantity of reserve money; fiddling with the amount of reserves matters only insofar as it affects the price—and the renewed Treasury buying is designed not to affect the price.’

The US monetary system is about the price of reserve money then, not the quantity.

Fair enough.

But is it not a little worrying that the Fed sees the need to increase the quantity of reserves by US$60 billion per month, just to keep prices stable?

Even if there is calm on the surface, it tells me there is turbulence underneath.

The Fed cannot disentangle itself from the market. Any attempt to do so just makes it worse.

It won’t be happy until it has flatlined the whole market. In the years to come, it will have increased the quantity of money so much, that it ceases to have any meaning.

Stock prices and investors will grow numb. There will be no life (volatility) in the market. It will be a listless state-owned enterprise, full of parasites feeding off its half-dead carcass.

Welcome to the future.”

What Will the Impact of Ultra-Low and Negative Rates Be?

We’ve been pondering this question lately. Here’s what we read earlier today from Money Morning Australia:

“The truth is no one really knows how a world of ultra-low and negative interest rates will work out.

It might cause property bubbles to grow?

It might hasten the demise of fiat currencies and lead to the rise of independent currencies like bitcoin?

Or it might destroy the financial fabric of society and result in a prolonged depression?

Like we said, we’re in uncharted territory here, so it’d be foolish to guess the future with any certainty.

But our instinct here at Money Morning is it’s the wrong course of action over the long term.

When central planners try to control the economy like this, history suggests they’ll stuff it up.”

Yes odds are they “stuff it up” in the long run. But what happens between now and then?

As stated early, US Central Bank has announced they’ll begin ramping up their reserves again soon. Of course this is not QE (wink wink). It’s also strange how they say they will begin “soon”.

Because check out these recent numbers for the Fed balance sheet increases. Care of our favourite investment newsletter writer Chris Weber:

- Week ending September 18: up $23.3 billion

- Week ending September 25: up $58.5 billion

- Week ending October 2: up $83.9 billion

“…a year ago the Fed said its target was to shrink its balance sheet by $50 billion a month. But now, at the rate we’re increasing, it is now up by well over $50 billion a week.”

We’ve reported previously how the Fed balance sheet reductions had a negative effect on asset prices such as stock markets.

So now that they’ve reversed course, what will this do to asset prices?

We think the odds are they might start heading up again. The US stock market and the major banks there will likely be the first beneficiaries.

Bond prices could also continue to rise as yields continue to fall.

Perhaps we’ll now see the “melt up” that a few financial writers have been expecting?

What about here in New Zealand?

Our share market continues to tick higher. So perhaps this will continue too? That extra credit needs to find a home. And with lower interest rates likely coming, perhaps more people will look to share markets?

What about the kiwi favourite BBQ conversation – house prices?

There seems to be a few head winds there still. With migration still down from past highs and the economy slowing. But don’t discount the possibility of them heading higher still in the longer term.

(For more on this see topic: Gold Cycles vs Property Cycles: When Will Gold Reach Peak Valuation?)

So if all these assets once again start rising, won’t that be negative for gold and silver?

Not so fast there. We think some of this excess credit is likely to find its way into precious metals. Particularly with interest rates so low – why keep money in the bank?

We’ve also been working on some interesting numbers for Real Interest Rates vs Gold here in New Zealand. This is a very useful indicator for the gold price. Stay tuned for that next week.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Central Bank Issues Stunning Warning: “If The Entire System Collapses, Gold Will Be Needed To Start Over”

We’ve also got a Central Bank extolling the virtues of gold – don’t have a heart attack, it’s not the RBNZ! The Dutch Central Bank writes:

“Shares, bonds and other securities are not without risk, and prices can go down. But a bar of gold retains its value, even in times of crisis. That is why central banks, including DNB, have traditionally held considerable amounts of gold. Gold is the perfect piggy bank – it’s the anchor of trust for the financial system. If the system collapses, the gold stock can serve as a basis to build it up again.”

Source.

ZeroHedge asks:

“Why this sudden admission of what goldbugs have been saying for years? Perhaps it has to do with the fact that on October 7, the bank announced it would soon be moving a large part of its gold reserves to “the new DNB Cash Center at military premises in Zeist.”

Almost as if the Netherlands is preparing for the grand reset, and is moving its most valuable asset to a “military” installation just for that purpose.”

Source.

For more on this topic see: Why New Zealand Won’t Have Any Say in a Global Currency Reset

Be sure you have your own reserves well before the “great reset”.

Give us a call. Or book a time online that suits you for a free bullion consultation.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Royal Berkey Water Filter

Shop the Range…

—–

|

Pingback: The Biggest Take-Away From this Years LBMA Event in China - Gold Survival Guide