Imagine this.

You’re going to fall asleep and not wake up for 10 years. Something like in the style of sleeping beauty. However with one difference. You know it’s going to happen at some point in the not too distant future. You just don’t know exactly when.

Now. Here’s a question to ponder.

If you know you’re not going to wake up for 10 years, how would you choose to preserve your savings?

While this sounds a lot like a fairy tale, today we face a not completely dissimilar situation.

Table of Contents

Estimated reading time: 7 minutes

The World’s Monetary System is Changing

The world’s monetary system is dying – or at the very least changing profoundly. So it’s worth pondering how you will negotiate this shift.

So what’s changing?

The latest In Gold We Trust report notes that:

De-dollarization is a reality: Adjusting for FX movements, USD has lost about 11% of its market share since 2016 and 2x that amount since 2008. USD’s share of global currency reserves dropped to only 58% in 2022 from a share of 73% in 2001.

Source

Sanctions Speeding up De-Dollarisation

As we recently discussed the USA has effectively been shooting itself in the foot with the various sanctions it has taken out against the likes of Russia and Iran. See: US Sanctions Ineffectual and Speeding up De-Dollarisation.

The sanctions seem to be easily circumvented. For example:

Iran’s gold-for-export receipts top 1mt in March-May

“Alireza Paymanpak, who led Iran’s Trade Promotion Organization until earlier this month, said on Saturday that Iran’s gold-for-exports receipts had totaled only 80 kilograms in the three years before March.

Paymanpak said imports of gold by exporters to settle their foreign exchange debts to the government is one of the best solutions to get round the US sanctions that put restrictions on Iran’s access to the international banking system.

“More than one ton of standard gold bullions have been imported into the country with the help of the central bank (CBI) as part of (a commitment) by small exporters to return foreign exchange,” he said in a tweet in Farsi.”

Not only that, the sanctions are actually actually encouraging other nations to look outside the US dollar. Why? Because they are asking themselves the question “if the US will do it to them, maybe they could do it to us too?”

Higher Interest Rates Combined with Huge Debt Levels

Up until 2021, the world’s central banks had adopted very low or even negative interest rates in the hope it would force people to spend money and keep the current debt based money system going. Debt must continually grow for the system to function.

That worked for a time but it eventually stoked high inflation rates.

Which they have now been trying to bring down via higher interest rates for the past couple of years.

However this process is very much complicated by the very high public (government) and private debt levels that exist today. Demand is being severely dampened as debt becomes much more expensive to service. Meanwhile governments are using up more tax receipts just to pay the interest bill on their debts.

Technology and Money

On the flip side, there is a lot of new technology and advancement happening in the world of money and finance. It doesn’t have to be doom and gloom. We’ve seen the birth of Bitcoin and the rise of cryptocurrencies in recent years.

Like many other areas of life it seems decentralisation is coming to money as well. In the long run that’s a good thing. Let people decide what they want to use as money.

Perhaps we will eventually no longer have various national currencies?

US Dollar’s Reserve Currency Status in Danger

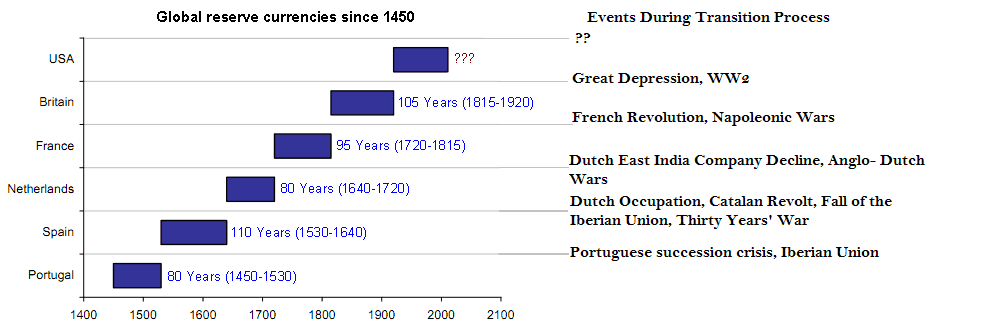

The average length of the previous 5 reserve currencies is 94 years.

Source: economicreason.com

The US dollar has officially been the global reserve currency for 68 years since the Bretton words agreement at the conclusion of World War 2. However it has been used in international trade since after the First World War in the 1920’s, which means it’s more like 100 years now. So it’s getting fairly long in the tooth. What will replace it?

When Sleeping Beauty Wakes Up, What Will Money Look Like?

The difficulty is, much like our “sleeping beauty” mentioned earlier, we simply don’t know how all this will play out.

- What will the monetary system look like in 5 or 10 years?

- Will today’s banks still exist?

- What impact will the currency printing (which was massively increased worldwide in response to Covid19 lockdowns) have on the value of today’s currencies?

- Will we see high inflation rates continue for many years?

- Will interest rates remain historically high?

Look to the Past to Prepare for the Future

Here’s a novel idea. Consider looking to the past to prepare for the future.

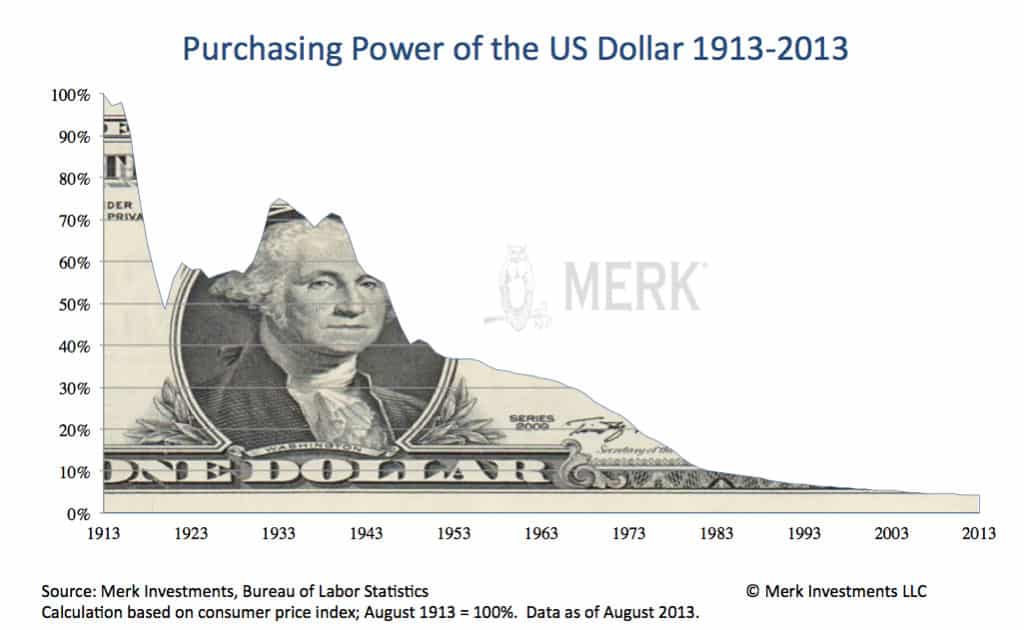

It is said that an ounce of gold bought a fine toga and pair of sandals in ancient Rome. Today, an ounce of gold still buys a quality mens suit and shoes. Whereas the US Dollar has lost over 94% of its value since 1913.

In 2023 Central Banks have continued adding to their gold reserves. The World Gold Council notes:

“On a y-t-d basis, central banks have reported net #gold purchases of 125t. This is the strongest start to a year back to at least 2010 – when central banks became net buyers on an annual basis. Read more here.”

Chinese Are Buying – But Are Likely Much Larger Holders of Gold Than They Declare

While China who is not only the largest gold miner on the planet, but also the biggest consumer, continues to buy large amounts of gold.

China increased their central bank gold reserves for the fifth month in a row in March. Prior to this stretch China hadn’t reported any addition to their official gold reserves since 2019. Despite China being the largest miner of gold in the world, it is illegal to export gold from China. So what gold is mined in China, stays in China. This interesting report outlines why China likely has much much more gold than their official 2068 Tonnes. As the report mentions, eventually the Chinese may announce their true gold reserves, and that may have a significant impact on the price when they do.

What are they preparing for?

How to Transfer Your Wealth into an Unknown Future

Wealth can be thought of as an accumulation of knowledge. Gold is a stable means to safely transfer that wealth into the future.

Bitcoin and cryptocurrencies may well play a part in the future monetary system. But it’s very difficult to predict which one, if any, will win out over the others. Plus they are so far untested in a global crisis.

Whereas gold and silver have stood the test of time. They have been used as money and retained their value for millenia.

Gold and Silver are “Financial Insurance”

Think of physical gold and silver as your financial “insurance policy”. Gold and silver are the only financial assets that have no counter-party risk. This simply means you are not relying upon another party to remain solvent for your asset to maintain its value.

So store a portion of your wealth in physical gold and silver. A rule of thumb is 5-10% of your liquid assets (that is excluding property/real estate) in gold is recommended. Read more about how much gold you should hold in your portfolio.

Then you are free to continue to invest and speculate with your remaining savings. Whether that be stocks, bonds or taking a punt on a few cryptocurrencies. Or even investing in a promising start up company.

That way when you “wake up” in 5 or 10 years time, regardless of how things change, you can rest easy that your wealth in gold and silver will hold its purchasing power.

Then you can transfer your stored wealth into whatever is being used as money at that time. Or “spend” your gold and silver on whatever the most undervalued assets are at that time.

Check out the range of gold and silver available to purchase.

Or sign up below to get our free 19 Nuggets of Knowledge on Buying Gold and Silver.

Editors Note: First published 15 October 2019. Last updated 20 June 2023.

Pingback: Central Bank: "If The Entire System Collapses, Gold Will Be Needed To Start Over" - Gold Survival Guide

Pingback: The Biggest Take-Away From this Years LBMA Event in China - Gold Survival Guide

Pingback: What Will the Impacts of the COVID19 Lockdown be on the Global and New Zealand Economy? - Gold Survival Guide

Pingback: Societal Breakdown: Are Gold and Silver Coins Better Than Tradable Items Like Tools, Water and Wine? - Gold Survival Guide

Pingback: The Fourth Turning and Gold: What’s Still to Come in This Crisis? - Gold Survival Guide

Pingback: Silver Outperforming Gold This week - Gold Survival Guide

Pingback: Thoughts on the “Dollar MilkShake” Theory - Gold Survival Guide

Pingback: US Inflation May be Bottoming Now - How About NZ? - Gold Survival Guide