Prices and Charts

RBNZ Announcement Causes Jump in Local NZ Gold Price

Just before we sent out last week’s newsletter, the RBNZ announced they were only increasing the OCR by 0.25% and that this was most likely the peak in their interest rate increases.

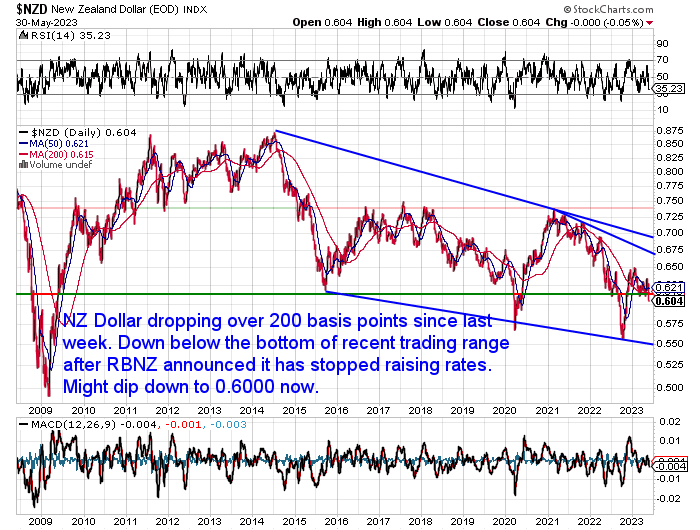

This surprised the markets and the NZ dollar dropped sharply and has continued to fall the past week by over 3%.

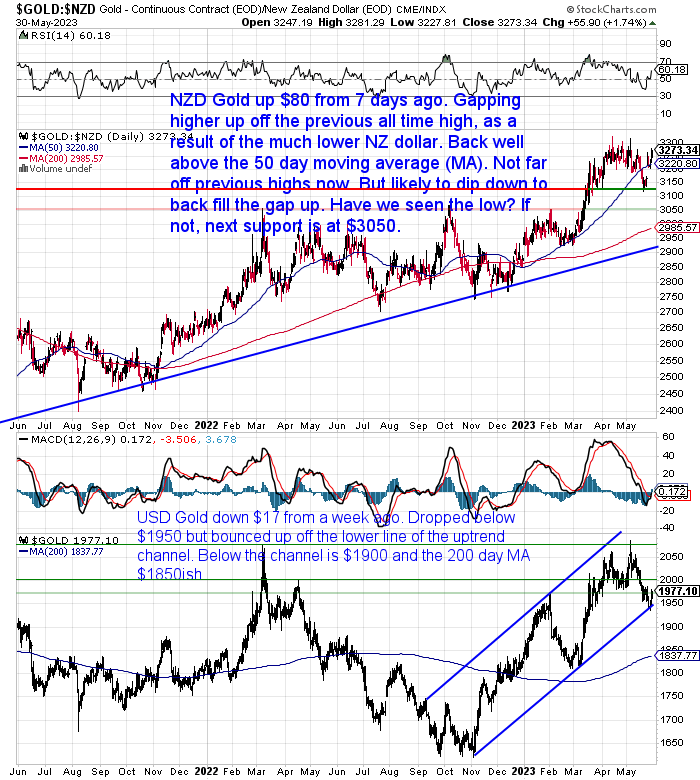

The falling Kiwi dollar in turn boosted the NZD gold price. It is up $80 (2.5%) from last week. Having bounced up off the previous all time high just below $3150, it then gapped sharply higher back above the 50 day moving average (MA).

When these sharp jumps happen we often see the price reverse back down to “back fill” the gap up. So it wouldn’t be a surprise to see a return back down close to $3150. But perhaps we have seen the low for NZD gold? If not, the next support level is at $3050.

Meanwhile USD gold was down $17 for the week. During the past 7 days it dropped down to touch the lower line of the uptrend channel, before bouncing up from there. USD gold got close to very oversold on the RSI, so we might have seen the bottom. If not, then the next support lines are $1900 and then the 200 day MA which will likely be around $1850ish.

NZD Silver Back Above Downtrend Line

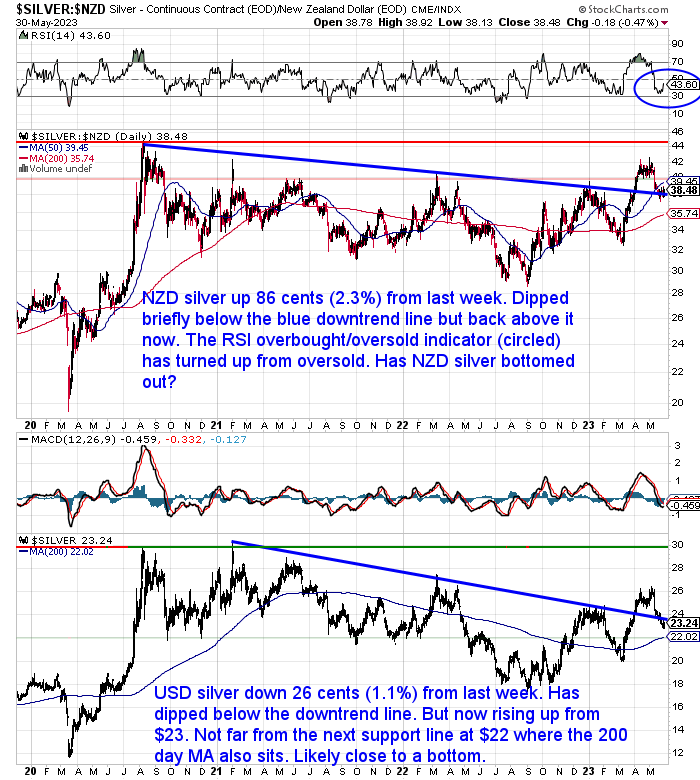

Silver In NZ dollars was up 86 cents (2.3%) from 7 days prior. It dipped briefly below the blue downtrend line, but has risen back above that level now. The RSI overbought/oversold indicator has turned up from oversold. So that could be the bottom for this correction. But if not, NZD silver is not too far from the 200 day MA. That would be strong support if reached.

Overall it’s likely a good long term buy zone here. Then average down if we see any further falls.

Conversely USD silver was down 26 cents (1.1%) from a week ago. Dipping below the downtrend line, but now rising up from $23. Silver is now only just over $1 above the 200 day MA. So if it hasn’t bottom already it is likely very close to it.

NZD Plummets After RBNZ Announcement

As noted already the NZ dollar dropped sharply after last week’s monetary policy announcement. Dropping over 200 basis points and is now not far from 0.6000. It has dropped down out of the trading range it had been in. So it could fall a little lower yet before it gets very oversold. So for now the trend seems to be lower.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

How Would Hyperinflation in the USA Affect New Zealand? [2023 Projections]

We have been discussing inflation rates an awful lot this year. Despite most mainstream commentators saying they have peaked we earlier this month saw food prices rise the most since 1987.

So we have our doubts that inflation is getting back to normal any time soon. In fact we’d say that high inflation rates is likely the new normal we’ll all have to get used to.

But what about hyperinflation? Is that possible in an advanced economy like the USA? How would that affect us here down under?

This week we turn our crystal ball to the topic of hyperinflation. Here’s what’s covered:

- What Is Hyperinflation?

- A Real World Hyperinflation Example

- How Could Hyperinflation Occur in the USA?

- A Historic First: Global Reserve Currency Hyperinflation

- How Did New Zealand Compare to the USA in the Inflationary 1970’s?

- How About Interest Rates in the Inflationary 1970’s?

- What About the New Zealand Dollar in a Hyperinflationary USA?

- How Hyperinflation Isn’t Needed to Destroy a Currency

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

US Sanctions Ineffectual and Speeding up De-Dollarisation

The USA has implemented many sanctions on various countries including Russia and Iran. But the results are showing that not only have these sanctions been ineffectual but they are likely encouraging other nations to also limit their use of the US dollar. Because if the US will “do it them” – it might “do it to us too”.

Economist Zoltan Pozsar (until recently with Credit Suisse) is known for his astute market analysis. More so than most bank economists.

He recently was interviewed and some highlight were:

“Money is extremely geopolitical… the unipolar reserve currency construct is slipping… deficits will continue to expand… bilateral trade will continue to increase and reduce $ creation… there’s a migration from inside to outside money”

Source.

“Outside money” of course includes gold.

Now the US has imposed sanctions on some of Russia’s biggest gold miners.

But as Jan Nieuwenhuijs correctly points out, all the USA is doing is:

“…stimulating the integration of gold business between Russia, China, UAE, and other Asian countries. That is all.”

Source.

Same with Iran. They also seem to be managing to get around the USA’s sanctions:

Iran’s gold-for-export receipts top 1mt in March-May

“Alireza Paymanpak, who led Iran’s Trade Promotion Organization until earlier this month, said on Saturday that Iran’s gold-for-exports receipts had totaled only 80 kilograms in the three years before March.

Paymanpak said imports of gold by exporters to settle their foreign exchange debts to the government is one of the best solutions to get round the US sanctions that put restrictions on Iran’s access to the international banking system.

“More than one ton of standard gold bullions have been imported into the country with the help of the central bank (CBI) as part of (a commitment) by small exporters to return foreign exchange,” he said in a tweet in Farsi.”

Source.

Then more again from Zoltan Pozsar on de-dollarization from an interview with In Gold We Trust Report:

“The money you have in the Western banking system is only yours if the political process that those banks ultimately report to or exist in allows you access to this money. When that trust is broken, you start building out your alternative payment and clearing systems.

China and the BRICS countries are basically doing with the renminbi all these steps that don’t seem to add up to much when you read about them in isolation; but when you look at them in the totality of things, and when you take a 10-year perspective about what they have been building, it adds up to quite something.”

“There’s a mechanism through which China is going to provide the world with renminbi it will need to import stuff from China, and that’s swap lines. That’s how China is going to pump money into the system.”

“The second thing is that China reopened the gold window in Shanghai with the Shanghai Gold Exchange. There’s that convertibility of offshore renminbi into gold if someone so wishes; that’s another important feature.”

Full Interview transcript with Zoltan Pozsar.

Latest in Gold We Trust Report Just Released

Speaking of the In Gold We Trust Report (IGWT), the 2023 report has just been released. As always this is a must read for anyone interested in gold. But also silver features more prominently this year too.

Here’s 5 of the highlights:

- Despite US equities becoming more undervalued in the last year (Shiller P/E ratio 38.3 in 2021 vs 2022’s figure of 28.3), gold is still historically undervalued compared to US equities. The Gold/S&P 500 ratio of 0.49 is significantly lower than the long term average of 1.66

- 2022 saw the highest gold buying by central banks on record, i.e., since 1950, when the WGC started its records. Buying reached 1136t, with Türkiye reporting the largest purchases, adding 148t to its reserves.

- De-dollarization is a reality: Adjusting for FX movements, USD has lost about 11% of its market share since 2016 and 2x that amount since 2008. USD’s share of global currency reserves dropped to only 58% in 2022 from a share of 73% in 2001.

- Silver inventories declined in 2022 by 430.9Moz from their end-2020 peak. This is equivalent to more than half of annual mine production, and also more than half of the inventories held in London vaults offering custodian services, as reported by the LBMA.

- Commodities are historically undervalued: Today the S&P GSCI is below 50, and each time it dropped below this level (1929, the late 1960s, and the late 1990s), a substantial commodities bull market followed.

See the rest of the top 10 facts at the IGWT report twitter feed.

You can download the highly recommended full IGWT report here. There is a compact version as well.

There’s a lot of evidence above pointing to gold having a more significant role in international finance. So make sure you have enough to benefit from this change too.

Get in contact for a quote or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|

Pingback: Why New Zealand Won’t Have Any Say in a Global Currency Reset in 2023 or Beyond - Gold Survival Guide

Pingback: Why Sleeping Beauty Should Own Some Gold or Silver - Gold Survival Guide