Prices and Charts

Late Update:

As we hit send the RBNZ announced a 0.25% increase in the official cash rate. This was a little less than what the market expected. As a result the dollar has dropped by 66 basis points and local gold and silver prices have jumped to $3196.98 and $37.94. With NZD gold now back close to where it was a week ago. And NZD silver down just 29 cents, about half of what we have said below. So just bear that in mind as you read this week’s update…

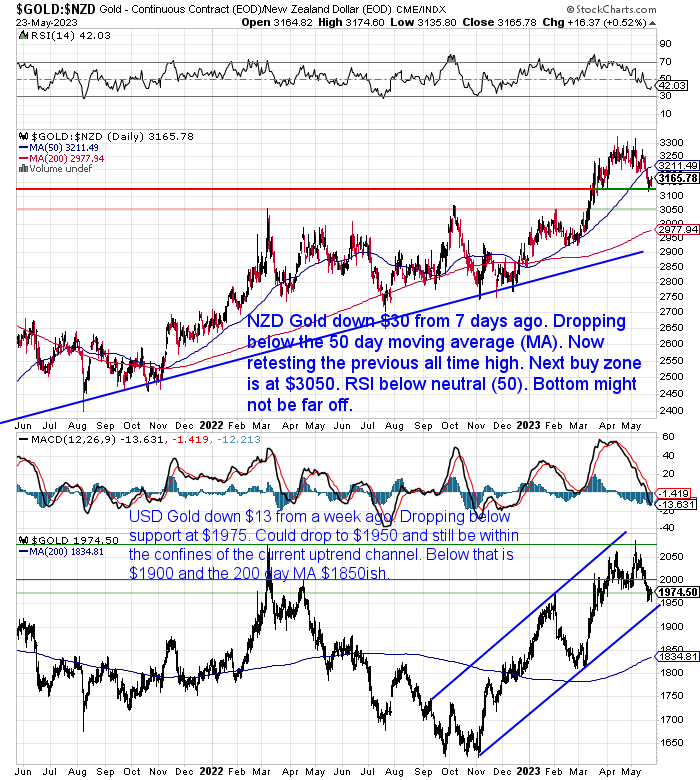

NZD Gold Holding Around Previous All Time High Support Line

Gold in New Zealand dollars was down $31 from 7 days ago. It has dropped below the 50 day moving average (MA) and has bounced up off the support line around the previous all time high. Now will it hold around these levels or dip down to retest the breakout from the 2022 highs at $3050? If NZD gold dropped down to there, we’d likely see the RSI overbought/oversold indicator get into very oversold territory near 30. That would also get the price down fairly close to the still rising 200 day MA – which is the major bull market indicator. That is, the price generally stays above that line when a bull market is in force. So either way a bottom may not be far off.

USD Gold was down $13 for the week. It dipped below the support line at $1975. It’s now not too far from the lower trendline in the uptrend channel. Although still a way above the 200 day MA.

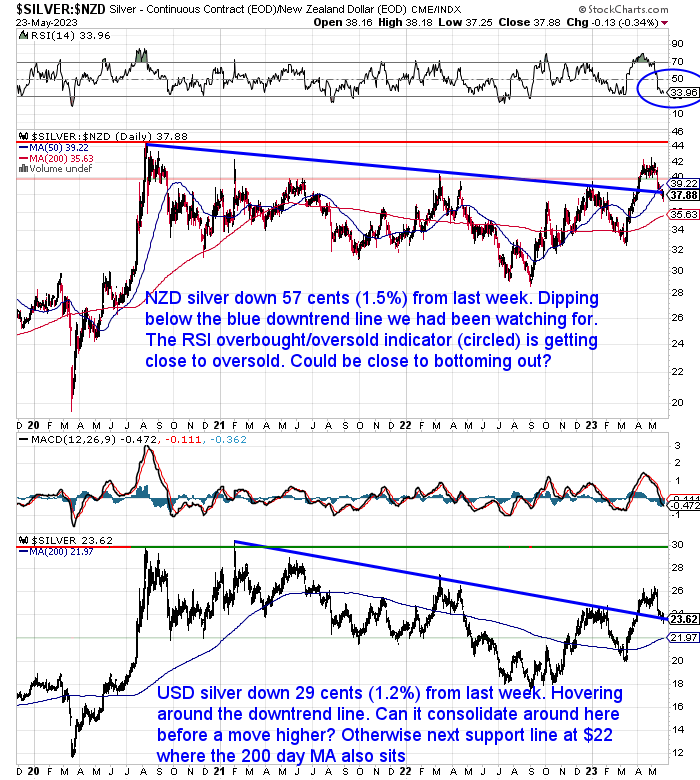

NZD Silver Down 1.5% – Dips Below Downtrend Line

Silver in NZ dollars fell 57 cents over the past week. Taking it down below the blue downtrend line. That was the area we had been watching for a retest of. As a result the RSI overbought/oversold indicator (see blue circle) is now approaching very oversold levels (below 30). There has now been a retracement of 50% of the run higher from March. As a result we could be getting close to the end of this correction. The next support level to watch for is $37 and below that the 200 day MA currently at $35.63 but still rising.

Meanwhile in USD, silver is hovering around the downtrend line after dipping 1.2% for the week. Can it consolidate around here? Otherwise watch for buying zones at $23 or even the 200 day MA at $21.97.

So with silver, regardless of what currency you look at, we are likely in a pretty good long term buying zone here.

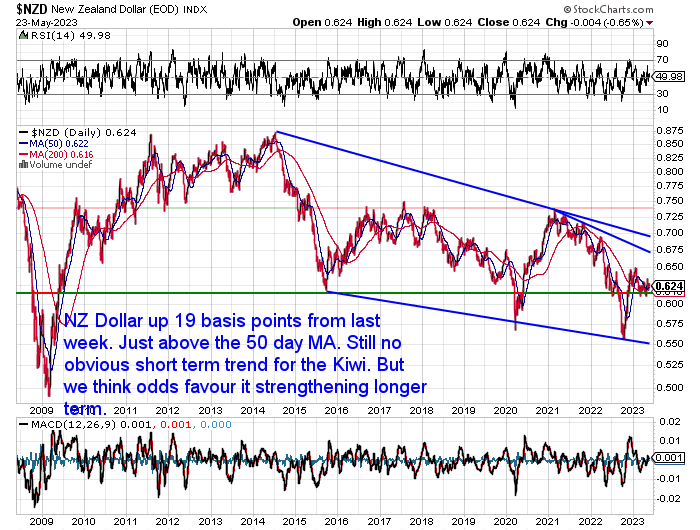

NZ Dollar Remains in Sideways Range

The New Zealand dollar was up 19 basis points from last week. It continues in the fairly tight sideways range showing no real clear direction at present. We still think in the longer term the USD is likely to weaken and so the Kiwi may gain a bit against it. But maybe we’ll just see more sideways action overall.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Why Buy Silver? Here’s 21 Reasons to Buy Silver in 2023

At the start of the month we looked at the current reasons to buy gold. There is a fair bit of commonality in the reasons to also buy silver. But there are also a number of key different factors to consider too.

So this week we look at our top 21 reasons to buy silver in 2023 including:

- How it’s cheap compared to gold

- How it’s in a stealth bull market

- How the silver market is tiny

- Growing Industrial demand

- How it’s being used up

- How investment demand is growing

- How supply is insufficient to meet demand

- Silver – Does it have more upside than gold?

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Interesting Buying During a Correction in GLD ETF

King World News had a report yesterday from Fred Hickey, where he pointed out how there had been unusual inflows into the GLD exchange traded fund (ETF) in 4 of the last 5 trading days.

While gold dropped $40, the GLD ETF actually grew by 10 tons. While you might think buying the dip makes sense, that is not what we usually observe in the GLD ETF. With it being more likely to grow in size during upswings in the price.

Hickey outlined how the falls in gold price in March 2022, mid May 2022, early 2021 and in 2020 were all accompanied by outflows of gold from GLD.

He believes the recent gold correction has been “solely driven by hot-money hedgies and CTAs and may not last.” (Note: he likely means commodity trading advisors although could also be referring to computer traded algorithms. But either way, not long term buy and holds).

Source.

So that could be another indicator that this correction is not far from complete.

Are You Happy to Work an Extra 22 Days a Year For Free?

Do you agree with economist Simon Bagree that: “…most New Zealanders would embrace tax hikes if they know they’re going to get bang for their buck. It comes as experts raise concerns last week’s budget has entrenched a “big-Government” spending pattern.”

Read more

Is that actually possible? If they can’t wisely spend what they already take, why should we expect them to do better if they took even more?

But then comes this report that regardless of whether the tax rates were increased or not, we’re already paying more in taxes anyway…

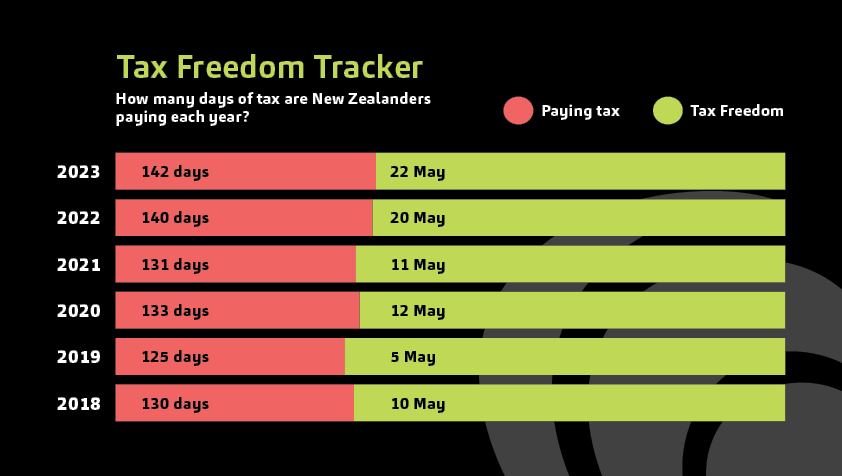

“Bracket creep pushing ‘tax freedom day’ out

Bracket creep is to blame for New Zealanders’ “tax freedom day” falling two days later this year than last, Baker Tilly Staples Rodway says.

The accounting firm has released its latest calculation of the day, which demonstrates how far through the year New Zealanders have paid their collective tax bill.

This year, it is forecast to arrive on May 22.

In 2021, it was May 11 and in 2016, it was May 1.

Baker Tilly Staples Rodway head of taxation services Mike Rudd said the change was due to bracket creep – as New Zealanders’ incomes rose but tax brackets did not, their tax bills would increase.”

Source.

So in just 7 years the average Kiwi has to spend another 22 days working per year before they have paid their taxes!

Source.

This is a case where the invisible tax that is inflation, is actually quite visible!

Because it is the inflation rate that pushes up incomes into these higher brackets. But of course at the same time wages have not actually kept pace with inflation. So you’re actually getting hit twice! Once by loss of purchasing power (invisible tax). Second by bracket creep and paying more actual tax.

But to show for it all we have are worsening health, education and public services like roading.

Meanwhile in the same week the government announces they are subsidising a multi-national company to the tune of $140 million to purchase a new “electric arc-furnace” costing $300 million. An investment which the company NZ Steel said wouldn’t have been economical without government help.

So maybe Mr Bagrie is right that Kiwis may pay more tax if they got more “bang for buck”. But I’m not sure how exactly we’ll see that. Are you?

Kiwi Inflation Survey: Higher Then Lower

Sticking to the topic of inflation, the average Kiwi seems to think inflation will be higher than the RBNZ predicts.

“A survey for the Reserve Bank shows that households think inflation is going to actually rise in the short term and still be 4.5% in two years’ time.”

Source.

So is the average Kiwi a good forecaster? We’re not so sure.

More likely this is the “recency effect” in operation. Where we are more likely to look at what has happened recently and predict there is more of the same to come.

Because in the same survey, the “participants saw inflation of just 1.1% in five years’ time, which of course is well within the RBNZ’s targeted 1% to 3% range.”

So the average person can’t see the possibility of inflation remaining high for a long period of time. Because recent history says we have had just the opposite.

Our guess is that we likely have higher than average inflation rates to come for many years yet.

That’s why it’s so important to make sure your investments are able to beat the inflation rate at the very least. Because the odds are high you will lose more of your income to taxes and inflation in the coming years. So you need to maximise the return on what is left.

Got enough gold and silver to hedge against higher inflation and taxes?

Get in contact for a quote or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Shop the Range…

—–

|

Pingback: US Sanctions Ineffectual and Speeding up De-Dollarisation - Gold Survival Guide

Pingback: Could This Be What Finally Unleashes the Silver Price? - Gold Survival Guide