Here’s an interesting question for anyone who might have significant funds in a New Zealand bank account. Or anyone who wants to keep their savings liquid with a view to purchasing precious metals or other tangible assets and investments.

Table of contents

Estimated reading time: 8 minutes

Reader DM asks:

“I have just sold my farm and will shortly have a significant chunk of capital,

Some of this I want to hold as cash, so I can take advantage of any opportunities over the next few months.

Given that the bank can give my account a haircut if I have over $50,000 with them and they get into trouble.

Question – what is the safest way to hold funds so they are very quickly available?”

In New Zealand it is not that easy to achieve right now. You either sacrifice safety to be totally liquid. Or sacrifice immediate liquidity for more safety. Here’s why:

No New Zealand Bank Deposit Guarantee

Currently there is actually no deposit guarantee of any amount with New Zealand banks. If a bank fails the Reserve Bank of New Zealand’s (RBNZ) Open Bank Resolution (OBR) policy means all deposits are potentially open to a haircut. We’ve been doing our best to publicise this for many years. Recently New Zealand’s lack of deposit protection even made the headlines in Bloomberg:

Bank Turmoil Highlights This Nation’s Lack of Deposit Insurance

Source.

“After the implosion of three US lenders, Kiwis are squirming over the lack of deposit protection for savers.”

There is legislation likely to be passed giving bank deposit protection up to $100,000 per bank.

“New Zealanders will have up to $100,000 of their deposits in any eligible institution guaranteed in the event that institution fails, under legislation introduced in Parliament today [22 September 2022].”

Source.

However this looks unlikely to be in place until late next year.

“The Depositor Compensation Scheme is being prioritised ahead of the rest of the Act coming into effect and is expected to be up and running in late 2024.”

Source.

Although it’s hard to know for sure just when it will actually be in place – as noted here:

Deposit guarantee scheme in place for 2024? Don’t bet on it.

Source.

Spread Your Eggs

So there doesn’t seem to be a simple solution to guarantee your savings in a New Zealand bank account. Other than spreading it around as many banks as you can. But given our banks are predominantly Australian owned, and predominantly hold mortgages for the same types of assets i.e. mostly residential real estate, if one got into trouble then we guess that trouble could be widespread?

Of course there are also decent odds the government might still choose to bail a failed bank out. Because imagine the uproar when a huge chunk of the populace lost a good portion of their savings! But then relying on what a government may or may not do is probably not the best option to rely upon.

Physical Cash

Physical cash means you are not relying upon the solvency of a bank. You are of course exposed to loss of purchasing power over the long term. Also if holding a significant amount of capital then this is not really feasible either!

You are very liquid for smaller purchase. But it is becoming more and more difficult to use cash for large purchases. So it then also gets problematic when you have to put it back into a bank account in terms of dealing with the Anti Money Laundering laws.

Hold an Australian Bank Account with $250,000 Protection

Perhaps another option would be an Australian bank (or banks). Where they do have a $250,000 protection:

“The FCS is a government-backed safety net for deposits of up to $250,000 per account holder per ADI [Authorised Deposit-taking Institutions].”

Source.

This deposit guarantee covers both Aussie citizens as well as non-residents:

“An account holder can be an Australian resident/citizen or non-resident/non-citizen. In other words, the citizenship or residency status of an account holder does not have an impact on whether a deposit account is covered under the FCS. A group of individual trustees of a trust, superannuation fund or approved deposit fund are treated as a single account holder.”

Source.

This would still be pretty liquid. As you’d only have to wait a few days to get the wire transfer back to your New Zealand bank account. So that could be an option. But then you are also exposed to exchange rate risk.

Hold Short Term New Zealand Government Bonds

The other option would be to put some of your capital into New Zealand government bonds of a short duration.

Kiwibonds

6 months is the shortest for a KiwiBond which the public can purchase directly from the NZ Debt Management Office. Then you would have the government guarantee these as long as they don’t go broke! But they can always print their way out – whereas a bank can’t. So you have pretty low default risk there.

Treasury Bills

Treasury Bills do come in 3 Month options.

These have to be purchased from a “Registered Tender Counterparty” – which are mostly banks as listed here.

However then you’d need to be careful about how the Treasury Bills you have purchased are held. They could be held on your behalf through a third party custodian. This could be similar to how some shares are held. So in that case the “Registered Tender Counterparty” (mostly banks) would be as the name clearly states the counterparty. Therefore are the bonds yours if they were to become insolvent? You’d need to be clear if you actually own the treasury bills.

Bonds can also be very liquid. With bonds you can sell them before maturity too. Such as on the NZX debt market.

You are of course then exposed to interest rate risk. So if interest rates continued to rise, then your Bond would fall in value if you tried to sell it before maturity (as a newly issued bond would have a higher interest rate. So they need to trade at a discount to these).

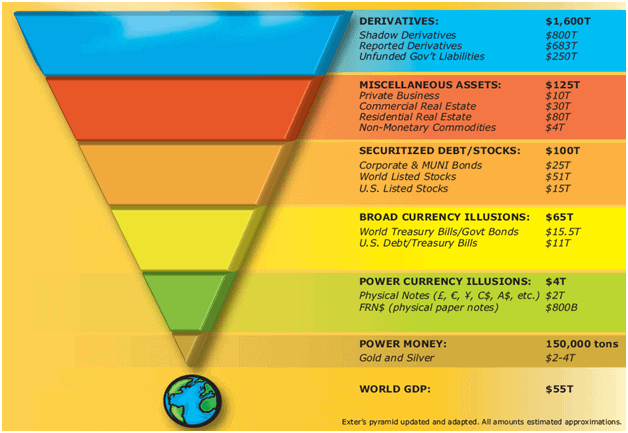

Exter’s Inverse Pyramid

But government bonds could be an option for the next best thing to physical cash and gold and silver in terms of avoiding counterparty risk but remaining quite liquid.

As shown in Exter’s pyramid:

See here for more on John Exter and his Inverse pyramid.

Here are some more links if you would like to learn more about investing in New Zealand Bonds:

https://sorted.org.nz/guides/saving-and-investing/bonds

https://www.fma.govt.nz/consumer/investing/types-of-investments/bonds/

A Cook Islands Bank Account?

Our reader then replied:

“Thank you so much for your VERY comprehensive response – it’s taken me a while to digest

I was not aware of several points you made:

- I thought the deposit guarantee was already in place, so that makes me even less happy with the idea of having money in an NZ bank – given their performance over the last couple of years I’m not that optimistic that the government would choose to do the right thing in the event of a failure.

- Exters pyramid is very interesting – the following article looks at it more from an individual investors perspective https://seekingalpha.com/article/4332917-re-imagining-exters-pyramid-in-todays-panicked-market#comments

- Any thoughts on using a Cook Islands bank as an alternative to Australian ?”

We’re not aware of the Cook Islands having a deposit guarantee scheme either.

The only reference we could find was here:

“Whilst there is no deposit guarantee scheme in place for Banks in the Cook Islands, CSB maintains professional Indemnity in the amount of USD 5,000,000.”

Source.

So if you want a deposit guarantee then the Cook Islands is probably no better.

Why Buy Gold Instead of Leaving Savings in a Bank?

We have a feeling our reader is looking to purchase some physical gold and silver. That is likely the reason they wish to remain liquid once they have sold their farm. So as to take advantage of any dips in price.

However for anyone else we would be remiss not to mention the advantages in holding physical gold and silver:

- Liquidity – you will still have liquid funds readily able to be turned into cash should they be needed.

- No counterparty risk – There is no risk of failure as gold and silver are the only financial assets with no counterparty risk. Learn more. That is why they are at the bottom of Exter’s inverted pyramid.

- Plus with gold and silver there is also the possibility of significant upside. See: How Do You Value Gold | What Price Could Gold Reach?

Shop the range of available gold and silver bars and coins today.

Pingback: New Zealand Bank Deposit Protection Scheme - Does N. Z. Have Bank Deposit Insurance in 2021? - Gold Survival Guide

Pingback: Caution: Don't Be Caught on the Sidelines - Gold Survival Guide