With gold breaking out to new all time highs in most currencies including the New Zealand dollar and US Dollar, this question from a reader is quite timely.

They asked “What will the future resale value of gold be?” Or rather what they were really getting at, what price will gold likely reach in the future? How do you value gold?

They accepted we did not have a crystal ball – although that would be handy! They were merely after some kind of methodology to give them a possible indication of how high the gold price could go.

We pointed them in the direction of a previous article we wrote: “When will you know it’s time to sell gold?”

This gives a number of indicators to follow to determine when it might be time to sell gold.

However this article didn’t give an actual method for trying to place a value on gold.

Here’s another article of ours that gives various opinions on what the price of gold may reach in the next year and the next 5 years. See: Gold Price Forecast: What Experts Predict.

But, the expert predictions also don’t mention how they arrived at their prices.

So today we attempt to place a value on gold with the numbers to back it up. Given the huge increase in quantitative easing (currency printing) by the US central bank during the covid19- response, we’ve also updated the numbers to take this into account.

Table of Contents

Estimated reading time: 10 minutes

Is Buffet Right That You Can’t Value Gold?

Much like Warren Buffett, many people run into the problematic thinking that there is no way to value gold. The argument is that gold has no earnings and is of no productive use etc etc. And so therefore how can you place a value on it? The argument expounded by Buffett and others, is that buying gold merely relies upon you finding a bigger fool to buy it off you.

To put it not so politely, this is all “arse about face”. You can’t measure gold using the elastic tape measure that is fiat currency. New currency is constantly being created distorting any measure (as we saw during 2020 and 2021 with the reaction of central banks across the planet to COVID19).

Rather it is gold that is actually the barometer of the fiat currency being produced. So to try and put a price on gold is nigh on impossible. Because it is dependent upon how many more fiat Dollars / Yen / Pounds / Euros / Renminbi the Central Banks of the world create.

That’s why we like to use measures like the housing to gold ratio to look at house prices. As using gold can give a more accurate picture of value rather than using inflated dollars.

Read more on Warren Buffet and Gold: Why Buffett is (Still) Wrong About Gold – But How He Loves Silver

But We Digress, Back to the Topic at Hand – How Do You Value Gold?

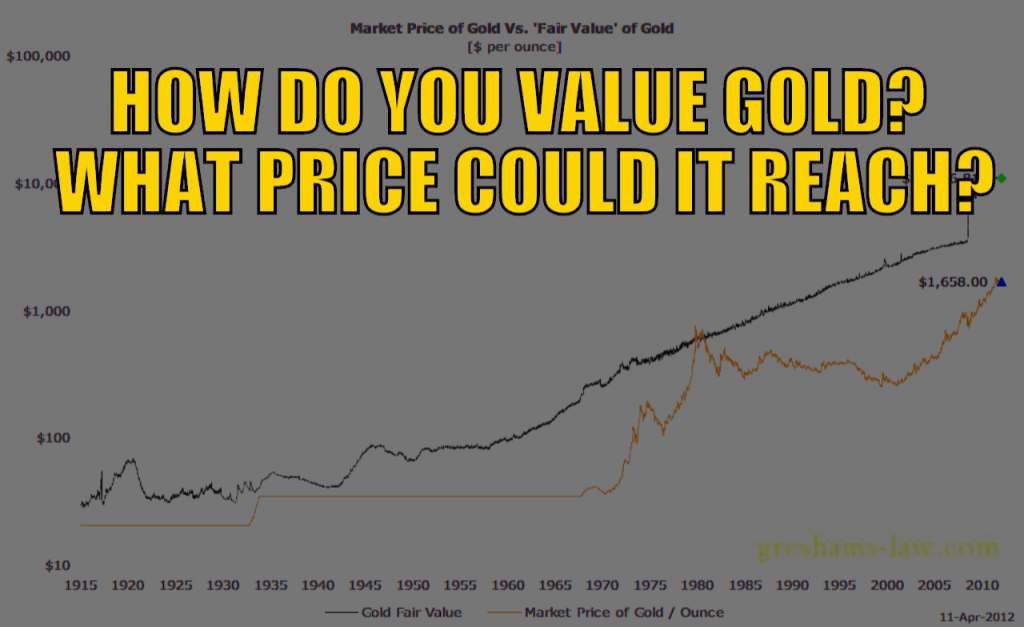

One methodology for valuing gold we’ve seen has been wonderfully laid out over on Greshams-Law.com.

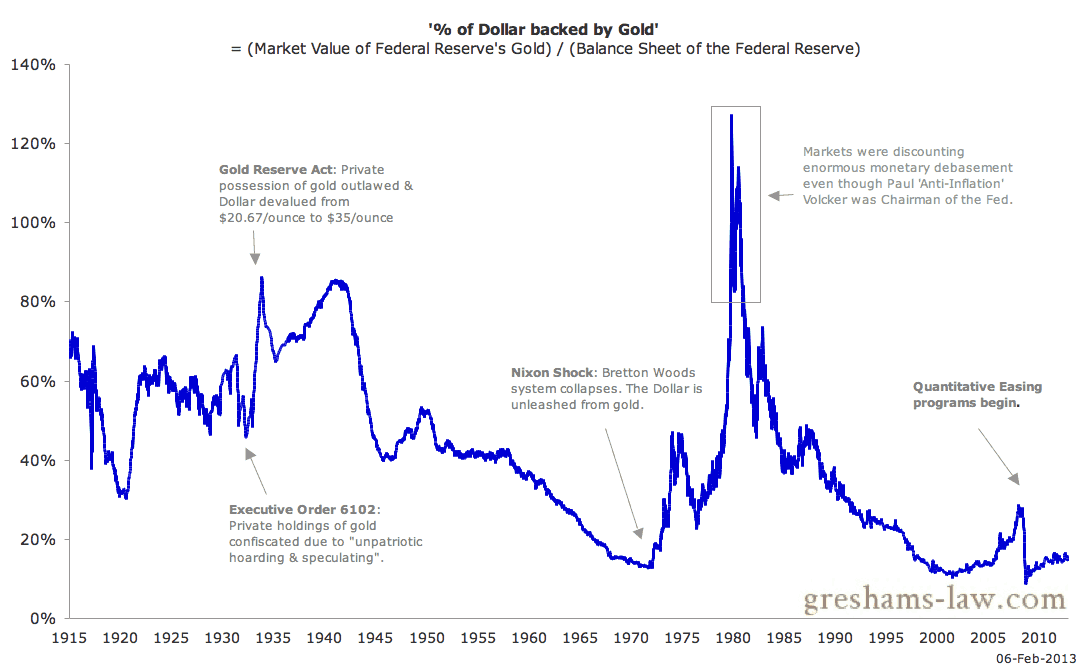

This methodology starts with simply looking at the percentage gold backing of the US dollar at the current gold price.

How Do You Determine the Percentage Gold Backing of the Dollar?

Simply take the dollar amount of the Federal Reserve’s total balance sheet and divide into this the current value of the Federal Reserve’s gold (supposing they still have it all!). See the chart below from Greshams Law.

This calculation shows the dollar as of 6 February 2013 was only 15% backed by gold. Compare this to the 1980 high, where the dollar was in fact over 130% backed by gold!

Or said another way in 1980 gold was overvalued by 30%. Perhaps not so surprisingly, this is when gold also started to fall.

(Interestingly at this point in time the US could have again returned to a gold standard had it chosen too. But the Reagan Gold Commission of 1981 didn’t quite conclude that. As an aside here’s an interesting article on the Gold Commission with some mind bending conclusions about it.

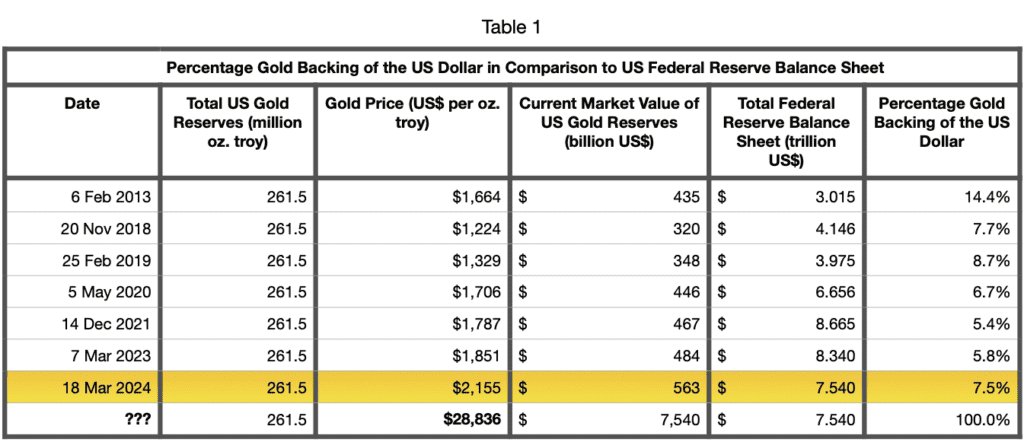

The Gresham’s Law website hasn’t been updated since 2013 [editors note: Actually it has now been removed entirely]. So we’ve gathered the data together to show the current percentage gold backing of the US dollar in the table below:

Table 1: Percentage Gold Backing of the US Dollar in Comparison to US Federal Reserve Balance Sheet

Since 2013 the Fed balance sheet has increased. Despite attempting to shrink their assets in 2019, the Fed reaction to COVID19 meant their balance sheet almost tripled between 2013 and 2021!

With the percentage gold backing of the US dollar falling to only 5.4% over that 8 year period.

However since March 2022, the Federal Reserve has been reducing its balance sheet. Down from US$8.665 trillion to US$7.540 trillion. With the gold price also rising that has increased the percentage gold backing of the US dollar to 7.5%. Similar to what it was in 2018.

We can therefore use this level of gold backing of the dollar as an indicator for when to sell or swap our gold for something else. That is, when the dollar is close to 100% gold backed (as it was in 1980).

2024 Gold Price Prediction: But What Price Could Gold Reach in the Future?

As we said above, determining a future price of gold is dependent upon how much more currency is created in the future. So it is a constantly moving value. Nonetheless, it can give us a good indication of where the price could go based upon present numbers.

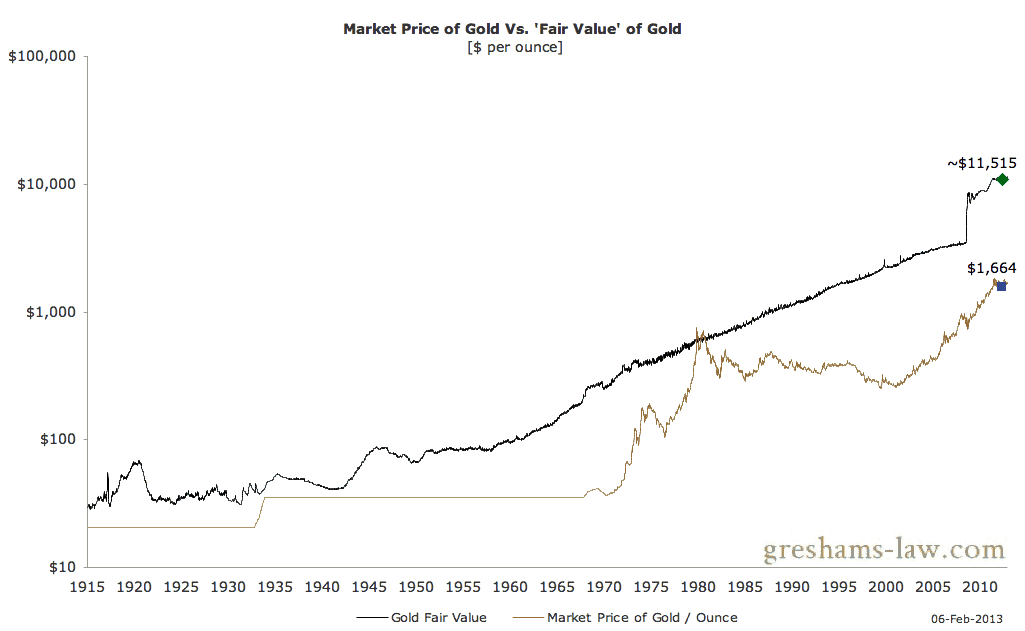

So using the methodology above we can plot over time, gold’s potential fair value. That is, if the dollar was to be 100% backed by gold today, what price would it need to be at?

With the size of the Fed balance sheet in 2013 – the answer was over $11,500! See the chart below from Greshams Law:

However, again the Greshams Law website has not been updated since 2013. So we have done the calculation again as of 2023.

Referring to Table 1 above we arrive at the gold price figure of $28,836 per ounce for the US Dollar to once again be 100% backed by gold. That is of course, assuming the US gold reserves don’t change and neither does the Federal Reserve balance sheet.

The shocking thing is this value as recently as May 2020 was “only” $25,453. There was a massive increase in quantitative easing from the start of the COVID19 outbreak. As a result the Fed balance sheet ballooned from $6.7 trillion in May 2020, to just under $9 trillion in March 2021. Since then the balance sheet has dropped to $7.54 trillion. But we still have the gold price figure of just under $29,000 for the US dollar to be 100% backed by gold.

How Much Upside Does Gold Have Today?

At only 7.5% gold backing today and a current US dollar gold price of around $2150, it seems there is plenty of upside in gold yet. And a long way from the bubble territory of 1980. Again you can see in the above chart (see: Market Price of Gold Vs. ‘Fair Value’ of gold) how in 1980 gold reached its “fair value” – that is the dollar was 100% gold backed. (See the point in the chart where the 2 lines meet in 1980).

Gold would have to rise by 13.4 times the current price for the US dollar to be fully backed by gold, as it was in 1980.

So if someone ever tells you Gold is in a bubble ask them – “Why?” Unless they say, “Because Gold is at fair value as the dollar is now 100% backed by gold”, you’ll know not to pay them too much heed.

Other Methods to Value Gold and Determine How High the Gold Price Could Go

The $28,836 figure using the Federal Reserve Balance sheet is just one method of determining how high the gold price could go.

There are various other methodologies that can be used.

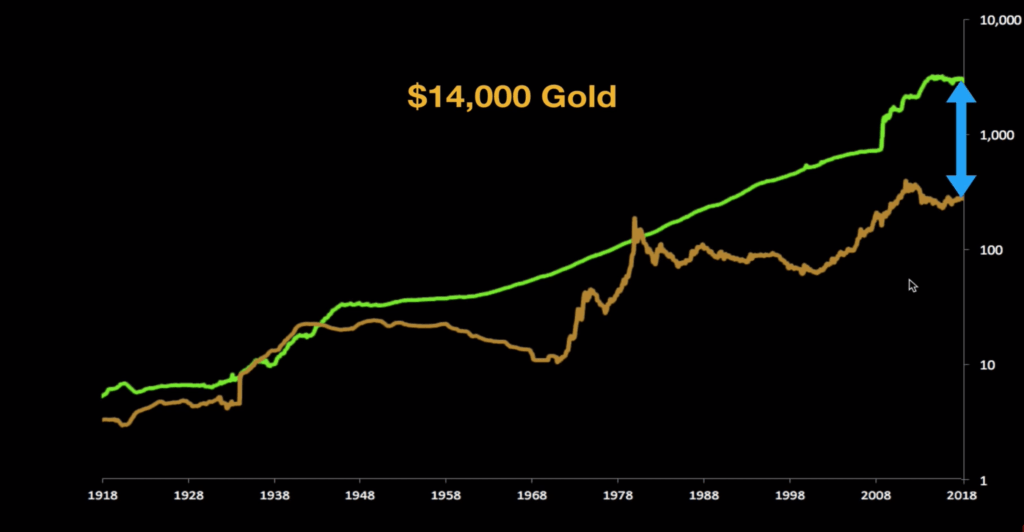

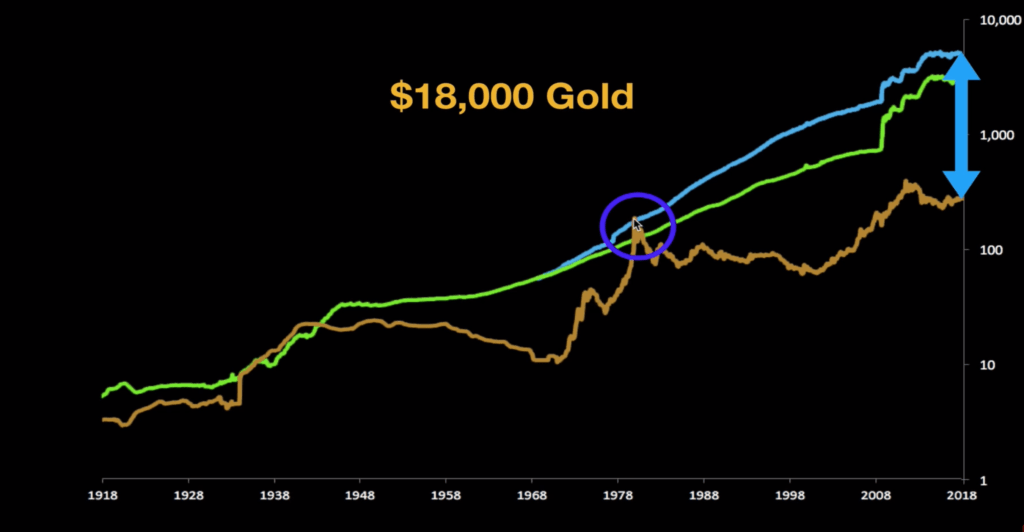

For example Mike Maloney uses US Dollar base currency versus the value of all the gold in the US treasury.

However Maloney also argues that we should add the credit currency (i.e. credit card debt) to the base money supply. In which case this would increase the price gold would have to rise to in order to “cover” the total base and credit currency.

(As it did in 1980 shown in the circle below.)

Here’s the full video – How High Can the Gold Price Go?:

Our current potential future valuation of around $29,000 is also very similar to this calculation: Gold Backing to Debt Ratio: A Reset Like in 1934 and 1980 Would Mean $28,000 Gold. But much more than the figure Jim Rickards arrives at, of around $10,000 per ounce. However, Rickards figure uses only a 40% gold backing. So using just 40% gold backing we now also arrive at a figure of around $11,500. (Note all these comparisons were in 2019/2020, hence why they are all now much less than our most recent figure of $28,836. As there has been much more currency created since then).

These all use slightly different methodologies to compare gold to fiat currency. Some using base currency, some using the Federal Reserve balance sheet. Others using debt. But they arrive at the same conclusion as GreshamsLaw.com: That is – gold remains cheap today. In fact due to the amount of currency created in the past decade, almost as cheap as gold was in 1999.

How High Could the Gold Price Go in New Zealand Dollars?

Now it’s also worth noting that all of the above calculations are in US Dollar per ounce of gold.

So it’s worth converting these to New Zealand dollars for anyone buying gold in New Zealand.

Let’s look at our projected price of $28,836 per ounce in US Dollars.

At the current exchange rate of $0.680 this would amount to a potential future gold price in New Zealand Dollars of $47,428! That might seem totally insane. But this 100% gold backing has occurred in history before. So it is not without precedent.

Even using Rickards more conservative 40% gold backing, we still arrive at NZ$18,970 per ounce.

Key take away point: With the amount of currency that has been printed into existence across the planet in recent years, gold likely has much much higher to rise yet.

Check out the range of gold bullion to buy here.

Read more on valuing gold: How Does Gold Compare to Shares For the Past 100 Years?

Editors Note: This post was originally published 24 April 2012. Updated 20 November 2018 to include latest charts and numbers. Updated again 4 March 2019 to include Mike Maloney charts and methodology and latest numbers. Last updated 18 March 2024.

Pingback: Gold in NZD - how much longer at this level? | Gold Prices | Gold Investing Guide

Pingback: Is it Time to Sell Gold or Silver? | Gold Prices | Gold Investing Guide

Pingback: Exit Strategies For When the Time Comes to Sell Gold and Silver

Pingback: Gold and Silver Technical Analysis: The Ultimate Beginners Guide - Gold Survival Guide

Pingback: Why Gold Bullion is Your Financial Insurance - Gold Survival Guide

Pingback: Is it too late to buy Gold?

Pingback: What Percentage of Gold and Silver Should Be in My Portfolio? - Gold Survival Guide

Pingback: Gold vs Bitcoin/Cryptocurrencies - Which One Should You Choose? - Gold Survival Guide

Pingback: Gold Cycles vs Property Cycles: When Will Gold Reach Peak Valuation? - Gold Survival Guide

Pingback: The “Time Price” - Why Gold is Money and Will Continue to Be - Gold Survival Guide

Pingback: NZ Housing to Gold Ratio 1962 - 2019: Measuring House Prices in Gold

Pingback: Why Buy Gold? Here's 15 Reasons to Buy Gold Now

Pingback: Gold Backing to Debt Ratio: A Reset Like in 1934 and 1980 Would Mean $25,000 Gold - Gold Survival Guide

Pingback: Is it Too Late to Buy Gold? [Video] - Gold Survival Guide

Pingback: Silver Bouncing Off Trendline - Gold Survival Guide

Pingback: 27 Ounces of Ancient Gold to Buy “a Fancy House in One of the Best Neighborhoods” - Gold Survival Guide

Pingback: New Zealand Bank Deposit Protection Scheme - Does N. Z. Have Bank Deposit Insurance? - Gold Survival Guide

Pingback: Gold Price Forecast: What Experts Predict - Gold Survival Guide

Pingback: Real Gold vs Fake Gold: How To Tell if Gold is Real - Gold Survival Guide

Pingback: What Will the Long Term Impacts of SVB and Signature Bank Bailouts Be? - Gold Survival Guide

Pingback: A Worldwide “Glut” of Unsold Properties? - Gold Survival Guide

Pingback: How to Safely Hold Dollars, Remain Liquid, and Seize Short-term Opportunities - Gold Survival Guide