Prices and Charts

NZD Gold Hits Another All Time High

Gold in New Zealand dollars hit another new all time high today at $3570. Up $58 dollars due solely to the weaker Kiwi dollar. NZD Gold is now very close to the top of the uptrend channel. Also remains extremely overbought on the RSI indicator, so we are still expecting a pullback from around here. A buy the dip opportunity likely approaches with possible buying zones at $3500, $3450, $3400 and the 200 day MA which will keep rising from here to maybe $3300.

USD Gold was flat this week. Up just $1 from a week ago at $2159. Unlike NZD gold, USD gold is down a little from the recent high. Although it’s likely we’ll see more of a pullback to come yet. Maybe even a retest of the breakout around $2100? We’d see any pullback as a buying opportunity.

Silver Sharply Outperformed Gold

Silver played a bit of catchup to gold this week. In NZD terms silver surged $1.91 or almost 5% to reach the blue downtrend line in the wedge pattern for the 4th time in 12 months. With the RSI overbought, odds favour another pullback from here in the short term. But there can’t be too many more zig zags to go in this wedge pattern, as we are running out of space as the silver price gets more and more compressed. A break out may not be far away.

Same situation with USD silver. Also hitting the downtrend line with a jump of 78 cents to almost hit $25. There might not be too many more chances to buy silver below $25 left.

Kiwi Dollar Down 1.5%

As noted already the Kiwi dollar was sharply weaker this week. It fell 96 basis points or over 1.5% and boosted the NZD gold price to a new all time high. For now the NZ dollar remains in a clear downtrend. We still expect this to change sometime this year.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

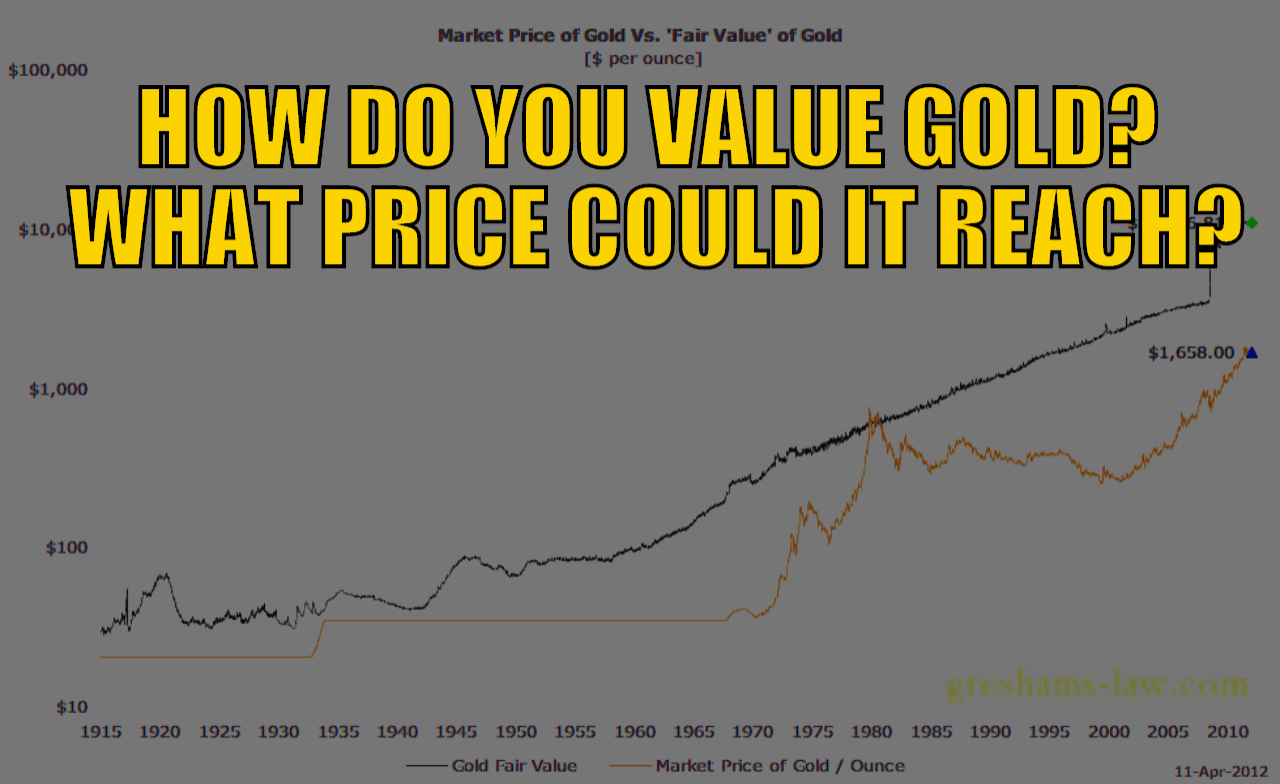

Unveiling the True Value of Gold: Is it Undervalued or Overhyped?

Gold’s allure as an investment has endured for millennia. Recently gold has hit an all time high in many currencies including in US and NZ Dollars. But how do you determine its true worth in today’s ever-changing market? In this week’s feature article, we delve into the complexities of gold valuation, exploring methods that go beyond its current price tag.

In this article, you’ll discover:

- How experts assess the intrinsic value of gold, considering factors beyond just supply and demand

- Why some believe gold is significantly undervalued based on comparisons to historical metrics like debt levels

- Different methodologies used to compare gold’s value to fiat currencies

Whether you’re a seasoned investor or just starting to explore precious metals, this article equips you with valuable insights as to where the gold price could head.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Bank of Japan Hikes Rates for the First Time in 17 Years

Big news overnight was that Japan became the last country to exit negative interest rates…

The Bank of Japan hikes interest rates for the first time… IN 17 YEARS.

Is this the start of a new era?

Source.

ASB notes this morning that the:

“Bank of Japan (BoJ) raised interest rates yesterday for the first time in 17 years. In doing so, the BoJ exited its negative interest rate policy (NIRP). It also ended its yield curve control (YCC) programme. The BoJ’s move also means that there are now no central banks with negative interest rates.

In making its decision, the BoJ judged its NIRP and YCC had ‘fulfilled their roles’. The BoJ will continue to buy government bonds though. There was little in the way of forward guidance provided in the statement. The BoJ said in the statement it ‘anticipates that accommodative financial conditions will be maintained for the time being’. Despite the significance of yesterday’s decision, the moves were actually very modest. For example, the BoJ raised interest rates 10bp from a range of -0.1%-0.0% to 0.0%-0.1%. As a result, the macroeconomic impacts of the move are likely to be small. Moreover, market participants appear to have interpreted the move as a dovish hike, especially given the lack of forward guidance. JPY has fallen since the announcement (USD/JPY now trading near 151.00) and the 10-year yield is down almost 3bp.”

The most important takeaway from this move? Japan was the first major economy to take interest rates negative and it is now the last to end this regime. While ASB and ‘market participants’ think this is a ‘dovish hike’, we’d say the odds favour it being just the first of many more to come for Japan. And likely for the rest of the world too. You don’t end years and years of close to zero interest rates in just a matter of months.

Still we might see rate cuts in the short term. ASB again notes that:

“…the big event of the next 24 hours is the FOMC policy meeting (7am NZT). We expect the FOMC to leave the Funds rate unchanged, as do most other analysts. However, the FOMC could announce it will step down the pace of shrinking its balance sheet from the current cap of $90bn/mth. There is also a risk the FOMC reduces its ‘dot plot’ of expected interest rate cuts in by the end of 2024 from three to two.”

Second Wave Inflation Evidence

But other data not widely reported points to what the longer term trend may be.

Because it’s not just gold and silver rising of late, other commodity prices have also surged:

“March saw copper soar nearly 6% to over $4.10 per pound after months of stagnation. Goldman Sachs predicts prices could hit $6.80 per pound by 2025.”

Source.

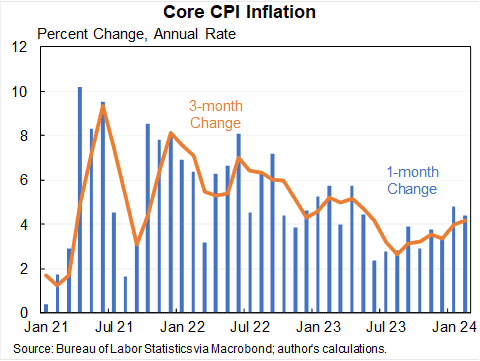

Oil prices have been rising again since December. Same with the CRB foodstuff index. While the CRB raw industrials index recently hit the highest level since October. As a result US core consumer price index continues to tick higher:

Golly sure sounds like Second Inflation Wave

Core CPI came in high for the eighth month in a row.

Annual rates:

1 month: 4.4%

3 months: 4.2%

6 months: 3.9%

12 months: 3.8%

For perspective, the 3/6/12 month rates higher than any time from 1992-2019. Inflation remains unusually high.

Source.

Sorry if we are boring you with these reports of further waves of inflation to come. But they’re not being reported much elsewhere. So hopefully you’ll see there is a good chance that higher than normal inflation and interest rates are not over yet. This is likely just a pause in a long term trend for both.

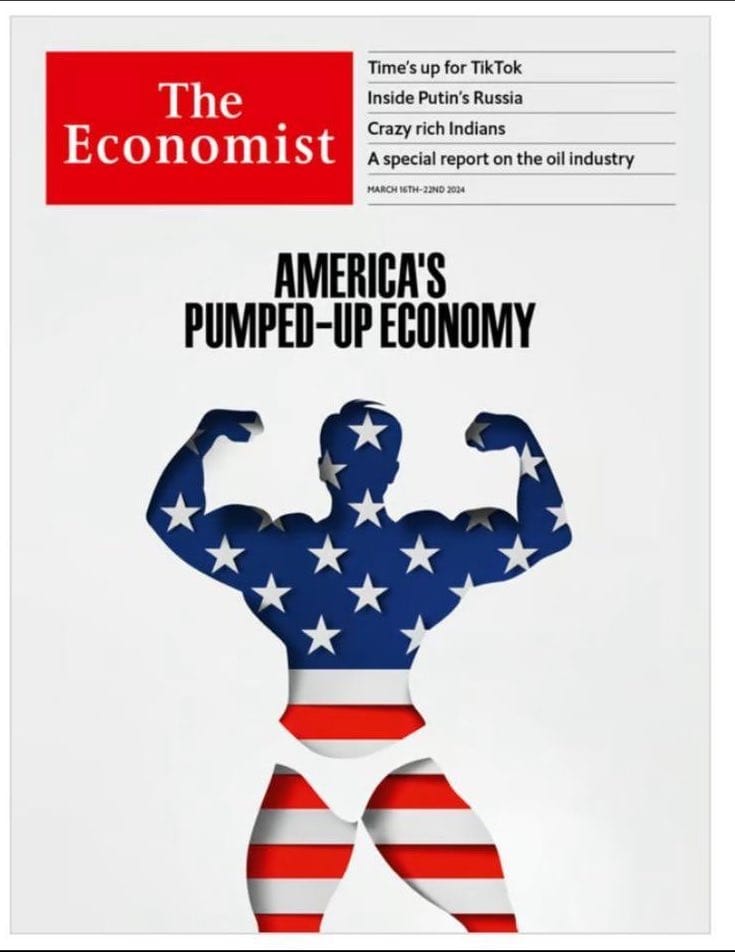

US Economy: Soft Landing, Pumped-Up or Just the Opposite?

While the economy is noticeably sluggish here in New Zealand. In the US the reporting is much more upbeat. Although perhaps the past is a guide that this is not such a positive indicator?

Soft Landing is THE consensus

This also happened in 2000 and 2007

Both instances did not end well

Source.

Then we have a possible contrarian indicator with the latest front page of The Economist:

Recession may have just gone from inevitable to imminent…

Oh, so page 1 of the newspaper is not about Soft Landing anymore.

It’s exuberantly moving to No Landing at all.

The mother of all contra indicators?

Source.

Silver’s Time Will Come

With gold hitting new all time highs, there will be many getting very impatient for silver to hurry up and follow suit.

Craig Hemke of Sprott Money makes the case for why silver is lagging gold.

Basically there has been a momentum and technical based price surge in gold driven by a big flow of speculator cash into the gold futures market. Whereas the rise in silver has just been a reaction to the rise in gold, as some speculators in silver covered some of their short position:

“And this explains why so many precious metal advocates were frustrated by COMEX silver’s relative “underperformance” last week. Yes, seeing silver rally 8% in seven days was fun, but shouldn’t it have rallied more? The thinking goes: If gold was up 7%, shouldn’t silver have been up 15% or more?

That type of explosive rally in COMEX silver is coming, but not just yet. Again, the rally in COMEX gold was driven by an easily recognizable, long-term technical breakout.

…But COMEX silver is nowhere near that type of technical breakout. To achieve something similar, price will have to move decisively up through the $28 level…and it’s not even to $26 yet! WHEN that breakout comes, hot speculator cash will flow into COMEX silver too. However, as you can see below, the breakout is still a long way away.”

Source.

However since Hemke wrote this 9 days ago, silver has moved up to the first resistance line just under $26. Odds favour a pullback now, but we get the feeling we are getting closer and closer to a breakout for silver.

Alisdair MacLeod outlines why he thinks it might be the Indian government that sets silver off and running due to them incentivising solar panel production (silver is a major ingredient in photovoltaic panels):

“The feature of these markets is the extraordinary extent to which bullion is leeching out of Comex. So far this year, 95 tonnes of gold have moved from establishment hands presumably into the Other Reported category. But the real surprise is silver, which by this morning had 1,201 tonnes stood for delivery. Normally, these deliveries are merely the shuffling of ownership in Comex-registered vaults. However, the evidence suggests that silver is actually being transferred with a view to being physically delivered outside the vaulting system.

The Indian government introduced a solar production linked incentive scheme. Reliance Industries, among others, are investing heavily in photovoltaic production, and is commissioning the first 5 giga-watt phase of a 20 GW manufacturing facility scheduled for opening this month. I am informed by industry sources that being unable to source sufficient silver from refiners, Reliance has been buying what it can in silver markets, including Comex. It is almost certainly Reliance which is taking the bulk of that 1,201 tonnes and the acceleration of deliveries this month reflects the commissioning of Phase 1 in Jamnagar.”

MacLeod goes on to say that he believes:

“China has deliberately suppressed the silver price while importing significant quantities to bolster its photovoltaic production. Now that India is rapidly developing its output under government schemes, China is likely to lose its grip on price.”

Source.

Finally, chartist Clive Maund sounds positive towards silver, outlining why he thinks it might do better than gold earlier in this bull market:

Silver Market Update – the STRONGLY BULLISH CASE FOR SILVER COULD NOT BE CLEARER…

This is a good juncture to address the issue of how, in the early stages of a major sector bullmarket, gold and gold investments hog the limelight, usually leaving silver and silver investments to ‘bring up the rear’. This time round silver looks set to do a lot better in the early stages of this bullmarket ‘why?’ because it is so horribly undervalued relative to gold, as the following long-term 20-year silver over gold chart makes clear”

Source.

So for those holding silver it is really just a case of hurry up and wait! But for those yet to buy, the lag of silver after the breakout in gold is giving you a likely excellent buying opportunity. If we get the expected pullback from here, that is looking like a greta buy the dip opportunity.

Please get in contact for a gold or silver quote, or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Shop the Range…

—–

|