Prices and Charts

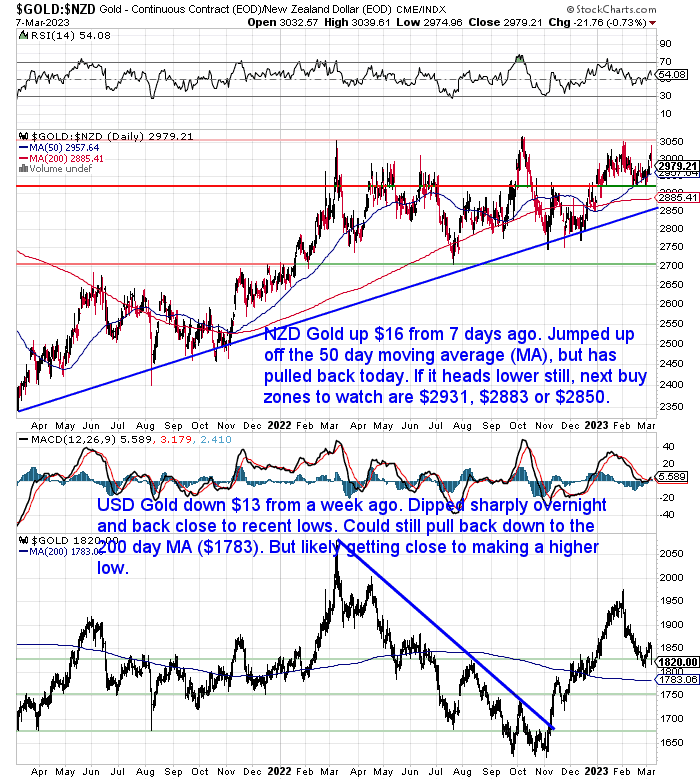

NZD Gold Still Holding Above the 50 Day Moving Average

Gold in New Zealand dollars was up half a percent from a week ago. It got up close to the overhead resistance line at $3050, but has pulled back overnight. NZD gold remains above the 50 day moving average (MA). But if it were to head any lower the next buy zones to watch for are at $2900, $2885 and $2850.

The fall overnight followed remarks by the US central bank chair Jerome Powell. Powell said interest rates are likely to go higher than previously expected (more on that later). As a result share markets took a tumble and so too did gold and in particular silver.

USD gold (lower part of chart below) fell $33 overnight and is down $13 from a week ago. It is back close to the recent lows. USD gold could still pull back to the 200 day MA at $1783. But it is likely close to making a higher low.

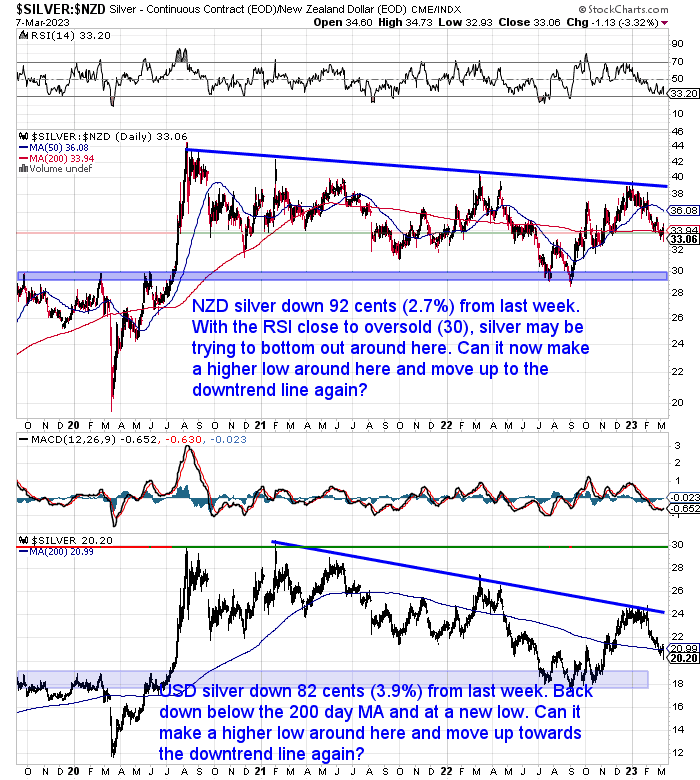

NZD Silver Down 2.7% From 7 Day Ago

Silver in New Zealand dollars was down 2.7% or 92 cents from a week ago. It is once again back under the 200 day moving average and also back close to oversold in the RSI (below 30). So the odds favour silver being close to bottoming out. We may soon see it make a higher low and head back towards the downtrend line.

Silver in USD was down even more. Down 3.9% from 7 days prior. It is also back below the 200 day MA and at a new low for this correction. Can it finally make a higher low around here and head back up towards the blue downtrend line?

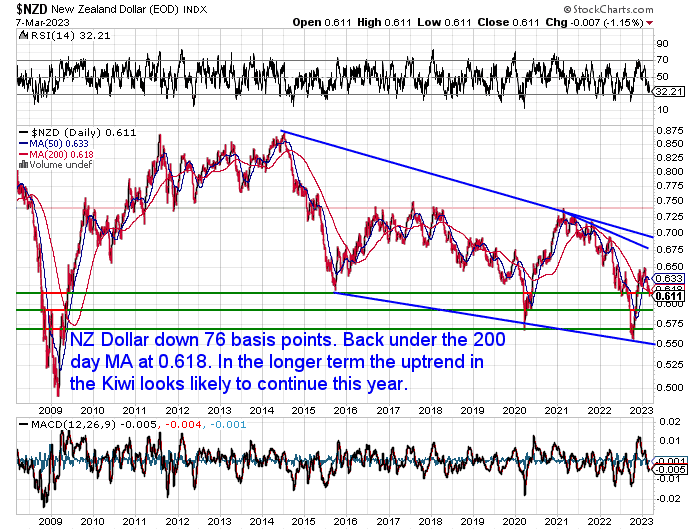

NZ Dollar Down 1.23%

The NZ dollar also took a hit overnight. Down 76 basis points (1.23%) from a week ago. As noted above the weaker Kiwi dollar has shielded local metals prices somewhat compared to their USD price falls.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

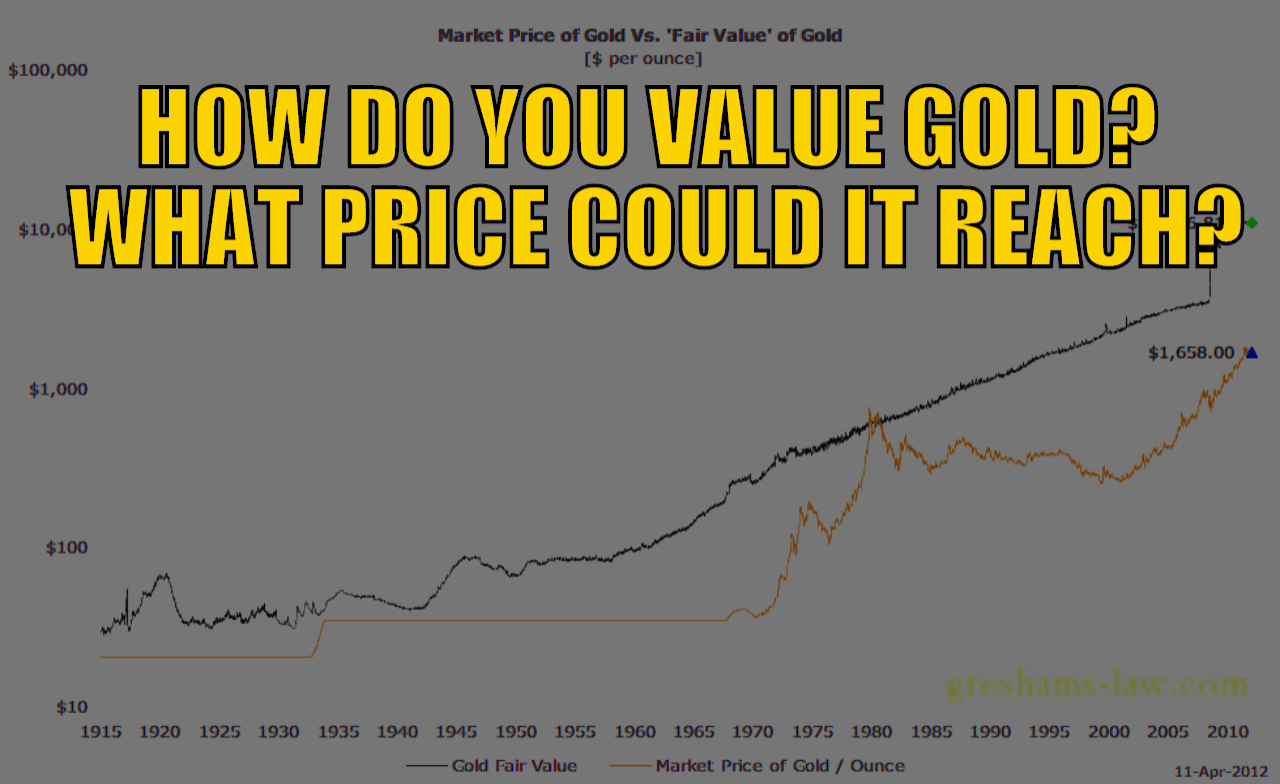

How Do You Value Gold? – What Price Could Gold Reach?

The last couple of weeks we featured articles that compared house prices to both gold and housing to silver prices.

These are very useful ways in determining when one of these assets is overvalued compared to the other.

But what about dollars? Is it possible to come up with a future potential price for gold in dollar terms? Given more dollars are created almost every year, is this relevant?

So this week we look at how to value gold and attempt to come up with a potential price it could reach.

You’ll discover:

- Is Buffet Right That You Can’t Value Gold?

- How Do You Determine the Percentage Gold Backing of the Dollar?

- But What Price Could Gold Reach?

- How Much Upside Does Gold Have Today?

- Other Methods to Value Gold and Determine How High the Gold Price Could Go

- How High Could the Gold Price Go in New Zealand Dollars?

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

A Worldwide “Glut” of Unsold Properties?

Here’s a headline from last week:

Housing market awash with unsold properties at what should be its busiest time of the year

This article states NZ has a real estate market:

“…where fewer properties are selling and there is a build up of unsold properties, putting buyers in a very strong negotiating position.

The Realestate.co.nz figures also contain a clue as to why sales might be so sluggish.

They show the only region in the country where the total number of homes for sale at the end of February was lower than it was at the same time last year was Wellington.

It may be coincidence, but the latest figures from property data company CoreLogic show that average dwelling values in Wellington have declined by $215,000 since March last year, down more than anywhere else in the country.

That suggests there could still be a significant gap in many regions between the price vendors are hoping to achieve and the price vendors are prepared to pay and as a result, more and more properties are sitting on the market unsold.”

Source.

This glut of property seems to be happening worldwide. Likely caused by rising interest rates worldwide. Our “secret investment advisor” said last week:

“These rising rates we’ve seen over the last few years have been hurting certain people tremendously. The Economist estimated that for the richest 59 nations “In 2021 their interest bill stood at a $10.4trn, or 12% of combined GDP. By 2022 it had reached a whopping $13trn, or 14.5% of GDP.”

The full article, which bears reading is found here:

At the most local and individual level, everyone who wants to sell a home now can no longer pretend we are back in the good old days. Unless one is paying cash, buyers must take on mortgage rates that are many times what they were recently. To the extent that property transactions have stalled all over the globe, it is because sellers haven’t yet realized this. (That’s a much more polite way than calling them greedy, isn’t it?)

If you read between the lines when Fed chair Powell speaks, he’s saying that rates have more to rise. They are still below the inflation rate.”

Higher Interest Rates to Come

Well, today people didn’t have to read between the lines so much as Powell said:

“The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated”.

Source.

As noted already gold and silver took a hit following Powell’s comments. Share markets also fell sharply. Higher interest rates make funding for businesses more expensive. The belief is also that higher rates are bad for gold and silver as they earn no interest.

However as we have discussed many times before it is the real rate of interest that matters for gold and silver. That is the after inflation interest rate.

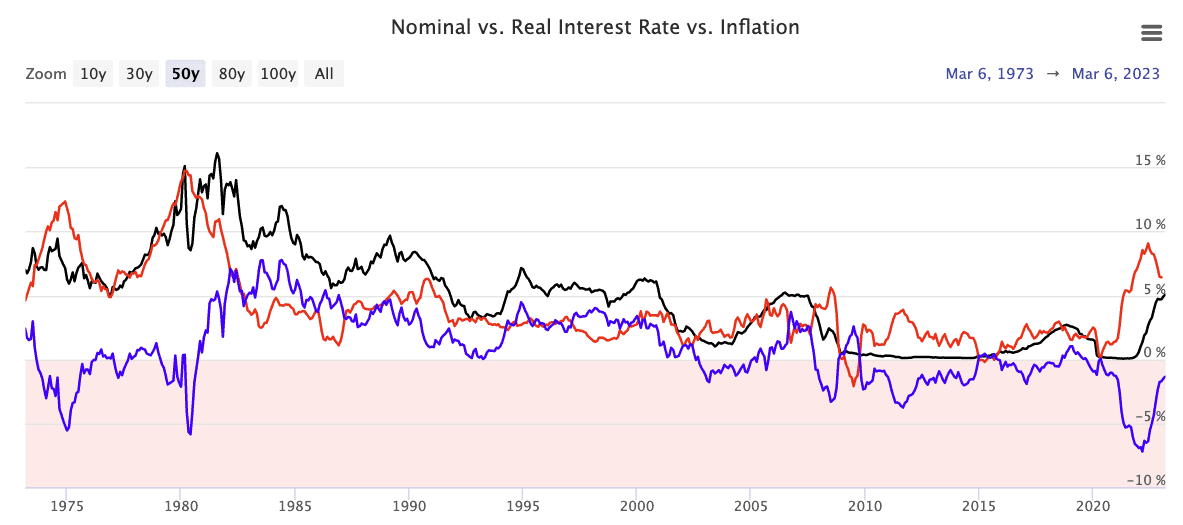

US real interest rates, while up over the past year, are actually still negative. See the blue line below. Black line is the nominal interest rate, while the red line is the inflation rate.

Source.

So while the real interest rate is negative people are losing money every year. What seems like high interest returns are actually eaten by inflation. So gold and silver generally do better in these environments. For more on this see: Real Interest Rates vs Gold Prices – What Can They Tell Us About When to Buy Gold in New Zealand?

Higher Inflation Rates For Longer Too

We continue to warn that inflation is likely to stick around and remain higher than most expect for some time to come.

We may see inflation dip lower before then bouncing back. So there could be some head fakes along the way. In the US there could be one of these underway right now. Where inflation has been falling since June last year.

But we think it’s best to plan and prepare for high inflation rates for some years to come.

We’re starting to see similar warnings from mainstream analysts too:

One expert has warned that inflation is set to remain high “for a bit longer”. Devon Funds’ Tama Willis joined Breakfast this morning to discuss the economy.

Source.

Then today we see this headline:

“Why the Reserve Bank could be forced to shelve its [1-3%] inflation target”

It points out the RBNZ projects inflation won’t drop back under that level until September 2024.

The author asks:

“Can the bank get inflation down by then, and if it took longer, would that really matter?”

“…Waikato University honorary professor Leo Krippner …fears interest rates may not have risen enough to reduce demand.

Central banks have tightened interest rates to try and bring inflation down, but, at present, ‘real’ interest rates are still at negative levels,” he notes.”

Source.

So real interest rates are still negative here in NZ too. So interest rates may rise further, but if inflation stays high then real interest rates could remain negative for a protracted period of time as well.

Even bank economists are starting to wonder if inflation can come down…

“ANZ chief economist Sharon Zollner also believes stubborn global inflation may prove more than just a pothole.

“If inflation doesn’t obediently fall all the way back to target like we’re all forecasting it to – and I certainly see the risks as tilted in that direction –then I think at some point there will be questions asked by politicians about whether the ‘pain is worth it’, or whetherwe should settle for getting inflation down to some more middle-sized number for a few years,” she says.

“I fully expect that to become a very loud debate over the next year or two and I wouldn’t rule out that some countries’ politicians might decide to change their inflation targets.”

Then how’s this for an out of touch statement from ANZ’s chief economist? That 5% inflation would be “fine”!

“If inflation was 5%, give or take 0.5%, year after year, then people could just live with it and that’d be fine,” Zollner says.”

Perhaps her final comment in this article is a more accurate one.

“Central banks have got every incentive to talk super-tough on inflation, until they decide the job is done, just like a politician will ‘deny, deny, deny’ they’re resigning until they suddenly quit. There’s nothing to be gained from expressing uncertainty.”

Source.

So continue to plan for higher interest rates, but also higher inflation rates, and therefore lower (and negative) real interest rates. Just the sort of environment that holding gold and silver will benefit from.

Have you got enough protection?

Get a quote on gold or silver products:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|

Pingback: Another Economist: RBNZ Should Shift Inflation Goalposts - Gold Survival Guide