Prices and Charts

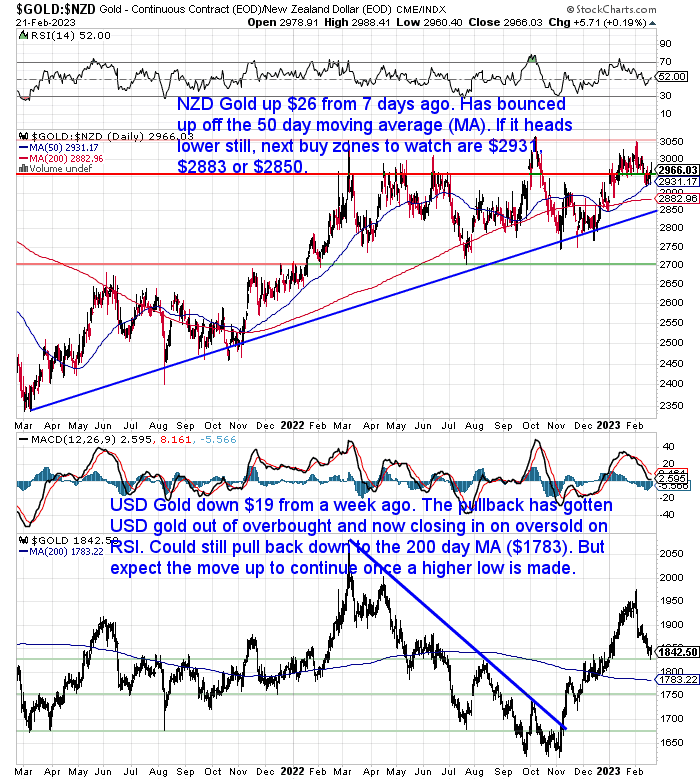

NZD Gold Bouncing Up Off 50 Day Moving Average Line

Gold in New Zealand dollars was up $26 or almost 1% from 7 days ago. It has bounced up off the 50 day moving average (MA). If that line doesn’t hold then the next buy zones to watch are the 200 day MA at $2883, or the rising trend line currently at $2850.

The pullback in US dollar terms has been much sharper. USD gold was down $19 from a week ago. This has gotten USD gold out of overbought and is in fact now closing in on oversold levels on the RSI. We could still see a further pullback down to the 200 day MA ($1783). Wherever the higher low is made, we’d then expect the move up to continue.

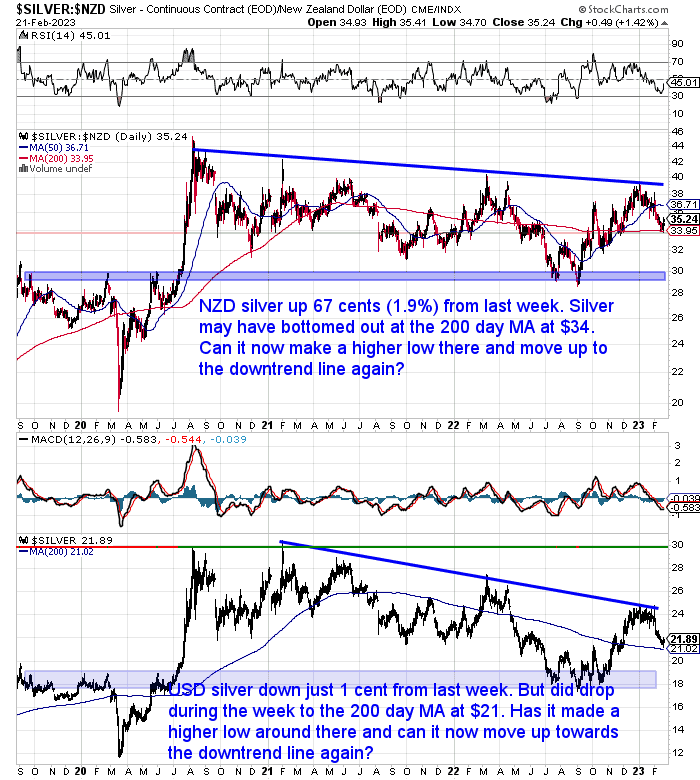

NZD Silver Up 2% From Last Week

Silver in NZ dollars has bounced back more this past 7 days. Up almost 2% after bouncing off the 200 day MA. It may well have bottomed out there. Now the question is can it make a higher low at the 200 day MA and move up towards the downtrend line again?

USD silver was basically unchanged from a week ago. But during that week it did drop down to the 200 day MA at $21. Has it also made a higher low there? Can it now move up towards the downtrend line again?

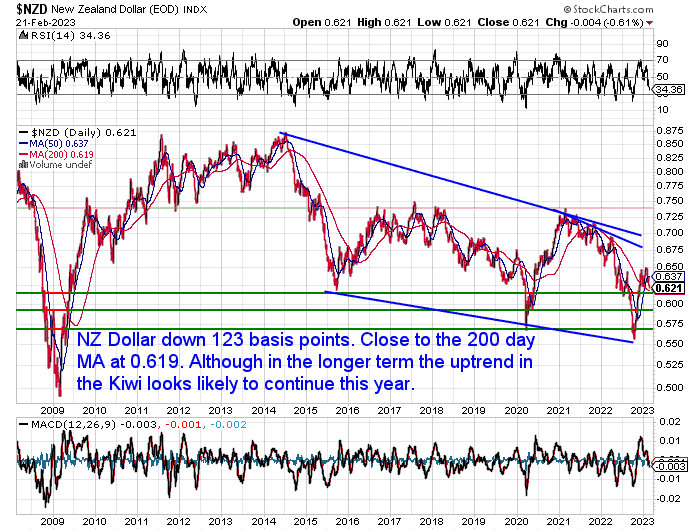

NZ Dollar Back Close to the 200 Day MA

The Kiwi dollar was down 123 basis points over the past 7 days. This was the key difference in the performance of gold and silver in NZ or US dollars that we spoke about above.

With the RSI getting close to oversold, it’s likely we’ll see the NZ dollar bottom out soon. Maybe around the 200 day MA. Then the uptrend from later in 2022 is likely to continue.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

House Prices in NZ Have Fallen Sharply, How Much Further Could They Fall?

It won’t come as a surprise that house prices have been falling around New Zealand. The latest numbers out seem to show the biggest falls have been at the lower end of the market…

“A dramatic fall in house prices at the bottom of the market last month considerably improved the prospects of first home buyers, according to interest.co.nz’s Home Loan Affordability Report.

According to the report the Real Estate Institute of New Zealand’s lower quartile selling price dropped substantially in most regions of the country in January.

The latest drop in prices means there are now six regions around the country where the lower quartile selling price has declined by more than $100,000 since prices peaked in November 2021.”

Source.

However another report states:

“House prices drop outweighed by mortgage rates rise – CoreLogic

Houses are becoming more affordable as prices continue to drop, but are still expensive by most measures. The latest CoreLogic Housing Affordability Report indicated continued rate rises and mortgage payments were eating up a large part of household income, but getting on the property ladder was becoming more affordable.

Residential properties were currently valued at 7.8 times the average household income, which was still well above the long-term average of 6.0, but better than the peak of 8.8.

“The falls in property values that we’ve seen in recent months will in part have helped the required debt servicing costs for a home-buyer, alongside higher incomes, but these effects have been outweighed by the rise in mortgage rates themselves,” CoreLogic NZ chief property economist Kelvin Davidson said.

The cost of servicing a loan to value (LVR) mortgage requiring a 20 percent deposit would cost more than 53 percent of the average household income, which compares the long term average of 38 percent to service a mortgage.

The amount of time it took to save a deposit was still high at 10.4 years, but an improvement on the peak of 11.8 reached in the first three months of last year.

“In other words, this measure is signalling that housing is still as unaffordable as ever,” Davidson said.

Source.

The CoreLogic economist above then goes on to say that:

“…affordability as measured by mortgage repayments as a percentage of income should start to improve as prices are expected to continue to fall.”

Some bank economists have adjusted their forecast falls and now say house prices are expected to drop further 15-20% in second half of the year.

However in today’s feature article you’ll see how house values in NZ could actually drop by up to 80% if history repeats.

Because rather than only looking at the price of housing simply in dollars, we like to compare “real estate” to “real money”.

It’s been exactly one year since we last looked at the housing to gold ratio. As it happens, things have changed quite a lot in that time. While house prices have fallen, gold in NZ dollars has risen. So check out this week’s feature article.

Here’s what you’ll discover:

- How to Calculate the Housing to Gold Ratio

- Comparing the NZ Housing to Gold Ratio to the UK and USA

- Could NZ House Values Drop by 80 Percent?

- Key point: It’s the proportional drop in the value of housing to gold that is the key factor.

- Comparing Some Numbers: If the Ratio Falls What Price Could Gold Reach?

- Paper Currency Varies – Gold Does Not

- Summary – Using the Housing to Gold Ratio

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Property Markets and Borrowers Under Stress in Many Countries

But it’s not just New Zealand’s property market that is taking a bit of a beating.

An interesting read from “Grahams Benjamins”, a “Fund Manager, Writer, Sort of Historian” has data showing the US, Canada Europe and Australia are all having issues due to rising borrowing costs creating borrower stress. He does also comment on New Zealand:

“…Things are unravelling even more rapidly in New Zealand, whose central bank has been even more aggressive in rate hikes than Australia.

From the Real Estate Institute of New Zealand:

“Just 2,759 residential properties in NZ were sold in January 2023. Down 27% YoY and the lowest month on record excluding the COVID lockdown in April 2020.

Yet 27,732 properties were on the market at 31 January, up a huge 39.4% YoY.”

House prices are falling sharply in the likes of Canada, Australia and NZ. So what does this mean?

“…There are two key messages here:

1. We are learning just how highly sensitive highly leveraged household sectors are to interest rates meaningfully above zero

2. The full flow-on effect of higher interest rates are yet to impact the broader economies of these regions. Economic impact is a lagging indicator, which again reveals how vulnerable the household property market has become as it leads this downturn

3. What then happens when unemployment increases?

In previous articles we have evidenced the increasing number of layoffs recently announced in the US – we can now add GE and Morgan Stanley to this list, which is literally growing by the week.

While the US seems to be ahead of the other “housing bubble” economies, we expect Canada, Europe, Australia and New Zealand will be following a similar unemployment path in the months ahead.

So what does this mean?”

The author postulates that recent borrowers will end up in negative equity. Quite the opposite of the past where home equity was used to borrow against for further consumption. People will also be able to borrow less due to higher interest rates and banks will tighten up further. Then here’s what could happen next:

- “As consumption declines, so too will corporate profitability

- As corporate profitability declines, unemployment increases – we are already seeing this in the US

- Households seek to save by reducing discretionary expenditure – Campbell’s Soup stock and General Mills stock increased by 31% and 24% respectively in 2022, while the S&P 500 declined by 20%, reflecting a decline in discretionary expenditure

- Housing prices enter a negative feedback loop as borrower’s capacity declines and serviceability costs increase – added to rising unemployment

- Housing construction will decline, putting further pressure on the building industry – a significant employer in the developed world

- Bank provisioning and loan losses will increase, further tightening credit conditions

- Potentially separating distressed mortgages into a “bad bank” category, effectively removing a sizeable portion of borrowers from the broader economy”

Governments may respond with measures to assist under stress borrowers, but the author believes this will have negligible impact. Because:

“Household budgets are being increasingly squeezed by inflation, and even if inflation is quickly brought under control, it is extremely unlikely that interest rates will move back towards zero. This means a structural upward adjustment to mortgage borrowing costs and therefore reducing the amount that borrowers are able to borrow.

Unemployment is beginning to rise in the US and Australia, and higher rates elsewhere will have the same impact on labor markets.

Even if repayment “holidays”, extended duration and lower capital requirements for banks were implemented, the credit system becomes anaemic in terms of growth. As property prices stop increasing, and indeed continue to decline, the negative wealth impact on the broader economy accelerates.

Housing affordability remains historically low. This means the number of new entrants to the property market decreases, further compounded by rising unemployment.

The world has passed the point of no return for a residential property market correction. This still has a long way to go, and the second and third order impacts are still yet to materialize.”

Source.

The takeaway from this interesting piece of research is that property markets worldwide likely have further to fall. But also that this fall will have much wider ramifications than just those over-leveraged borrowers. The second order effects listed above will impact many more people.

This week’s feature article shows that gold will likely do the opposite of property. And that just 50oz of gold may well buy you a house at some point down the line.

Get a quote on gold or silver products:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Shop the Range…

—–

|

Pingback: A Worldwide “Glut” of Unsold Properties? - Gold Survival Guide