After you’ve decided to buy precious metals, the question now on your mind is “Should I buy gold or silver?” Which metal is a better choice for you?

Many of the reasons to buy gold or reasons to buy silver are very much the same. However there are also some significant differences between gold and silver. In this article you’ll learn what those differences are and how to choose between buying gold or silver.

We’ll outline 7 factors to take into consideration in making your decision and highlight whether gold or silver is the winner in each case. If you don’t have time to read you can always skim through the “Deciding between gold or silver tips”…

Table of Contents

Estimated reading time: 12 minutes

1. Gold or Silver as a Crisis Hedge

Both gold and silver are viewed as monetary metals. However given silver has so many industrial applications, silvers price can also be impacted by industrial demand. So silver can fall sharply during times of economic distress.

Whereas gold is the more pure monetary metal. With far fewer industrial uses and the greater stock to flow ratio, gold is more stable than silver.

(Stocks to flow ratio is the ratio between the above ground stock and the new supply that comes to market each year – the flow. Gold has the highest by a wide margin – about 70 to 1 versus silver 1.5 to 1. This means gold is very stable as there is so much of it available in comparison to it’s annual new supply. Gold is rare but it is this high stocks to flow ratio that makes gold so sought after. For more on stocks to flow ratio see: Stock to Flow Ratio – A Primer)

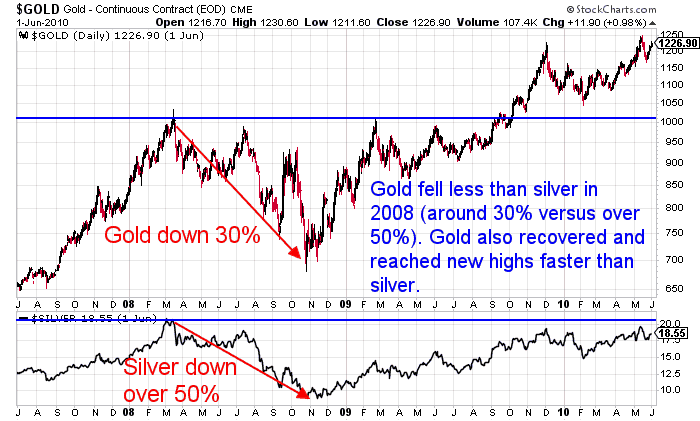

So gold is less likely to fall in a crisis or will likely not fall as far as silver and will recover faster as it did in 2009. See the chart below for 2008/09. Gold at the top, silver below:

Gold vs Silver Winner: Gold (However over the longer term and in the course of a full precious metals bull market – such as the 1970’s – silver will likely still outperform gold).

2. Volatility

The Gold market is around 9 times larger than the silver market on an annual basis. The result of a much larger market for gold is that gold is decidedly less volatile than silver. Why? It takes much less money moving into or out of the silver market to affect the price.

You only need to look at the charts of each over the last decade or so to see that. Read more: Does Record Low Gold Volatility and Sentiment Mean Time to Buy?

To read more on volatility then check out this post: Embrace Silver’s Volatility All the Way to the Bank

But to summarise the lessons to take from this are:

On average, silver rises higher and falls further than gold. This is true as much today as it was in the 1970s. The difference has reached as much as 15 percentage points during this cycle, while it hit 30 during the last mania. This means that investors:

1. Must be able to stomach the bigger moves, regardless of the direction. If you have a tendency to get emotional about your investments, you may want to reduce your exposure to silver.

2. Have an opportunity to get better prices on silver than gold. If you buy during the downdrafts, you will likely reap a bigger percentage gain than gold, as history has shown.

Gold vs Silver Winner: Gold (Although this depends on how you view and therefore use volatility. As it is this volatility that gives silver more upside potential too).

3. Affordability

Currently it costs just under 80 times more per ounce for gold than silver.

You can buy a 1oz silver coin for about $65 versus a 1 ounce gold coin for around $4,205. So clearly silver is more affordable than gold. Particularly if you don’t have too much cash.

Silver also has the added advantage of being sold in much smaller dollar increments. So silver would be much better to fund day to day purchases. You could sell a few coins to fund your grocery bill in an emergency.

Silver coins are also likely to be much more useful for day to day purchases in a currency collapse. See: What Use Will Silver Coins be in New Zealand in a Currency Collapse?

Compared to: What is the Best Type of Gold to Buy For Trading in a Currency Collapse?

Gold vs Silver Winner: Silver (Clearly the winner in terms of affordability and advantages of being able to sell or exchange in smaller dollar or value increments).

4. Mark Ups or Margins Over Spot Price

The mark up or premium over the spot price of silver is usually more than gold for most products. For a detailed explanation as to why this is see: Why is it so expensive to buy silver in New Zealand? Therefore some people prefer gold over silver for that reason.

However when you get down to buying amounts of gold or silver below around $4000, then this changes the outcome.

So when buying less than an ounce of gold (i.e. roughly around $4000), it is silver that will generally have the lower mark-up over the spot price. Why is this?

Because it takes the refiner roughly the same amount of effort to create a 1 oz gold bar/coin as it does to create a 1/4 ounce bar/coin. So percentage wise, the premium above spot increases for these smaller gold bars and coins under the 1 oz size.

Gold vs Silver Winner: Tie (it depends entirely on how much you are spending as to whether gold or silver is better value in terms of the premium above their spot prices)

5. Storage

As stated already, currently it takes just under 80 times as much silver to reach the same dollar value of gold. But on top of this, gold is also almost twice as dense as silver. Or put another way, pure silver takes up 84% more space than gold.

As a result, at current prices, silver takes up to 128 times more space for the same value in comparison to gold!

So silver will be more costly or difficult to store. Professional storage costs for gold can be as low as 0.40% per annum while silver can be as low as 0.55% per annum.

If you go for a safety deposit box for storage you will also pay more for larger volumes of silver.

This same factor of volume, means silver can be more costly to transport. So your initial purchase may be more expensive because of this.

With silver there is also the possibility it will tarnish over the longer term if it is not stored in a dry place. In comparison gold is completely inert and so there is no such worry.

Gold vs Silver Winner: Gold (Cheaper to store, transport and doesn’t tarnish – clear winner).

6. Ability to be Borrowed Against

While we view gold and silver as financial insurance with no counter-party risk, there are times when some people would like to be able to borrow against their precious metals.

Say you wanted to purchase a property, but didn’t want to sell the gold you had in order to do this. Instead you may choose to borrow against your gold.

As the only New Zealand brokers for the Singapore Precious Metals Exchange (SGPMX), we have an option available to borrow against gold (and now silver) stored in Singapore.

This borrowing was previously only available against 1kg gold bars. (You couldn’t borrow against silver). However you can now also use silver as collateral.

Presently (July 2024) the lending margin for gold is 60% and silver is 50% for amounts below US$1 million at a lending rate of 7.8% per annum.

The minimum loan size is USD250,000.00.

Gold vs Silver Winner: Tie (Since you are now also able to borrow against silver).

7. Potential Upside

Does gold or silver have more possible upside? Here’s what the numbers say…

How far are gold and silver from their inflation adjusted highs?

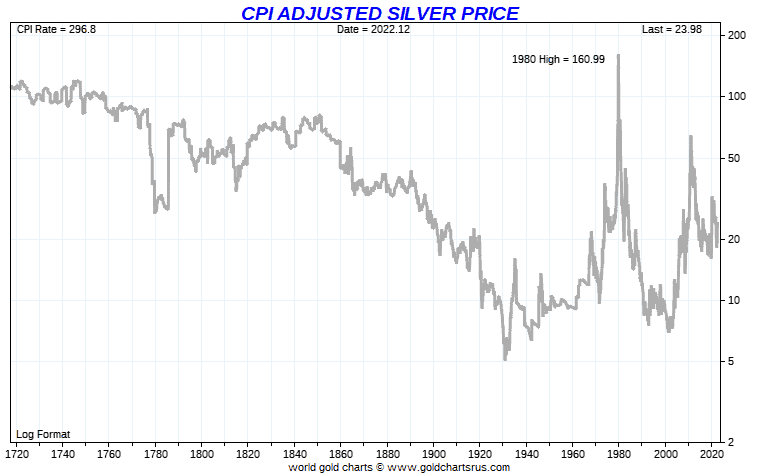

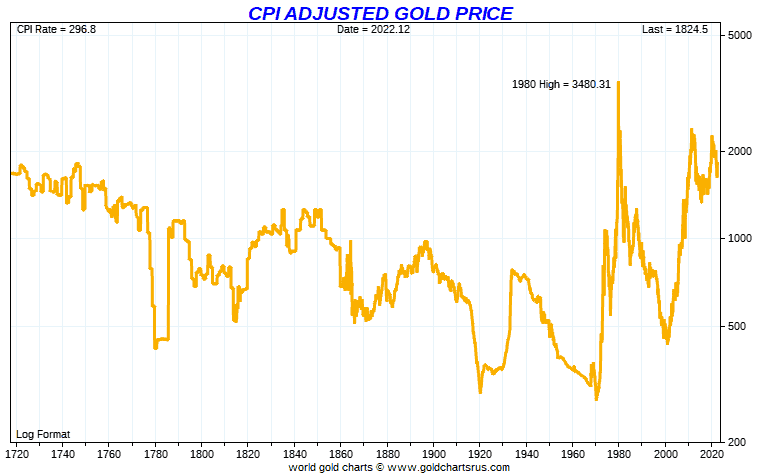

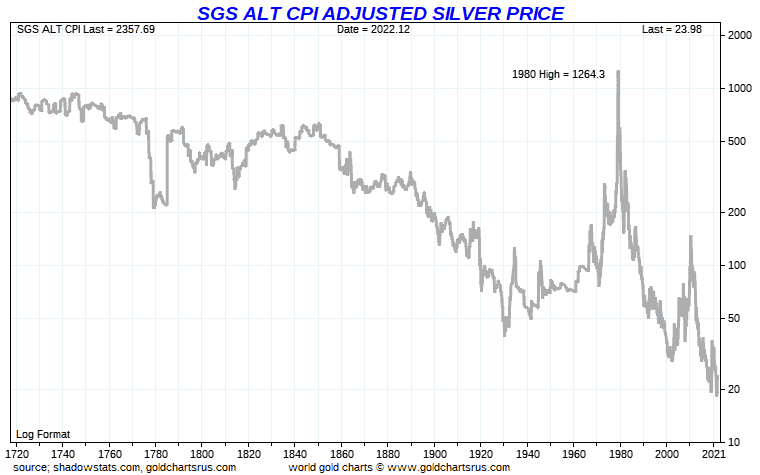

- Silver is still to reach its previous highs – Silver is the only commodity still cheaper than 44 years ago and still to make a new nominal high. Gold has well and truly surpassed its nominal high from 1980 of US$850. Whereas the price of silver is still some way off its 1980 high of US$49.50, when the Hunt brothers had basically cornered the silver market. Some would argue that these prices were “bubble-like” and not fair comparisons. However the likelihood is that gold and silver will eventually reach bubble prices again in this bull cycle. A general rule of thumb is that prices usually make extremes in either direction at the start, and at the end, of a cycle.

- Silver has even further to reach its inflation adjusted high. Gold has to rise to US$3480.31 to reach its inflation adjusted 1980 high of US$850 – over 85% higher than the current price). Silver has even further to go. Needing to reach US$160.99 to match its inflation adjusted 1980 high of US$49.50. Just over 7 times higher than today’s price.

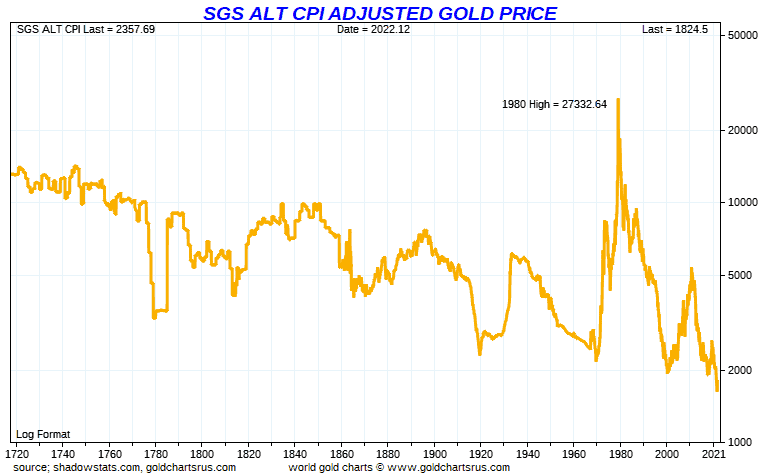

However these numbers are using the very fudged government CPI figures that have been tweaked many times over the past few decades. With these adjustments and substitutions definitely under reporting inflation. Using Shadow Government Statistics numbers we’d arrive at something closer to US$27,333 for gold and US$1264 for silver.

Note: these numbers are as of the end of 2022. So they will be even higher today.

The Gold Silver Ratio

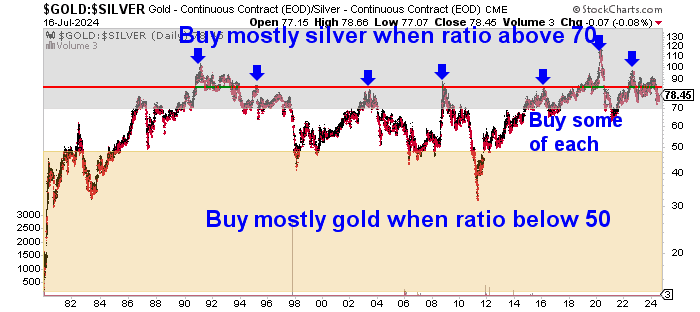

There is a useful indicator to follow that can help identify whether gold and silver are under or over-valued against each other. Therefore helping to identify the better times to buy silver versus gold.

What is the Gold Silver Ratio?

The gold silver ratio is simply the price of an ounce of silver divided into the price of an ounce of gold. The resulting number shows how many ounces of silver it takes to buy an ounce of gold. See this article for a full explanation of the gold to silver ratio: What is the Gold Silver Ratio?

But the chart below is a simple indicator of the best times to buy silver or gold.

With the gold to silver ratio currently just below 80, silver is clearly the better buy today.

Gold vs Silver Winner: Silver (Silver clearly has more upside potential. Regardless of whether that is measured against inflation adjusted previous highs or against gold with the gold to silver ratio).

Related: Some people believe silver could be worth more than gold one day. Therefore they choose to buy silver instead of gold. We look at this concept in detail here: Could Silver Be Worth More Than Gold?

Should I Buy Gold or Silver? Choosing Between the Two Precious Metals – or Maybe Don’t Choose?

Overall Winner?

Perhaps a better option than simply trying to choose between gold and silver, and picking an overall winner, is to instead get a bit of both?

Given the two monetary metals perform differently in certain circumstances, there is a good argument to hold both to balance each other out.

It may be better to own gold in periods of economic weakness such as the 2008/09 financial crisis. Whereas silver may be better in periods of growth. Silver is also more likely to perform better later in the cycle – perhaps such as right now?

You’ll have seen the current numbers favour silver in terms of which precious metals has more upside. So you could choose to weight your percentage in favour of silver right now. So long as you have patience and can stand more potential volatility in price.

Editors Note: This post was first published 2 May 2018. Last updated 17 July 2024 with updated charts and numbers.

For more information on how to buy gold and silver see: How to Buy and Invest in Gold and Silver

Or you can buy silver here. Or buy gold here.

For help with timing your purchase of gold or silver see: When to Buy Gold or Silver: The Ultimate Guide

Pingback: NZ Dollar Gold Breakout About to Happen? - Gold Survival Guide

Pingback: When to Buy Gold or Silver: The Ultimate Guide - Gold Survival Guide

Pingback: Why Buy Silver? Here's 21 Reasons to Buy Silver Now

Pingback: Buy Silver in New Zealand

Pingback: PAMP Suisse Gold/Silver vs Local NZ Gold/Silver: Which should I buy?

Pingback: What Percentage of Gold and Silver Should Be in My Portfolio? - Gold Survival Guide

Pingback: Buying Precious Metals: Common Questions from First Time Buyers

Pingback: What is the Gold Silver Ratio?

Pingback: Bank Economists Change Their Tune - Again - Gold Survival Guide

Pingback: The Correction is Here - Gold Survival Guide

Pingback: Update: RBNZ Bank Financial Strength Dashboard - How Helpful is it? - Gold Survival Guide

Pingback: Where Will the NZ Govt Get the Money for its Dramatic Increase in Spending? Tax, Borrow or Just Print it? - Gold Survival Guide

Pingback: What's Next for Gold and Silver in New Zealand Dollars?

Pingback: Gold or Silver? Higher or Lower? - Gold Survival Guide

Pingback: Gold & Silver Performance: 2021 in Review & Our Guesses for 2022 - Gold Survival Guide